EN_Prevas Q3 2010.indd

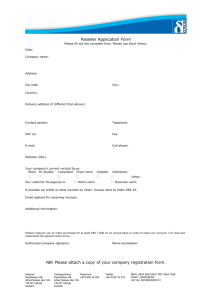

advertisement

Interim Report January - September 2010 Västerås, 22 October 2010 JANUARY - SEPTEMBER JULY - SEPTEMBER • Sales SEK 371.1 (389.7) million • Operating profit EBIT SEK 7.6 (0.0) million • Operating margin EBIT 2.1 (0.0) % • Net income SEK 4.3 (-0.9) million • Earnings per share SEK 0.41 (-0.09) • Cash equivalents SEK 5.9 (12.6) million • Sales SEK 106.2 (109.9) million • Operating profit EBIT SEK -0.8 (2.0) million • Operating margin EBIT –0.7 (1.9) % • Net income SEK -0.9 (1.3) million • Earnings per share SEK -0.09 (0.13) A word from the CEO We have noticed that the Nordic market continues to stabilize. For us, this has resulted in more new orders and higher rates. Prevas has entered into a growth phase having established new offices in Gävle, Borlänge and Oslo. The Product Development and Industrial Systems business areas are also in a phase of organic growth. Evidence of Prevas' strong delivery performance can be found in our customer satisfaction rating of 8.4 (on a scale of 1 to 10) and delivery reliability for projects of 96 percent. We are very happy that Prevas was nominated for the Swedish Embedded Award for the third year in a row. Together with its customer, Zenicor Medical Systems, Prevas has developed a hand-held ECG unit that was nominated in the category, Enterprise. Our Swedish and Norwegian operations continue to report stable profitability. In Norway, we are making new investments in the Product Development business area. In Denmark, efforts continue to establish existing and new businesses, along with restructuring efforts. This has involved costs that are essential to our future growth strategy. Overall, we have noticed that our customers are optimistic and we are confident that there is a strong and growing market for our services. Nevertheless, for 2010 overall, what we previously communicated still holds true, i.e. this will be a year of squeezed margins. Mats Lundberg, CEO Prevas AB Interim Report January - September 2010 page 2 (12) Prevas develops intelligence in products and industrial systems. Sales SALES PER SECTOR Q1-3 2010, GROUP FÖRSÄLJNING PER BRANSCH KvTHE 1-3 2010, KONCERNEN Telecom Telecom JANUARY – SEPTEMBER Sales amounted to SEK 371.1 (389.7) million, corresponding to a decline of 4.8 percent. Sales per employee increased and were SEK 896 (817) thousand. The number of workdays was 188 (187). Fordon Automotive 11 % Other Övriga Energy Energi 10 % 13 % Defense Försvar Engineering Verkstadsindustrin 30 % 13 % JULY – SEPTEMBER Sales amounted to SEK 106.2 (109.9) million, corresponding to a decline of 3.4 percent. Sales per employee were SEK 260 (245) thousand. The total number of working days was 66 (66). Income 10 % 13 % Life LifeScience Science FIVE CUSTOMERS 1-3 2010, THE GROUP FEMLARGEST STÖRSTA KUNDER Kv 1-3Q2010, KONCERNEN Ericsson JANUARY – SEPTEMBER Operating profit EBIT was SEK 7.6 (0.0) million, with a corresponding operating margin of 2.1 (0.0) percent. Profit before depreciation EBITDA was SEK 17.6 (9.5) million, with a corresponding profit margin before depreciation of 4.7 (2.4) percent. 13 % 11 % Other Övriga Saab Saab (defense) (försvar) 4 %, Westinghouse 66 % 3 %, ABB 3 %, Bombardier Net income was SEK 4.3 (-0.9) million, resulting in profit margin of 1.7 (–0.2) percent. The increase in profits compared to last year is primarily due to improvements in capacity utilization. During the period, Prevas' costs associated with establishing the business in Dubai were SEK 1.5 million, plus additional impairment losses on products of SEK 0.9 million, which had a negative impact on the Industrial Systems business area. In the Product Development business area, costs were recognized for confirmed and anticipated bad debt losses equal to SEK 1.2 million. JULY – SEPTEMBER Operating profit EBIT was SEK -0.8 (2.0) million, with a corresponding operating margin of -0.7 (1.9) percent. Profit before depreciation EBITDA was SEK 3.1 (5.1) million, with a corresponding profit margin before