our Caterpillar paper - University of Miami School of Business

advertisement

Submitted for publication. Updated on September 4, 2014.

Restructuring the Backhoe Loader Product Line at

Caterpillar: A New Lane Strategy

Masha Shunko

Krannert School of Management, Purdue University, mshunko@purdue.edu

Tallys Yunes

School of Business Administration, University of Miami, tallys@miami.edu

Giulio Fenu

Caterpillar Inc., fenu giulio@cat.com

Alan Scheller-Wolf

Tepper School of Business, Carnegie Mellon University, awolf@andrew.cmu.edu

Valerie Tardif

SAP, vtardif@sap.com

Sridhar Tayur

Tepper School of Business, Carnegie Mellon University, stayur@andrew.cmu.edu

Caterpillar recently embarked on an ambitious program to radically change how it markets and sells key

products of its Building Construction Products division (BCP). The goal was to move from a strict build-toorder strategy, in which customers selected one of millions of possible configurations, to a Lane Strategy in

which the majority of their customers would choose machines from just over 100 configurations. To successfully make such a radical change Caterpillar needed to quantify how customers would potentially react to the

new strategy, and how such a drastic simplification of their product line would affect their manufacturing,

sales, and service costs. We embarked on a study with Caterpillar to explicitly model customers’ reactions to

reduced product lines, to estimate the (positive and negative) effect such variety has on Caterpillar’s costs

– the cost of complexity – and ultimately help them design and implement this strategy for their flagship

BCP product, the Backhoe Loader. Based on our analysis, Caterpillar began implementing the new strategy

with their 2010 price list, moving completely to the new strategy in 2011. Since that time Caterpillar has

expanded their Lane strategy throughout all of their product lines, fundamentally remaking their business.

Key words : product portfolio optimization; cost of complexity; manufacturing; machinery

1. Introduction

In 2010 Caterpillar (CAT) unveiled a dramatically new strategy for pricing and marketing their

“BHL” series of small backhoe loaders, one of the most popular products within their Building

Construction Products (BCP) division. This new strategy has radically changed how BCP markets

and sells their small machines, focusing the bulk of CAT’s customers on a few popular models.

1

2

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Previously, BCP offered customers an almost unlimited variety of products, built-to-order, priced

according to an itemized price list. This maintained very high customer satisfaction, but greatly

complicated BCP’s supply chain and service operations: With such broad demand dealers had to

hold large amounts of inventory to give a representation of the many possible choices. Moreover,

Caterpillar had to maintain documentation and provide service for an extremely heterogeneous

group of machines, driving up their costs. Finally, as demand was fragmented across thousands of

configurations, forecasting was problematic, leading to frustration among CAT’s supply base.

Thus CAT’s BCP division saw great potential for a rationalization of their BHL product line.

But there were three crucial questions that needed to be answered before such a new strategy could

be devised and implemented:

1. “How would customers react to a product line reduction?” Answering this question required

developing an understanding of how customers value different machines.

2. “How much could be saved by focusing their BHL product lines?” Answering this question

required developing an understanding of the general form of the cost of complexity.

The answers to these two questions could help Caterpillar answer the ultimate question:

3. “How should we configure our new BHL product line?” Specifically, which machines should

we offer, and at what prices?

The primary contribution of this paper is to demonstrate the power of our three-step analytical

framework for product line simplification. Step 1 answers question 1 by capturing customer behavior

using migration lists; step 2 answers question 2 by creating a detailed mathematical representation

of the company’s cost of complexity (CoC); and step 3 answers the final question by combining the

migration lists and the CoC function into an optimization model that proposes an improved product

line. The generality and flexibility of our framework stem from the fact that the mathematical

and statistical techniques used in steps 1, 2, and 3 can be tailored to the situation at hand, as

long as they produce the output required by each subsequent step. We also demonstrate that our

framework can be used as an effective what-if tool for managers, allowing them to successfully

evaluate different solutions under varying problem conditions.

To answer CAT’s first question we leveraged BCP’s extensive dealer network to gain an understanding of the segmentation, preference patterns, and price sensitivities of BCP’s customer base.

We combined this dealer knowledge with the entire line’s sales history over the previous two years

to construct a detailed analytical model of customer preferences and substitution (see Section 4).

This produced a model of how BCP’s customers would react to changes in the product line.

To answer the second question, we built a detailed model to estimate the total direct and indirect

costs of complexity, using an extensive empirical analysis of CAT’s cost data, as well as surveys with

Caterpillar engineering and marketing experts. This model captured both variety-based (driven by

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

3

the number of options offered) and attribute-based (driven by specific complex options) costs and

benefits of product diversity, from manufacturing, to spare parts, to sales effort. (See Section 5).

We then combined the customer and cost models within a mathematical programming model,

in Section 6, to evaluate different product lines against randomized demand patterns and market

scenarios. In coordination with expert input from CAT, this step determined the right product

mix for the line, offering customers broad choice while also controlling the costs of complexity.

The outcome of the project was implemented as a new Lane strategy, offering machines within

three different lanes: Lane 1, the Express Lane, featuring four built-to-stock configuration choices

at an expected lead time of a few days; Lane 2, the Standard Lane, featuring 120 predefined

configurations, built-to-order at an expected lead time of a few weeks; and Lane 3, the A-La-Carte

Lane, built to order machines with an expected lead time of a few months.

Caterpillar committed to a phased roll-out of the project, publishing both an (old) a-la-carte

price list and a (new) Lane price list in 2010, and transitioned to a single Lane price list in 2011.

The Lane 1 configurations were immediately able to capture a significant portion of demand,

contributing to a reduction in warranty costs on the order of 10%, as predicted by our analysis.

Caterpillar has continued expanding and refining their BHL lane strategy – for example, they have

now reduced the Lane 1 configurations to only two. In addition, Caterpillar has applied variations of

our cost of complexity analysis to other divisions within the firm, helping to guide their extensions

of the lane approach – a fundamental strategic change – to the entire company.

To the best of our knowledge, no previous work has ever combined an empirically-developed

CoC function as detailed and comprehensive as ours, with customer preferences regarding product

substitution, in an optimization algorithm that was implemented with real-life data, at an industrial

scale. Moreover, our work ultimately produced recommendations that were actually implemented

and verified to generate significant improvements.

In Section 2 we place our work within the product line optimization and practical application

literature. Then, in Section 3 we briefly describe the BHL lines. In Section 4 we present our key

tool for answering the first of Caterpillar’s questions (“How would customers react to a product

line reduction?”), our customer migration list model. Next, in Section 5, we describe how we

answered the second question (“How much could be saved by focusing their BHL product lines?”)

by presenting our Cost of Complexity model. We then combine these in our optimization model, in

Section 6, to answer the ultimate question, (“How should we configure our new product line?”). We

present the results and insights from our analysis in Sections 7 and 8, and conclude in Section 9.

2. Literature Review

The marketing literature illustrates the difficulty of predicting the effects of reducing product line

complexity: Some works describe how narrowing a product line may detract from brand image or

4

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

market share, e.g. Chong et al. (1998), while others posit that reducing the breadth of lines and

focusing on customer “favorites” may actually increase sales, see for example Broniarczyk et al.

(1998). Our model is consistent with both of these streams: If a customer finds a product that

meets her needs (i.e. a “favorite”) she will make a purchase; if such a product and its acceptable

alternatives are no longer part of the product line, she will not.

There is also a long history of empirically studying the impact of product line complexity on costs.

