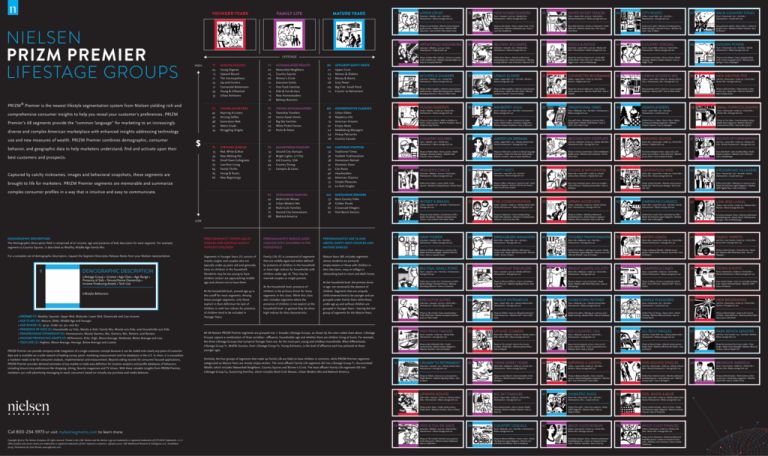

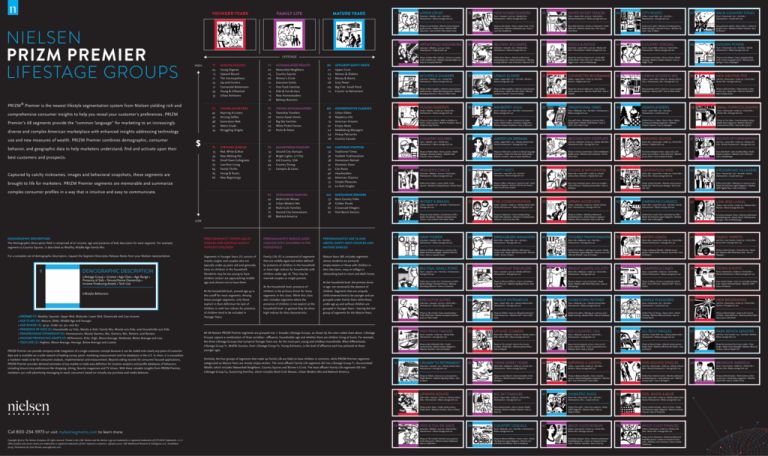

YOUNGER YEARS

NIELSEN

PRIZM PREMIER

LIFESTAGE GROUPS

FAMILY LIFE

MATURE YEARS

LIFESTAGE

HIGH

Y1

04

13

21

25

31

34

35

MIDLIFE SUCCESS

Young Digerati

Upward Bound

The Cosmopolitans

Up-and-Comers

Connected Bohemians

Young & Influential

Urban Achievers

F1

02

05

06

10

11

14

15

16

ACCUMULATED WEALTH

Networked Neighbors

Country Squires

Winner's Circle

Executive Suites

Fast-Track Families

Kids & Cul-de-Sacs

New Homesteaders

Beltway Boomers

M1

01

03

07

08

09

12

AFFLUENT EMPTY NESTS

Upper Crust

Movers & Shakers

Money & Brains

Gray Power

Big Fish, Small Pond

Cruisin' to Retirement

Y2

40

47

48

50

54

YOUNG ACHIEVERS

Aspiring A-Listers

Striving Selfies

Generation Web

Metro Grads

Struggling Singles

F2

23

26

27

29

30

YOUNG ACCUMULATORS

Township Travelers

Home Sweet Home

Big Sky Families

White Picket Fences

Pools & Patios

M2

17

18

19

20

22

24

28

CONSERVATIVE CLASSICS

Urban Elders

Mayberry-ville

American Dreams

Empty Nests

Middleburg Managers

Pickup Patriarchs

Country Casuals

Y3

55

59

60

63

64

65

66

STRIVING SINGLES

Red, White & Blue

New Melting Pot

Small-Town Collegiates

Low-Rise Living

Family Thrifts

Young & Rustic

New Beginnings

F3

33

37

39

44

51

MAINSTREAM FAMILIES

Second City Startups

Bright Lights, Li'l City

Kid Country, USA

Country Strong

Campers & Camo

M3

32

36

38

41

43

46

49

52

53

CAUTIOUS COUPLES

Traditional Times

Toolbelt Traditionalists

Hometown Retired

Domestic Duos

City Roots

Heartlanders

American Classics

Simple Pleasures

Lo-Tech Singles

F4

42

45

56

61

68

SUSTAINING FAMILIES

Multi-Culti Mosaic

Urban Modern Mix

Multi-Culti Families

Second City Generations

Bedrock America

M4

57

58

62

67

SUSTAINING SENIORS

Back Country Folks

Golden Ponds

Crossroad Villagers

Park Bench Seniors

®

PRIZM Premier is the newest lifestyle segmentation system from Nielsen yielding rich and

comprehensive consumer insights to help you reveal your customer's preferences. PRIZM

Premier’s 68 segments provide the "common language" for marketing to an increasingly

diverse and complex American marketplace with enhanced insights addressing technology

use and new measures of wealth. PRIZM Premier combines demographic, consumer

behavior, and geographic data to help marketers understand, find and activate upon their

best customers and prospects.