depreciation of 2.9 (4.7) percent. Profit/loss before tax was SEK -0.9 (1.3) million, with a corresponding profit margin of -1.0 (1.6) percent. During the period, the Industrial Systems business area reported extra impairment losses on products of SEK 0.9 million along with costs associated with setting up the business in Dubai of SEK 0.8 million. The Product Development business area recognized costs for confirmed bad debt losses of SEK 0.2 million in Sweden, as well as anticipated bad debt losses in Denmark of SEK 1 million. Cash flow and cash equivalents Cash flow from continuing operations for the period January through September was SEK 11.2 (19.2) million. At the end of the period, cash equivalents totaled SEK 5.9 (12.6) million, excluding bank overdraft facility. Financial position Equity was SEK 151.6 (166.1) million at the end of the period, with a corresponding equity ratio of 56 (60) percent. Equity per share was SEK 14.98 (16.44). SALES PER QUARTER (MSEK), THE GROUP OMSÄTTNING PER KVARTAL MKR, KONCERNEN 200 150 100 50 0 06 07 08 09 10 06 07 08 09 10 06 07 08 09 10 06 07 08 09 Q1 Q2 Q3 Q4 EBIT PER QUARTER PER (MSEK), THEMKR, GROUP RÖRELSERESULTAT KVARTAL KONCERNEN 25 20 15 10 5 0 -5 -10 -15 -20 06 07 08 09 10 06 07 08 09 10 06 07 08 09 10 06 07 08 09 Q1 Q2 Q3 Q4 CASH FLOW FROM ACTIVITIESMKR, (MSEK), KASSAFLÖDE FRÅN OPERATING LÖPANDE VERKSAMHET KONCERNEN THE GROUP 30 25 20 15 10 5 0 -5 -10 06 07 08 09 10 06 07 08 09 10 06 07 08 09 10 06 07 08 09 Q1 Q2 Q3 Q4 Interim Report January - September 2010 page 3 (12) Prevas develops intelligence in products and industrial systems. Employees During the period, the average number of employees was 414 (477), of which 290 (354) worked within the area of Product Development and 106 (106) worked in the area of Industrial Systems. In addition, there were 18 (17) employees in senior management and administrative positions. The total number of employees at the end of the period was 452 (484), of which 13 % were women. Investments The company made investments in fixed assets worth SEK 3.0 (5.9) million during the period. Of the total amount, SEK 3.0 (3.8) million was for machinery and equipment, while SEK 0.0 (2.1) million was for product development and intangible assets. Besides these items, goodwill increased SEK 4.0 million related to the additional consideration on prior acquisitions. During the period, Prevas started up operations in Gävle and Gothenburg with shared ownership. Prevas is the majority owner. Key indicators per quarter Net sales, MSEK 2010 2010 2010 2009 2009 2009 2009 2008 2008 2008 2008 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 106,2 132,3 132,6 123,5 109,9 127,7 152,1 159,9 134,3 167,8 153,7 EBIT, MSEK –0,8 1,6 6,8 –19,4 2,0 –9,1 7,1 14,8 14,0 24,7 16,8 Operating margin, % –0,7 1,2 5,2 –15,7 1,9 –7,2 4,7 9,2 10,4 14,7 11,0 66 60 62 63 66 59 62 62 66 62 62 452 449 449 497 484 492 528 548 554 554 565 Number of working days Number of employees at the end of the period Average number of employees 409 419 432 456 449 480 511 518 504 521 528 Net Sales/employee, kSEK 260 316 307 271 245 266 298 309 266 322 291 56 52 54 53 60 55 52 57 54 48 46 Earnings per share, SEK Equity Ratio, % –0,09 0,06 0,45 –1,43 0,13 –0,70 0,49 1,09 1,02 1,79 1,18 Equity per share, SEK 14,98 15,28 15,31 15,09 16,44 16,54 17,26 18,14 16,61 15,49 13,60 Strong business financial indicators: on-time delivery of projects As a part of the company's quality assurance system, we constantly measure customer satisfaction, delivery reliability and warranty work. More than 90 percent of our projects are delivered on time. That figure is significantly above the industry average. That, in combination with a customer satisfaction level of 8.4 (on a scale of 1 to 10) makes Prevas highly valued by its customers. DELIVERY RELIABILITY, LEVERANSSÄKERHET,% % 100 80 60 40 20 0 1994 1997 2000 2003 2006 2009 Important events during the period Nominated for the Swedish Embedded Award – for the third year in a row For the third year in a row, Prevas was nominated for the Swedish