Guide to accounting

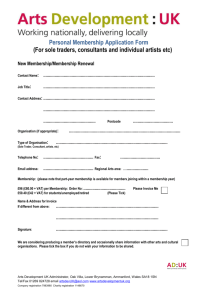

advertisement

Guide to accounting This guide to accounting provides you with a simple introduction to the most important areas of accounting. It is not our intention to provide comprehensive documentation. Our aim is to help you get started. The contents of the guide: 1. 2. 3. 4. 5. 6. 7. 8. 9. Take accounts seriously! .................................................................................................................. 2 Accounting system ............................................................................................................................ 5 Understanding accounts ................................................................................................................... 8 Budgets – a management tool ........................................................................................................ 11 Reporting requirements .................................................................................................................. 13 Invoice your sales quickly and correctly ......................................................................................... 16 Cashing up ...................................................................................................................................... 17 Payroll procedures .......................................................................................................................... 19 Stocktaking – why and how ............................................................................................................ 23 Guide to accounting Page1 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 1. Take accounts seriously! Can you keep the accounts yourself? What system should you choose? Keeping accounts is not just an obligation; thoroughly prepared accounts are the best tool available to you in the management of your enterprise. Particularly to start with, you should spend some time on establishing good accounting procedures and systems: Find good partners with whom you can collaborate Prepare a good accounts chart Plan what reports you wish to have Set aside some time for the accounts every day Keep up-to-date – maintain an overview, so that you know whether you are on the right course. Can you keep the accounts yourself? If you are interested and have sufficient know-how to keep your own accounts, you should consider doing so, at least in the beginning. That way, you can be hands-on and keep a close eye on the enterprise's 'internal life'. Whatever you choose to do, you should consult with an authorised accountant in order to prepare an accounts chart and establish good procedures. As your enterprise grows and recruits employees, or expands in some other way, you should consider using an external accountant or employing someone to keep the accounts for you. Important accounting terms Some terms are essential when discussing accounts, and if you intend to keep your own accounts, you should be familiar with the following: Account – a place where accounting information is recorded and systemised. Similar transactions are recorded in the same account. Example: Goods purchased are recorded in the 'Goods purchased' account. Accounts chart – a chart of accounts specified according to the nature of the enterprise in accordance with the specification requirements set out in the Norwegian Accounting Act and the enterprise's own need for information. There are two main types of accounts charts: profit/loss account charts and balance-sheet account charts. An account number usually consists of four digits. Debit/credit – an account consists of a debit side (on the left) and a credit side (on the right). Making entries on the debit side is called 'debiting', while making entries on the credit side is called 'crediting'. This principle can be illustrated by a 'T' account, i.e. a visual image of an account showing both the debit and credit side at the same time. Balance – the net effect of all amounts recorded in one account at any given time. The balance of an account is the total carried over from the previous period combined with the net effect of all transactions in the account during the chosen period. The general ledger is a list of all account balances on a given date. Double-entry bookkeeping means that a transaction must always be entered twice, by debiting and crediting equal amounts. Closing of accounts – the total profit/loss is calculated by adding the balances of all profit/loss accounts. The enterprise's equity is increased by any profit for the period, or reduced by any loss for the period. Guide to accounting Page2 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. In order to keep your own accounts, you must be able to do the following: 1. Enter account codes (see Standard Accounts Chart) on vouchers, also called posting. This involves assigning an account to each voucher to be entered in the books. 2. Decide how purchases are to be dealt with as regards VAT, considering that the rates differ. Input VAT is only deductible when documented by a voucher. 3. Decide whether an expense allowance is subject to a reporting duty, payroll withholding tax, and employer's National Insurance contribution. Expense allowances are benefits that employees receive to cover costs incurred in connection with the performance of their work. 4. Decide whether major purchases of machinery and other fixtures and fittings should be capitalised or expensed. As a rule, tangible assets should be capitalised in full (entered in the balance sheet) at the time of purchase. Insignificant procurements can be charged to income directly. In an accounting context, there is no exact limit for capitalisation while, in the tax context, there will be clear criteria to consider. 5. Register accounting information in an accounting system. Accounting information is usually registered in the accounting system using specially developed accounting software that has to be bought. Although it is legal to keep accounts using pen and paper, in most cases, it is hardly expedient or efficient. As a rule, you may not keep accounts using spreadsheets. Those who have a bookkeeping obligation and less than 600 vouchers per year may nevertheless do so. In this context, a 'voucher' means documentation of a single transaction with another party, for example a purchase, sale or payment. A paper copy of the spreadsheet must be printed out by given deadlines, dated, signed and filed (the accounts are deemed to be manually kept accounts on paper). See the Norwegian Bookkeeping Standards Board's statement concerning spreadsheets. GBS 14 – Bookkeeping by use of spreadsheets discusses this (in Norwegian only). 6. Prepare accrued income statements and balance sheets, usually every other month. This is also called accruals accounting. To accrue means to assign income and expenses to the correct period. 7. Specify purchases/sales according to which party they are purchased from / sold to (keep subsidiary ledgers). A subsidiary ledger (purchases/sales ledger with customer/supplier specification) is a current account between a customer and a supplier or vice versa. When an invoice is received, it must be entered in the accounts on the invoice date. It is debited to a cost centre and credited to the purchases ledger for the relevant supplier. When the invoice is paid, the payment is credited to a bank account and debited the purchases ledger. 8. Reconcile bank accounts, cash and taxes/public charges. All balance-sheet accounts must be documented. In practice, this means that all balance-sheet accounts in the general ledger must be reconciled. 