Tutorial 4

advertisement

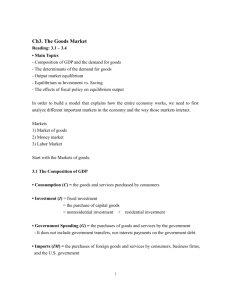

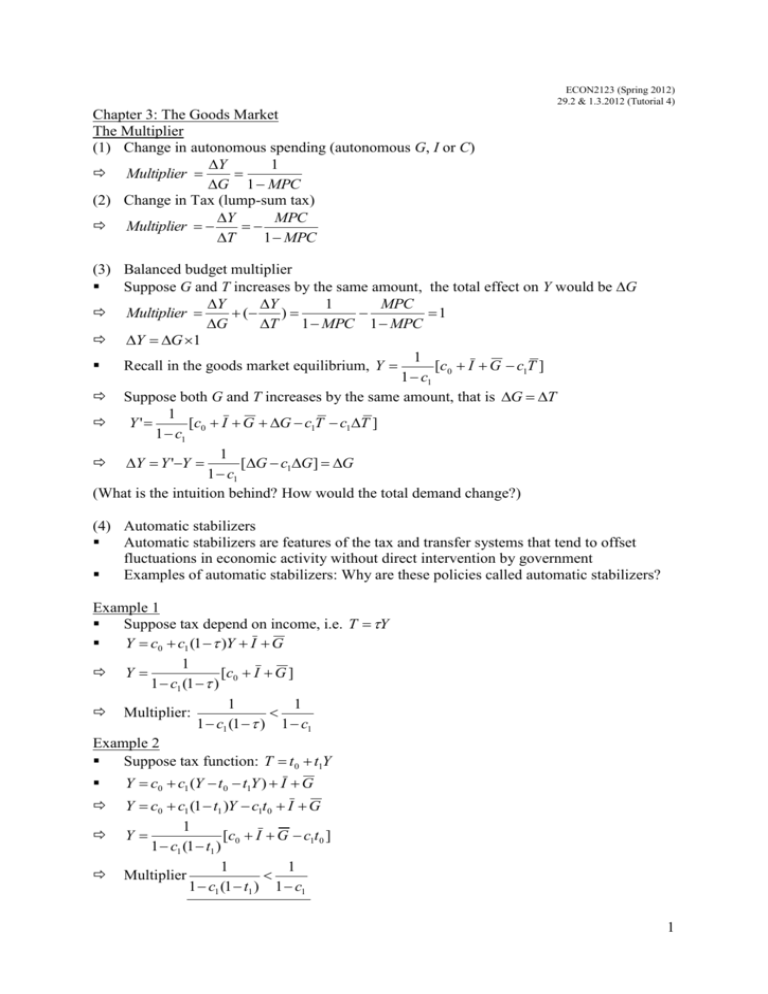

ECON2123 (Spring 2012) 29.2 & 1.3.2012 (Tutorial 4) Chapter 3: The Goods Market The Multiplier (1) Change in autonomous spending (autonomous G, I or C) Y 1 Multiplier G 1 MPC (2) Change in Tax (lump-sum tax) Y MPC Multiplier T 1 MPC (3) Balanced budget multiplier Suppose G and T increases by the same amount, the total effect on Y would be G Y Y 1 MPC Multiplier ( ) 1 G T 1 MPC 1 MPC Y G 1 1 Recall in the goods market equilibrium, Y [c0 I G c1T ] 1 c1 Suppose both G and T increases by the same amount, that is G T 1 Y ' [c0 I G G c1T c1T ] 1 c1 1 Y Y 'Y [G c1G] G 1 c1 (What is the intuition behind? How would the total demand change?) (4) Automatic stabilizers Automatic stabilizers are features of the tax and transfer systems that tend to offset fluctuations in economic activity without direct intervention by government Examples of automatic stabilizers: Why are these policies called automatic stabilizers? Example 1 Suppose tax depend on income, i.e. T Y Y c0 c1 (1 )Y I G 1 Y [ c0 I G ] 1 c1 (1 ) 1 1 Multiplier: 1 c1 (1 ) 1 c1 Example 2 Suppose tax function: T t0 t1Y Y c0 c1 (Y t0 t1Y ) I G Y c0 c1 (1 t1 )Y c1t0 I G 1 Y [c0 I G c1t 0 ] 1 c1 (1 t1 ) 1 1 Multiplier 1 c1 (1 t1 ) 1 c1 1 Goods market equilibrium (1) Production = Demand, i.e. Y = Z = C + I + G In equilibrium, Y c0 c1 (Y T ) I G 1 Y [c0 I G c1T ] 1 c1 (2) Saving = Investment i.e. I = S + (T – G) This is the IS relation in the IS-LM model (Chapter 5) Y=C+I+G Y–T–C=I+G–T S=I+G–T I = S + (T – G) Saving = private saving + public saving: S + (T – G) Private saving: S = Y – C –T = YD – C Public saving: T – G (budget surplus/ budget deficit/ balanced budget) In the equilibrium, I = S + (T – G) I = S = Y – C –T + (T – G) I = Y – T – c0 + c1 (Y –T) + (T – G) 1 Y [c0 I G c1T ] 1 c1 The paradox of thrift (The paradox of saving) S, I As people attempt to save more, the result is both S’ a decline in output and unchanged saving S Suppose at a given level of disposable income, consumers decide to save more (reduction in c0, S=I I assuming c1 remains unchanged). What will happen to output and saving? Y ’ -c0 Given -c0 C = c0 + c1YD S = –c0 + (1 –c1) YD I I 1 [c0 I G c1T ] 1 c1 Output (Y): drops, since in equilibrium, Y Private saving (S): S does not change. Why? –c0 is higher, YD is lower, that is (1 –c1) YD is lower. In the goods market equilibrium, I = S + (T – G) and I I Increase –c0 = drop (1 –c1) YD Paradox of thrift Suppose consumers decide to save more and increase their MPS (decrease in c1 and c0 remains unchanged). What will happen to output and saving? (P.52) 2 Examples and Problems Question 1: It is often argued that a balanced budget amendment would actually be destabilizing. Consider these following behavioral equations C =c0 + c1YD T = t0 + t1Y YD = Y – T G and I are both constant. Assume that t1 is between zero and one. (a) Solve for equilibrium output. In the goods market equilibrium, Y = c0 + c1(Y – T) + I + G = Z Y = c0 + c1Y – c1t0 – c1t1Y + I + G Y = [1/ (1 – c1 + c1t1)] [c0 – c1t0 + I + G] (b) Solve for taxes in equilibrium. T = t0 + t1Y T = t0 + t1 [1/ (1 – c1 + c1t1)] [c0 – c1t0 + I + G] Suppose that the government starts with a balanced budget and that there is a drop in c0. (c) What happens to Y? What happens to taxes? When there is a drop in c0, Y and so T will be lower. As G does not change, with a lower T, a budget deficit will be created. (d) Suppose that the government cuts spending in order to keep budget balanced. What will be the effect on Y? Does the cut in spending required to balance the budget counteract or reinforce the effect of the drop in c0 on output? (Don’t do the algebra. Use your intuition, and give the answer in