Foster and Gupta (1990) analyze the responses to a questionnaire to assess the impacts of volumebased, efficiency-based, and complexity-based cost drivers within an electronics manufacturing

company. They find that manufacturing overhead is associated with volume, but not complexity or

variety. Banker et al. (1995) use data from 32 manufacturing plants to evaluate the same question;

they find an association of overhead costs with both volume and transactions, which they take

as a measure of complexity. Anderson (1995) examines the effect of product mix heterogeneity on

overhead costs in three textile factories. Of the seven different types of heterogeneity she identifies,

two are shown to be associated with higher overhead costs. Fisher and Ittner (1999) analyze data

from a GM assembly plant, finding that option variety contributes to higher labor and overhead

costs. We complement these works by explicitly formulating and calibrating a detailed model

to estimate the total direct and indirect costs (and benefits) of complexity for the BHL line at

Caterpillar, based on expert surveys and empirical analysis of cost data.

Product line optimization has a rich literature: Kok et al. (2009) and Tang (2010) provide recent

surveys. Several recent papers consider the strategic selection of a product line via equilibrium

analysis: Alptekinoglu and Corbett (2008), Chen et al. (2008), Chen et al. (2010), and Tang and

Yin (2010). Our paper uses math programming to optimize a more detailed model.

Bitran and Ferrer (2007) consider the problem of determining the optimal price and composition

of a single bundle of items and a single segment of customers in a competitive market. They provide

extensions to multiple segments or multiple bundles based on mathematical programming, but

this latter problem becomes very complex, and is left as future research. Wang et al. (2009) use

branch-and-price to solve the problem of selecting a line to maximize the share of market, testing

their algorithm on problems with a small number of items but many levels of product attributes

on simulated and commercial data. And Schoen (2010) extends the work of Chen and Hausman

(2000) to allow more general costs and heterogeneous customers. None of these algorithms have

been shown to be suitable for problems anywhere near the size and complexity of Caterpillar’s

(thousands of customers and millions of potential configurations). This has led to the investigation

of heuristic line optimization methods: For example Fruchter et al. (2006) apply a genetic algorithm

to simulated and survey data; and Belloni et al. (2008) compare several heuristics to the optimal

solution for small (up to 5-product) instances. Neither of these are actual implementations.

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

5

Kok and Fisher (2007) develop and apply a methodology to estimate demand and substitution

patterns for a Dutch supermarket chain, based on empirical demand data. They develop an iterative heuristic that determines the facings allocated to different categories, and the inventory of

individual elements within the categories. In contrast: (i) We develop an empirical cost of complexity function; (ii) We use a more comprehensive substitution mechanism, the migration list. In

Kok and Fisher (2007), customers who find their first choice absent will substitute at most once

(so if their second choice is absent they leave); (iii) We develop a single product lane strategy for

use by all dealers in the network; and (iv) Our results are based on actual implementation.

Fisher and Vaidyanathan (2011) explore how to select assortments for retail stores; they describe

their work as enhancing a localized choice model to make it operational in practice. Our models

share a localized choice model with randomization, location at extant configurations, and preference

sets for substitution (i.e. our migration lists). But whereas in Fisher and Vaidyanathan (2011) all

customers who prefer a particular product have the same preference set, we randomize the option

utilities of each customer, so customers who purchased the same product may spawn different

migration lists. Furthermore, we use an additive model of attribute utilities, theirs is multiplicative.

Other important differences include: Fisher and Vaidyanathan (2011) estimate demand intensity

and substitution parameters from historical data, whereas we use expert opinion to get utilities,

and generate demand by randomizing past sales. In contrast to our approach that seeks to maximize profits using our empirical cost of complexity function, they maximize revenue with greedy

heuristics. Finally, they show just two examples — snack cakes and tires — implementing a small

set of their recommended changes with the tires line, increasing revenue by 5.8%.

Ward et al. (2010) is another recent paper that rigorously applies an analytical framework to

the product line problem, developing two tools to help Hewlett-Packard. Like Caterpillar, HP has

product lines that could, in theory, span millions of different configurations.

The first tool develops a comprehensive complexity cost function, comprised of variable and fixed

costs, to be used when evaluating the introduction of new products. This complexity cost function

has some similarities to ours, but focuses more on inventory costs, lacking anything related to

our attribute based costing. Furthermore, any substitution effects on inventory, which they term

cannibalization, are subjectively estimated at a high level.

Their second tool uses a heuristic to construct a line from a selection of extant products. This

tool does not use their complexity cost function, nor does it consider substitution — rather it

constructs a Pareto frontier of those top k products that would cover the desired percentage of

historical order demand (or order revenue). So while they seek the appropriate line to satisfy

possibly multi-product orders assuming customers will not substitute, we find the correct line of

products to satisfy orders for individual products in which customers may substitute.

6

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Rash and Kempf (2012) recently published work on product line design and scheduling at Intel.

They find the set of products to produce, for different markets, to maximize profit over a time

horizon while obeying budget and availability constraints. They perform hierarchical decomposition, utilizing genetic algorithms along with MIPs. This work is quite different from ours in that

their demand is viewed as deterministic, so substitution is not included in the model.

The three-step framework we use was first introduced in Yunes et al. (2007), which describes a

product line simplification effort implemented at John Deere & Co. Our current work shares some

of its methodology with Yunes et al. (2007), but extends this work in several dimensions.

Specifically, we: (i) Explicitly calculate and validate estimates of the parts utilities and complexity

function; they were exogenous in Yunes et al. (2007). (ii) Create a sophisticated, endogenous, cost

of complexity function; the function used in Yunes et al. (2007) was exogenous. (iii) Owing to the

form of our endogenous function, we utilize a different optimization procedure, the “differential

approach.” (iv) To achieve the aggressive product line goals of Caterpillar, we make decisions at

the option level, rather than the machine level, as in Yunes et al. (2007). We also incorporate

pricing decisions and migration across models, which are not possible in Yunes et al. (2007).

3. BHL Product Families

Our product line simplification effort at CAT involved four models in the backhoe loader (BHL)

family: 416E, 420E, 430E, and 450E. The 416E is the basic model, while the 420E, 430E and 450E

provide progressively superior horsepower and capabilities. We refer to a complete machine as a

configuration. Each configuration is composed of features; for each feature, a configuration specifies

one of the options within that feature. For example, the feature stick has the options standard

and electronic. Table 1 contains a summary of the features present in each BHL model that were

included in our project, together with the number of options in each. A dash “-” indicates that a

feature is not present in a model or was not included in our analysis.

To create a complete configuration, a customer selects one option for each of its features, while

making sure that these options are compatible. One of the difficulties faced by CAT is that the

number of potential configurations is immensely large. For example, for model 416E in its most basic

version, the number of feasible configurations is 37,920. When we include choices for attachments,

there are 2,275,200 distinct feasible configurations. The vast majority of these configurations have

never been, and most likely will never be, built. The mere fact that they could be purchased,

however, creates overhead costs for CAT’s operations (see Section 5).

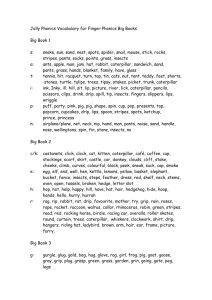

So how many configurations are built? Figure 1 depicts the number of different configurations

(left panel) and options (right panel) required to capture specified revenue and sales targets for

eight month’s worth of sales data for model 420E. Of the 569 built configurations, 400 were needed

7

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Table 1

Number of options in each feature of CAT’s BHL

models.

