loss reserving: it's more than just numbers

advertisement

LOSS RESERVING: IT’S MORE

THAN JUST NUMBERS

KEY CONSIDERATIONS IN ESTIMATING IBNR

2

ABOUT THE PRESENTER

Derek Freihaut, FCAS, MAAA

Senior Consulting Actuary

Bloomington, Illinois

• 7 years with Pinnacle

• 10+ years in the industry

3

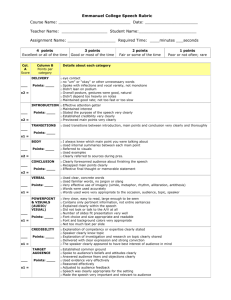

AGENDA

• Loss Reserving: It’s More Than Just Numbers

– Key Considerations in Estimating IBNR

• Background/Loss Reserving 101

• Key Considerations

–

–

–

–

–

–

Claims Handling

Reinsurance

Underwriting

Rates

External Influences

Other Key Information

• How Actuaries Handle

4

BACKGROUND/LOSS RESERVING 101

INCURRED LOSS TRIANGLE Accident Months of Maturity Year 12 24 36 2001 10 20 30 2002 10 20 30 2003 10 20 30 2004 10 20 30 2005 10 20 30 2006 10 20 30 2007 10 20 30 2008 10 20 30 2009 10 20 2010 10 48 40 40 40 40 40 40 40 60 50 50 50 50 50 50 72 60 60 60 60 60 84 70 70 70 70 96 80 80 80 108 90 90 120 95 5

AGE TO AGE FACTORS Accident 12 Year 24 2001 2.000 2002 2.000 2003 2.000 2004 2.000 2005 2.000 2006 2.000 2007 2.000 2008 2.000 2009 2.000 Average Selected 24 36 1.500 1.500 1.500 1.500 1.500 1.500 1.500 1.500 BACKGROUND/LOSS RESERVING 101

36 48 1.333 1.333 1.333 1.333 1.333 1.333 1.333 48 60 1.250 1.250 1.250 1.250 1.250 1.250 60 72 1.200 1.200 1.200 1.200 1.200 72 84 1.167 1.167 1.167 1.167 84 96 1.143 1.143 1.143 96 108 120 108 120 UlKmate 1.125 1.056 1.125 2.000 1.500 1.333 1.250 1.200 1.167 1.143 1.125 1.056 2.000 1.500 1.333 1.250 1.200 1.167 1.143 1.125 1.056 1.053 CumulaKve LDF 10.000 5.000 3.333 2.500 2.000 1.667 1.429 1.250 1.111 % of UlKmate 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 1.053 95.0% 6

BACKGROUND/LOSS RESERVING 101

Incurred Accident Expected Incurred Percent of Expected Loss Dev Year Premium Loss RaKo Losses UlKmate Losses Method (1) (2) (3) (4) (5) (6) (7) 2001 200 50% 95 95.0% 100 100 2002 200 50% 90 90.0% 100 100 2003 200 50% 80 80.0% 100 100 2004 200 50% 70 70.0% 100 100 2005 200 50% 60 60.0% 100 100 2006 200 50% 50 50.0% 100 100 2007 200 50% 40 40.0% 100 100 2008 200 50% 30 30.0% 100 100 2009 200 50% 20 20.0% 100 100 2010 200 50% 10 10.0% 100 100 Total 2,000 545 Col (6) = Col (2) x Col (3) Col (7) = Col (4) / Col (5) Col (8) = Col (4) + Col (6) x { 1 -­‐ Col (5) } 1,000 1,000 B-­‐F Method (8) 100 100 100 100 100 100 100 100 100 100 1,000 7

CLAIMS HANDLING PROCEDURES

• Change in procedures

•

•

•

•

•

•

How initial case reserves are set up

Relative adequacy of case reserves

Emphasis on speed of closing claims

Desire to fight claims

Staffing, number of claims per adjuster

Different Third Party Administrator (TPA)