9. Reconcile sales and purchases ledgers by obtaining bank statements and comparing the amounts to the enterprise's corresponding accounts. 10. Prepare documents that you are legally obliged to submit to the tax collector, the tax office and the Brønnøysund Register Centre, such as payment record forms, income statements, tax returns, VAT returns and annual accounts. Note that information about the forms you are obliged to submit is available on the website of Brønnøysund's Register of Reporting Obligations of Enterprises. Here, everyone can look up 'their obligations': by entering the enterprise's organisation number, or if you do not have an organisation number, by entering the enterprise's form of incorporation, industry code and number of employees. You can cope, but ... Many people find this quite manageable. A bit of training, interest in the task and good accounting software will enable you to tackle most common tasks, and you can ask the experts when in doubt. As a rule of thumb, you should nevertheless devote your time to what you do best and buy other services from reliable experts. This also applies to accounting. To many people, the price is important: Maybe you reckon with a more favourable hourly rate for yourself than that charged by the accountancy firm. But remember that an accountancy firm can do Guide to accounting Page3 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. the task must faster and, in most cases, more accurately than you yourself can. You should also put a high price on your own free time! When choosing an accountant, you should preferably find a partner with whom you can also discuss how to resolve any problems that you encounter from day to day. Approach several accounting firms and seek advice from your banking partner, auditor and other businesspersons. The Norwegian Bookkeeper Act helps to provide those who buy accounting services with a better product. All accountancy firms must have at least one certified accountant with a certain educational background and length of service within the profession. The Financial Supervisory Authority of Norway's spot checks have shown that the quality varies widely from one firm to the next. The accountant is obliged to establish a written assignment agreement describing the tasks to be carried out by the accountant and the tasks that you must carry out yourself, and what reports you will get and when. Keep the enterprise's finances separate from your private finances It can be both expensive and time-consuming to tie up the loose ends of an enterprise's finances if you have failed to keep your private finances separate. It is important to be systematic in keeping them apart in your day-to-day work. Open a separate bank account for the enterprise. Pay all business expenses using the enterprise's funds. What accounting system should you choose? If you intend to keep the accounts yourself, you must choose an accounting system. The Norwegian Bookkeeping Act sets out several requirements for accounting systems. Among other things, it states that the accounting system must be proper and clear and capable of generating all statutory financial reports. Let an accounting professional (your accountancy firm or auditor) help you decide on the most suitable accounting software in your case. It may also be smart to choose a system that others have competence in, so that you do not find yourself completely alone in the world when things go wrong after you have made hundreds of entries. You must also make sure that the system is capable of generating all statutory reports. More information about this topic can be found in: (In Norwegian only) The Norwegian Tax Administration's brochure: Office work and accounting Guide to accounting Page4 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 2. Accounting system Statutory requirements for the accounting system, requirements of the accountant, how to calculate VAT in an accounting system, keeping vouchers in order. What statutory requirements apply to accounting systems? Good accounts are a very useful tool for you and your enterprise. Keeping accounts is also a statutory requirement. The Norwegian Bookkeeping Act requires you to keep records of all information that is necessary in order to prepare mandatory specifications and reports. Such records must include the following as a minimum: 1. 2. 3. 4. 5. 6. Number and date Information about amount and quantity Codes showing assignment of account in the accounting system Reference to supporting documentation Calculation of VAT, if applicable Name of buyer/seller (subsidiary ledger), if applicable Before the accounts are closed for statutory financial reporting (submission of VAT return or similar), book entries can be changed directly in the accounting system without further documentation. Once the reports have been generated and the accounts for the period closed, it must not be possible to change the recorded information. Any correction of incorrectly recorded vouchers must then be in the form of a new entry. The original posting must then be reversed as a whole. The correction voucher should refer to the voucher number that is being corrected and state the reason for the correction. When a posting is deleted, for example due to double-posting of an incoming invoice, it must always be specified in the books or on the voucher that such deletion has taken place. Reports The Norwegian Bookkeeping Act specifies what reports must be prepared as a minimum: Bookkeeping specifications (posting records) Account specification (ledger) Customer specification (sales ledger) Supplier specification (purchases ledger) Specification of withdrawals by owners Specification of sales to owners/partners and own use Specification of sales and other benefits to leading personnel Specification of VAT Specification of benefits/payments that must be included in certificates of pay and tax deducted An income statement and balance sheet shall be prepared for each reporting period. You do not have to print the reports/ income statement / balance sheet, provided that the complete reports have been generated and are stored electronically in your accounting system. Guide to accounting Page5 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. Storage Section 13 of the Norwegian Bookkeeping Act states that the following accounting material must be stored for ten years: Annual accounts, annual reports and auditor's reports Other statutory financial reporting (tax returns, VAT returns etc.) Specification of statutory financial reporting (ledgers, posting records etc.) Numbered letters from the auditor Documentation of book entries and deleted information (vouchers) Accounting system documentation Balance sheet documentation Some additional requirements apply to certain trades and industries, for example hotels and foodserving establishments, hairdressers and taxi drivers. Some documents only have to be stored for 3 1/2 years. They are: - Agreements of importance to the enterprise - Correspondence containing material additional information to that entered in the books - Outgoing packing notes etc. existing in hardcopy at the time of delivery - Price lists required by law/regulations Accounting material shall be stored in an orderly manner and be adequately secured against destruction and theft. Throughout the storage period, it must be possible to present the accounting material to public supervisory authorities in a form that enables it to be reviewed. How to calculate VAT in an accounting system VAT is easy to deal with using VAT codes. You must always enter the invoice amount inclusive of VAT and then indicate how the amount is to be processed for VAT purposes by means of a VAT code. The codes vary somewhat from one system to the next. The