BHL Models

416E 420E 430E 450E

Sticks

2

2

2

2

3

3

3

6

Backhoe Hydraulics

Backhoe Controls

2

5

13

13

4

Loader Buckets

Loader Hydraulics

2

2

2

2

5

5

4

2

Cab/Canopy

Powertrain

4

3

2

2

2

2

Engine Cooling

Counterweights

4

4

4

3

3

3

3

Backhoe Aux Lines

Engine Coolant Heater

2

2

2

2

Product Link

2

2

2

2

2

2

2

Ride Control

Front Loader Mechanics

2

2

Features

Figure 1

Number of distinct configurations (left) and options (right) required to capture given percentages of

revenue and sales volume for BHL model 420E.

100

100

90

90

Revenue

Sales

80

80

70

70

Percentage of coverage

Percentage of coverage

Revenue

Sales

60

50

40

60

50

40

30

30

20

20

10

10

0

0

0

100

200

300

Number of configurations

400

500

600

0

5

10

15

20

25

Number of options

30

35

40

to capture about 95% of revenues and sales volume. Similarly, 41 out of the 45 available options

were needed to capture at least 90% of revenues and sales volume. Therefore, in order to achieve the

sought reductions in product offerings, it was imperative to steer purchases toward a considerably

smaller subset of products and options.

4. Modeling Customer Behavior

The key to evaluating the potential pitfalls of reducing a product line is a good understanding of

customers’ purchasing flexibility: while customers will require that the product they are buying

satisfy some minimum requirements, not every feature needs to be in perfect alignment with their

expectations. In addition, customers typically display some degree of price flexibility.

45

8

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

The centerpiece of our approach to capture flexibility is the migration list, an ordered list of

products within the customer’s price and utility tolerance (see Yunes et al. 2007 for details). The

first configuration on the list is the customer’s first choice; if available the customer will buy that

configuration. If that configuration is unavailable and there is a second configuration on the list

the customer will buy that if available, and so on. If none of the configurations on a customer’s list

are available, that customer buys nothing (i.e. goes to a competitor). As mentioned in Section 2,

this is an enhanced localized choice model, in the spirit of Fisher and Vaidyanathan (2011).

For each unique purchase in our database, we construct a corresponding migration list. Many

factors come into play when constructing a customer’s migration list. Below is pseudo-code showing

how the process works; each step is described in detail in a subsection below.

Construction of Migration Lists: For each customer C who bought a configuration over the past

H months repeat:

1. Let MC be the configuration (machine) bought by C.

2. Apply segmentation rules to MC (Section 4.1) to place C in a segment SC .

3. Based on the price and utility of MC , and on characteristics of segment SC , construct a

randomized list of configurations, LC , as acceptable alternatives to MC (Section 4.2).

4. Sort LC in non-increasing order of configuration utility, pruning it if it exceeds the maximum

allowed length (Section 4.3).

4.1. Customer Segmentation

Customer segmentation plays an important role in the creation of migration lists because it affects

customer flexibility. For example, customers who live in extreme weather conditions are unlikely

to buy a configuration that does not include a cab with climate control, and customers who need

to carry very heavy loads are not willing to sacrifice horsepower. We used focus groups composed

of CAT experts and actual customers to identify the main customer segments and their characteristics. This produced six segments: performance extreme (PE), performance extreme versatility

(PEV), performance mild (PM), performance mild versatility (PMV), commodity extreme (CE),

and commodity mild (CM). The performance category represents customers who are less price sensitive and need powerful machines. The extreme and mild categories refer to weather conditions,

and the versatility category represents customers who need their machines to perform a variety of

tasks. Based on historical sales data, the fraction of customers in each of the above six segments

are approximately 20, 20, 25, 10, 5, and 20 percent.

A set of segmentation rules was created to classify each purchase: given a configuration, its

customer segment is determined by the presence and/or absence of certain options, represented as

part numbers. For example, there are eight ways for a 416E loader to be placed in segment PE.

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Table 2

9

AHP example: Pairwise and Normalized comparisons.

Pairwise Comparisons

Sticks Powertrain Hydraulics

Sticks

1

1

3

Powertrain

1

1

2

1

1

Hydraulics

1

3

2

7

5

Sum

6

3

2

Normalized Comparisons

Sticks Powertrain Hydraulics Avg. Scores

2

1

3

0.4429

7

5

2

3

2

1

0.3873

7

5

3

1

1

1

0.1698

7

5

6

One is: two out of the options 2146913, 2099929, and 2139293 must be present (89HP powertrain

and e-stick), and one out of the options 2044161, 2044162, and 2284602 must be present (cabs),

and the option 2120206 cannot be present (6-function hydraulics), and neither option 2497912,

nor option 2624213 can be present (one-way and combined auxiliary lines).

In addition to the segment-specific option utilities that will be discussed in Section 4.2, the

other segment-specific parameters that affect migration list generation are the reservation price

and reservation utility (see Section 4.3).

4.2. Estimating Utilities

For each of the customer segments identified in Section 4.1, we calculate option utilities as follows.

First, to estimate the importance of a model’s features, we asked a group of CAT employees with

sales and manufacturing expertise to use the Analytic Hierarchy Process (AHP) (Saaty 1980).

AHP asks experts to estimate different feature’s relative importance, on a scale from 1 (equally

important) to 9 (much more important). After these pairwise relationships have been established,

the scores are transformed into absolute scores, the relative importance of each feature. The same

group of experts is then asked to rank the options within each feature on a scale from 0 to 100.

These option scores are scaled so that the option receiving a score of 100 is assigned a value equal

to its feature’s relative importance. These scaled scores represent the option utilities.

We demonstrate this on a simplified example with three features: sticks, powertrain, and backhoe

hydraulics. Assume the experts have ranked the pairwise importance as shown in the “Pairwise”

portion of Table 2. The numbers in the “Sticks” row mean that sticks are as important as powertrain, and three times more important than hydraulics. Similarly, the second row indicates that

powertrain is twice as important as hydraulics. Note that a perfectly consistent group of experts

would have said that powertrain is three times as important as hydraulics, but in practice they

may not be this consistent. Disparities like this are not unexpected, and are taken into account by

the AHP. The AHP then calculates the column sums for each feature (last row of the “Pairwise”

portion of Table 2), normalizes each column, and takes row averages to determine the final relative

importance for each feature, as shown in the “Normalized” portion of Table 2. A final check is then

performed to make sure that any inconsistencies are within an acceptable tolerance.

10

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Now let us assume that the backhoe hydraulics feature has three options: 4, 5, and 6 function,

assigned scores of 15, 50 and 100 by the experts, respectively. When we rescale these scores to a

scale from 0 to 0.1698 (the relative importance of hydraulics from Table 2), we obtain the final

utilities of these three options: 0.0255, 0.0849, and 0.1698, respectively.

The utility of a complete configuration is estimated as the sum of the utilities of its options.

Although this additive method has been studied and used extensively (Keeney and Raiffa 1976),

other ways of estimating option and configuration utilities are also possible (e.g. conjoint analysis

and its many variations, Hauser and Rao 2004). One advantage of our migration list approach is

that it is independent of the way in which utilities are calculated: The only thing it requires is a

score ranking the relative desirability of each configuration.

