Guide to completing Form 4684 to Claim a Casualty Loss

An Individual’s Guide to completing Form 4684 to Claim a Casualty Loss resulting from the 2011 ND Floods.*

2011 was a year for major flooding – and many counties in North Dakota were deemed Presidentially Declared Disaster Areas. If you were affected by the flooding, you may have a deductible casualty loss on your personal income tax return.

For the counties that were so declared by the President, you have the option of reporting the loss on your 2011 income tax return or amending your 2010 individual income tax return. You have until April 15, 2012 to determine which return will yield the greatest benefits to you and your family.

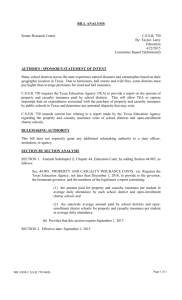

The IRS form to report your casualty is Form 4684. It is used to report losses for both personal and business property. We have provided some guidance to measure the amount of the casualty that may have been suffered.

There are three (3) main values that you need to have figured in order to complete the Form 4684. You will need to know (1) the Fair Market Value of the property immediately prior to the flood, (2) the Fair Market Value of the property immediately after the flood, and (3) you will need to determine what your cost basis is in the property. If you received flood insurance proceeds, you will need to have those amounts available as well.

Once you determine the values, you are able to calculate your casualty loss. This loss then is reported on Line 20 on Schedule A of your individual income tax return if it relates to personal use property and on page 1 line 14 of the 1040 if it relates to business use property.

Please see the next page for a summary that can be used as a guide to determine the amounts needed to calculate the casualty loss. Please also note that there are examples found in IRS Publication 547 which may assist you in the calculation of your personal loss.

* Use of any information from this site or any other web site referred to is for general information only and does not represent personal tax advice, either express or implied. You are encouraged to seek professional tax advice for personal income tax questions and assistance.

Information needed to prepare Form 4684

Cost or other (adjusted) basis of property _____________ (Note A)

Fair market value before casualty

Fair market value after casualty

_____________ (Note B)

_____________ (Note C)

Flood Insurance Reimbursements _____________

Note A: If you purchased your home, the cost of the home can be found on the closing statements. You would also include in the cost any major improvements that you have done to the property. Examples may include building a garage, new roof, patio and landscaping, fencing, renovation of kitchen or bathroom.

Note B: The following are suggestions as to how to determine the value prior to the flood:

-Purchase price of your home if you recently purchased your home.

-Appraisal if you recently refinanced your home.

-Comparable sales of home in your neighborhood of similar size and detail.

-Real Estate Tax Assessed value as determined by local tax authority.

Note C: The following are suggestions as to how to determine the value after the flood:

-Estimated loss as determined by SBA or FEMA.

-Actual costs of repairs to property to return to pre-flood condition.

-Real Estate Tax Assessed value post flood as determined by authorities.

(Phone call to tax assessor and they can tell you what they determined the value to be).

Circular 230 Disclosure: Any information contained herein (including any attachments unless expressly stated otherwise) is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

Form

4684

Department of the Treasury

Internal Revenue Service

Name(s) shown on tax return

Casualties and Thefts

▶ See separate instructions.

▶

Attach to your tax return.

▶

Use a separate Form 4684 for each casualty or theft.

OMB No. 1545-0177

20 11

Attachment

Sequence No.

26

Identifying number

SECTION A—Personal Use Property (Use this section to report casualties and thefts of property not used in a trade or business or for income-producing purposes.)

1 Description of properties (show type, location, and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft.

Property A

Property B

Property C

Property D

Properties

A B C

2 Cost or other basis of each property .

.

.

.

.

.

2

3 Insurance or other reimbursement (whether or not you filed a claim) (see instructions) .

.

.

.

.

.

.

.

Note: If line 2 is more than line 3, skip line 4.

4 Gain from casualty or theft. If line 3 is more than line 2, enter the difference here and skip lines 5 through 9 for that column. See instructions if line 3 includes insurance or other reimbursement you did not claim, or you received payment for your loss in a later tax year .

.

5

6

7

Fair market value

Fair market value before after

casualty or theft

casualty or theft .

Subtract line 6 from line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

5

6

7

8 Enter the smaller of line 2 or line 7 .

.

.

.

.

.

9 Subtract line 3 from line 8. If zero or less, enter -0- .

.

