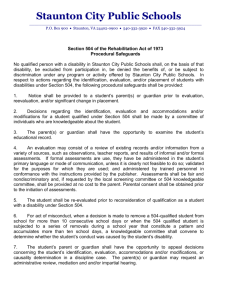

View/Download - Professional Insurance Enrollers

advertisement

You count on your employees to rise to the occasion. disability insurance protects them when they can’t. We take your business personally® DENTAL • LIFE • DISABILITY • MEDICAL • CRITICAL ILLNESS • SECTION 125 • VISION Guardian has been protecting businesses and their employees against financial hardships for more than 50 years. Unfortunately, disability strikes more often than you may think. A disabling injury occurs every three seconds in a public setting and every four seconds in the home.* Even though health insurance will cover most medical costs, it will not replace lost income. And with 71% of Americans living paycheck to paycheck**, clearly disability insurance is not an option, but a necessity. That’s why it is so important to work with a company and a team with the experience you can count on. As a disability market leader, Guardian is there when disability strikes to protect your employees against financial hardship, and to help make the transition back to work smoother. In addition to financial support to your employees, our disability insurance helps reduce medical costs, downtime and business interruption. * Source: National Safety Council, “Injury Facts,” 2007 Edition ** Source: American Payroll Assocation, “Getting Paid in America” Survey, 2008 Disability Protection 3 in 10 workers entering the workforce will become disabled before retiring.1 Flexible, comprehensive plans for a wide variety of employee needs. Responsive to your employee needs and business demands. nE mployees get the support they need when they need it, including quick response to questions, accurate claims payments based on established standards, and fast claims turnaround. Whether you have two or 5,000 employees covered by a disability plan, Guardian offers exceptionally flexible plans and customized features to cover a variety of business as well as employee needs. Guardian offers Short Term Disability (STD), Long Term Disability (LTD), Employee Assistance Programs, Enhanced FMLA Services2 and multi-product packaged plans that include disability. n Guardian thoroughly reviews each claim using resources such as national databases, highly-skilled medical and peer-review specialists, and rehabilitation counselors. Options and add-ons let you customize features and benefits for greater value to you and your employees. In addition to standard disability options, Guardian can help you meet the needs of your employees though innovative optional plan features: • Critical Disability Supplement pays an additional benefit over the regular LTD benefits (10% - 40% of salary for certain serious disabilities). • Medical/Dental Plan Premium Benefit helps disabled employees pay medical and dental premiums. • Presumptive Disability Benefit includes guaranteed benefits in the case of loss of limbs, hearing, or vision. • Revenue Protection Rider compensates employers for revenue lost when a key employee is disabled. • Spousal Disability Benefit pays a benefit to help care for a critically disabled spouse. • Lifetime Critical Disability Benefit continues benefits beyond the maximum duration if the insured is functionally disabled. Guardian will be there when it counts The financial strength and stability of your insurance company should be a key factor in the selection process, especially in challenging economic times. Our exemplary ratings affirmed by the major rating agencies help reinforce Guardian’s ability to pay your employees’ short and long-term disability claims, quickly and reliably. Founded in 1860, as one of the largest mutual companies in the United States, Guardian is able to focus on the financial well-being of our policyholders – without the distractions that can result from the short-term demands of Wall Street. Visit www.GuardianLife.com for current, detailed information on Guardian’s financial strength.3 Note: Plans and options available may vary by state. 1 2 3 4 Source: Social Security Administration, Fact Sheet 2007 FMLA services are provided by FMLASource®, an affliate of ComPsych® Corporation. Ratings as of 12/09: Fitch (AA+/Very Strong), Moody’s (Aa2/Excellent), Standard & Poor’s (AA+/Very Strong), A.M. Best (A++/Superior). Financial information concerning The Guardian Life Insurance Company of America as of 12/31/09 on a statutory basis: Admitted Assets = $30.9 Billion; Liabilities = $26.7 Billion (including $23.5 Billion of Reserves); and Surplus = $4.2 Billion. Program services are provided by Integrated Behavioral Health, Inc. and its contractors. n Early Alert Program helps improve return-to-work outcomes by administering and evaluating both STD and LTD in one location. n Social Security Filing Assistance helps eligible employees obtain Social Security benefits to maximize coverage. n TeleGuard claims submission telephone service helps to quickly and accurately file and evaluate STD claims. n One bill for all product lines makes it simple for you. n TravelAid available to help protect employees when they travel.4 nG uardian Anytime® is our comprehensive web site, offering self-service for both employers and employees. nP ersonalized Customer Response Units are available by phone or e-mail to answer questions promptly. Dental • Life • Disability • Medical • Critical Illness • Section 125 • Vision Disability Protection Enrollment Support Resources Full-service, expert enrollment support helps ensure satisfaction and ease at every stop for employers and employees. Our Enrollment Success Plan (ESP) waives participation requirements for voluntary plans. ESP is a set of enrollment recommendations designed to help employees better understand their plan options and make it easier for them to choose coverages that best fit their needs. More than 100 Certified Enrollment Specialists are available to conduct your enrollment meetings.