Embedded Award. Together with Zenicor Medical Systems, Prevas competed against four other companies in the category “Enterprise” for this prestigious prize. Prevas and Interspiro won the award in 2009 for an advanced communication system for smoke diving teams. New operations in Norway within the area of product development Prevas is continuing to invest and is starting new product development activities in Norway. Prevas has been established in Norway since 2007 with offerings within industrial IT. When industrial companies are looking for manufacturing-related IT solutions, Prevas is a natural partner. The investment has been very successful, and Prevas recognizes major possibilities for expansion within the Product Development business area in Norway, with Oslo as the base. Operations will consist of 4-5 employees from the start, with the aim of growing to 30 employees within a 3-year period. Recruitment of key individuals for the initiative is complete, and Eivind Eriksen has been recruited to serve as the team leader. Eriksen most recently worked at Teknologisk Institutt where he was a group leader for electronics and instrumentation. The investment in Norway is an important and strategic step. In this area, Prevas is able to offer new services to its existing customers, as well as reaching out to a new market. Interim Report January - September 2010 page 4 (12) Prevas develops intelligence in products and industrial systems. Examples of exciting project commitments Prevas, in cooperation with National Instruments, has helped the Gothenburg-based company Medfield Diagnostics to develop the Strokefinder R10 measurement system. The Strokefinder R10 is a research instrument that can help save many lives and prevent a lot of suffering for future stroke victims. The product consists of measurement equipment and a helmet that is put on the patient and used to examine the brain with the help of microwaves. There are antennas in the helmet that, together with the measurement equipment, act as transmitters and receivers. Consultants working with embedded electronics face challenges associated with the environment. Since Prevas provides solutions and services within many sectors and application areas, we are thus involved in many types of greentech projects. It is possible to use some solutions in a general context. Most, however, are customerspecific. Examples vary from updates to existing products such that they become more environmentally friendly, to getting involved in greentech projects. General agreements In order to assist customers in the best manner possible, Prevas invests in long-term customer relationships that include deep insight into customers’ enterprises. General agreements important for continued cooperation have been signed with such companies as: ABB, Atlas Copco, Ericsson, FMV, GE Healthcare, Maquet, Saab AB, Sandvik and Volvo. Market trends and events within the business areas Recovery in the area of industrial IT continued during Q3 - Industrial Systems business area Recovery in the market for industrial IT, which got underway during the second quarter, also continued during the third quarter. The willingness to invest is increasing across the entire line and projects that had been put on hold have been dusted off and are being considered once again. The focus is on how to increase productivity with current staffing. We are also getting more and more inquiries on how to modernize equipment. Operating margin for the Industrial Systems business area remains strong. Capacity utilization is high and expansion is now on the agenda. We need to recruit more employees to several of Prevas' regions. New orders continue to increase and the newly established unit in Gävle has gotten off to a good start. Our assessment continues to be quite positive in terms of the market outlook for investments in manufacturing-related IT solutions, industrial IT. Customers want to already have efficient internal IT processes that are linked to production in place, once a recovery gets underway. Manufacturing