most common VAT codes are: 0 No VAT processing 1 Deduction for input VAT 3 Output VAT. The book entry may take the following form: DATE VOUCHER ACCOUNT VAT AMOUNT NO 22.12 15030 6800 1 1,500 This shows an incoming invoice for office supplies entitling to a deduction for input VAT. The invoice amount inclusive of VAT is NOK 1,500. When this is registered to account 6800 using VAT code 1, the system will make the following postings: Account 6800 office supplies, debit NOK 1,200 Account 2710 input VAT, debit NOK 300 Account 2400 trade creditors, credit NOK 1,500 When you have booked all vouchers for the period, you can generate a VAT return from the accounting system. How to keep your vouchers in order You may choose to keep your vouchers in a ring binder, ordered by date. If you only have a few vouchers in the course of a year, this is a simple system that makes sense. But if you have many vouchers, it soon becomes difficult to keep an overview. It is much quicker to register vouchers if the accountant can work with long series of similar vouchers. Place the vouchers in a ring binder. Use a divider for each type of voucher. Guide to accounting Page6 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. If you have many vouchers, you should use one ring binder for each accounting period. One common way of sorting vouchers is as follows: 1. 2. 3. 4. 5. Miscellaneous vouchers Bank Cash – ordered by date Incoming invoices Outgoing invoices – ordered by number The oldest vouchers are at the back under each divider. The newest vouchers are at the top of the pile. The accountant will always start at the back of the binder and work his/her way forward numbering the vouchers consecutively. If you have many bank vouchers, you should separate incoming and outgoing payments. If your enterprise uses several bank accounts, they should be sorted separately. Set aside sufficient time to look through incoming mail every day. Check immediately that incoming invoices tally with the packing notes received. Is the quantity on the invoice the same as the quantity received and of the requisite quality? If the invoice is correct, you can sign to confirm it and place it directly in the voucher binder. If you use internet banking, you can schedule payment on the due date. Remember that the invoice must be included even if it is not paid by the end of the period. Whether a voucher belongs to the period or not depends on its date (the 'voucher date'). If you in any one month receive an invoice for goods or services delivered in the previous month, a copy of that invoice shall be placed in the voucher binder and marked with 'copy – to be accrued'. If you receive an invoice for deliveries to be made in the following period, it shall be entered in the books as a pre-paid expense. The expenses are incurred on the date when the delivery takes place. Only the net amount is accrued; VAT follows the invoice date. What more can you do? An orderly voucher system saves time for you, or your accountant if you have one. Consider each voucher at the end of the month to determine which period it belongs to. If you have an external accountant: Deliver the voucher binder to the accounting firm as soon as you have received the bank statements. Write a small explanation on any vouchers that are not self-evident. Respond quickly when the accounting firm asks for documentation. Limit private withdrawals to one or two transfers to your private account per month. The fewer private transactions your business has, the better. You should therefore use a separate bank account for business purposes. More information can be found at Tax calendar Electronic submission of VAT return Guide to accounting Page7 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 3. Understanding accounts What do the profit/loss account and balance sheet tell us? The relationship between liquidity and equity. The relationship between liquidity and profit. Can you save tax by faster loan repayment? Will you save tax by investing this year? The accounts are based on a standard. Roughly speaking, the accounts consist of two parts: the profit/loss account and the balance sheet. What are accounts? Accounts are meant to provide the reader with financial information, and they are an important tool in the financial management of an enterprise. The accounts are an aid that provides you with an overview of your earnings, consumption of input factors, what you own and what you owe. The balance sheet gives an overview of the enterprise's financial position at the end of an accounting period, while the profit/loss account shows the enterprise's financial development during that same period. What does the profit/loss account show? The profit/loss account is a statement of income and expenses. Revenues are assigned account numbers between 3000 and 3999, while expenses are assigned account numbers between 4000 and 8999. Use of a standard accounts chart is an assurance that you will be able to meet all official requirements for specification of your enterprise's accounts: Account Content of account category 3000 - 3999 Revenues 4000 - 4999 Cost of goods 5000 - 5999 Payroll expenses 6000 - 6099 Depreciation 6100 - 7999 Other operating expenses 8000 - 8199 Financial income and expenses 8200 - 8999 Extraordinary items, tax and allocations = Profit/loss The profit/loss is the enterprise's actual profit or loss for the period. If rent is paid per quarter, only rental payments for the relevant accounting period should be expensed. Other rental payments should be entered as pre-paid rent. The accounts have been accrued when they show actual income and expenses for the period. Typical accruals items: Depreciation Insurance Interest Holiday pay Employer's National Insurance contributions Accrued, not invoiced revenues Changes in stocks of goods Guide to accounting Page8 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. The profit should cover the enterprise's taxes and dividends. Any remaining profit after tax and dividends is added to equity and carried forward to the subsequent year. Retained profit strengthens the enterprise's equity. The enterprise increases its solidity and builds up a buffer, so that it is better able to take a loss in future. Make sure that you retain some of the profit until the enterprise's equity corresponds to between 20 and 25% of its assets. If you are operating a sole proprietorship, the profit must also cover the owner's 'salary', i.e. private withdrawals and taxes. What does the balance sheet show? As the name tells us, a balance sheet has two sides that must balance. What assets do we have and how are they financed? The balance-sheet equation: total assets = total equity + liabilities. When the accounts are settled and the profit/loss is transferred to the balance sheet, the two sides of the balance sheet must always be equal. If they do not, you must have made a fundamental mistake somewhere. Additions to assets are always accompanied by a corresponding reduction of other assets, or a corresponding increase in liabilities or equity. Similarly, an increase in a liability account must be accompanied by a corresponding increase in assets, or a reduction in another liability account or in equity. Obviously, a combination of the above alternatives is also possible. Account Content of account category 1000 - 1399 Tangible assets (investment of more than NOK 15,000 and long-term receivables) 1400 - 1999 Current assets (stocks of goods, receivables and bank deposits) = Total assets 2000 - 2099 Equity 2100 - 2299 Long-term liabilities (debt with more than one year to maturity) 2300 - 2999 Short-term liabilities (overdrafts, trade creditors, accrued expenses) = Total financing When