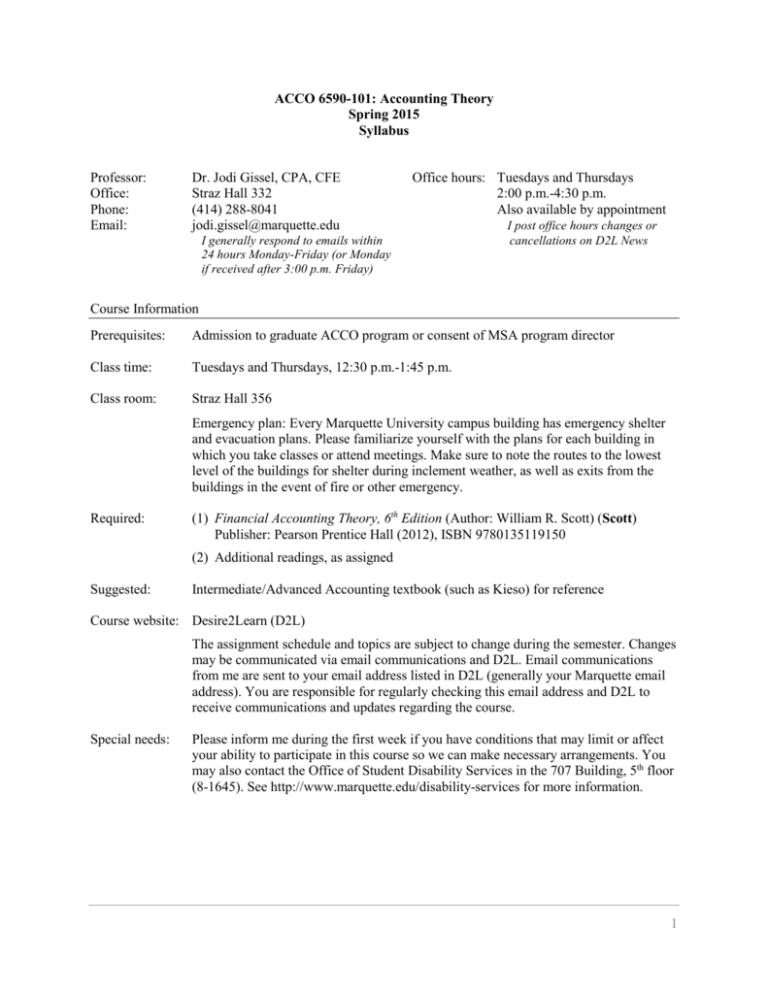

ACCO 6590-101: Accounting Theory

Spring 2015

Syllabus

Professor:

Office:

Phone:

Email:

Dr. Jodi Gissel, CPA, CFE

Straz Hall 332

(414) 288-8041

jodi.gissel@marquette.edu

Office hours: Tuesdays and Thursdays

2:00 p.m.-4:30 p.m.

Also available by appointment

I generally respond to emails within

24 hours Monday-Friday (or Monday

if received after 3:00 p.m. Friday)

I post office hours changes or

cancellations on D2L News

Course Information

Prerequisites:

Admission to graduate ACCO program or consent of MSA program director

Class time:

Tuesdays and Thursdays, 12:30 p.m.-1:45 p.m.

Class room:

Straz Hall 356

Emergency plan: Every Marquette University campus building has emergency shelter

and evacuation plans. Please familiarize yourself with the plans for each building in

which you take classes or attend meetings. Make sure to note the routes to the lowest

level of the buildings for shelter during inclement weather, as well as exits from the

buildings in the event of fire or other emergency.

Required:

(1) Financial Accounting Theory, 6th Edition (Author: William R. Scott) (Scott)

Publisher: Pearson Prentice Hall (2012), ISBN 9780135119150

(2) Additional readings, as assigned

Suggested:

Intermediate/Advanced Accounting textbook (such as Kieso) for reference

Course website: Desire2Learn (D2L)

The assignment schedule and topics are subject to change during the semester. Changes

may be communicated via email communications and D2L. Email communications

from me are sent to your email address listed in D2L (generally your Marquette email

address). You are responsible for regularly checking this email address and D2L to

receive communications and updates regarding the course.