8

9

10 Casualty or theft loss. Add the amounts on line 9 in columns A through D .

.

.

.

.

.

.

.

.

.

.

.

.

11 Enter the smaller of line 10 or $100 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12 Subtract line 11 from line 10 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Caution: Use only one Form 4684 for lines 13 through 18.

13 Add the amounts on line 12 of all Forms 4684 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14 Add the amounts on line 4 of all Forms 4684.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. 14

15 • If line 14 is more than line 13, enter the difference here and on Schedule D. Do not complete the rest of this section (see instructions).

• If line 14 is less than line 13, enter -0- here and go to line 16.

}

.

.

.

.

.

.

.

15

• If line 14 is equal to line 13, enter -0- here. Do not complete the rest of this section.

16 If line 14 is less than line 13, enter the difference .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

13

10

11

12

17 Enter 10% of your adjusted gross income from Form 1040, line 38, or Form 1040NR, line 37. Estates and trusts, see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

D

17

18 Subtract line 17 from line 16. If zero or less, enter -0-. Also enter the result on Schedule A (Form 1040), line 20, or

Form 1040NR, Schedule A, line 6. Estates and trusts, enter the result on the “Other deductions” line of your tax return .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 12997O

18

Form

4684

(2011)

Form 4684 (2011) Attachment Sequence No. 26

Name(s) shown on tax return. Do not enter name and identifying number if shown on other side.

Identifying number

Page

2

SECTION B—Business and Income-Producing Property

Part I Casualty or Theft Gain or Loss (Use a separate Part l for each casualty or theft.)

19 Description of properties (show type, location, and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft.

Property A

Property B

Property C

Property D

Properties

A B C D

20 Cost or adjusted basis of each property .

.

.

.

.

20

21 Insurance or other reimbursement (whether or not you filed a claim). See the instructions for line 3 .

.

.

.

Note: If line 20 is more than line 21, skip line 22.

22 Gain from casualty or theft. If line 21 is more than line 20, enter the difference here and on line 29 or line 34, column (c), except as provided in the instructions for line 33. Also, skip lines 23 through 27 for that column. See the instructions for line 4 if line

21 includes insurance or other reimbursement you did not claim, or you received payment for your loss in a later tax year

23 Fair market value before casualty or theft .

.

.

.

24 Fair market value after casualty or theft .

.

.

.

.

25 Subtract line 24 from line 23 .

.

.

.

.

.

.

.

26 Enter the smaller of line 20 or line 25 .

.

.

.

.

21

22

23

24

25

26

Note: If the property was totally destroyed by casualty or lost from theft, enter on line 26 the amount from line 20.

27 Subtract line 21 from line 26. If zero or less, enter -027

28 Casualty or theft loss. Add the amounts on line 27. Enter the total here and on line 29 or line 34 (see instructions)

Part II Summary of Gains and Losses (from separate Parts l) (b) Losses from casualties or thefts

(a) Identify casualty or theft

(i) Trade, business, rental or royalty property

28

(ii) Incomeproducing and employee property

29

Casualty or Theft of Property Held One Year or Less

( ) (

( ) (

)

)

30 Totals. Add the amounts on line 29 .

.

.

.

.

.

.

.

.

.

.

.

30

( ) ( )

31 Combine line 30, columns (b)(i) and (c). Enter the net gain or (loss) here and on Form 4797, line 14. If Form 4797 is not otherwise required, see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

31

32 Enter the amount from line 30, column (b)(ii) here. Individuals, enter the amount from income-producing property on Schedule A

(Form 1040), line 28, or Form 1040NR, Schedule A, line 14, and enter the amount from property used as an employee on Schedule

A (Form 1040), line 23, or Form 1040NR, Schedule A, line 9. Estates and trusts, partnerships, and S corporations, see instructions

Casualty or Theft of Property Held More Than One Year

33 Casualty or theft gains from Form 4797, line 32 . . . . . . . . . . . . . . . . . . . . . . . . .

34

( ) (

( ) (

35 Total losses. Add amounts on line 34, columns (b)(i) and (b)(ii) . . . . .

35

( ) (

36 Total gains. Add lines 33 and 34, column (c) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

37 Add amounts on line 35, columns (b)(i) and (b)(ii) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

38 If the loss on line 37 is more than the gain on line 36: a Combine line 35, column (b)(i) and line 36, and enter the net gain or (loss) here. Partnerships (except electing large partnerships) and S corporations, see the note below. All others, enter this amount on Form 4797, line 14. If Form