tangible assets are acquired, they must be entered in the balance sheet and the asset must be depreciated (expensed) over time. There is a big difference between depreciation for accounting purposes and depreciation for tax purposes. Enterprises that only have a bookkeeping obligation or that have a limited accounting obligation need only observe the tax-related depreciation rules. Tangible fixed assets and significant operating assets that decrease in value due to wear and tear etc. are depreciated for tax purposes using the reducing balance method of depreciation. An operating asset is deemed to be a tangible fixed asset when it is expected to have a service life of at least three years from the date of acquisition. An operating asset is deemed to be significant when the cost price is equal to or exceeds NOK 15,000 (excl. of VAT). The balance sheet says a lot about the enterprise's 'health condition'. An experienced reader of accounts will form an impression of financing, stock-keeping, investments, credit periods and liquidity. As a rule, all investments should be based on long-term financing. This means that equity plus longterm liabilities should be at least equal to fixed book assets. You should also ensure 20-25% equity financing. Equity financing improves the enterprise's ability to cope with a recession. Limited companies are required by law to have 'adequate' equity. Board members are personally liable if the board fails to act correctly when more than half the enterprise's equity is lost. Guide to accounting Page9 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. More about the relationship between profit/loss and the balance sheet When establishing an enterprise, you are required to prepare an opening balance (sheet). We distinguish between opening balance and closing balance. The opening balance is the initial balance of an enterprise. On closing the first accounting period, you get a new balance, which is the closing balance of the enterprise on the date that you have chosen to settle the accounts. This closing balance will be the opening balance at the start of the next period. In other words, a profit means an increase in equity, while a loss means a reduction of equity. What you get is a new balance sheet that shows how your assets are currently financed. At the end of the period, all accounts in the profit/loss account are set to zero, so that you start the new period with a clean sheet. This can be illustrated by the following example: You invoice sales to a customer for NOK 1,000. This involves debiting NOK 1,000 to the balance-sheet account 'Trade debtors' and crediting NOK 1,000 to the profit/loss account 'Sales'. When the amount in a balance-sheet account is increased or reduced 'through' changes to a profit/loss account, the balance sheet becomes imbalanced. This 'imbalance' corresponds to the profit/loss for the period. The balance-sheet balance is restored by transferring the profit/loss to the balance sheet equity. At the start of a new accounting year, the balance of the balance-sheet accounts will be transferred, while the profit/loss accounts are reset to zero. The difference between income and expenses (profit/loss for the year) is the only item that is transferred from the profit/loss account. The profit/loss is added/deducted from the balance-sheet equity. Equity at the end of the period is thus equal to equity at the start of the period +/- profit/loss for the period. What is the relationship between liquidity and equity? There is no direct relationship between liquidity and equity. It is a common misconception that an enterprise with a book equity of NOK 150,000 has NOK 150,000 'in the bank'. Liquidity consists of bank deposits plus unused overdraft facilities. Equity is paid-up capital plus any retained profit. In other words, equity does not consist of cash, but is an indication of what proportion of the enterprise's assets is owned by the enterprise itself. The rest is owned by the bank and other creditors. What is the relationship between liquidity and profit? There is no direct relationship between liquidity and profit. An enterprise can be insolvent, even if it makes a large profit. It is true that a profit can strengthen liquidity, but liquidity is also influenced by instalments on longterm loans, new investments, additions to stock, outstanding receivables, payments to suppliers and distributions to owners. Can you save tax by faster repayment of loans? No, there is no tax deduction for loan instalments, only for the interest you pay. Will you save tax by investing this year? Yes, you can save tax by investing in December rather than waiting until January next year. If the procured operating asset is worth more than NOK 15,000, it must be capitalised however. You are entitled to full depreciation for tax purposes even if the investment is made in December (provided that the delivery is also made in December). In connection with investments, it may be useful to be acquainted with some of the most important depreciation rates: Office machinery, computer equipment: 30% Lorries, trailers etc. 20% Passenger cars, fixtures and fittings 20% Guide to accounting Page10 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 4. Budgets – a management tool Must you have a budget? How to prepare a budget. Do you have adequate funding? Budget simulation. Monitoring performance. Do you need to have a budget? In order for the enterprise to be favourably placed at start-up, you must have made plans and defined a system for measuring the effect of what you do. You work within a financial framework, and all decisions have consequences. Without a budget, you will be groping in the dark. You will not know where you are going or how far you have come. How to prepare a budget Your budget should be based on your business plan and, if applicable, the previous year's accounts. 1. Performance requirements Review the accounts, one by one. Use a spreadsheet. The following setup may be useful for preparing a rough budget: Account Description Last year’s Change result Next year's budget 3000 Revenues (goods sold) 500,000 + 5% 525,000 4300 Cost of goods 300,000 + 5% 315,000 5000 Payroll expenses 100,000 + 3% 103,000 5092 Holiday pay 10,000 + 3% 10,506 5400 Employer's National Insurance contributions 15,538 + 3% 16,004 5990 Other social costs 15,000 unchanged 15,000 When you have reviewed all income and expenses, you start on the second phase of the budget work. Will the profit/loss satisfy your own and the owners' goals? In a limited company, the owners will probably require a return in the form of dividends. You will probably have to review your plans again in order to identify possible cost cuts, changes and opportunities for increasing income. When you have a budget that provides a satisfactory profit/loss, you are ready to proceed to the next step: 2. Monthly performance budget If you wish to compare your budget and accounts each month, you must prepare a month-on-month budget. What will be your income and expenses each month? Take account of seasonal variations and estimate revenues and cost of goods each month. Do seasonal variations affect payroll expenses? 3. Liquidity budget If you are about to make investments, take up new loans or have poor liquidity, you will need a liquidity budget. A liquidity budget simulates loan instalments, credit periods, tax payments etc. A spreadsheet may have certain shortcomings when many parameters have to be taken into account. It may be a good idea to request the help of your accountancy firm in preparing the liquidity budget. Guide to accounting Page11 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 4. Evaluation of financing A well-prepared liquidity budget will be able to uncover any unnecessarily tied-up capital and poor financing solutions. Based on the assumptions entered in the budget system (income, expenses, credit periods, interest rates etc.) you will be able to view month-on-month liquidity developments. A clothing shop typically has 60% of its turnover during the second half of the year. Such significant seasonal variations will have a great impact on liquidity. 