words.) If the government eliminates the deficit by reducing G, demand will be lower which ends up in a lower Y. Therefore the cut in G reinforces the effect of the decrease in c0 on output. A balanced budget amendment is destabilizing Question 2: Balanced budget versus automatic stabilizers It is often argued that a balanced budget amendment would actually be destabilizing. To understand this argument, consider the economy of problem 5. (a) Solve for equilibrium output. In the goods market equilibrium, Y = c0 + c1(Y – T) + I + G = Z (equation 3.7), Y = c0 + c1Y – c1t0 – c1t1Y + I + G Y = [1/ (1 – c1 + c1t1)] [c0 – c1t0 + I + G] (b) Solve for taxes in equilibrium. T = t0 + t1Y T = t0 + t1 [1/ (1 – c1 + c1t1)] [c0 – c1t0 + I + G] Suppose that the government starts with a balanced budget and that there is an increase in c0. (c) Explain why the increase in c0 will create a budget surplus. (Hint: Consider the effect on Y and, therefore, on taxes.) When there is an increase in c0, Y and so T will be higher. As G does not change, with a higher T, a budget surplus will be created. 3 (d) Suppose that the government eliminates the surplus by reducing the fixed part of taxed (t0). What effect will this have on Y? Does that cut in t0, which keeps that budget balanced, counteract or reinforce that effect of the increase in c0 on output? (Don’t do the algebra. Use your intuition, and give the answer in words.) It the government eliminates the surplus by reducing t0, consumption will be higher which ends up in a higher Y. Therefore the cut in t0 reinforces the effect the effect of the increase in c0 on output. Question 5: Investment and income This problem examines the implications of allowing investment to depend on output. Chapter 5 carries this analysis much further and introduces an essential relation – the effect of the interest rate on investment – not examined in this problem. (a) Suppose the economy is characterized by the following behavioral equation: C =c0 + c1YD YD = Y – T I = b0 + b1Y Government spending is constant. Note that investment now increases with output. Chapter 5 will discuss the reasons for this relation. Solve for equilibrium output. In the goods market equilibrium, Y = c0 + c1(Y – T) + I + G = Z (equation 3.7), Y = c0 + c1Y – c1T + b0 + b1Y + G Y = [1/ (1 – c1 – b1)] [c0 – c1T + b0 + G] (b) What is the value of the multiplier? Howe does the relation between investment and output affect the value of the multiplier? For the multiplier to be positive, what condition must c1 + b1 satisfy? Explain your answers. The multiplier is 1/ (1 – c1 – b1) = 1/ [1 – (c1 + b1)]. The value of the multiplier is positively related to b1. The multiplier is larger when comparing to 1/ (1 – c1). It is because, in this case, an increase in autonomous spending now has a multiplier effect through consumption as well as investment. For the multiplier to be positive, c1 + b1 must be small than 1. If c1 + b1 >1, then the economy would not have a well-defined equilibrium. One extra unit of autonomous spending would lead to a greater than one unit increase in spending (consumption plus investment) in every round of the multiplier, so the economy would explode into infinite output. (c) Suppose that the parameter b0, sometimes called business confidence, increases. How will equilibrium output be affected? Will investment change by more or less than the change in b0? Why? What will happen to national saving? Equilibrium output increases by b0 times the multiplier. Investment increases by more than the increase in business confidence, since the increase in output also leads investment to increase (b1Y). In equilibrium, national saving equals investment. If investment increases in equilibrium, national saving increases as well. 4