To validate the utility values calculated for each of the options – for every BHL model in all

customer segments – we conducted a survey asking actual customers to choose among alternate

configurations. Caterpillar then used t-tests to examine the differences between these surveys and

the utility estimates provided by CAT experts. These differences were not statistically significant.

4.3. Building Migration Lists

Although customers of a given segment tend to behave similarly, they are certainly not identical.

To account for variations within each segment, we modify the migration list procedure in several

ways. First, for each segment we randomly perturb the relative importance (and, consequently,

the option utilities) of randomly selected features. The number of features to perturb is an input

parameter (for CAT, this was around three). Given a perturbation factor t (approximately ten),

the change to a feature’s relative importance is randomly drawn from a uniform distribution over

the interval [−t%, +t%]. CAT also did not want customers to have lists containing configurations

too dissimilar from the one purchased. Therefore, a number called disparity factor (around five)

limits how many options an alternative machine can have that differ from MC . Finally, the model

generates the customer’s reservation price and reservation utility; again, these values are randomly

picked from a predetermined interval around the price and utility of MC .1

We collect the above procedures into a Constraint Programming (CP) model (Marriott and

Stuckey 1998) that finds feasible configurations for LC . This CP model needs to know what constitutes a feasible configuration, i.e. which options are compatible. We use configuration rules to

describe these interdependences. For example, for model 420E, one rule is: if a configuration has

option 9R58666 and either option 2139272 or 2139273, then it cannot have option 9R5321. These

1

Note that randomness in our choice model is restricted to the generation of option utilities and reservation values,

which influence the construction of customer migration lists. Once created, these (fixed) lists serve as input to a

deterministic optimization algorithm. Thus we refer to our model as being “randomized,” as opposed to a random

choice model, which typically has a different meaning.

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

11

rules may involve tens of different options; logical conditions of this form can be easily handled by

CP models. After all feasible configurations are found, those that exceed the generated reservation

price or fall short of the reservation utility are pruned from the customer’s migration list.

Next, configurations are sorted in non-increasing order of total utility and LC is truncated, if

desired, while respecting two conditions. First, if LC is truncated MC must always be retained.

Second, we assume customers place MC first, regardless of MC ’s utility, with a certain probability

(the β factor ; for CAT it was between 0.3 and 0.7). This is an attempt to capture the fact that

some customers are attracted to their MC for reasons we cannot capture with utilities.

Migration across different models is also possible. In this case we apply a set of migration rules

that map a purchased configuration M1 of model m1 (e.g. 416E) to its most likely counterpart

M2 , of a different model m2 (e.g. 420E). Once M2 is known, we generate alternatives as if it

were the customer’s original purchase, and include them (together with alternatives to M1 in m1 )

into LC . Because m2 configurations may have higher utilities, when LC is sorted it may contain

almost no highly ranked m1 configurations. Thus, to capture the fact that customer C originally

preferred an m1 machine, we inflate the utilities of all m1 machines in LC by a preference factor

(between 10 and 20%). As a result, LC ends up with machines of both models, but it does not

allow utilities to overemphasize the attractiveness of m2 machines. According to CAT, the plausible

model migrations are from 416E to 420E and from 430E to 420E.

As was done for option utilities, we also conducted an extensive validation study with CAT

experts to evaluate the quality of our migration lists: Lists were repeatedly generated and examined

to determine whether the substitution patterns indicated were realistic. Throughout this process

the experts provided valuable feedback that helped us fine tune our input parameters. After a few

iterations, CAT experts agreed that our migration lists could be safely used by our optimization

algorithm. Before we present that algorithm, we describe how we estimate a key element of our

objective function, the cost of complexity.

5. Capturing Cost of Complexity

Our next task is to estimate how a line reduction might affect costs. This is a significant challenge,

as product variety affects many functional areas. In most areas the direction of the impact is clear:

material planning costs increase as the number of options to be included increases. In some areas,

however, the impact is not straightforward: sales costs may increase as variety increases because

a large line may overwhelm customers and sales personnel; on the other hand, sales costs may

decrease in variety if it is easier to satisfy a demanding customer. We refer to all costs impacted

by the variety of product offerings, i.e. number of features and options, as the cost of complexity.

12

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Table 3

Main business processes impacted by complexity and the corresponding cost measures. A dagger (†)

indicates alternative cost measures used due to lack of data availability.

Department

Purchasing

Processes impacted

Capital tooling

Supplier operations

Ordering

Forecasting

Quoting and training

Price list creation

Training

Publications

Drawing changes

Customer

acquisition

Marketing

Engineering

Order fulfillment

Product support

Original design & development

Attachment forecasting

Sequencer work

Grief resolution

Dealer solution network - calls

Publications - manuals

Warranty costs

Material planning

Operations

Quality

Inventory management

Schedule volatility

Expedition

Initial process setup

Assembly process

Initial setup

Hot test

Cab test

Measure of complexity

Capital tooling cost

Supplier delivery performance†

Cost of customer acquisition†

Budget expenditure†

Cost of engineering changes

Cost of product & component

Cost of new releases

Headcount cost†

Cost of service calls

Cost of publications

Cost of repairs (first 10 hours)

Cost of repairs (during 11-100 hours))

Cost of repairs (above 101 hours)

Inventory handling cost (prime product)

Inventory handling cost (components)

Headcount cost

Freight cost

Man-hour cost, production planning

Man-hour cost, assembly

Cost of initial setup

Hot-test cost (man-hours)

Cab-test cost (man-hours)

In this section we describe how we built a cost of complexity function for CAT. This includes

both data collection and data analysis to determine and estimate the necessary parameters. The

result of this process is used in our optimization model in Section 6.

5.1. Data collection stage

In conjunction with CAT experts we selected nine functional areas that we felt were most significantly affected by product complexity. We met with these areas’ representatives in a focus group

setting that also included an information systems (IS) representative and a project manager from

CAT. The primary goals of these meetings were: (i) to identify up to three major processes within

each functional area most impacted by product complexity; (ii) to understand which cost-measures

capture the impact of complexity for each major process; and (iii) to identify particular product

features and/or options that have the largest impact on the complexity cost.

We then contacted an accounting representative from CAT who, working with the IS representative and the functional areas, identified which of the identified cost measures were obtainable. For

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

13

some of the processes we identified there was no appropriate accounting data available; hence, we

used an alternative cost measure as a proxy. Table 3 lists the functional areas, processes impacted,

and measures used; when alternate cost measures are used they are denoted by a dagger (†). We

elaborate on several cost measures in Table 3.

Cost of supplier delivery performance refers to a program targeted towards improving availability;

as a part of this program, CAT contacts suppliers with low delivery performance to improve their

processes. We use the cost allocated to this program as a proxy for the cost of supplier operations.

In the customer acquisition department, CAT calculates sales variance cost by tracking all the

discounts that go into making a sale: invoice, extended service, cost of free attachments, etc. We use

this measure to approximate cost of customer acquisition. We rely on CAT’s accounting system for

cost estimates of engineering changes (mainly consisting of payroll to engineers working on changes)

and engineering of new releases (mainly consisting of the payroll of developers and engineers who

work on new parts, and costs of testing and design equipment).

Another outcome of our focus group discussions was the observation that there were two distinct

ways in which complexity affects different business departments: Variety Based and Attribute

Based. We discuss this distinction now.