5. Budget simulation A thoroughly prepared liquidity budget is also a good basis for assessing the effects of new investments and new financing. The budget allows you to play with various business scenarios on paper. What if there is a 1% increase in the gross profit? What if the credit period is reduced by ten days? What if we repay the overdraft and take out a long-term mortgage loan? These are fun, interesting and very important exercises that you can do alone or together with your accountancy firm or auditor. You will be surprised how great the effects can be of seemingly small and simple measures. An experienced budget user can provide you with much input so that you can increase the enterprise's profitability and have more financial leeway. 6. Monitoring performance The final step in the budget process is to check actual accounting figures in relation to the budget. Most accountancy software will be able to present accounting figures and comparable budget figures in a single report. When you check actual income and expenses in relation to the budget, you will see whether the performance of your enterprise is good or poor in relation to the goals you set yourself. You will be able to identify budget variances at an early stage. Some variances are acceptable. If you have a problem with your earnings, any budget variance will require a correction of the course. You should correct your course while you still have momentum! Perhaps you need to return to phase one in the budget process in order to review the plans? More information, in Norwegian only, can be found at Example of business plan Example of operating budget Example of liquidity budget Financial key ratios/figures Guide to accounting Page12 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 5. Reporting requirements Are you liable to VAT? Reporting (VAT, annual accounts, tax return, employer's National Insurance contributions, payroll withholding tax) VAT returns Anyone operating an enterprise that is liable to VAT must submit a VAT return every other month (for each period). Enterprises with sales liable to VAT of less than NOK 1 million exclusive of VAT can apply to the tax office to submit annual VAT returns. The VAT return shall be submitted even if the enterprise has been without activity. The accounts must not be changed once the VAT return has been submitted (the period must be locked for editing). If you fail to submit a VAT return, the tax office will stipulate an amount that you will subsequently be required to pay. If you then submit a VAT return, the tax office will disregard the stipulated amount. You must always be ready to pay an additional charge of 3% of output VAT, however. The tax office calculates interest on overdue payment. Public agencies are quick to contact the Enforcement and Execution Commissioner in order to collect their claims. If you are smart, you will submit the VAT return and pay outstanding VAT in time. You can submit the VAT return electronically via Altinn. On electronic submission, you will be notified immediately of any accounting errors or missing information in your VAT return. The deadlines are the same as for submission on paper, however. You can read more about VAT in 'Value Added Tax – Guidelines for businesses' Annual accounts All private and public limited companies, foundations, housing associations, housing cooperatives etc. that are under an obligation to submit annual accounts pursuant to the Norwegian Accounting Act Section 1-2 must submit their annual accounts. No later than one month after adoption of the annual accounts, those who are obliged to submit accounts shall send a copy of the annual accounts, the annual report and notes to the Register of Company Accounts in Brønnøysund. Those who are subject to an auditing obligation must also submit the auditor's report. The reporting obligation applies from the date on which the enterprise is established, including to enterprises that are being wound up, until the date of deletion from the Register of Business Enterprises. The obligation exists even if the enterprise has not had any activity. If the annual accounts are not submitted to the Register of Company Accounts by 1 August (or 1 September via Altinn), the enterprise will be subject to a penalty charge. The penalty charge increases every week and can reach a total of around NOK 45,000. Members of the board are jointly and severally liable for payment. In practice, a remission of this charge is very difficult to obtain. Tax returns Pre-completed tax return for self-employed persons etc. Just like tax returns for wage earners, the tax return for self-employed persons (RF-1030) has been pre-completed with information received from employers, banks, financial institutions and kindergartens, among others. The tax return for self-employed persons has a separate page for entering business items. You will still need to fill in the necessary business forms. Guide to accounting Page13 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. Easier to submit online If you do not have an accountant or an annual accounts program, the quickest and easiest way to submit your tax return is to submit it via the internet. You will find your pre-completed tax return and all relevant attachment forms in your message box in Altinn. Self-employed persons using Income Statement 1 (RF-1175) can get help in Altinn to fill in the necessary attachment forms and transfer values between the forms. You will find support in control and help functions during the filling-in process. Your tax return is stored for ten years in your own electronic archive at www.altinn.no. If you submit your tax return electronically, the tax settlement notice will also be sent to you electronically. For persons using an annual accounts program Users of annual accounts programs are already used to quick and simple electronic submission of their tax returns. The web service has been extended so that preliminary information from the Norwegian Tax Administration can be downloaded to your annual accounts program. Self-employed persons etc. who wish to submit their tax return before 1 April can do so from midFebruary using an annual accounts program (without obtaining preliminary information). Important dates for self-employed persons etc.: 30 April: deadline for submitting your tax return on paper 31 May: deadline for submitting your tax return electronically via www.altinn.no For companies and partnerships: 31 March: deadline for submission on paper 31 May: deadline for electronic submission The tax return is submitted electronically via www.altinn.no. Ordinary wage earners submit their pre-completed tax returns by 30 April. Shareholders in private limited companies must check that any share dividends received and their calculated personal income are included on the tax return. Employer's National Insurance contributions and payroll withholding tax Employer's National Insurance contributions and payroll withholding tax (tax deducted from employees' pay) shall be paid to the tax collection office every other month. Tax deducted shall be deposited in a separate bank account no later than on the first business day after pay day. The amount will remain there until the tax deducted is transferred to the tax collection office. As an alternative, the