Surrogate Rules of Court - Alberta Queen's Printer

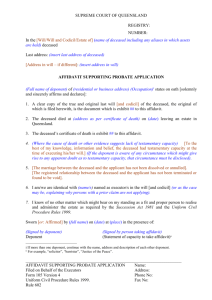

advertisement