Carla Da Silva Professor Sampson MGMT 392 Case Analysis

advertisement

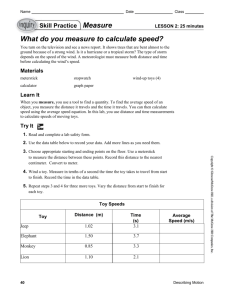

Carla Da Silva Professor Sampson MGMT 392 Case Analysis: Mattel and the Toy Recalls February 3rd, 2014 Issue/Decision In the case Mattel and the Toy Recalls by Hari Bapuji and Paul Beamish the major issue being presented is how the renowned toy company Mattel experiences the recalls of several of its products and the circumstances that may have attributed to them. These products included their Sarge Cars and over 967,000 children’s character toys due to excess amounts of lead in their surface paint. These recalls are the result of inconsistencies within a complex supply chain made up of several primary and secondary vendors in China who Mattel may or may have not had complete control over. The decision problem being solved is whether to recall the Sarge Cars and other unsafe products, finding where the recall problem originated within a complex supply chain in China, and how to minimize the negative consequences of the recall and make sure they do not occur again. The case also briefly describes the state of toy production in China and its supplier/ vendor relationship to major toy companies in the U.S. during the year of 2007, outlining the safety of the products made by Chinese manufacturers in particular. Several products made by manufacturers overseas, especially in China, were produced using materials that compromised product safety due to immense “pressure on the physical, technical, and human resource infrastructures” (Bapuji, Beamish, 2008, p. 2). This was U.S. consumers wary of purchasing all Chinese-made goods. Specific to the case, a large quantity of these products included Mattel’s toys which were made by Chinese manufacturers and did not meet the safety requirements of the Consumer Product Safety Commission (CPSC). This leads into an analysis on Mattel’s internal strengths and weaknesses as well as its external opportunities and threats that may lead to product recalls and other issues such as stakeholder management, company values, and external forces that influence supply and demand. Strategic Framework The marketing tools that will be used in this analysis include a description of the external market environment of the global toy market, Mattel’s internal environment, and how the recall will influence Mattel’s reputation. Recommendations on different scenarios Mattel could exercise are also included based on the analyses. Mattel was formed in 1944 and from selling a mass-produced, inexpensive music box they became an extremely successful company following the introduction of popular products such as Barbie and Hot Wheels. Mattel, alongside Hasbro, was an industry leader and the third largest company in the industry. It became a powerful player because of its sales and its corporate social responsibility accomplishments which included being named one of the top 100 Best Corporate Citizens by CRO Magazine in 2006 and being the recipient of the highest global rating of 10 by Governance Metrics Internation (GMI). In 2007 the global toy market was a booming business worth $71 billion with 36 per cent of the market concentrated in North America. The markets in Asia were growing rapidly and were expected to increase by 25 per cent during the year for a 37 percent market share. There were several toy companies competing within the toy industry in the U.S. and it was dominated by companies Mattel and Hasbro. Their combined sales exceeded the usual sales of other toy companies which usually made under a billion dollars. The entry of large retailers such as WalMart and Target resulted in increased competition and they eventually became major players in the U.S. toy market, selling over 60 per cent of all toys sold in the U.S. Specialty toy retailers began to lose market share due to this phenomenon. The trend in the industry was for U.S. toy companies to outsource their production overseas to Asian countries, which led to a decline in overall employment within the industry. Domestic operations were solely focused on “product design, marketing, R&D, and other highvalue functions” (Bapuji, Beamish, 2008, p. 2). This meant that the majority of demand for toys in the U.S. market was mainly met through Chinese imports, with only 10 percent from domestic production. Exhibit 3 shows the relationship between the total U.S. toy imports and U.S. imports from China. This reveals that the majority of toy-related products that were purchased by consumers in the U.S. were made in China. Major markets for toys was in the U.S. and Europe but their production took place in Asia, specifically China. There were several toy-making companies in China at the time and 60 per cent of all toys sold globally were made in China. They made up a complex web of supply chains that tended to outsource their own production of product components to other companies. They usually had contacts with large Western toy companies and were themselves involved in a complex web of supply chains. Mattels’ main manufacturing facilities were in various Asian countries and Mexico. In 2002 it closed its last toy factory in the U.S. and it began to