enterprise can provide a bank guarantee in an amount great enough to cover the amount deducted at all times. It is up to you to calculate employer's National Insurance contributions and pay the amount to the tax collection office / tax collector. Employer's National Insurance contributions are paid directly from the enterprise's current account. Certificates of Pay and Tax Deducted: Certificates of Pay and Tax Deducted and the accompanying cover letter are submitted in the year following the accounting year, subject to the following deadlines: 20 January: deadline for submission on paper 31 January: deadline for electronic submission You can read more about tax deducted and employer's National Insurance contributions in Chapter 8 'Payroll procedures' Guide to accounting Page14 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. More information can be found at: Electronic submission of VAT returns Electronic submission of tax return for self-employed persons etc. Annual accounts – submission obligation Guide to accounting Page15 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 6. Invoice your sales quickly and correctly What should an invoice look like? Should you add VAT? How often should you invoice? How much does the credit period cost? If you are supplying goods or services on credit, you should issue the invoice as soon as possible after delivery. It is important that the money comes in quickly. As a result of poor invoicing procedures, some people actually forget to invoice deliveries. In other instances, invoices are so poorly filled in that they provide a basis for the tax authorities to increase the issuer's income by discretionary assessment. What should an invoice look like? Date of issue Computer-generated or pre-printed number The seller's name and organisation number, followed by the letters MVA if the enterprise is registered in the VAT Register The buyer's name, address or organisation number (some exemptions exist for cash sales) A clear description of the goods or service Nature and scope of the goods/service provided Price of the goods or service and due date for payment. Time and place of delivery If applicable, VAT and other taxes For limited companies, public limited companies and branches of foreign enterprises the word ‘Foretaksregisteret’ must be stated on all sales documents Sales liable and not liable to VAT and sales that do not fall under the scope of the Norwegian VAT Act shall be stated and added up separately. The same applies to sales that are subject to different VAT rates. Invoices must be issued in at least two copies, one of which shall be retained by the seller. Incorrectly filled-in invoices must be kept but marked as 'discarded', so that the number series of the invoices remains intact. Where outgoing invoices are entered manually in the books, the 'discarded' invoices can be left out. Where amounts are transferred automatically from the accounting system's invoice module to the books, incorrectly filled-in invoices must be credited internally. Should you add VAT? In principle, everybody registered as liable to VAT must add VAT to all outgoing invoices, regardless of who the recipient is. Exemptions apply to exports and the sale of used cars, among other things. How often should you invoice? You should invoice the goods/service as soon as possible after delivery, preferably on the same day as the delivery takes place. Reminders When an invoice has fallen due, you should send a reminder as soon as possible. The faster you put forward your claim for the invoiced amount, the more likely you are to get it. Guide to accounting Page16 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. How much does the credit period cost? In recent years, the number of debt collection cases has increased significantly. One reason is that customers often try to stretch the credit as much as possible. What does it actually cost if the customer uses the credit period to the maximum? Assuming that you have a credit facility of 9% and credit sales of NOK 4 million, you will earn NOK 20,000 if you are able to reduce the credit period by 20 days. 7. Cashing up Minimum statutory requirements for cashing up, and how to do it. What are the minimum statutory requirements for cashing up? Your cash etc. should be counted and reconciled every day. You will often be personally liable if cash differences cannot be explained. Reconciliation is an accounting exercise that shows the relationship between the day's sales and the cash that is counted. This exercise can be time-consuming if you have used the cash register for advance payments, purchases and private withdrawals. How to cash up Use one cash register and one cash box: The cash register is used for the day's cash sales and the cash box is used for paying bills etc. The cash box is used for paying small bills. You can, for example, start with NOK 3,000 in cash. When small bills have been paid with money from the cash box, the cash and amounts for which you have receipts in the cash box will always add up to NOK 3,000. Make sure you have vouchers Make sure that all expenditure is documented by vouchers. If you do not have a voucher, you must write a note stating what the amount has been spent on and any important accounting information. The cash box must be reconciled for each accounting period so that the vouchers are included in the correct period. If the box contains NOK 10 plus receipts for NOK 1,990, you must ensure that you remove exactly NOK 1,990 from the cash register. Put the money in the cash box and attach the receipts to the back of the withdrawal voucher. Place the withdrawal voucher in the voucher binder. When purchases are paid for in cash, remember to ensure that your enterprise's name is included on the voucher. Make it a rule to always use bank transfers for private withdrawals (and advance payments to employees). Keep cash payments to a minimum by requesting monthly invoices for small day-to-day expenses (petrol, office supplies, groceries, computer equipment etc.). Register every sale on the cash register Ring up every cash sale on the cash register when the sale is made. If you are a hairdresser or running a hotel or food-serving establishment, there are special statutory requirements for specification of sales according to product group. Enterprises with a bookkeeping obligation that engage in ambulant or sporadic cash sales are exempt from the requirement to have a cash register, provided that the value of the ambulant or sporadic activities does not exceed three times the National Insurance basic amount in the course of an accounting year. These enterprises can instead document cash sales on a continuous basis in a bound ledger the pages of which are pre-numbered, or by keeping copies of dated, pre-numbered sales vouchers. Guide to accounting Page17 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. The Norwegian Directorate of Taxes has written an article about the interpretation of the terms 'sporadic' and 'ambulant' (in Norwegian only). The Norwegian Tax Administration: Article on ambulant and sporadic cash sales Deposit cash from sales in the bank Cash received on the sale of goods etc. should be deposited in the bank regularly, preferably every day. Ask your bank about night safe arrangements etc. Cash up and reconcile the cash register every day Run day reports from the cash register and count your cash. The day report (Z report) must be dated and signed, and the time of running the report must be stated. In practice, you will start the day with a fixed amount of cash, for example NOK 3,000. Reconciliation is then carried out as follows: Opening balance + Today's revenues (take to income) - Card payments (to bank