4797 is not otherwise required, see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Enter the amount from line 35, column (b)(ii) here. Individuals, enter the amount from income-producing property on

Schedule A (Form 1040), line 28, or Form 1040NR, Schedule A, line 14, and enter the amount from property used as an employee on Schedule A (Form 1040), line 23, or Form 1040NR, Schedule A, line 9. Estates and trusts, enter on the “Other deductions” line of your tax return. Partnerships (except electing large partnerships) and S corporations, see the note below. Electing large partnerships, enter on Form 1065-B, Part II, line 11 .

.

.

.

.

.

.

.

.

39 If the loss on line 37 is less than or equal to the gain on line 36, combine lines 36 and 37 and enter here. Partnerships

(except electing large partnerships), see the note below. All others, enter this amount on Form 4797, line 3 . . . .

Note: Partnerships, enter the amount from line 38a, 38b, or line 39 on Form 1065, Schedule K, line 11.

S corporations, enter the amount from line 38a or 38b on Form 1120S, Schedule K, line 10.

32

33

)

)

)

36

37

38a

38b

39

(c) Gains from casualties or thefts includible in income

Form

4684

(2011)

Page 8 of 19 of Publication 547 14:10 - 12-DEC-2011

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Example 2. Thieves broke into your home in

January and stole a ring and a fur coat. You had a loss of $200 on the ring and $700 on the coat.

This is a single theft. The $100 rule applies to the total $900 loss.

Example 3. In September, hurricane winds blew the roof off your home. Flood waters follows.

caused by the hurricane further damaged your home and destroyed your furniture and personal car. This is considered a single casualty. The

$100 rule is applied to your total loss from the flood waters and the wind.

thefts, see Gains and losses , later in this discussion.

Example. In June, you discovered that your house had been burglarized. Your loss after insurance reimbursement was $2,000. Your adjusted gross income for the year you discovered the theft is $29,500. Figure your theft loss as

Example. Your theft loss after reducing it by reimbursements and by $100 is $2,700. Your casualty gain is $700. Your loss is more than your gain, so you must reduce your $2,000 net loss ($2,700 gross income.

− $700) by 10% of your adjusted

Gains more than losses. If your recognized gains are more than your losses, subtract your losses from your gains. The difference is

1. Loss after insurance . . . . . . . . .

$2,000 treated as a capital gain and must be reported

More than one loss. If you have more than one casualty or theft loss during your tax year, you must reduce each loss by $100.

Example. Your family car was damaged in an accident in January. Your loss after the insurance reimbursement was $75. In February, your car was damaged in another accident. This time your loss after the insurance reimbursement was $90. Apply the $100 rule to each separate casualty loss. Since neither accident resulted in a loss of over $100, you are not entitled to any deduction for these accidents.

More than one person. If two or more individuals (other than a husband and wife filing a joint return) have losses from the same casualty or theft, the $100 rule applies separately to each individual.

Example. A fire damaged your house and

2. Subtract $100 . . . . . . . . . . . . .

100 on Schedule D (Form 1040). The 10% rule does

3. Loss after $100 rule . . . . . . . . .

$1,900 not apply to your gains.

4. Subtract 10% of $29,500 AGI . . .

$2,950

5.

Theft loss deduction . . . . . . . .

$ -0-

You do not have a theft loss deduction because your loss ($1,900) is less than 10% of your adjusted gross income ($2,950).

Example. Your theft loss is $600 after reducing it by reimbursements and by $100. Your casualty gain is $1,600. Because your gain is more than your loss, you must report the $1,000 net gain ($1,600 − $600) on Schedule D (Form

More than one loss. If you have more than 1040).

one casualty or theft loss during your tax year, reduce each loss by any reimbursement and by

More information. For information on how

$100. Then you must reduce the total of all your losses by 10% of your adjusted gross income.

to figure recognized gains, see Figuring a Gain , later.