produce its core brands in companyowned facilities but used third-party manufacturers for the production of its non-core brands. Over 800 million products were manufactured by Mattel and its vendors annually, with half of the toys made in Mattel’s own plants. The company’s outsourcing and manufacturing strategy took five decades to develop and it was able to manage the associated risks by “employing a mix of company-owned and vendor-owned manufacturing facilities across Asia” (Bapuji, Beamish, 2008, p. 6). This would soon be disproved by the vast number of product recalls Mattel was to face in a short period of time. Mattel had contracts with 37 main vendors who were responsible for producing its toys; the main vendors themselves used smaller companies for either full or partial production. Because of this trend, Mattel’s supply chains in China were both “long and complex” and it is stated in the case that over 3,000 different Chinese companies made Mattel products. However, an underlying issue with its supply chain was that Mattel only had contact with the main vendors so they could not have full control over how and where their products were sourced from. This reveals an important issue that Mattel faces when dealing with the recall situation concerning its Sarge Cars and other unsafe products: The company has no idea which manufacturer in the supply chain had used surface paint with illegal amounts of lead for their products. It could have been a principal vendor or a smaller company that produced for them. On June 2007 two test were conducted by Intertek, an independent lab, which revealed that the toys made by the Chinese vendor Lee Der Industrial Company contained an excess amount of lead. Another case occurred when a consumer reported that their home test kit found an excessive amount of lead in Mattel’s toys, those also being produced by Lee Der. Soon after, all products made by Der Lee were unaccepted since a large percentage of its toys contained excessive amounts of lead in the surface paint. Mattel management also ordered a suspension of all shipments of products made by Lee Der. It was later found out that normally Lee Der had purchased its paint from Dongxing New Energy Co. but when they had ran out they had to source it from another company, the Dongguan Zhongxin Toner Powder Factory. It turns out that Dongguan was a fake company and its owners were not able to be traced. On July 26th, 2007 Mattel decided to issue a recall on all products made by Lee Der on April 19th, 2007 from when they received the delivery of the lead-tainted paint until all products made by Lee Der ceased to be accepted on July 6th, 2007. While preparations for the recall were underway it was discovered that the paint on Mattel’s Sarge Cars contained lead. It was another case of a main Chinese vendor that outsourced its paint from an uncertified supplier. Lead was not the only issue with product safety that Mattel experienced. There were reports of loose magnets in Mattel’s Polly Pocket play sets that were all manufactured in China. There were also approximately a few hundred reports of loose magnets from other types of play sets all sold before November 2006. This created another issue that Mattel had to address immediately: what products were to be recalled and how to do go about the process. Analysis Although Mattel is one of the most successful companies in the U.S. toy industry the way in which it handles this recall situation will influence the consequences that may tarnish its overall reputation and future success. As aforementioned, the company needs to figure out what products need to be recalled, how to reduce the recall’s negative consequences, and how to prevent any other recalls from recurring in the future. It was 2007 during the time of the recalls and the global toy market was prosperous. Most of the market was concentrated in the U.S. and in Europe but production was mainly centered in Asia, especially China. There were many toy companies in China and this provided Mattel with a great deal of vendors to choose from since. The sheer number of vendors, over 3,000 companies, meant that they formed extremely long and complex supply chains, not very efficient for a product that requires different components to be made with certain requirements. This made it so that if recalls were to happen it would be a challenge to identify where in the supply chain any manufacturing incident occurred and how to handle it. Mattel chose to do business with Chinese vendors due to China’s position in the global toy industry and the lower cost business environment in China. While outsourcing toy production to these vendors may have guaranteed reduced costs and allowed the company more flexibility in its domestic operations, product design and development it did increase the risk of incidents in the supply chain. Recalls for products that were made with unsafe materials was common at the time since the surge in economic growth in China led to pressures on the countries labor force. Ultimately, product safety was sacrificed for production efficiency and Mattel’s product recalls were inevitable. Exhibit 4 presents the number of toy recalls