account) NOK 3,000 carried over from yesterday NOK 10,000 in accordance with day report from the cash register NOK 1,000 customers who have paid by card = Calculated cash balance NOK 12,000 - Counted cash balance NOK 12,050 Shortfall (+) Surplus (-) Corrected cash balance . -NOK 50 The cash difference is entered in a separate account in the accounts NOK 12,050 . - Night safe deposit (in bank account) NOK 9,050 . Closing balance NOK 3,000 to be carried over to the following day Cash reconciliation is carried out using a form. Use a new form every day. The form must be dated and signed by the person who cashed up. Attach the day report from the cash register and the card sales report to the back of the form. File the forms continually in the voucher binder under a separate divider for cash. If the cash differences exceed +/- NOK 50 per day, you must review the procedures together with your employees. Remember that the cash box should be used for expenses, if any. The possibility of making errors is reduced if the cash register is used to calculate the amount to be returned to the customer. More information can be found at: The Bookkeeping Regulations Guide to accounting Page18 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 8. Payroll procedures What must you remember before you pay your employees? Can you leave payroll procedures to the accountancy firm? Can you pay your employees yourself? Travel expenses claims. Many entrepreneurs find that they have to make major changes to their accounting procedures when they start to employ others. Many choose to employ the requisite competence, or they outsource the accounting and payroll administration to an accountancy firm. If you wish to handle payroll administration and reporting yourself, the regulatory framework that you need to observe is extensive. If you are only required to calculate pay and deduct tax for your employees, you can create a spreadsheet to keep the figures in order. Payroll withholding tax As an employer, you are obliged to deduct tax from pay and other remuneration paid to your employees. The amount to be withheld is stated on the employees' tax cards. If you are an employee of your own limited company, you must also deduct tax from payments made to yourself. Among other things, tax deductions have to be made for free board and lodging, free use of a company car and the benefit of low-interest loans from the employer. The employee shall present you with a tax card on which the amount to be withheld is stated. If the employee does not present you with a tax card, you must deduct 50% withholding tax. The amount deducted shall be deposited in a tax withholding account no later than on the first business day after pay day. You can also establish a bank guarantee instead of a tax withholding account. The tax deducted must be paid to the tax collector on the same day as you submit the payment record forms for the period. Payment record forms showing the amount of tax deducted during the past two months must be sent to the authorities via Altinn or to the tax collector in the municipality where the enterprise is domiciled or has its head office. Employer's National Insurance contributions When you have employees in your service, you are obliged to pay employer's National Insurance contributions on pay and other remuneration paid to your employees. If you are an employee of your own limited company, you must also pay employer's National Insurance contributions on payments to yourself. It is up to you to calculate employer's National Insurance contributions and to pay the amount to the tax collector every other month. Payment record forms showing the amount of employer's National Insurance contributions calculated during the past two months should preferably be submitted via Altinn. On submission via Altinn, a receipt will be generated containing a Customer ID (KID) number and an account number for the tax collector. If it is not possible for you to submit the form via Altinn, you can submit it on paper to your local tax collection office. You can generate a KID number at skatteetaten.no/kid. There, you will also find a link to the account numbers of individual tax collection offices. If you wish to receive a payment giro, please contact your local tax office to arrange it. Employer's National Insurance contributions are paid directly from the enterprise's current account. Certificates of Pay and Tax Deducted After the turn of the year, Certificates of Pay and Tax Deducted shall be submitted for each individual employee. The employee shall also receive a copy. The deadline for submitting Certificates of Pay and Tax Deducted electronically or via Altinn is 31 January. If you submit them on paper, they must be sent to the tax collector before 20 January. Guide to accounting Page19 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. Annual Statement of Employer's National Insurance Contributions / cover letter for Certificates of Pay and Tax Deducted Employers who submit Certificates of Pay and Tax Deducted on paper shall send the annual statement to the tax collector together with the Certificates of Pay and Tax Deducted by 20 January. Employers who have submitted these certificates electronically must send the statement as soon as they receive confirmation of receipt of the data. Employers who submit Certificates of Pay and Tax Deducted via Altinn will get a pre-completed annual statement from the Norwegian Directorate of Taxes and are therefore not required to submit this form. Spouses and children When both spouses work in a single proprietorship, the profit from the activities (net business income) can be allocated for taxation according to the hours worked by each of the spouses. The submission of Certificates of Pay and Tax Deducted is not required for this income. Pay and other remuneration paid to children/youths working in their parents' enterprise shall be reported. Can you leave the payroll procedures to the accountancy firm? If you have many employees, travel expense claims, insurance schemes, free company car and/or free telephone, it may be a good idea to buy this service from an accountancy firm. This also gives you a partner that can support you in personnel matters. Problems often arise concerning the Holidays Act, leave of absence, lay-offs and notices/dismissals. The accountancy firm needs to receive a confirmed pay basis on a fixed date. The pay basis shall include all information that is necessary in order to make correct payments. The pay basis may take the following form: Employee Pay Supplements Advance payment Other 01 Hansen Fixed . . . 02 Nilsen Fixed Bonus 5,000 5,000 . 