Enterprise Solutions (MES) and Business Intelligence (BI) are two areas that are developing quite well. The driving factors for investments are the customer's own productivity in combination with their demands for traceability and quality assurance. In certain sectors, requirements from authorities must also be considered, e.g. product traceability in manufacturing. Energy savings is another area where there is increased interest from customers. Prevas works with several world-leading companies, such as ABB, Ericsson, Outokumpu, Sandvik, SSAB, Statoil and Volvo. Nordic Leader in Embedded Systems - Product Development business area The Product Development business area has continued to experience increased demand for its services during the last quarter. Customers' greatest needs continue to be for on-site consulting. However, new orders and inquiries have increased significantly, particularly regarding outsourcing of product development for both complete products and subsystems. Operating margin has gradually improved during the year. In September, it was at a satisfactory level for Swedish operations within the Product Development business area. In Denmark, the situation continues to be difficult and anticipated bad debt losses have a negative impact on profits. For the third year in a row, Prevas has been nominated for the Swedish Embedded Award. This year, Prevas was nominated along with its customer, Zenicor Medical Systems. Prevas has developed Zenicor's new, innovative product, Zenicor ECG-2. It is a unique product that can be used in a home environment to easily diagnose heart rhythm disturbances. Interim Report January - September 2010 page 5 (12) Prevas develops intelligence in products and industrial systems. During the period, Medfield Diagnostics, a Prevas customer, launched its new product, Strokefinder R10. Prevas was involved in developing the product in close cooperation with the strategic partner, National Instruments. Strokefinder R10 is an instrument that is used for diagnosis of stroke patients. This groundbreaking system received a great deal of attention as Key-Note at the annual NI-Week in Austin, Texas. Prevas works with many world-leading companies, such as ABB, Atlas Copco, Bombardier, Danfoss, Ericsson, Maquet Critical Care, Novo Nordisk, Saab, Vestas and Volvo. The Parent Company JANUARY – SEPTEMBER Sales were SEK 308.6 (320.6) million and profit/loss after financial items was SEK 5.1 (-3.3) million. Risks and uncertainties The market situation improved during the period and we have noticed that things are stabilizing. However, VC-funded companies are still experiencing the aftermath of the recession. Prevas relies on certain guiding principles when it comes to managing risks in various parts of its business. Successful risk management is a continuous process conducted within the framework for operations management. It is an integral part of the everyday follow-up of the business. Examples of business and market related risks are: competition and downward pressure on prices, how our customers' businesses develop, bad debt losses, risks associated with the state of the market and fluctuations in exchange/interest rates. During the period, Prevas increased its provision for anticipated bad debt losses. Accounting principles This summary interim report for the Group was prepared in accordance with IAS 34, Interim Financial Reporting and the Annual Accounts Act, where applicable. The interim report for the Parent Company was prepared in accordance with Chapter 9, Interim Report, of the Annual Accounts Act. The revised accounting standards that affect Prevas as of 2010 are as follows: IFRS 3, Business Combinations and IAS 27, Consolidated and Separate Financial Statements. The revisions result in changes to how transaction costs are reported in conjunction with acquisitions as well as the revaluation of additional consideration reported in net profit/loss for the year. These changes only have an effect going forward. As of 2010, there are holdings without controlling influence. The