5.1.1. Variety Based vs. Attribute Based complexity. Certain processes are impacted

by the number of options offered for a feature, while other processes are more impacted by the

presence of specific options. For example, material planners need to calculate requirements for each

type of bucket offered, which increases the departmental cost for material planning. If one type of

bucket is eliminated, the cost of complexity will go down proportionally, regardless of which option

is eliminated. We refer to this effect as Variety Based Complexity, or VBC.

In contrast, for the Cab/Canopy feature, the Deluxe Cab with Air Conditioning is significantly more complicated than a canopy. Hence, if we were to reduce the number of options in the

Cab/Canopy feature, the change in cost would be different depending on which particular option

was eliminated. We refer to this effect as Attribute Based Complexity or ABC. Note that attribute

based complexity is not limited to single options; it is the combination of Deluxe Cab with Air Conditioning that drives complexity cost. In Table 4, we summarize the features that were identified

as most important during our focus group meetings, along with their VBC or ABC classifications.

In addition to the VBC/ABC classification, there were two other important considerations that

came out of our focus group discussions: time lag and volume drivers of complexity.

5.1.2. Time lag of the impact of complexity Our discussions revealed that the effect of

complexity on different processes may be felt at different times. For example, assembly cost today

is impacted by the product complexity being built today, while warranty costs are affected by

14

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Table 5

VBC

VBC

VBC

ABC VBC

VBC VBC

VBC

VBC VBC

VBC VBC

VBC

VBC

VBC

VBC

VBC

VBC

VBC VBC VBC

VBC

ABC

Sticks

Cab/Canopy

Control Groups

Hoe Buckets

Quick Coupler

Auxiliary Lines

Loader Buckets

Department/Feature

Purchasing

Customer acquisition

Marketing

Engineering

Order fulfillment

Product support

Material planning

Operations

Quality

ABC/VBC classification of features.

Backhoe Hydraulics

Table 4

VBC VBC

VBC

VBC

ABC

VBC VBC

VBC

VBC

ABC ABC

ABC

Summary of cost time lags (in months).

Department

Time Lag

Purchasing

0

Customer acquisition

3

Marketing

0

Engineering:

Changes

-6

Releases

-8

Product and component costing

-7

Order fulfillment

0

Operations

0

Quality

0

Department

Time Lag

Product support:

Service calls

6

Repairs in the first 10 hours

4

Repairs in 10-100 hours

9

Repairs after 100 hours

9

Material planning:

Prime product inventory

2

Scrap of surplus materials

6

Inventory scrap

6

complexity that was offered a certain time ago (positive time lag), and engineering and marketing

costs may be impacted by the complexity that will be offered in the future (negative time lag).

Based on our focus group discussions we estimated the number of months of time lag for different

cost pools. Later (in Section 5.2.1), we use this information in estimating the parameters of the

cost of complexity function. Table 5 summarizes our analysis of time lag parameters.

5.1.3. Volume drivers for complexity Another important aspect in understanding the

impact of complexity is understanding different volume metrics and how they affect costs. Not

surprisingly, most areas are affected by sales volume: costs increase as more items are produced and

sold. However, costs are also driven by other volumes. For example, product support is impacted

by the number of unique configurations built, because quality may decrease when employees have

to work on many different configurations. Other processes, such as assembly planning and engineering, are impacted by the complexity offered, as CAT should be ready to assemble any feasible

configuration offered. Later (again, in Section 5.2.1), we use this information to determine which

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Table 6

15

Volume drivers.

Department/Volume driver Sales volume Complexity offered Complexity built

Purchasing

X

X

Customer acquisition

X

X

Marketing

X

X

Engineering

X

Order fulfillment

X

X

Product support

X

X

Material planning

X

X

X

Operations

X

X

Quality

X

X

predictors should be included in the cost model for each department. Table 6 provides a summary

of the most important volume drivers for each department.

5.2. Cost of complexity function

Before defining the cost functions and notation associated specifically with VBC and ABC costs, we

present supplementary notation that will be common to both. We use small letters for superscripts

and subscripts, bold letters for sets, and capital letters for numbers coming from collected data.

Supplementary Notation:

d∈D

Superscript used to represent attributes pertaining to department d,

where D is the set of all departments considered in the study;

f ∈F

Superscript used to represent attributes pertaining to feature f ,

where F is the set of all features in the product line;

d

F ⊂ F The set of all features identified as relevant for department d;

o∈O

Superscript used to represent attributes pertaining to option o,

where O is the set of all options in the product line;

Of ⊂ O The set of all options in feature f ;

Nf

Number of options in feature f : |Of |;

Nd

Set of cardinalities of all features relevant for department d: N d = {Nf : f ∈ F d }.

5.2.1. Estimation of VBC effect To estimate the VBC effect for each department d, CVd BC ,

we use the Cobb-Douglas log-linear function. The Cobb-Douglas function is frequently used for

estimating non-linear relationships (see Greene 2000); it can capture different returns to scale and

has several attractive analytical properties. Two properties are of particular convenience for us:

First, the log transformation of the Cobb-Douglas function is linear and hence can be estimated

using linear regression. Second, a partial derivative of the Cobb-Douglas function has a simple form

that is useful in the derivation of the differential cost of complexity (Section 5.3). After estimating

the models, we validate our Cobb-Douglas function via several goodness of fit tests (e.g. Figure 2).

Using lower-case Greek letters to represent estimated parameters, the Cobb-Douglas function

for CVd BC is given by

16

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

d

CVd BC (N d , V, U ) = ξ d V α U β

d

Y

f ∈F

Where:

V

U

ξd

αd

βd

γfd

γd

Nf f .

(1)

d

Total sales volume;

Total number of unique configurations sold;

The size of the cost pool at department d relative to other departments;

The effect of the sales volume on the cost of complexity;

The effect of the number of unique configurations sold on the cost of complexity;

The effect of the cardinality of feature f on the cost of complexity;

We fit this function to the data to estimate ξ d , αd , β d , and γfd for all d and f . Using data collected

for 60 months, from January 2001 to December 2005, for all cost measures summarized in the third

column of Table 3. We also collected data from the price lists from 2000 to 2006 to capture all

changes in the option offerings, which were used as independent variables. (Due to the time lags

identified in Section 5.1.2, we collected price list data over a wider time range than cost data.)

Similarly, we collected monthly sales (V ) and number of unique configurations sold per month (U )

from 2000 to 2006 and ran regression analysis to confirm our hypotheses concerning lags in Table 5.

The nature of the data suggests that there is serial correlation, which was confirmed with the

Durbin-Watson statistic for all cost pools. Therefore, we use the Yule-Walker approach to fit

the data to the log transformation of CVd BC (N d , V, U ) (Greene 2000). The log transformation of

CVd BC (N d , V, U ) used for estimation, with as the model error term, is

Log[CVd BC (N d , V, U )] = Log[ξ d ] + αd Log[V ] + β d Log[U ] +

X

f ∈F

γfd Log[Nf ] + .

(2)

d

Next, we fitted collected data to equation (2) and obtained statistical models for all departments.

We analyzed our model using both graphical and numerical tests: we examined the plots of residuals

for normality, heteroscedasticity, and for influential outliers (an example of these plots for one of

the cost pools, customer acquisition cost, is depicted in Figure 2). We also checked for significance

of the models, and only accepted models with reasonable coefficients of variation (as summarized

in Table 7) and low RMSE. The estimates that are statistically significant at the p = 0.05 level are

marked with an asterisk in Table 7. Hence, not all of the originally identified departments were

included in the final cost of complexity function, and some of the sets F d were reduced.