made by the CPSC since 1988 and reveals that in 2006, 33 out of 41 recalled toys were manufactured in China. In other words, over 80 per cent of toys that were recalled were made in China in 2006. This should motivate Mattel to revisit their outsourcing strategy in China. SWOT Analysis Internal Strengths & Weaknesses Mattel’s internal strengths equip the company with certain advantages over other companies within the toy industry and allow it to be an industry leader. Rather than relying on point-of-sale (POS) data to forecast demand for toys Mattel relied on “variety as being the key driver of sales” (Bapuji, Beamish, 2008, p. 8). Following this realization they introduced a rolling-mix strategy through their Hot Wheels brand, changing the physical mix of car assortments “by seven to eight percent every two weeks” (Bapuji, Beamish, 2008, p. 8). Additionally, the company partnered with ABC Television and sponsored a 15-minute segment of Walt Disney’s Mickey Mouse Club for a full year which gave them a connection with kids, their primary consumer, which allowed them to influence consumers’ buying habits. One of Mattel’s internal weaknesses are its overseas principal vendors and highly complex supply chain. The company’s business groups may have provided its revenue beforehand but consumer demand as a result of the trend known as “kids getting older younger (KGOY)” is shifting especially for video games and electronics they need to change in order to keep up with the demand. Opportunities The company has outsourced the majority of its manufacturing overseas so that its domestic operations can focus on higher-value tasks such as product design and marketing. This allows it to minimize the time and costs of domestic production and focus on product design and function. This includes the development and design of Mattel’s products which was done in its corporate headquarters. The company also produced its core brands in company-owned facilities but used third-party manufacturers for the production of its non-core brands. Additionally, the company made significant acquisitions in the 1990’s that have aided in its success in the toy industry including Fisher-Price, Kransco, Tyco, Pleasant Company, and Bluebird Toys. Mattel also sold through Wal-Mart, Toys’R’Us, and Target, three major retailers that allowed the company to experience high sales. Exhibit 2 shows U.S. toy sales organized according to product category and it highlights the top product segments in the U.S. toy market: the infant/preschool toys, outdoor and sport toys, and dolls. These segments had been stagnant but it also shows that although the total amount of sales in the traditional toy industry were the highest, total sales for video games were growing rapidly. This is a threat since the business groups offered by Mattel does not include many products within this segment. This can also be an opportunity for Mattel to expand their product line into the video game and electronics industries. Being in the toy market Mattel’s target market would be children who could enjoy the character-based toys, play sets, and toy cars. Nevertheless, they have the opportunity to reach consumers of that are older children if they begin to produce toys and other products geared towards an older audience. This may include products such as portable electronics, books, and video games. Mattel could expand its horizons and find opportunities for new partnerships and license agreements. They benefitted greatly from making licensing agreements to make toys of characters that were owned by companies including Disney, Warner Brothers, Viacom, Origin Products, and Sesame Workshop. This allowed them to expand their product line while making sure they were making products that were in popular at the time, and thus taking advantage of consumer demand. Mattel also licensed some of its core brands to companies in different industries so they could design a variety of additional products named after the core brand. This expanded the reach of Mattel’s products to more consumers and ultimately, more market segments. Threats The recall of its Sarge cars and other products may hurt the reputation the company has worked to build over the course of its life as an industry leader. This could result in Mattel losing sales to Hasbro, one of its major competitors and fellow industry leader. Another major threat is the reoccurrence of product recalls due to the environment of Chinese manufacturers that compromise product safety. This can hurt Mattel’s reputation as a key player in the global toy market, reduce sales, and hurt its stock price. If Mattel does not produce products from different segments, such as those in the video game and electronics segment, it may fall behind competitors that are expanding to this segment and not be able to meet the demands of KGOY which coincid with a growth in youth electronics, products that are outside of the traditional toy industry. Recommendations All of the products made by Lee Der between April 19, 2007 and July 6th, 2007 should be recalled because of the lead-tainted paint used in their manufacture. Further testing should be conducted for the lead-tainted Sarge