revised IAS 27 has an effect on what certain things are called, but no effect on the amounts reported in this report. Except for the changes mentioned above, the company has applied the same accounting principles and bases of calculation as in the most recent Annual Report. Stockholm, 22 October 2010 Prevas AB (publ) Mats Lundberg, CEO Prevas AB UPCOMING REPORTS • Year-end report 2010, 4 February 2011 INFORMATION For more information, please contact: Mats Lundberg, CEO, tel. 08-726 40 02, 0733-37 75 40 Mats Åström, CFO, tel. 021-360 19 34, 070-191 31 65 This is a translation of an original document in Sweden. In case of dispute, the original document should be taken as authoritative (Delårsrapport januari - juni 2010 at www.prevas.se). Or, contact the company directly. Published on 22.10.10, 8:30 CET. This is information that Prevas AB (publ) must make available to the public in accordance with the Swedish Securities Market Act (2007:528) and/or the Financial Instruments Trading Act. Interim Report January - September 2010 page 6 (12) Prevas develops intelligence in products and industrial systems. Auditor's Report Regarding Review of the Interim Report To the Board of Directors of Prevas AB (publ.), CIN: 556252-1384 Introduction We have conducted a review of the summary financial information for Prevas AB (publ.) as of 30 September 2010 and the nine-month period ending on that date. The Board of Directors and CEO are responsible for the preparation and presentation of this interim report in accordance with IAS 34 and the Swedish Annual Accounts Act. Our responsibility is to express an opinion on this interim report that is based upon our review. Focus and scope of the review We conducted our review in accordance with the Swedish Standard on Review Engagements SÖG 2410, "Review of Interim Financial Information Performed by the Independent Auditor of the Entity," issued by FAR. A review consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially more limited in scope than an audit conducted in accordance with Standards on Auditing in Sweden, RS, and other generally accepted auditing practices. The procedures performed in a review do not enable us to obtain a level of assurance that would make us aware of all significant matters that might be identified in an audit. Therefore, the conclusion expressed based on a review does not give the same level of assurance as a conclusion based on an audit. Conclusion Based on our review, nothing has come to our attention that causes us to believe that the accompanying interim financial information does not, in all material respects, accord with IAS 34 and the Swedish Annual Accounts Act for the Group, and the Swedish Annual Accounts Act for the Parent Company. Västerås, 22 October 2010 KPMG AB Helena Arvidsson Älgne, Authorised Public Accountant Interim Report January - September 2010 page 7 (12) Prevas develops intelligence in products and industrial systems. Consolidated Financial Statements SUMMARY INCOME STATEMENTS (SEK thousands) Net sales 2010 Q1-3 2009 Q1-3 2010 Q3 2009 Q3 2009 Full Year 371 097 389 712 106 203 109 938 513 235 Capitalized work Other external costs Personnel costs Profit/loss before depreciation – 1 654 – – 1 654 –97 429 –88 813 –29 500 –24 711 –118 276 –256 059 –293 082 –73 608 –80 083 –402 838 17 609 9 471 3 095 5 144 –6 225 Amortization/impairment of intangible assets –5 841 –4 956 –2 657 –1 792 –7 185 Depreciation of property, plant and equipment –4 136 –4 497 –1 208 –1 311 –5 925 EBIT 7 632 18 –770 2 041 –19 335 1) Net financial items –1 457 –831 –283 –262 –641 Profit/loss before tax 6 175 –813 –1 053 1 779 –19 976 Taxes –1 836 –84 206 –507 4 626 Net profit (loss) for the period 4 339 –897 –847 1 272 –15 350 Net profit (loss) for the period attributable to Parent Company's shareholders 4 165 –897 –925 1 272 –15 350 Net profit (loss) for the period attributable to holdings without a controlling interest 174 – 78 – – Basic and diluted earnings per share, SEK 0.41 -0.09 -0.09 0.13 -1.52 2010 2009 2010 2009 Q1-3 Q1-3 Q3 Q3 2009 Full