Click here fore more information.

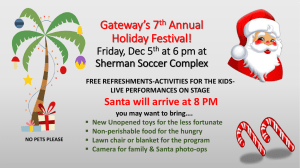

advertisement