cars as well as the various play sets made in China in order to identify exactly where in the supply chain the incident began. Mattel should conduct additional testing on all other products whose components did not come from verified vendors and suppliers, especially on vendors with previous cases of excessive lead use. Mattel should also advise their principal vendors to run tests on all of their existing products to see if their components include any lead or other hazardous materials. Reducing the negative consequences will be a challenge for the company but there are certain actions that can reduce their effect on its reputation. Firstly, Mattel must establish an efficient set-up to handle the different product recalls. Hiring individuals who are experienced in recall situations, product safety, China’s toy industry and supply chain management, or toy manufacturing in general may help expedite the process for the company. Additional employees may also be in charge of ensuring that the unsafe products already sold to consumers are delivered back to the company. Since Mattel has a strong reputation when it came to its corporate social responsibility accomplishments, the company’s reputation may be saved and the recalls could be considered as an incident out of the company’s control since the products were originally manufactured in China. Reducing costs, losing sales, and having the stock price decline may be inevitable consequences for the company but if Mattel decides to shift their product offerings to match the demand for video games and electronics they could profit. During 2007 there was already an increased suspicion of Chinese-made goods not only in the U.S. toy industry but several others as well. The exponential growth that China’s economy experienced did mean low cost business but it also meant strained resource infrastructures which may have resulted in Chinese manufacturers disregarding product safety. As in the case where several of Mattel’s toys were recalled due to excessive levels of lead in their paint, it is no surprise that many of the recalled products were all manufactured in China and were the result of unclarity in its complex supply chain. Exhibit 5 portrays a list of the toys recalled in the U.S. since the beginning of 2007 and all of them were made in China, with only one exception. This data should support the company’s decisions to ensure their supply chain in China was functioning efficiently and according to regulations. Mattel should have expected accidents to occur in their supply chain since so many of their principal vendors were located in China. Stricter regulations on principle vendors and their outsourcing should be exercised in order to help prevent any recalls from reoccurring in the future. The final list of principle vendors and their own outsourcing should be reevaluated to ensure they are certified or non-certified. Another strategy that could benefit Mattel’s financial position and save its reputation is to increase its domestic manufacturing operations and reduce its overseas outsourcing. This will minimize chances of any products being recalled due to excessive levels of lead or other hazardous materials. This will also enable Mattel to regain people’s trust in the brand since they will appreciate the company’s in-house, American-made products over those that are Chinesemade. Limitations & Assumptions The recall of Mattel’s Sarge cars as well as their other at-risk products may be a considerably challenging process for Mattel to undertake. Since most outsourcing is managed by Chinese manufacturers within a large supply chain it would be difficult for the company to directly identify the problems and solutions associated with the recall process. The same difficulties would be present for the additional product testing for increased levels of lead; the more complex the supply chain the more difficult the process would be. Hiring additional workers to aid in the recall process may not be an option if Mattel’s sales decrease since there would be no way to fund these new workers. This would also require additional employee training, development, and resources that the company may not have during this period. Moreover, due to Mattel’s declining reputation because of the recalls there may be a lower number of applicants interested in working for the company. Stricter regulations on principle vendors and their outsourcing may be a difficult task to accomplish since there are so many primary and secondary vendors and they are all located overseas. Governmental and business regulations in China may also pose some challenges for Mattel to overcome. Mattel increasing its domestic manufacturing operations may be feasible if the number of primary vendors decreased enough to allow this. The company could have company-owned facilities produce its non-core brands rather than third-party facilities. However, just as it would cost the company to hire more employees expanding domestic production would also translate into increased expenses. Works Cited Bapuji, H., Beamish, P. (2014, Dec 15). Mattel and the Toy Recalls. Retrieved from: https://cb.hbsp.harvard.edu/cbmp/import/ptos/33384089