Year 4 339 –897 –847 1 272 –15 350 –5 286 –1 252 –1 958 –2 224 –440 STATEMENT OF COMPREHENSIVE INCOME in summary, kSEK Net profit (loss) for the period Other comprehensive income: Translation differences for the period –947 –2 149 –2 805 –952 –15 790 Comprehensive income for the period attributable to Parent Company's owner Total comprehensive income for the period –1 121 –2 149 –2 883 –952 –15 790 Comprehensive income for the period attributable to holdings without a controlling influence 174 – 78 – – 2010 Q1-3 2009 Q1-3 2010 Q3 2009 Q3 2009 Full Year BUSINESS UNIT PERFORMANCE Net sales, kSEK Product Development 257 880 275 684 72 239 76 055 369 977 Industrial Systems 113 217 114 028 33 964 33 883 143 258 371 097 389 712 106 203 109 938 513 235 Total EBIT, kSEK Product Development –8 902 –18 359 –4 517 –2 858 Industrial Systems 16 534 18 377 3 747 4 899 Total 7 632 18 –770 2 041 –38 580 2) 19 245 3) –19 335 –10,4 % Operating margin, % Product Development –3,5 % –6,7 % –6,3 % –3,8 % Industrial Systems 14,6 % 16,1 % 11,0 % 14,5 % 13,4 % Total 2,1 % 0,0 % –0,7 % 1,9 % –3,8 % 1) Includes the Q2 and Q4 action plan in the amount of SEK 16 456 thousand. 2) Includes the Q2 and Q4 action plan in the amount of SEK 13,696 thousand. 3) Includes the Q2 and Q4 action plan in the amount of SEK 2 760 thousand. Interim Report January - September 2010 page 8 (12) Prevas develops intelligence in products and industrial systems. Consolidated Financial Statements (cont.) SUMMARY BALANCE SHEET (SEK thousands) Goodwill 2010 30 Sept 2009 30 Sept 2009 31 Dec 111 424 109 865 110 117 Other intangible assets 13 260 21 866 19 804 Property, plant and equipment 13 373 14 446 14 519 Deferred tax assets 4 939 605 5 023 Current receivables 121 018 120 025 128 452 Cash Equivalents Total assets Equity attributable to Parent Company's owner 5 911 12 644 11 765 269 925 279 451 289 680 152 492 151 371 166 133 Equity attributable to holdings without a controlling influence 263 – – Long-term provisions 642 1 020 813 9 435 11 633 8 743 22 294 21 813 31 800 Deferred tax liability Long-term interest-bearing liabilities Current interest-bearing liabilities 4 065 3 902 3 987 81 855 74 950 91 845 Total liabilities and equity 269 925 279 451 289 680 CHANGES IN EQUITY, in summary, SEK thousands 2010 30 Sept 2009 30 Sept 2009 31 Dec 152 492 181 248 181 248 –1 121 –2 149 –15 790 Other current liabilities Opening balance Total comprehensive income for the period attributable to the Parent Company's owner Total comprehensive income for the period attributable to holdings without a controlling influence Employee stock option program Holdings without a controlling influence 174 – – – 2 150 2 150 89 – – – –15 116 –15 116 Closing balance 151 634 166 133 152 492 Equity attributable to Parent Company's owner 151 371 166 133 152 492 263 – – Dividends Equity attributable to holdings without a controlling influence Interim Report January - September 2010 page 9 (12) Prevas develops intelligence in products and industrial systems. Consolidated Financial Statements (cont.) CASH FLOW ANALYSIS (SEK thousands) 2010 Q1-3 2009 Q1-3 2010 Q3 2009 Q3 2009 Full Year Operating activities Profit/loss before tax 6 175 –813 –1 053 1 779 –19 976 Adjustment for items not included in cash flow 9 372 8 088 2 186 2 221 13 526 –1 309 –8 115 –108 –1 177 –5 097 14 238 –840 1 025 2 823 –11 547 27 916 Income tax paid Cash flow from operating activities before changes in working capital Cash flow from changes in working capital 7 434 36 343 19 244 12 512 Change in operating liabilities Change in operating receivables –10 517 –16 283 –16 746 –22 615 –7 419 Cash flow from operating activities 11 155 19 220 3 523 –7 280 8 950 Acquisition of business and shares excl. cash equivalents –4 022 –4 592 – – –4 592 Disposal of businesses and shares, excl. cash equivalents 40 – 40 – – –20 –2 087 – –66 –2 113 Investing activities Investments in intangible assets Investments in property, plant and equipment Cash flow from investing activities –2 990 –3 834 –835 –589 –5 335 –6 992 –10 513 –795 –655 –12 040 –9 533 –98 –4 485 –464 9 974 – 2 150 – – 2 150 Financing activities Change in interest-bearing liabilities Employee stock option program – –15 116 – – –15 116 Cash flow from financing activities Dividends paid –9 533 –13 064 –4 485 –464 –2 992 Cash flow for the period –5 370 –4 357 –1 757 –8 399 –6 082 16 745 11 765 16 745 7 843 21 102 Translation difference on cash equivalents Cash equivalents at the beginning of the year –484 256 –175 –59 1 102 Cash equivalents at the end of the period 5 911 12 644 5 911 12 644 11 765 –5 370 –4 357 –1 757 –8 399 –6 082 KEY FIGURES 2010 Q1-3 2009 Q1-3 2010 Q3 2009 Q3 2009 Full Year Profit margin before depreciation/EBITDA 4,7 % 2,4 % 2,9 % 4,7 % –1,2 % Operating margin/EBIT 2,1 % 0,0 % –0,7 % 1,9 % –3,8 % Profit margin 1,7 % –0,2 % –1,0 % 1,6 % –3,9 % 10 102 10 102 10 102 10 102 10 102 10 102 10 062 10 102 10 102 10 072 0.41 -0.09 -0.09 0.13 -1.52 14.98 16.44 Cash flow for the period Number of outstanding shares at the end of the reporting period basic and diluted Average number of outstanding shares basic and diluted Basic and diluted earnings per share, SEK Equity per share, basic and diluted 15.09 Equity ratio 56 % 60 % 53 % Return on capital employed, % 4,4 % 0,4 % –9,3 % Return on equity, % 2,8 % –0,5 % Average number of employees 414 477 409 449 –9,1 % Number of working days 188 187 66 66 250 Sales per employee, kSEK 896 817 260 245 1 087 Interim Report January - September 2010 page 10 (12) Prevas develops intelligence in products and industrial systems. 472 Parent Company Financial Statements SUMMARY INCOME STATEMENTS (SEK thousands) Net sales Capitalized work Other external costs Personnel costs 2010 2009 2010 Q1-3 Q1-3 Q3 2009 Q3 Full Year 2009 308 643 320 605 87 378 87 123 418 476 – 1 296 – – 1 296 –88 351 –80 504 –27 198 –20 493 –105 730 –202 832 –232 285 –56 539 –62 813 –322 064 Amortization/impairment of intangible assets –9 174 –8 324 –3 775 –2 921 –11 680 Depreciation of property, plant and equipment –2 166 –2 630 –534 –670 –3 417 EBIT 6 120 –1 842 –668 226 –23 119 Profit/loss from participations in Group companies 174 –988 – 3 603 –988 Interest income and similar profit/loss items 454 613 221 121 772 Interest expenses and similar items –1 680 –1 082 –412 –183 –1 320 Profit (loss) after financial items 5 068 –3 299 –859 3 767 –24 655 12 750 – – – – Taxes Appropriations –1 390 458 203 –81 2 528 Net profit (loss) for the period 3 678 –2 841 –656 3 686 –9 377 SUMMARY BALANCE SHEETS (SEK thousands) Intangible assets Property, plant and equipment Financial assets Current receivables Cash and cash equivalents Total assets Equity Untaxed reserves Provisions Long-term interest-bearing liabilities Current interest-bearing liabilities Other current liabilities Total liabilities and equity 2010 2009 2009 30 Sept 30 Sept 31 Dec 15 105 27 591 24 259 4 074 5 185 4 968 40 247 39 097 41 677 102 245 94 225 98 039 418 2 420 5 843 162 089 168 518 174 786 74 985 77 843 71 307 – 12 750 – 396 928 813 15 683 15 400 25 146 2 200 2 200 2 200 68 825 59 397 75 320 162 089 168 518 174 786 Interim Report January - September 2010 page 11 (12) Prevas develops intelligence in products and industrial systems. In 2010 Prevas will be celebrating its 25th anniversary, and the company is currently the Nordic leader for embedded systems and industrial IT. We are the main supplier and innovative development partner to leading companies in industries such as life science, telecommunications, vehicle, defense, energy and engineering. Prevas' foundation is based on developing intelligence in products and industrial systems for world-leading companies. Prevas’ solutions are renowned for innovation, quality assurance and reliable delivery. Offices are located in Sweden, Denmark, Norway, The United Arab Emirates and India. The company has approximately 500 employees. Prevas has been listed on the NASDAQ OMX Nordic Exchange in Stockholm since 1998. Prevas AB (publ), CIN 556252-1384 Box 4, SE 721 03 Västerås, Telephone +46 21 360 19 00, Fax +46 21 360 19 29 info@prevas.se, www.prevas.se