Special needs:

Please inform me during the first week if you have conditions that may limit or affect

your ability to participate in this course so we can make necessary arrangements. You

may also contact the Office of Student Disability Services in the 707 Building, 5th floor

(8-1645). See http://www.marquette.edu/disability-services for more information.

1

Department of Accounting Mission Statement

The mission of the Department of Accounting in the College of Business Administration is to prepare

students to be responsible, competent and ethical leaders in accounting, business, government and

not-for-profit careers. Marquette’s undergraduate degree in accounting builds upon the liberal arts

requirements by emphasizing oral and written communication skills, ethical behavior, analytical

reasoning, computer competency, and technical knowledge sufficient for attaining a relevant

accounting profession. The Master of Science in Accounting (MSA) degree focuses on: (1) enhancing

the student’s knowledge in finance, management, and specific accounting areas, (2) preparing the

student for professional examinations (e.g., CPA, CMA, CIA, CPFO), and (3) qualifying students for

positions in public, corporate, or government/not-for-profit accounting.

We emphasize leadership and service through the internship program and activities of our student

chapter of Beta Alpha Psi. Students can meet the 150 hour requirement for certification either through

the undergraduate degree (with 150 credit hours), the MSA, or the Master of Business Administration

(including courses needed to qualify for the CPA examination). This information is also available at

http://business.marquette.edu/departments/accounting.

College of Business Administration Assessment Statement

The fundamental mission of the College of Business Administration is to provide a quality education

grounded in Catholic, Jesuit intellectual values. Students are expected to learn how to function

effectively in a diverse and global economy so that they may develop into ethically and socially

responsible global leaders and responsible members of their organizations and communities. As one

of many methods of assuring that the goals of our educational mission are successfully met, the

college regularly and systematically engages in the assessment of these competencies.

Students in the Bachelor of Science in Business Administration program are assessed on their ability

to reason ethically, communicate effectively, analyze critically, and understand local, national and

global business and cultural issues. Students in our MBA programs are also assessed on their

competency to communicate effectively, reason ethically and apply critical thinking, as well as their

capacity to comprehend the global strategic issues of firms and perform fundamental activities of

business managers. Students in our other graduate programs are assessed on specific competencies

related to their disciplines.

The Master of Science in Accounting (MSA) current learning outcomes (also available at

http://business.marquette.edu/academics/msa-learning-outcomes) are:

i.

ii.

iii.

iv.

v.

vi.

Apply critical thinking to accounting issues

Demonstrate effective written communication skills

Demonstrate effective oral communication skills

Apply professional knowledge skills of accounting

Analyze ethical issues

Analyze the international environment

Assessment takes place each semester in all programs and settings using quantifiable measures; that

information is gathered and analyzed to help continuously improve the educational process. The

College of Business Administration is dedicated to successfully providing a quality education for all

students. Assessment is the continuous improvement process of evaluating our success. More

information on assessment can be found at http://www.marquette.edu/assessment/ or in the assurance

of learning tabs under http://business.marquette.edu/academics/assurance-of-learning-undergrad or

http://business.marquette.edu/academics/assurance-of-learning-graduate.

2

Course Objectives

This course considers accounting from a theoretical perspective, with emphasis on current issues

under debate by Financial Accounting Standards Board (FASB). Primary course objectives are:

1. To understand and analyze the theoretical structure underlying financial accounting.

2. To understand how accounting theory relates to basic financial statements and standard setting.

3. To apply critical thinking, ethical reasoning, and research skills relating to standards, standard

setting, and case analyses.

4. To enrich communication skills.

Each of these primary course objectives relates to MSA goals to apply critical thinking to accounting

issues, to demonstrate effective communication skills, to apply professional knowledge skills of

accounting, to analyze ethical issues, and to analyze the international environment.

Course Policies

Statement on Academic Integrity

Students, faculty, and staff at Marquette University developed a Statement on Academic Integrity

that recognizes the importance of integrity, both personal and academic, and includes an Honor

Pledge and Honor Code applicable to all.

