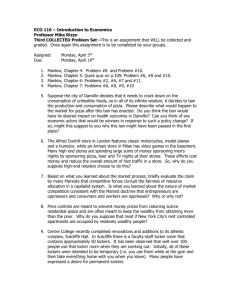

Practice Questions Chapter 1

advertisement