• Change in reporting of claims

• Changes in how the accident date or report date is assigned

• Changes in the process of how incidents are labeled claims

• Underlying claims trends

• Changes in industry wide trends for claim frequency or severity

• Changes in trends specific to a coverage or region (FL PIP, CA WC)

8

Accident Year (1) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total CLAIMS HANDLING PROCEDURES EXAMPLE

Expected Premium Loss RaKo (2) (3) 200 50% 200 50% 200 50% 200 50% 200 50% 200 50% 200 50% 200 50% 200 50% 200 50% 2,000 Incurred Percent of Expected Losses UlKmate Losses (4) (5) (6) 95 95.0% 100 90 90.0% 100 80 80.0% 100 70 70.0% 100 60 60.0% 100 50 50.0% 100 40 40.0% 100 30 30.0% 100 50 20.0% 100 40 10.0% 100 605 1,000 Incurred Loss Dev Method (7) 100 100 100 100 100 100 100 100 250 400 B-­‐F Method (8) 100 100 100 100 100 100 100 100 130 130 1,450 1,060 9

REINSURANCE

• Reinsurance

• Changes in program structure

– Excess of loss versus quota share

– Change in retention level

• Commutations

• Changes in historical retentions

• Change in reinsurance premiums

• Impact on large claims or potential exposure above reinsurance layers

• Handling of expenses

• Specific contract details

– Quota share percentage

– Retention

– Risk limiting features

» Loss ratio caps

» Loss corridors

» Swing rated premiums or commissions

• Risk transfer concerns

10

RATES AND UNDERWRITING

• Rates

• Higher/lower rates due to rate changes

• Changes in schedule rating

• Concern with adverse selection

• Underwriting

•

•

•

•

Changes in what’s acceptable to write

Change in focus on profit or growth

New markets/rates

Changes in mix of business

– Geographical mix

– Limits or deductibles written

11

Accident Year (1) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total RATE EXAMPLE

Expected Incurred Percent of Expected Premium Loss RaKo Losses UlKmate Losses (2) (3) (4) (5) (6) 200 50% 95 95.0% 100 200 50% 90 90.0% 100 200 50% 80 80.0% 100 200 50% 70 70.0% 100 200 50% 60 60.0% 100 200 50% 50 50.0% 100 200 50% 40 40.0% 100 200 50% 30 30.0% 100 300 50% 20 20.0% 150 450 50% 10 10.0% 225 2,350 545 Col (6) = Col (2) x Col (3) Col (7) = Col (4) / Col (5) Col (8) = Col (4) + Col (6) x { 1 -­‐ Col (5) } 1,175 Incurred Loss Dev Method (7) 100 100 100 100 100 100 100 100 100 100 B-­‐F Method (8) 100 100 100 100 100 100 100 100 140 213 1,000 1,153 12

EXTERNAL INFLUENCES

• External Influences

– Law changes

• FL PIP

• FL sinkhole

• SCHIP

• ACA

– Tort reforms

– Inflation or other economic factors

– New competitors

– New claims sources

• FL public adjusters

13

OTHER KEY INFORMATION ITEMS

• DDR – Death, Disability, and Retirement

– Unearned premium is required

• Extra Contractual Obligations (ECO) claims

– Need to understand how they are included in the data and reserved for

• Large claims/specific claim detail

• Subrogation and salvage

– Need to understand how they are included in the data

• Treatment of Expenses

– ALAE/ULAE vs DCC/A&O

14

HOW ACTUARIES HANDLE

• Trust But Verify

• Verification

–

–

–

–

–

–

Loss data

Claim count and average severity triangles

Diagnostics

Comparison exhibits

Company expectations

Time

• Tools

–

–

–

–

Alternative methods -- Berquist Sherman

Judgment

Non traditional methods

Wait

15

• Thank You

• Derek W. Freihaut, FCAS, MAAA

•

• (309) 807-2313

dfreihaut@pinnacleactuaries.com