Example. In March, you had a car accident that totally destroyed your car. You did not have collision insurance on your car, so you did not receive any insurance reimbursement. Your loss on the car was $1,800. In November, a fire damaged your basement and totally destroyed the furniture, washer, dryer, and other items you had stored there. Your loss on the basement items after reimbursement was $2,100. Your adjusted gross income for the year that the accident and fire occurred is $25,000. You figure your casualty loss deduction as follows.

also damaged the personal property of your house guest. You must reduce your loss by

$100. Your house guest must reduce his or her loss by $100.

Married taxpayers. If you and your spouse file a joint return, you are treated as one individual in applying the $100 rule. It does not matter 4. Total loss . . . . . . . . . . . . . . .

whether you own the property jointly or separately.

incident . . . . . . . . .

3. Loss after $100 rule

Car

1. Loss . . . . . . . . . . . .

$1,800

2. Subtract $100 per

100

$1,700

5. Subtract 10% of $25,000 AGI . .

Basement

$2,100

100

$2,000

$3,700

2,500

6.

Casualty loss deduction . . . .

$ 1,200

If you and your spouse have a casualty or theft loss and you file separate returns, each of Married taxpayers. If you and your spouse you must reduce your loss by $100. This is true file a joint return, you are treated as one individeven if you own the property jointly. If one ual in applying the 10% rule. It does not matter if spouse owns the property, only that spouse can you own the property jointly or separately.

figure a loss deduction on a separate return.

If the casualty or theft loss is on property you own as tenants by the entirety, each of you can figure your deduction on only one-half of the loss on separate returns. Neither of you can figure your deduction on the entire loss on a separate return. Each of you must reduce the loss by

$100.

More than one owner. If two or more individuals (other than a husband and wife filing a joint return) have a loss on property jointly owned, the

$100 rule applies separately to each. For example, if two sisters live together in a home they own jointly and they have a casualty loss on the home, the $100 rule applies separately to each sister.

10% Rule

If you file separate returns, the 10% rule applies to each return on which a loss is claimed.

More than one owner. If two or more individuals (other than husband and wife filing a joint return) have a loss on property that is owned jointly, the 10% rule applies separately to each.

!

Figuring the Deduction

Generally, you must figure your loss separately for each item stolen, damaged, or destroyed.

However, a special rule applies to real property you own for personal use.

Real property. In figuring a loss to real estate you own for personal use, all improvements

(such as buildings and ornamental trees and the land containing the improvements) are considered together.

1. Adjusted basis of the entire property (cost in this example) $144,800

2. FMV of entire property before fire . . . . . . . . . . . . . .

$180,000

3. FMV of entire property after fire

4. Decrease in FMV of entire

35,000 property (line 2 − line 3) . . . . .

$145,000

5. Loss (smaller of line 1 or line 4) $144,800

6. Subtract insurance . . . . . . . .

Gains and losses. If you have casualty or theft gains as well as losses to personal-use

7. Loss after reimbursement . . . .

8. Subtract $100 . . . . . . . . . . . .

property, you must compare your total gains to 9. Loss after $100 rule . . . . . . . .

your total losses. Do this after you have reduced 10. Subtract 10% of $80,000 AGI each loss by any reimbursements and by $100 11.

Casualty loss deduction . . .

but before you have reduced the losses by 10% of your adjusted gross income.

CAUTION

Casualty or theft gains do not include gains you choose to postpone. See

Postponement of Gain , later.

Example 1. In June, a fire destroyed your lakeside cottage, which cost $144,800 (including $14,500 for the land) several years ago.

(Your land was not damaged.) This was your only casualty or theft loss for the year. The FMV of the property immediately before the fire was

$180,000 ($145,000 for the cottage and $35,000 for the land). The FMV immediately after the fire was $35,000 (value of the land). You collected

$130,000 from the insurance company. Your adjusted gross income for the year the fire occurred is $80,000. Your deduction for the casualty loss is $6,700, figured in the following manner.

130,000

$14,800

100

$14,700

8,000

$ 6,700

Example 2. You bought your home a few years ago. You paid $150,000 ($10,000 for the land and $140,000 for the house). You also spent an additional $2,000 for landscaping. This year a fire destroyed your home. The fire also

You must reduce the total of all your casualty or Losses more than gains. If your losses are damaged the shrubbery and trees in your yard.

theft losses on personal-use property by 10% of more than your recognized gains, subtract your The fire was your only casualty or theft loss this your adjusted gross income. Apply this rule after gains from your losses and reduce the result by year. Competent appraisers valued the property you reduce each loss by $100. For more infor10% of your adjusted gross income. The rest, if as a whole at $175,000 before the fire, but only mation, see the Form 4684 instructions. If you any, is your deductible loss from personal-use $50,000 after the fire. Shortly after the fire, the have both gains and losses from casualties or property.

insurance company paid you $95,000 for the

Page 8 Publication 547 (2011)

Page 9 of 19 of Publication 547 14:10 - 12-DEC-2011

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

loss. Your adjusted gross income for this year is

$70,000. You figure your casualty loss deduction as follows.

