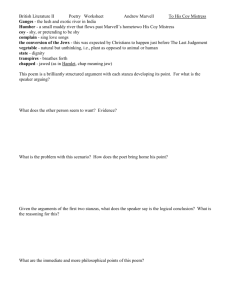

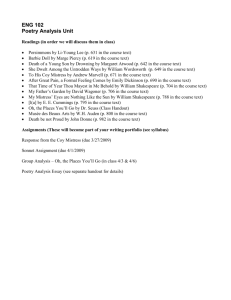

Nick's Notes

advertisement