* Enrollment kits personalized to each employee, featuring his/her name and enrollment form pre-filled with employee’s demographic information and cost based on age and salary. Employee Online Enrollment that enables employees of existing Guardian customers to conveniently enroll or make updates to benefits — plus customers can easily check status of Evidence of Insurability applications online. Toll-free Employee Benefits Hotline provides answers to questions prior to enrollment. Employee Assistance Program improves business productivity Guardian offers WorkLifeMatterssm, an EAP, to help employees cope with balancing work and home life. Since problems at home can lead to issues on the job, WorkLifeMatterssm supports employees with everything from child and eldercare to resources for legal assistance and substance abuse counseling. This valuable service is available to groups that purchase three or more lines of Guardian coverage. WorkLifeMatterssm program services are provided by Integrated Behavioral Health, Inc. and its contractors. Guardian. Insurance for companies that take employee protection personally. No matter how big your business is, insurance is more than just a business decision. It’s also a personal decision. The benefits you provide protect your employees and their families – employees who work hard to make your business a success. Yet you still need to look out for the needs of the company as a whole. For 150 years, Guardian has been providing diversified financial strategies to Americans nationwide; and for over 50 years we’ve been helping companies strike the balance for employee benefits. We recognize that each situation is different, so we bring a wide variety of options to the table. A broad product portfolio. Flexibility in the choice of features. And the personal expertise to help you navigate your choices. From Medical, Dental and Life Insurance to Disability, Long Term Care and Retirement plans, Guardian and its subsidiaries provide more ways for you to take good care of your employees. Call your broker for more information about Guardian Disability Protection. * May not be available for cases under a certain case size. Check with your local sales office. Limitations and exclusions apply. Plan documents are the final arbiter of coverage. Important Information: We limit the duration of payments for long term disabilities caused by mental or emotional conditions, or alcohol or drug abuse. We do not pay benefits for charges relating to a covered person: taking part in any war or act of war (including service in the armed forces); committing a felony or taking part in any riot or other civil disorder; or intentionally injuring themselves or attempting suicide while sane or insane. We do not pay benefits for charges related to legal intoxication, including but not limited to the operation of a motor vehicle, and for the voluntary use of any poison, chemical, prescription or non-prescription drug or controlled substance unless it has been prescribed by a doctor and is being used as prescribed. We do not pay benefits during any period in which a covered person is confined to a correctional facility, an employee is not under the care of a doctor, an employee is receiving treatment outside of the US or Canada and the employee’s loss of earnings is not solely due to disability. This policy provides disability income insurance only. It does not provide “basic hospital,” “basic medical,” or “major medical” insurance as defined by the New York State Insurance Department. If the plan is new (not transferred): This LTD plan does not pay charges relating to a pre-existing condition, unless the disability begins after the employee has been insured for the specified number of months. This STD plan will limit payment for disabilities due to pre-existing conditions to 26 weeks (applicable to non-voluntary plans with greater than 26 week duration) and 2 weeks on all voluntary plans. A pre-existing condition includes any condition for which an employee, in the specified period prior to coverage under this plan, consults with a physician, receives treatment, or takes prescribed drugs. Please refer to the plan documents for specific time periods. Contract GP-1-LTD07-1.0, et al. & GP-1-STD07-1.0, et al. The Guardian Life Insurance Company of America, 7 Hanover Square, New York NY 10004 2010-537 (3/10) PUB 4119 (3/10)