First, we comment on the coefficient of determination of the models (R2 ) in Table 7. Some of

the departmental costs are heavily impacted by factors outside CAT’s walls: for example, cost

of customer acquisition is impacted by competitors’ actions, and cost of supplier delivery performance is impacted by the suppliers’ operations. Hence, we expect the coefficients of determination

to be lower for such departments. The results in Table 7 are consistent with our expectations.

The SAS System

17:05 Tuesday, October 24, 2006 3

The REG Procedure

Model: linear

ariable: dealer_trades

dealer_trades

Figure 2

Goodness of fit plots for the customer acquisition cost model.

17

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

The SAS System

The REG Procedure

Model: MODEL1

Dependent Variable: DRF1_l

(a)

Normal Q-Q plot

(c)

Cook’s distance

(b)

Histogram of residuals

Table 7

Fn.

CA

MP

MP

ENG

ENG

PS

PS

PS

P

(d)

Residuals vs. predicted values

Fit results. An asterisk * indicates statistically significant parameters at p = 0.05 level. Subscripts HC, C,

CW and H stand for hydraulic combinations, cabs, counterweights, and hydraulics.

Cost pool (d)

Customer acquisition

Inventory (components)

Inventory (prime product)

Engineering changes

Engineering product & component

Repair costs in the first 10 hours

Repair costs during 11–100 hours

Repair costs above 101 hours

Supplier delivery performance

R2

0.37

0.29

0.38

0.41

0.55

0.29

0.32

0.55

0.33

ξd

962771120.4*

1087617.41*

297.68

0.00342591

6.39E-04*

26238.94*

3055.00*

934.63*

36.65

αd

0.19

−0.03

0.91*

−0.21

−0.32

−1.41*

βd

d

γHC

d

γC

−1.13*

1.04*

4.81712*

4.107*

−0.54

d

γCW

d

γH

−1.68*

0.91

3.14*

0.59*

1.28*

2.78*

1.5*

Similarly, when analyzing the models for warranty costs, we expect that earlier failures would be

less predictable, due to learning effects. The results are again consistent with this expectation; the

coefficient of determination increases for repair costs as the time of failure increases. Nevertheless, in order to ensure that our results are robust, we use ranges of parameters in running the

optimization model as described in Section 7.

We comment on some of the findings from Table 7. First, increasing the number of options

CA

for hydraulics and cabs decreases the cost of customer acquisition: i.e. γH

< 0 and γCCA < 0. A

large proportion of the cost of customer acquisition consists of sales variance or discounts given

18

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Figure 3

Actuals versus 95% confidence interval of predictions for customer acquisition.

to customers by dealers in order to attract business. Cabs and hydraulics are very important

considerations for customers; having a large selection of options for these features makes it easier

for the dealer to make a sale, decreasing the sales variance. This finding is in line with the intuition

of sales and marketing representatives from CAT. However, this was the first time that CAT was

able to quantify this effect.

Another interesting observation is that sales volume has a negative impact on product support

costs (i.e. repair costs). When volume goes up CAT employees assemble more machines with the

same options, employees get more experienced with particular options, and the number of mistakes

decreases. This intuition again seemed plausible to CAT, but had never been quantified. Guided by

our study, CAT subsequently has performed similar cost of complexity analysis in other product

divisions and obtained comparable results.

Finally, we tested our predictions by using the first year of data to fit the model, then calculated

the predicted values for the next four years, and finally compared them to the actual data. Figure 3

shows that a large majority of the actual values lie within the 95% confidence interval around the

predicted values, again for customer acquisition cost.

5.2.2. Estimating ABC effect From focus groups, we identified that ABC effects were observed primarily in three departments: assembly, production planning, and engineering. The nature

of work in these departments suggested that the relationship between ABC cost and complexity

is linear: if it takes 5 extra minutes to install a particular option on a machine, this cost will

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Table 8

19

ABC costs.

Option

δo

ωo

Any option

$1,000.00

In addition:

IT

$6,000.00 $23.61

Cab

$14,656.25 $53.80

E-Stick

$125.00 $1.30

One Way Line $3,593.75 $5.64

Ride Control

$1,281.25 $5.86

apply to each machine that contains the option. This coincided with expert opinion, which posited

that learning effects are minimal. Hence we model the total cost of offering and producing option

o

o, CABC

, as the sum of the one-time cost across all departments if option o is offered and the

incremental cost across all departments that is incurred each time a machine with option o is built:

o

CABC

(ao , V o ) = δ o ao + ω o V o .

Where:

δo

ao

ωo

Vo

V

Cost incurred if option o is offered;

Binary variable that indicates whether option o is offered or not;

Cost incurred each time option o is produced;

Number of configurations sold that contain option o;

Set of number of configurations sold for all options: V = {V o : o ∈ O }.

The cost parameters δ o and ω o were estimated using expert opinions, time studies, and accounting

information from all functional areas that identified this option as important; see Table 8.

5.3. Differential cost of complexity function

Instead of computing the total revenue and total cost of each line, our complexity cost function

enables us to start with the current line and compute the estimated change in revenue and the

estimated change in cost as the number of features and options change. To compute this “differential” cost of complexity, we take the partial derivatives of CVd BC (N d , V, U ) with respect to all

variables, and then combine them into a differential cost of complexity function. Specifically, the

change in cost of complexity when the number of options for feature f changes is:

γfd d αd β d Y γid

γfd d

dCVd BC (N d , V, U )

=

ξ V U

Ni =

CV BC (N d , V, U ),

dNf

Nf

N

f

d

(3)

i∈F

substituting the definition of

CVd BC (N d , V, U )

given by (1).

This differential cost of complexity function includes the predicted value of CVd BC (N d , V, U ), the

average size of the cost pool at department d. This is problematic for two reasons: (i) The predicted

CVd BC (N d , V, U ) contains an error term and hence may not give an accurate size of the cost pool;

20

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

and (ii) Values of V , Nf , and U change during the specified time period. Therefore we approximate

CVd BC (N d , V, U ) with the historical average cost at department d (Dd ) attributable to complexity,

taken over the period of 60 months from January 2001 to December 2005:

γfd d

dCVd BC (N d , V, U )

≈

D .

dNf

Nf

(4)

Using (4) the total change in complexity cost due to a change in the number of options offered

for feature f is then estimated as:

Dd

γfd

∆Nf ,

Nf

(5)

where ∆Nf represents the change in the number of options in feature f after line optimization;

similarly we will precede V , U , V o , N , N d , and V with ∆ to represent change. We will formally

define these functions in Section 6 when we introduce the optimization model.

In an analogous fashion we differentiate the cost of complexity function with respect to volume

and number of unique configurations. This yields the total differential cost of complexity DVd BC :

DVd BC (N d , V, U, ∆N d , ∆V, ∆U ) =

X

f ∈F

Dd

d

γfd

βd

αd

∆Nf + Dd ∆U + Dd ∆V.