1. Adjusted basis of the entire property (cost of land, building, and landscaping) . . . . . . . . .

$152,000

2. FMV of entire property before fire . . . . . . . . . . . . . .

$175,000

3. FMV of entire property after fire

4. Decrease in FMV of entire property (line 2 − line 3)

50,000

$125,000

5. Loss (smaller of line 1 or line 4) $125,000

6. Subtract insurance . . . . . . . .

7. Loss after reimbursement . . . .

8. Subtract $100 . . . . . . . . . . . .

9. Loss after $100 rule . . . . . . . .

10. Subtract 10% of $70,000 AGI

95,000

$30,000

7,000

11.

Casualty loss deduction . . .

$ 22,900

4. Decrease in FMV (line 2 − Example. You own a building that you conline 3) . . . . . . . . . . . . . $17,320 $500 structed on leased land. You use half of the

5. Loss (smaller of line 1 or line 4) . . . . . . . . . . . . . $17,320

6. Subtract insurance . . . .

7. Loss after reimbursement

16,000

$1,320

$250

-0-

$250 building for your business and you live in the other half. The cost of the building was

$400,000. You made no further improvements or additions to it.

8. Total loss . . . . . . . . . . . . . . . . . $1,570

9. Subtract $100 . . . . . . . . . . . . . .

100

10. Loss after $100 rule . . . . . . . . . . $1,470

11. Subtract 10% of $97,000 AGI . . .

9,700

12.

Casualty loss deduction . . . . . . $ -0-

Both real and personal properties. When a casualty involves both real and personal proper-

100 ties, you must figure the loss separately for each

$29,900 type of property. However, you apply a single

$100 reduction to the total loss. Then, you apply the 10% rule to figure the casualty loss deduction.

A flood in March damaged the entire building. The FMV of the building was $380,000 immediately before the flood and $320,000 afterwards. Your insurance company reimbursed you $40,000 for the flood damage. Depreciation on the business part of the building before the flood totaled $24,000. Your adjusted gross income for the year the flood occurred is

$125,000.

You have a deductible business casualty loss of $10,000. You do not have a deductible personal casualty loss because of the 10% rule.

You figure your loss as follows.

Personal property. Personal property is generally any property that is not real property. If your personal property is stolen or is damaged or destroyed by a casualty, you must figure your loss separately for each item of property. Then combine these separate losses to figure the total loss. Reduce the total loss by $100 and 10% of your adjusted gross income to figure the loss deduction.

Example 1. In August, a storm destroyed your pleasure boat, which cost $18,500. This was your only casualty or theft loss for the year.

Its FMV immediately before the storm was

$17,000. You had no insurance, but were able to salvage the motor of the boat and sell it for $200.

Your adjusted gross income for the year the casualty occurred is $70,000.

Although the motor was sold separately, it is part of the boat and not a separate item of property. You figure your casualty loss deduction as follows.

1. Adjusted basis (cost in this example) . . . . . . . . . . . . . . .

2. FMV before storm . . . . . . . . .

3. FMV after storm . . . . . . . . . .

4. Decrease in FMV

(line 2 − line 3) . . . . . . . . . . .

$18,500

$17,000

200

$16,800

Example. In July, a hurricane damaged your home, which cost you $164,000 including land. The FMV of the property (both building and land) immediately before the storm was

$170,000 and its FMV immediately after the storm was $100,000. Your household furnishings were also damaged. You separately figured the loss on each damaged household item and arrived at a total loss of $600.

You collected $50,000 from the insurance company for the damage to your home, but your household furnishings were not insured. Your adjusted gross income for the year the hurricane occurred is $65,000. You figure your casualty loss deduction from the hurricane in the following manner.

1. Adjusted basis of real property

(cost in this example) . . . . . . .