Captured by catchy nicknames, images and behavioral snapshots, these segments are

brought to life for marketers. PRIZM Premier segments are memorable and summarize

complex consumer profiles in a way that is intuitive and easy to communicate.

LOW

DEMOGRAPHIC DESCRIPTORS

The Demographic Description field is comprised of an income, age and presence of kids descriptor for each segment. For example,

segment 05 Country Squires, is described as Wealthy, Middle Age Family Mix.

PREDOMINANTLY UNDER AGE 45,

SINGLES AND COUPLES MOSTLY

WITHOUT CHILDREN

PREDOMINANTLY MIDDLE-AGED

FAMILIES WITH CHILDREN IN THE

HOUSEHOLD

PREDOMINANTLY AGE 55 AND

ABOVE, EMPTY-NEST COUPLES AND

MATURE SINGLES

For a complete set of demographic descriptors, request the Segment Descriptor Release Notes from your Nielsen representative.

Segments in Younger Years (Y) consist of

mostly singles and couples who are

typically under 45 years old and generally

have no children in the household.

Residents may be too young to have

children and/or are approaching middle

age and choose not to have them.

Family Life (F) is composed of segments

that are middle-aged and either defined

by presence of children in the household

or have high indices for households with

children under age 18. They may be

married couples or single parents.

Mature Years (M) includes segments

whose residents are primarily

empty-nesters or those with children in

their late teens, away at college or

rebounding back to mom and dad’s home.

• INCOME (7): Wealthy, Upscale, Upper Mid, Midscale, Lower Mid, Downscale and Low Income

• AGE CLASS (4): Mature, Older, Middle Age and Younger

• AGE RANGE (4): 35-50, Under 50, 50+ and 65+

• PRESENCE OF KIDS (5): Households w/ Kids, Mostly w Kids, Family Mix, Mostly w/o Kids, and Households w/o Kids

• TENURE/HOME OWNERSHIP (5): Homeowners; Mostly Owners; Mix, Owners; Mix, Renters; and Renters

• INCOME PRODUCING ASSETS (7): Millionaires, Elite, High, Above Average, Moderate, Below Average and Low

• TECH USE (5): Highest, Above Average, Average, Below Average and Lowest

PRIZM Premier can provide company-wide integration of a single customer concept because it can be coded onto nearly any piece of customer

data and is available on a wide network of leading survey, panel, marketing measurement and list databases in the U.S. In short, it is everywhere

a marketer needs to be for consumer analysis, implementation and measurement. Beyond coding records for consumer focused applications,

PRIZM Premier provides demand estimates of any market or trade area definition for location analytics and profile databases of behaviors,

including leisure time preferences like shopping, dining, favorite magazines and TV shows. With these valuable insights from PRIZM Premier,

marketers can craft advertising messaging to reach consumers based on virtually any purchase and media behavior.

Call 800-234-5973 or visit mybestsegments.com to learn more.

Copyright ©2015 The Nielsen Company. All rights reserved. Printed in the USA. Nielsen and the Nielsen Logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C.

Other product and service names are trademarks or registered trademarks of their respective companies. Lifestyle source: GfK Mediamark Research & Intelligence LLC. Doublebase

[2015]. Illustrations by Scott Brooks, www.sgbrooks.com.

At the household level, around age 45 is

the cutoff for most segments. Among

these younger segments, only those

explicit in their definition for lack of

children or with low indices for presence

of children tend to be included in

Younger Years.

At the household level, presence of

children is the primary driver for many

segments in this class. While this class

also includes segments where the

presence of children is not explicit at the

household level, in general they do show

high indices for that characteristic.

At the household level, the primary driver

is age, not necessarily the absence of

children. Segments that are uniquely

child-centered tend to be younger and are

grouped under Family Years while those

under age 45 and without children are

grouped in Younger Years—leaving the last

group of segments for the Mature Years.