Nf

U

V

(6)

To capture the differential ABC effect, we must account for the change in the number of options

offered and sold. If we eliminate an option o from the price list, the cost of complexity will decrease

by δ o and if sales with option o deviate from V o , the cost will change accordingly:

DABC (∆V , a) =

X

δ o (ao − 1) +

o∈O

X

ω o ∆V o , where a = {ao : o ∈ O }

(7)

o∈O

Finally, the total differential cost of complexity is:

D(N d , V, U, ∆N d , ∆V, ∆U, ∆V , a) =

X

DVd BC (N d , V, U, ∆N d , ∆V, ∆U ) + DABC (∆V , a). (8)

d∈D

Because the complexity cost function is non-linear, this approach is accurate only for small

changes. The accuracy of this approximation may be tested by calculating the actual change in

total cost of complexity CV BC between the original product line and the optimized product line, and

then comparing this to the result of the approximation DV BC . In our experiments, the differential

cost approximation was within 5% of the calculated change in the cost of complexity, which was

acceptable for the purposes of our project2 . As a result, equation (8), with estimated parameters,

becomes a part of the objective function in the optimization model of Section 6.

2

If desired, this approximation may be improved by using an iterative approach built into the optimization model,

in which the differential is re-estimated after each small change in variables.

21

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

6. The Optimization Model

With the migration lists described in Section 4, which contain the customer flexibility information,

and equation (8) of Section 5, which contains the differential complexity cost information, we can

now describe our optimization model: We use a mixed-integer program to select the set of options

and configurations offered, and their prices, to maximize total revenue from sales minus complexity

costs. We use customer purchases in 2006 as the basis for generating our migration lists.

In addition to the data defined in Section 5, our optimization uses the following data:

• I — The set of all customers;

• Li — The ordered set of configurations in the migration list of customer i ∈ I;

• J — The set of all possible configurations;

• Oj — The set of all options in configuration j ∈ J ;

• Ri — Reservation price of customer i ∈ I; this could be made machine dependent if desired;

• M — Maximum reservation price over all customers (M = maxi∈I Ri );

• Cj , Cj0 , Bj , Pj — Cost, variable cost, base price, and current sale price of configuration j ∈ J ,

respectively. The variable cost Cj0 is an internal CAT figure, lower than Cj , the purpose of which

is to enforce a constraint on the average profit margin over all machines sold (see (16)).

The decision variables are as follows (ao was already defined in Section 5.2.2):

• ao = 1 if option o ∈ O is available, 0 otherwise.

• qj = 1 if configuration j ∈ J is bought by some customer, 0 otherwise;

• xij = 1 if customer i buys configuration j, 0 otherwise (i ∈ I, j ∈ Li );

• po — Price of option o ∈ O (po ≥ δ o , where δ o is defined in Section 5.2.2);

• rij — Profit obtained from customer i if she purchases configuration j (i ∈ I, j ∈ Li ).

We now provide precise definitions to the following terms that appear in (6) and (7):

∆Nf =

X

∆U =

X

ao − Nf ,

o∈Of

qj − U,

j∈J

∆V =

XX

xij − V,

i∈I j∈Li

∆V o =

X

X

xij − V o .

i∈I j∈Li |o∈Oj

The objective function maximizes the total profit from sales (

P P

rij ) minus the differential

i∈I j∈Li

cost of complexity given by equation (8) of Section 5:

max

XX

i∈I j∈Li

rij −

X

d∈D

DVd BC (N d , V, U, ∆N d , ∆V, ∆U ) − DABC (∆V , a) .

22

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Our optimization model uses the following constraints, where max inc is the maximum allowed

percentage price increase for a configuration:

qj ≤ ao ,

∀ j ∈ J , o ∈ Oj

xij ≤ qj ,

X

(9)

∀ i ∈ I, j ∈ Li (10)

xik + qj ≤ 1,

∀ i ∈ I, j ∈ Li (11)

k after j in Li

rij ≤ Bj +

X

po − Cj ,

∀ i ∈ I, j ∈ Li (12)

o∈Oj

Bj +

X

rij ≤ (min{Ri , Pj (1+max inc)} − Cj )xij

∀ i ∈ I, j ∈ Li (13)

po ≤ Ri + (Pj (1+max inc) − Ri )(1 − xij )

∀ i ∈ I, j ∈ Li (14)

o∈Oj

Cj (1 + min marg) ≤ Bj +

X

po ≤ Pj (1 + max inc),

∀j∈J

(15)

o∈Oj

min avgmarg

XX

(rij + Cj qj ) ≤

i∈I j∈Li

XX

(rij + (Cj − Cj0 )qj ).

(16)

i∈I j∈Li

Constraint (9) says if option o is not available (ao = 0), no configuration that contains it can be

bought (qj = 0); (10): if configuration j is not bought (qj = 0), make xij = 0; (11): if j was bought

by someone (qj = 1) it must be available; therefore customer i will not consider configurations with

lower priority (k after j in Li ); (12): profit is at most equal to price minus cost; (13): profit is limited

by the customer’s reservation price Ri , and no purchase (xij = 0) means no profit (rij = 0); (14): if

customer i bought configuration j (xij = 1), price of j must be no more than Ri ; (15): configuration

margins have to be at least min marg and configuration prices cannot increase more than max inc

above original values; (16): average margin over all machines has to be at least min avgmarg.

We can turn off the price optimization aspect of the model by removing variables po , constraints

P

(14)–(16), making max inc = 0 in (13), and substituting Pj for Bj + o∈Oj po in (12). (This

additive price structure is in line with CAT’s pricing rules.)

Our optimization models have around 850,000 variables and 1.8 million constraints, and they

are solved using ILOG CPLEX Optimizer with default parameters. Typical solution times range

from 6 to 8 hours, including preprocessing.

7. Results from Our Analysis

CAT’s goal was to make a drastic reduction in the number of configurations offered without significantly impacting customer satisfaction and market share. How to achieve such a goal, or whether

such an outcome was even possible, was unclear at the outset of the project: Optimizing their

product line required careful understanding and modeling of potential losses due to reduced offerings, and potential savings due to reduced cost of complexity. Since this reduction would present

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

23

customers with fewer configurations, CAT assumed that each remaining configuration could be

priced a little lower; the reduced cost of complexity would allow this while maintaining profit.

Throughout our analysis, to ensure that our recommendations were robust we ran the optimization model across a range of parameters and migration list lengths.

7.1. Stage 1: Focusing on Configuration and Option Reduction

As an initial benchmark for our optimization, we first sought to identify the set of configurations

that maximized profit at the current option prices, assuming limited customer migration (no more

than a dozen configurations on a migration list, and no migration across models). While profits did

increase, we obtained very little reduction in the number of configurations, except when a reduction

P

was explicitly enforced by the constraint j∈J qj ≤ (1 − min conf red)|J |. Moreover, forcing a

large reduction resulted in a significant decrease of sales revenue.

Upon reflecting on the results, we hypothesized that further reducing the cost of complexity

would require significant cuts in options. Hence, a new constraint was added to the model to

P

force option reduction: o∈O ao ≤ (1 − min opt red)|O |. We then re-ran the optimization model

forcing a reduction in the number of configurations and the number of options. Reducing options

did succeed in reducing configurations, in some solutions by as much as 94%, and increased profit

by generating a large cost of complexity reduction. But it also resulted in a drop in sales volume

of up to 67%. This disturbed CAT team members since the company has always prided itself on

its market share. Fulfilling customer demand therefore became an important new metric of the

analysis.

7.2. Stage 2: Opening Up Choices

Thus in the next phase of our analysis we wanted to explore what results would be possible if

customers were significantly more flexible, possibly as a result of price incentives. We modeled

this flexibility in two ways: We increased the migration list length (to 100 configurations) and we

enabled model-to-model migration.

This approach started to generate encouraging results. A solution emerged with an increase in

profit of 8.8%, less than a 2% reduction in sales volume, and a reduction in configurations equal

to 65%. But further analysis showed that the number of options had not decreased significantly.