The Honor Pledge

I recognize the importance of personal integrity in all aspects of life and work. I

commit myself to truthfulness, honor, and responsibility, by which I earn the respect

of others. I support the development of good character and commit myself to uphold

the highest standards of academic integrity as an important aspect of personal

integrity. My commitment obliges me to conduct myself according to the Marquette

University Honor Code.

Student Obligations under the Honor Code

1. To fully observe the rules governing exams and assignments regarding resource material,

electronic aids, copying, collaborating with others, or engaging in any other behavior that

subverts the purpose of the exam or assignment and the directions of the instructor.

2. To turn in work done specifically for the paper or assignment, and not to borrow work

either from other students, or from assignments for other courses.

3. To give full and proper credit to sources and references, and to acknowledge the

contributions and ideas of others relevant to academic work.

4. To report circumstances that may compromise academic honesty, such as inattentive

proctoring or premature posting of answers.

5. To complete individual assignments individually, and neither to accept nor give

unauthorized help.

6. To accurately represent their academic achievements, which may include their grade

point average, degree, honors, etc., in transcripts, in interviews, in professional

organizations, on resumes and in the workplace.

7. To report any observed breaches of this honor code and academic honesty.

Please visit http://bulletin.marquette.edu/schoolofmanagement/academicregulations/.

3

Academic dishonesty

Academic dishonesty includes cheating, dishonest conduct, plagiarism, and collusion. In the

event of academic dishonesty, I follow the University’s procedures for incidents of academic

dishonesty. Please review the University’s academic honesty policies and procedures:

Definitions:

http://www.mu.edu/mucentral/registrar/policy_honesty-definitions.shtml

Consequences: http://www.mu.edu/mucentral/registrar/policy_honesty-consequences.shtml

Procedures:

http://www.mu.edu/mucentral/registrar/policy_honesty-procedures.shtml

Note: Students must submit electronic Microsoft Word versions of written assignments in

addition to printed versions. All written assignments are subject to a plagiarism detection service

such as ‘Turnitin’.

Grading distribution

Graded items percentage of final grade:

Participation

15%

Exams (3 at 20% each)

60%

Group project

25%

100%

Grade cut-offs:

A

93.00% – 100.0%

AB 88.00% – 92.99%

B

83.00% – 87.99%

BC 78.00% – 82.99%

C

72.00% – 77.99%

F

< 72.00%

Participation

Participation is essential to succeed in this course and to make this course a valuable experience

for everyone. Participation includes attending each class meeting, not arriving late or leaving

early, being prepared for class, asking thoughtful questions, providing meaningful insight to

discussions, and active involvement (for example, paying attention, voluntary participation, not

texting/emailing during class, not engaging in side conversations during class, contributing to inclass group activities).

Participation also includes appropriate etiquette with respect to cellular telephones (silence and

store in your bag during class) and laptops (relevant class-related use only). Both you and your

fellow classmates benefit from your appropriate course participation through minimized

distractions and shared experiences.

Being prepared for class is necessary for appropriate participation. You are responsible for

preparing for class by completing assigned pre-class readings and being able to discuss the

contents, as well as for giving thoughtful consideration to discussion questions in order to

facilitate in-class discussions and activities. Responses to discussion questions may not be

explicit in the readings – they are meant to be thought-provoking. You are responsible for all

assigned material, whether or not we specifically discuss it. Although we may not discuss every

detail of assigned material, it is important that you read all assigned material to gain

understanding of issues.

Attendance

The Marquette University Graduate School of Management considers regular class attendance an

important component of the learning process. Students are expected to attend scheduled class

meetings. Excessive absences may have adverse consequences, ranging from a lowered course

grade to forced withdrawal from the course. Excessive absence is generally defined as missing

more than 10-15% of regularly scheduled class time (including arriving late or leaving early). If

you arrive late, you are responsible for notifying me of your attendance at break or after class.

4

Exams

Exams test your understanding of course material, as well as your critical thinking skills,

analytical skills and ability to apply knowledge. Question types may include multiple choice,

matching, short answer, essay questions, and/or case problems. Exam material draws heavily

from lecture material and in-class discussions and activities, as well as pre-class readings.