$164,000

2. FMV of real property before hurricane . . . . . . . . . . . . . . .

$170,000

3. FMV of real property after hurricane . . . . . . . . . . . . . . .

4. Decrease in FMV of real property (line 2 − line 3) . . . . .

100,000

$70,000

5. Loss on real property (smaller of line 1 or line 4) . . . . . . . . .

6. Subtract insurance . . . . . . . .

7. Loss on real property after reimbursement . . . . . . . . . . .

$70,000

50,000

$20,000

Business Personal

Part Part

1. Cost (total

$400,000) . . . . . .

$200,000 $200,000

2. Subtract depreciation . . . . .

24,000 -0-

3. Adjusted basis . . .

$176,000 $200,000

4. FMV before flood

(total $380,000) . .

$190,000 $190,000

5. FMV after flood

(total $320,000) . .

6. Decrease in FMV

(line 4 − line 5) . . .

7. Loss (smaller of line

3 or line 6) . . . . . .

8. Subtract insurance

9. Loss after

160,000

$30,000

$30,000

20,000

160,000

$30,000

$30,000

20,000 reimbursement . . .

10. Subtract $100 on personal-use property . . . . . . .

$10,000

-0-

11. Loss after $100 rule $10,000

12. Subtract 10% of

$125,000 AGI on

$10,000

100

$9,900 personal-use property . . . . . . .

13.

Deductible

business loss . . .

14.

Deductible

personal loss . . .

-0-

$10,000

$

12,500

-0-

5. Loss (smaller of line 1 or line 4)

6. Subtract insurance . . . . . . . .

7. Loss after reimbursement . . . .

8. Subtract $100 . . . . . . . . . . . .

9. Loss after $100 rule . . . . . . . .

10. Subtract 10% of $70,000 AGI

11.

Casualty loss deduction . . .

$16,800

-0-

$16,800

100

$16,700

7,000

$ 9,700 auto accident that totally destroyed your per-

8. Loss on furnishings . . . . . . . .

9. Subtract insurance . . . . . . . .

10. Loss on furnishings after reimbursement . . . . . . . . . . .

11. Total loss (line 7 plus line 10)

12. Subtract $100 . . . . . . . . . . . .

13. Loss after $100 rule . . . . . . . .

14. Subtract 10% of $65,000 AGI

$600

-0-

$600

$20,600

100 If you receive an insurance payment or other

$20,500 reimbursement that is more than your adjusted

6,500 basis in the destroyed, damaged, or stolen prop-

Example 2. In June, you were involved in an 15.

Casualty loss deduction . . .

$ 14,000 sonal car and your antique pocket watch. You Property used partly for business and partly had bought the car for $30,000. The FMV of the for personal purposes. When property is car just before the accident was $17,500. Its used partly for personal purposes and partly for

FMV just after the accident was $180 (scrap business or income-producing purposes, the value). Your insurance company reimbursed you $16,000.

Your watch was not insured. You had purchased it for $250. Its FMV just before the accident was $500. Your adjusted gross income for the year the accident occurred is $97,000. Your casualty loss deduction is zero, figured as follows.

Car

1. Adjusted basis (cost) . . . $30,000

2. FMV before accident . . . $17,500

3. FMV after accident . . . .

180

Watch

$250

$500

Figuring a Gain

erty, you have a gain from the casualty or theft.

Your gain is figured as follows.

•

•

The amount you receive (discussed next), minus

Your adjusted basis in the property at the casualty or theft loss deduction must be figured separately for the personal-use portion and for the business or income-producing portion. You must figure each loss separately because the time of the casualty or theft. See

Basis basis.

Adjusted

, earlier, for information on adjusted losses attributed to these two uses are figured in Even if the decrease in FMV of your property two different ways. When figuring each loss, is smaller than the adjusted basis of your propallocate the total cost or basis, the FMV before erty, use your adjusted basis to figure the gain.

and after the casualty or theft loss, and the insurance or other reimbursement between the Amount you receive. The amount you rebusiness and personal use of the property. The ceive includes any money plus the value of any

$100 rule and the 10% rule apply only to the property you receive minus any expenses you casualty or theft loss on the personal-use porhave in obtaining reimbursement. It also in-

-0tion of the property.

cludes any reimbursement used to pay off a

Publication 547 (2011) Page 9