FIN575 – International Financial Management Module 5: Translation

advertisement

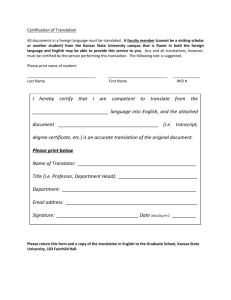

FIN575 – International Financial Management Module 5: Translation, Transaction, and Economic Exposures Critical Thinking Activity Solution 1. Assume that General Electric (GE)’s current assets are $401 billion, fixed assets are $797 billion, current liabilities are $323 billion, and long-term liabilities are zero. Calculate GE’s translation exposure using current/noncurrent, monetary/nonmonetary, temporal, and current rate methods. Solution Under the current/noncurrent method, GE’s translation exposure is $401 billion - $401 billion, or 0. We cannot determine GE’s translation exposure under the monetary/nonmonetary method because we do not know the monetary/nonmonetary breakdown of its assets and liabilities. Similarly, we cannot determine GE’s temporal exposure because we do not know the breakdown of its current assets between inventory and monetary assets. Under the current rate method, GE’s exposure is $875 billion ($401 billion + $797 billion-$323 billion). 2. Toyota has exposed assets of ¥7 billion and exposed liabilities of ¥5 billion. During the year, the yen appreciates from ¥110/$ to ¥80/$. a. What is Toyota's net translation exposure at the beginning of the year in yen? In dollars? b. What is Toyota's translation gain or loss from the change in the yen's value? c. At the start of the next year, Toyota adds exposed assets of ¥1.5 billion and exposed liabilities of ¥2 billion. During the year, the yen depreciates from ¥80/$ to ¥115/$. What is Toyota's translation gain or loss for this year? What is its total translation gain or loss for the two years? Solution a. Toyota has net translation exposure of ¥2 billion (¥7 billion - ¥5 billion). Converted into dollars, this figure yields translation exposure of $18,181,818 (2 billion/110). b. At the end-of-year exchange rate, Toyota's translation exposure equals $25,000,000 (2 billion/80). The net result is a translation gain for the year of $6,818,182 ($25,000,000 - $18,181,818). c. Toyota's new translation exposure at the start of the year is ¥1.5 billion (¥2 billion + ¥1.5 billion - ¥2 billion). Given this exposure and the exchange rate change during the year, its translation loss for the year equals $5,706,521.74 (1,500,000,000 x (1/80 - 1/115)). Over the two-year period, Toyota has realized a translation gain of $1,111,660.26 ($6,818,182 - $5,706,521.74). 3. Suppose an Agribusiness in Texas exports its crops. It expects an 18 million Peso invoice for an export to Mexico to be paid in 90 days. The current spot and 90-day forward rates are $0.7502/Peso and $0.7422/Peso respectively. a. Calculate the company’s peso transaction exposure associated with this fee. b. If the spot rate expected in 90 days is $0.7489, what is the expected U.S. dollar value of the invoice? c. What is the hedged dollar value of the invoice? Solution a. Disney's peso transaction exposure on this invoice equals Peso 18 million or $13,503,600 (18,000,000 x 0.7502). b. The expected value of this invoice in 90 days is $13,480,200 (18,000,000 x 0.7489). c. The hedged value of this invoice in 90 days is $13,359,600 (18,000,000 x 0.7422). 4. A US-based MNC imports 30% of its supplies from Europe. Exports to Europe, which are invoiced in euros, account for approximately 50% of its revenues. In about 250-350 words, explain how the MNC can reduce its economic exposure to exchange and interest rates fluctuations. Solution Answer varies by student. Students must be able to discuss hedging alternatives to manage MNC’s economic exposure.