All 68 Nielsen PRIZM Premier segments are grouped into 11 broader Lifestage Groups, as shown by the color-coded chart above. Lifestage

Groups capture a combination of three variables—affluence, householder age and whether there are children living at home. For example,

the three Lifestage Groups that comprise Younger Years are, for the most part, young and childless households. What differentiates

Lifestage Group Y1, Midlife Success, from Lifestage Group Y2, Young Achievers, is the level of affluence each has achieved at these

younger ages.

Similarly, the four groups of segments that make up Family Life are likely to have children in common, while PRIZM Premier segments

categorized as Mature Years are mostly empty-nesters. The most affluent Family Life segments fall into Lifestage Group F1, Accumulated

Wealth, which includes Networked Neighbors, Country Squires and Winner’s Circle. The least affluent Family Life segments fall into

Lifestage Group F4, Sustaining Families, which includes Multi-Culti Mosaic, Urban Modern Mix and Bedrock America.

URBAN

NIELSEN

PRIZM PREMIER

SOCIAL GROUPS

SUBURBAN

SECOND CITY

TOWN & RURAL

SOCIAL GROUPS

HIGH

U1 URBAN UPTOWN

S1 ELITE SUBURBS

C1

SECOND CITY SOCIETY

T1 LANDED GENTRY

04 Young Digerati

01 Upper Crust

22

Middleburg Managers

05 Country Squires

07 Money & Brains

02 Networked Neighbors

33

Second City Startups

09 Big Fish, Small Pond

19

American Dreams

03 Movers & Shakers

37

Bright Lights, Li'l City

11

21

The Cosmopolitans

Fast-Track Families

15 New Homesteaders

U2 MIDTOWN MIX

S2 THE AFFLUENTIALS

C2 CITY CENTERS

T2 COUNTRY COMFORT

17

Urban Elders

06 Winner's Circle

47

18 Mayberry-ville

31

Connected Bohemians

08 Gray Power

48 Generation Web

23 Township Travelers

35 Urban Achievers

10 Executive Suites

49 American Classics

24 Pickup Patriarchs

40 Aspiring A-Listers

12

Cruisin' to Retirement

53

27 Big Sky Families

and are grouped into 11 Lifestage Groups and 14 Social Groups. PRIZM Premier Social

13

Upward Bound

54 Struggling Singles

Groups are based on urbanization and socioeconomic rank. PRIZM Premier Lifestage

16

®

PRIZM Premier's 68 segments are numbered according to socioeconomic rank (which

takes into account characteristics such as income, education, occupation and home value)

Striving Selfies

Lo-Tech Singles

14 Kids & Cul-de-Sacs

Groups are based on age, socioeconomic rank, and the presence of children at home.

28 Country Casuals

29 White Picket Fences

Beltway Boomers

U3 URBAN CORES

S3 MIDDLEBURBS

C3 MICRO-CITY MIX

T3 MIDDLE AMERICA

42 Multi-Culti Mosaic

20 Empty Nests

59

New Melting Pot

32 Traditional Times

43 City Roots

25 Up-and-Comers

61

Second City Generations

38 Hometown Retired

45 Urban Modern Mix

26 Home Sweet Home

64 Family Thrifts

39 Kid Country, USA

56 Multi-Culti Families

30 Pools & Patios

66

New Beginnings

44 Country Strong

67

Park Bench Seniors

46 Heartlanders

63 Low-Rise Living

51 Campers & Camo

52 Simple Pleasures

S4 INNER SUBURBS

T4 RUSTIC LIVING

34 Young & Influential

55 Red, White & Blue

36 Toolbelt Traditionalists

57 Back Country Folks

41 Domestic Duos

58 Golden Ponds

50 Metro Grads

60 Small-Town Collegiates

62 Crossroad Villagers

65 Young & Rustic

68 Bedrock America

LOW

DEMOGRAPHIC DESCRIPTORS

The Demographic Description field is comprised of an income, age and presence of kids descriptor for each segment. For example,

segment 05 Country Squires, is described as Wealthy, Middle Age Family Mix.

For a complete set of demographic descriptors, request the Segment Descriptor Release Notes from your Nielsen representative.

HIGH DENSITY

POPULATION CENTERS

IN MAJOR

METROPOLITAN AREAS

MODERATELY DENSE

NEIGHBORHOODS

SURROUNDING THE

URBAN OR SECOND

CITY CORE

MODERATELY DENSE

POPULATION CENTERS

OF SMALLER CITIES AND

LARGER TOWNS

SMALL TOWN AND RURAL

AREAS, AS WELL AS LOW

DENSITY SUBURBS ON

THE EXURBAN FRINGE

Urban (U) Social Groups have

population density centiles

mostly between 85 and 99.