You must take the exams during the scheduled times, except in extreme circumstances (limited to

severe illness, death in your immediate family, unavoidable legal obligations such as jury duty, or

University-authorized absence such as athletic travel). I must receive appropriate documentation

and approve requests no later than one week before the related exam date, except in cases of

emergency (severe illness, accident, or death in your immediate family). If these conditions are

not met, you will not be given a make-up exam and will not receive credit for the missed exam. If

these conditions are met, but I determine it is not possible to schedule a make-up exam within a

timely manner, your final grade will be based on relative proration of remaining graded items.

Exam retention policy: I distribute your graded exams for you to review in class. However, you

may not remove your exams from the classroom or copy/scan/photograph the exams in any way.

Failure to return your exam to me before leaving the classroom may result in a zero grade for the

exam. You are welcome to review your exams during my office hours or by appointment as well.

Group project

You will complete one group project, preparing a written report analyzing an issue that requires

research and application of accounting standards, as well as critical assessment. The written

report is due Friday, March 6. Details and requirements are forthcoming.

Class cancellations

In the event of inclement weather, the Office of the Provost makes the decision to cancel courses.

If the University officially closes during a scheduled exam time, the exam will be given during

the next available class meeting. If the University officially cancels classes during finals week,

students will receive the grade earned to date.

Course Schedule

Schedule is subject to change during the semester. You are responsible for checking D2L News for any changes.

Date

Pre-Class Reading and Discussion Questions

T 1/13

HISTORY OF ACCOUNTING PROFESSION AND ACCOUNTING THEORY

Required Reading

Scott Chapter 1

NOTE: On February 12, we will work with the FASB Codification in class. Prior to that

time, you are responsible for reading and completing twelve lessons. I suggest you not leave

these lessons until the last minute, but work through them over the next few weeks.

R 1/15

ACCOUNTING THEORY FOUNDATIONS

Required Reading

Devine (1960) Research methodology and accounting theory formation

5

Date

Pre-Class Reading and Discussion Questions

T 1/20

ACCOUNTING UNDER IDEAL CONDITIONS

Required Reading

Scott Chapter 2

Discussion Questions

Scott Chapter 2 Questions & Problems 7, 8, 10, 13

R 1/22

THE CONCEPTUAL FRAMEWORK AND STANDARD SETTING

Required Reading

FASB Concepts Statement No. 8 Conceptual Framework for Financial Reporting

Read only

Intro “Statements of Financial Accounting Concepts” (2 pages before Contents)

Chapter 1 (para.OB1-OB21)

Chapter 3 (para.QC1-QC39)

FASB International Convergence of Accounting Standards – A Brief History

Schipper (2003) Principles-based accounting standards

Shortridge and Myring (2004) Defining principles-based accounting standards

Discussion Questions

1. Why are concepts statements not GAAP? How does the conceptual framework relate

to standard setting?

2. Why is it important to identify qualitative characteristics of useful financial

information?

3. What are factors that may influence development of accounting systems?

4. Why did international accounting standards gain attention?

5. Should FASB pursue principles-based standards, or should US accounting standards

remain primarily rules-based? Would principles-based standards improve quality and

transparency of US financial accounting and reporting?

6. Are financial statements comparable under current US standards? Would financial

statements be comparable if US standards become principles-based?

T 1/27

STANDARD SETTING PROCESS: ECONOMIC ISSUES

Required Reading

Scott Chapter 12

Discussion Questions

Scott Chapter 12 Questions & Problems 1, 3, 4, 5, 6

R 1/29

STANDARD SETTING PROCESS: POLITICAL ISSUES

Required Reading

Scott Chapter 13

Discussion Questions

Scott Chapter 13 Questions & Problems 1, 2, 3, 15

T 2/3

FASB PROJECT ON REVENUE RECOGNITION

Required Reading

FASB ASU No. 2014-09 Revenue from Contracts with Customers (Topic 606)

Read only Summary (pp.1-11)

Discussion Questions

1. Why did FASB believe improvements were necessary in how companies recognize

revenue in financial reporting?

2. How does the new guidance improve over previous standards?

6

Date

Pre-Class Reading and Discussion Questions

R 2/5

FASB PROJECT ON REVENUE RECOGNITION

Required Reading

AICPA Insights: 12 revenue recognition concerns

Tysiac (2014) Substantial new disclosures required by revenue standard

Ciesielski (2014) Can investors win in a new era of accounting?