03 Pettersen 20h x NOK 150 . . . Confirmed travel expenses forms are enclosed with the pay basis. Can you pay out salaries yourself? Small enterprises often choose to pay out salaries themselves. In connection with each payroll run, you must fill in a simple form. Use spreadsheets to create a template for each of your employee. Employee's name: Personal ID number: Position: Tax municipality: Tax table number and/or deduction rate on tax card: Pay day: Pay for the period: from................... to .................... Gross pay: Basis for deduction of tax etc.: - Tax withholding: = Payment to be made: To be paid into account number: 1234.56.78900. Basis for holiday pay: Guide to accounting Page20 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. The employee and the accountancy firm shall have a copy of the pay slip. You must then send a list to the bank showing the amount to be paid to each employee. You must also inform the bank about the amount of tax deducted to be transferred to the payroll withholding tax account. Can you leave the reporting to the accountancy firm? You can let the accountancy firm register the information in a payroll system and submit payment record forms and Certificates of Pay and Tax Deducted on your behalf. Some enterprises prefer to fill in the payment record forms themselves, while they leave it to the accountancy firm to prepare Certificates of Pay and Tax Deducted. You should consult with the accountancy firm and agree on what is most appropriate in your case. If you leave it to the accountancy firm to do all the official reporting while you make the payments yourself, you have in effect outsourced so much of the payroll procedure that you might as well leave all the accounting to the accountancy firm. How to prepare a travel expenses claim Employees are not automatically entitled to have their travel expenses covered in accordance with the government rates. In your capacity as employer, it is you who decide how much to pay. Even if you make payments in accordance with the government rates, you must inform about these payments on the Certificates of Pay and Tax Deducted. This applies to what is called reportable benefits, for example subsistence allowances and night supplements. If necessary information is not included in the travel expenses claim, the recipient risks having to pay tax on the payment received. A travel expenses claim must contain: The employer's name and address The employee's name, address and signature Date (and time for subsistence allowance) of departure and return The purpose of the trip Which event(s) the employee attended When a subsistence allowance is claimed, the travel expenses claim must also include the following: Name(s) and address(es) of the place(s) where the employee stayed overnight, and the dates of overnight stays The type of accommodation (hotel, guest house or private accommodation) must also be stated when a night supplement is claimed. When a car allowance is claimed, the travel expenses claim must also include the following: Travel route, stating the place of departure and the place of arrival, local driving at the place to which the employee was assigned, and any reasons for making detours The total distance driven based on the car's odometer reading at the start and end of each job-related or business trip The name(s) of any passenger(s) for whom a passenger supplement is claimed. For reimbursement of expenses, the travel expenses form must also include: All expenses documented by receipts/ original vouchers (flights, taxis, overnight stays etc.). The Ministry of Government Administration and Reform has published updated rates and a program for preparing travel expenses claims here. Be particularly careful to fill in where you have stayed overnight. The government subsistence allowance rates for business travel with overnight stays in Norway are the same regardless of the type of accommodation. For private accommodation, however, the rate not subject to payroll withholding tax (the 'portacabin rate') is reduced. If you use the government rate as a basis, the subsistence allowance in connection with private accommodation must be split into one part that is subject to tax and one part that is not. The night supplement is not subject to tax, however. One day means the time of departure plus 24 hours. Note that you can claim a subsistence allowance for two days when travelling time extends into the next day by more than six hours. Guide to accounting Page21 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. Sole proprietors cannot claim travel expenses using the government rates, but must document all expenses by vouchers. The proprietor is granted a deduction for use of a private vehicle; see page 4 of the income statement. More information (in Norwegian only) can be found at: Wage ABC Norwegian Tax Payment Act Tax calendar Government travel allowance rates Guide to accounting Page22 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. 9. Stocktaking – why and how What is required by law? How to establish good procedures. Checklist for stocktaking. Section 11 of the Norwegian Bookkeeping Act states that, in connection with the closing of accounts at year end, documentation must be available for all balance-sheet items unless they are insignificant. Stocks of goods are a significant balance-sheet item in many enterprises. This means that businesses must take stock of all goods owned at 31 December. Stocktaking can be time-consuming, depending on the quantities stocked. Good procedures relating to stocktaking can prevent unnecessary use of time. You must also consider when to take stock and whether the enterprise needs to close during stocktaking. If a shop stays open during stocktaking, it may for example prove difficult to keep an overview of the goods that are removed from stock while stocktaking is going on. Stocktaking is therefore often carried out after closing time or on the nearest holiday/day off. The timing should in any case be consistent with the closing date for the accounts, which for most people is 31 December. The stocktaking shall be documented using stock lists; see the Norwegian Bookkeeping Regulations Section 6-1. These lists must contain a specification of the type, quantity and value of each of the goods, and a column stating the total for each of the specified goods. A distinction must also be made between the accounting value and the tax value, as these two will often differ. For enterprises with a bookkeeping obligation that do not at the same time have an accounting obligation pursuant to Section 1-2 of the Norwegian Accounting Act, it is sufficient to assess the tax value of their stock, including for accounting purposes. For tax purposes, goods must always be valued at original cost (original cost = purchase price + related expenses (e.g. customs duty, freight, dispatch etc.) - discounts/bonuses). Stock write-downs on account of obsolescence or lower market prices are not permitted for tax purposes. Enterprises with an accounting obligation must assess both accounting values and tax values. The lowest of original cost and fair value shall be used for accounting purposes (see Section 5-2 of the Accounting Act). It is permitted to write down obsolete stock for accounting purposes. Checklist for stocktaking: Plan stocktaking well in advance; if possible, tidy up the storeroom/warehouse before you start. Stock sheets should be printed from the warehouse system, with specification of all the goods types. Prepare stocktaking instructions if more than one person is involved. Use pre-numbered stock lists or, if applicable, a stock book. Make sure you have a good system for keeping an overview of what you have taken stock of at any time. All goods must be included on the list, including obsolete items. Do not forget that stock must be accrued: o If you take stock before 31 December, you must remember to add goods that have arrived between the stocktaking date and 31 December. o If you take stock after 31 December, you must deduct any goods bought between 31 December and the stocktaking date. o Only goods that have been purchased but not sold as of 31 December must be included. The lists must be dated and signed by the person who carried out the stocktaking. Guide to accounting Page23 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive. In manufacturing enterprises, stock is classified according to whether it consists of raw materials, semi-manufactured goods, work in progress or finished goods The stock lists are accounting vouchers and must be stored for ten years. Example of stock list design Guide to accounting Page24 of 24 Altinn would like to emphasise that the information presented here is of an introductory/general nature and that the guide is not exhaustive.