Suburbs (S) have population

density centiles between 40

and 90 and are clearly

dependent on urban areas or

second cities.

Second Cities (C) are less

densely populated than urban

areas with population density

centiles typically between 40

and 85.

Town & Rural (T) Social

Groups have population

density centiles under 40.

Unlike Second Cities, they are

not the population center of

their surrounding community,

but rather a continuation of

the density decline as you

move out from the city center.

While similar to suburban

population densities, Second

Cities are the population

center of their surrounding

community. As such, many

are concentrated within

America’s smaller cities and

larger towns.

They include both the

downtown areas of major

cities and surrounding

neighborhoods.

Households in this

classification live within the

classic high-density

neighborhoods found in the

heart of America’s largest

cities.

• INCOME (7): Wealthy, Upscale, Upper Mid, Midscale, Lower Mid, Downscale and Low Income

• AGE CLASS (4): Mature, Older, Middle Age and Younger

• AGE RANGE (4): 35-50, Under 50, 50+ and 65+

• PRESENCE OF KIDS (5): Households w/ Kids, Mostly w Kids, Family Mix, Mostly w/o Kids, and Households w/o Kids

• TENURE/HOME OWNERSHIP (5): Homeowners; Mostly Owners; Mix, Owners; Mix, Renters; and Renters

• INCOME PRODUCING ASSETS (7): Millionaires, Elite, High, Above Average, Moderate, Below Average and Low

• TECH USE (5): Highest, Above Average, Average, Below Average and Lowest

PRIZM Premier can provide company-wide integration of a single customer concept because it can be coded onto nearly any piece of customer

data and is available on a wide network of leading survey, panel, marketing measurement and list databases in the U.S. In short, it is everywhere

a marketer needs to be for consumer analysis, implementation and measurement. Beyond coding records for consumer focused applications,

PRIZM Premier provides demand estimates of any market or trade area definition for location analytics and profile databases of behaviors,

including leisure time preferences like shopping, dining, favorite magazines and TV shows. With these valuable insights from PRIZM Premier,

marketers can craft advertising messaging to reach consumers based on virtually any purchase and media behavior.

While almost always anchored

by the downtown central

business district, these areas

often extend beyond city limits

and into surrounding

jurisdictions to encompass

most of America’s earliest

suburban expansions.

While some Suburbs may be

employment centers, their

lifestyles and commuting

patterns will be more tied to

Urban or Second City cores.

This class also includes

satellite cities or higher

density suburbs encircling

major metropolitan centers,

typically with far greater

affluence than their small city

cousins.

This Social Group includes

exurbs, towns, farming

communities and a wide

range of other rural areas.

The town aspect of this class

covers the thousands of small

towns and villages scattered

among the rural heartland, as

well as the low-density areas

far beyond the outer beltways

and suburban rings of

America’s major metros.

Households in these exurban

segments live among higher

densities and are more

affluent than their rural

neighbors.

PRIZM Premier enables marketers to create a complete portrait of their customers by answering these important questions:

WHO ARE MY BEST CUSTOMERS?

PRIZM Premier links your customer data with household-level and neighborhood-level demographics, syndicated survey and primary research data.

It reveals exactly what types of consumers are most likely to use your products or services, and allows you to group similar segments to realize the

greatest efficiency and reach.

WHAT ARE MY BEST CUSTOMERS LIKE?

Once you have identified and defined your best segments, you can use PRIZM Premier to generate a thorough behavioral profile that points to your

segments’ product usage patterns, media and lifestyle preferences. Use it to find out what and how they buy so you can make informed and

effective marketing decisions.

WHERE CAN I FIND THEM?

PRIZM Premier is a complete segmentation system that allows you to analyze your customer file and locate similar people anywhere in the U.S.

Accurate geographic information is essential for effective segment group creation, site selection, product distribution, media planning and more.

Call 800-234-5973 or visit mybestsegments.com to learn more.

Copyright ©2015 The Nielsen Company. All rights reserved. Printed in the USA. Nielsen and the Nielsen Logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C.

Other product and service names are trademarks or registered trademarks of their respective companies. Lifestyle source: GfK Mediamark Research & Intelligence LLC. Doublebase [2015].

Illustrations by Scott Brooks, www.sgbrooks.com.

HOW CAN I REACH THEM?

Once you understand your segment groups, you can use PRIZM Premier to evaluate the best ways to reach them for activation. For media

planning, you’ll learn their media and technology behaviors and how much they use mobile and online. Also, for traditional media, we know which

magazines and newspapers they read and which TV, cable or radio shows they prefer. For direct marketing, you can extensively define selection

criteria for mailing lists to improve the efficiencies of campaigns.