The increase in profit came from a decrease in the number of configurations, and increases in price

paid by customers who migrated to slightly more expensive configurations. Performing sensitivity

analysis confirmed this conclusion: expecting a large reduction in options was not realistic. However,

a large reduction in configurations was possible.

24

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

Figure 4

Final product hierarchy and packages for the BHL 420E series.

This resulted in a problem for CAT: Without a reduction of options, how would this new set of

configurations be presented to the customers? Restaurants can get by with a 3-4 page menu that

lists all their entrees. But no customer would flip through a menu of 70-90 pages listing all the

possible BHL configurations. A new scheme had to be devised.

7.3. Stage 3: Standardization and Options Packages

We decided to try two new strategies to concentrate customer demand on a manageable number of

configurations. The first strategy was standardization: Could options such as High Ambient Cooler

and Engine Heater be made standard across all configurations? Optimization models with these

options forced into every configuration yielded cost reductions that justified a reduction in price

large enough to make the standardized configurations attractive to customers, while maintaining

sales volumes and profit. Other rarely used options were eliminated using a similar approach. For

example, the Cab/Canopy options were cut from five to two.

The second strategy was creating packages of options commonly found together. For example,

guided by customer segment preferences, a single pair of loader hydraulics and powertrain options

most likely to meet each segment’s needs was proposed. Manual inspection and cluster analysis of

the best solutions found so far led to the discovery of other options often found together.

The optimization was then run assuming standardization and option packaging, with constraints

on the maximum price increase. This yielded the final product hierarchy for the 420E series,

shown in Figure 4: It consists of 9 base-machine-assembly (BMA) packages, 5 finished-to-order

(FTO) packages, and 3 hydraulics options, for a total of 135 possible configurations, some of them

anticipated to be much more popular than others.

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

25

Pricing optimization showed that with these 135 configurations, revenue from sales could increase

by almost 7% and profit by 15%, with 99.6% demand fulfillment. Interestingly, 76% of the projected

cost of complexity savings came from reductions in finished goods inventory and warranty costs

(in particular, the cost of addressing failures in the first 100 hours of machine operation). Since the

goal of the project was to maintain similar profit levels (rather than seeking increases), the team

determined appropriate option price reductions to drive dealer behavior toward these configurations

while maintaining profit. The proposed pricing policy resulted in an anticipated reduction in profit

from sales of 4%, which was easily made up by the reduction in cost of complexity to yield a

total profit increase of 4.8%. We had finally found the very small subset of configurations that we

believed was broad enough to satisfy CAT’s customers and dealers, but also focused enough to

drive operational and supply chain efficiencies.

This final recommendation was presented to CAT, and approved.

8. Implementation Details

8.1. Initial Implementation

The implementation of such a dramatic change faced challenges. The first challenge was a concern

that our solution would restrict customer choice too much, resulting in excessive lost sales. Caterpillar therefore showed the proposed packages to a subset of dealers, including their top 15 dealers,

responsible for nearly half of the North American demand. The dealers suggested configurations

to add and remove, and we adapted some of the packages slightly. Caterpillar also suggested the

addition of high-cost options, but the dealers did not support this, so they were excluded.

Overall, the response from the dealers was very favorable, with many dealers projecting they

would be able to satisfy 80% of their demand from these packages. In contrast, dealers estimated

that the machines they currently kept in stock satisfied only 5-10% of their demand. Thus, standardization and option packaging represented an effective way of potentially reducing configurations.

The second challenge came with the recession of 2009. Suddenly, every sale became crucial,

and configuration reduction became a lower priority. However, with the economy showing signs of

recovery in 2010 and with some changes to product sourcing at Caterpillar, reducing the number

of configurations again gained importance. Caterpillar therefore put an updated price list for the

430E product line into effect in April 2010; but, in order to minimize the risk of lost sales in the

still difficult economic environment, the new price list was introduced alongside the old price list,

rather than as a replacement.

Concurrent with this new price list, now featuring 124 configurations, Caterpillar introduced a

3-lane strategy for order fulfillment:

26

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

• Lane 1, the fastest lane, projected that orders on the four designated “most popular” fully

configured machines would be satisfied within a few days.

• Lane 2 projected that orders on the remaining 120 choices, broken into the Loader, Comfort

and Convenience, and Excavation packages, would be satisfied within a few weeks.

• Lane 3 projected any a-la-carte machine would be satisfied within a few months, as previously.

Upon implementation, Caterpillar experienced positive dealer feedback and large reductions

in the number of unique configurations sold. This contrasted with previous attempts to reduce

the size of the product line, based on a Pareto analysis of the top few dealers. These had likely

been ineffective, in CAT’s opinion, because they did not effectively model the interaction of cost,

customer preferences, and substitution, as we had.

It is worth noting that, to the best of our knowledge, neither standardization nor option packaging

were being considered prior to the start of our project. These concepts were only developed after

our analysis indicated that CAT needed to find a way to limit the number of configurations while

not eliminating too many options. Our analysis then gave CAT direction in implementing these

new strategies, by indicating which sets of configurations were likely to be successful.

8.2. Moving Forward

In 2011 Caterpillar consolidated the two price lists into a single price list featuring options packages.

They were able to capture over a quarter of their sales volume just in Lane 1; in contrast, the

four top-selling configurations Caterpillar used to offer before this project captured 11.3% of both

sales and total revenue for the 420E model (see Figure 1). In addition, CAT enjoyed a reduction

in warranty costs, attributable to many factors – including this project. Caterpillar has continued

to focus their BHL offerings, for example reducing the 420E (now the 420F) Lane 1 offerings to

three base machines by the middle of 2014. The other BHL lines have seen similar reductions.

Caterpillar has rolled out the lane approach to the entire company, making it an integral part

of CAT’s business strategy (Thomson Reuters (2014)). While the methodologies used to determine the lane offerings in other divisions were somewhat simpler than the analysis done here, our

work provided support for the corporate-wide Lane Strategy. In particular, our cost of complexity

analysis approach has been applied to other divisions, such as Wheel Loaders, with the goal of

capturing all the benefits and understanding all the consequences of proposed line changes. The

detailed analysis and structured optimization approach reported in this paper allowed Caterpillar

to counteract skepticism toward the lane approach embarked upon by BCP, prior to the CEO

mandate, and successful implementation, of this strategy for the entire company.

Shunko et al.: Restructuring the Backhoe Loader Product Line at Caterpillar

27

9. Conclusion

We present a three-step procedure to restructure a product line, and demonstrate its successful

application on the Backhoe Loader line at Caterpillar. Our methodology hinges on (i) The construction of migration lists to capture customer preferences and willingness to substitute; (ii) Explicitly

capturing the (positive and negative) cost of complexity of offering a specific product line across

different functional areas; and (iii) integrating these tools within a mathematical programming

framework to produce a final product line. One of the greatest strengths of our methodology is its

flexibility – each step can be custom tailored to a company’s particular setting, data availability

and strategic needs, so long as it produces the necessary output for the next step of the algorithm.

As Caterpillar evolves, so has their Lane Strategy. For example Thomson Reuters (2014) discusses

a new variation in which lanes may contain only partially completed machines, which can be finished

to customer order as needed. Ideas such as these offer opportunities to extend our work to new

problem domains – analytically characterizing the performance of such a delayed differentiation

strategy is an exciting and challenging problem.