Tysiac (2014) Revenue transition group debates difficult implementation issues

Discussion Questions

1. What are some concerns relating to the new revenue recognition guidance?

2. What are implications of the new guidance beyond financial reporting?

T 2/10

Exam

R 2/12

US GAAP & THE FASB CODIFICATION

Required Reading

FASB Statement of Financial Accounting Standards (SFAS) No. 168

Read only Introduction, Objective, Standards of Financial Reporting (para.1-13)

FASB Learning Guide for the Codification Research System Professional View

Read Lessons 1-12 and access the Codification as instructed in the text and “Try It

Now” boxes before class. You do not have to complete Questions, Exercises, or

Problems at the end of Lessons. We will work through a selection of these in class.

You must use this website (login will not give you access using the FASB website)

Website:

http://aaahq.org/ascLogin.cfm

Username: AAA51688

Password: X4yK8yB (case sensitive)

Discussion Questions

1. Why did FASB develop the Codification?

2. What if accounting treatment is not specified within authoritative GAAP? Are there

cases where entities may still need to refer to pre-Codification guidance?

* We will access the Codification during class. If you have a laptop, please bring it to class.

T 2/17

THE DECISION USEFUL APPROACH TO FINANCIAL REPORTING

Required Reading

Scott Chapter 3

Discussion Questions

Scott Chapter 3 Questions & Problems 6, 11

R 2/19

THE DECISION USEFUL APPROACH TO FINANCIAL REPORTING

T 2/24

EFFICIENT SECURITIES MARKETS

Required Reading

Scott Chapter 4

Discussion Questions

Scott Chapter 4 Questions & Problems 1, 4, 6

R 2/26

EFFICIENT SECURITIES MARKETS

T 3/3

THE INFORMATION APPROACH TO DECISION USEFULNESS

Required Reading

Scott Chapter 5

Discussion Questions

Scott Chapter 5 Questions & Problems 1, 2, 3, 5, 13

R 3/5

THE INFORMATION APPROACH TO DECISION USEFULNESS

F 3/6

Group Project DUE

continued discussion

continued discussion

continued discussion

7

Date

Pre-Class Reading and Discussion Questions

T 3/10

NO CLASS – SPRING BREAK

R 3/12

NO CLASS – SPRING BREAK

T 3/17

THE MEASUREMENT APPROACH TO DECISION USEFULNESS

Required Reading

Scott Chapter 6

Discussion Questions

Scott Chapter 6 Questions & Problems 1, 2, 3, 6, 12

R 3/19

THE MEASUREMENT APPROACH TO DECISION USEFULNESS

T 3/24

MEASUREMENT APPLICATIONS

Required Reading

Scott Chapter 7

Discussion Questions

Scott Chapter 7 Questions & Problems 1, 8, 12

R 3/26

MEASUREMENT APPLICATIONS

T 3/31

Exam

R 4/2

NO CLASS – EASTER HOLIDAY

T 4/7

ECONOMIC CONSEQUENCES AND POSITIVE ACCOUNTING THEORY

Required Reading

Scott Chapter 8

Discussion Questions

Scott Chapter 8 Questions & Problems 1, 3, 5, 7

R 4/9

ECONOMIC CONSEQUENCES AND POSITIVE ACCOUNTING THEORY

T 4/14

AN ANALYSIS OF CONFLICT

Required Reading

Scott Chapter 9

Discussion Questions

Scott Chapter 9 Questions & Problems 1, 2, 5, 6, 20

R 4/16

AN ANALYSIS OF CONFLICT

T 4/21

EXECUTIVE COMPENSATION

Required Reading

Scott Chapter 10

Discussion Questions

Scott Chapter 10 Questions & Problems 2, 3, 5

R 4/23

EXECUTIVE COMPENSATION

T 4/28

EARNINGS MANAGEMENT

Required Reading

Scott Chapter 11

Discussion Questions

Scott Chapter 11 Questions & Problems 1, 2, 12

R 4/30

EARNINGS MANAGEMENT

F 5/8

Exam (10:30 AM-12:30 PM)

continued discussion

continued discussion

continued discussion

continued discussion

continued discussion

continued discussion

8