Jonathan Heller ED 605 Unit Plan PATHWAY: Financial

advertisement

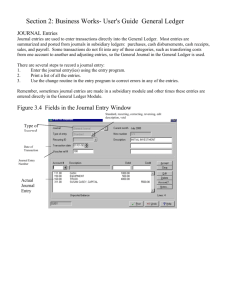

Jonathan Heller ED 605 Unit Plan PATHWAY: Financial Management - Accounting COURSE: Principles of Accounting II UNIT 1: The Accounting Cycle INTRODUCTION In this unit, students will be introduced to the Accounting Cycle. They will learn about the four special journals, as well as trial balances and ledgers. Grade(s): 10-12 Time: 2-3 weeks Students with Disabilities: For students with disabilities, the instructor should refer to the student's IEP to be sure that the accommodations specified are being provided. Instructors should also familiarize themselves with the provisions of Behavior Intervention Plans that may be part of a student's IEP. Frequent consultation with a student's special education instructor will be beneficial in providing appropriate differentiation. FOCUS STANDARDS Students will apply the various steps of the accounting cycle for corporations and partnerships and explain the purpose of each step. • Collect and verify source documents. • Analyze business transactions using source documents and interpret the effect on the accounting equation. • Journalize business transactions using multi-column journals. • Prepare and use an 8 and/or 10-column worksheet. • Analyze and prepare adjusting entries, including accruals and deferrals. • Create, evaluate and analyze financial statements and describe the way each interrelates with the others. • Execute the closing process by journalizing and posting the closing entries and preparing the post-closing trial balance. • Use manual and computerized accounting systems. Academic Standards: 1. The student acquires new vocabulary in each content area and uses it correctly. 2. The student demonstrates understanding and control of the rules of the English language, realizing that usage involves the appropriate application of conventions and grammar in both written and spoken formats. 3. The student participates in student-to-teacher, student-to-student, and group verbal interactions. 4. Students will solve problems (using appropriate technology). 5. Students will make connections among mathematical ideas and to other disciplines. National and State Standards: State of Connecticut CTE Performance Standards 2007 Business and Finance Technology CONTENT AREA— Accounting Content Measure – Thirty-five percent of concentrators assessed will achieve 65 percent proficiency. PERFORMANCE STANDARDS AND COMPETENCIES A. Accounting Cycle: Complete the various steps of the accounting cycle and explain the purpose of each step. 1. Describe the effects of the revenue, expense, and drawing accounts on the owner’s equity. 2. Analyze business transactions using source documents. 3. Describe the effects of business transactions on the accounting equation. 4. Define the purpose of a journal and its relationship to the ledger. 5. Journalize business transactions using various journal formats. 6. Prepare and analyze a trial balance to determine the necessary adjustments (accruals and deferrals) to prepare financial statements. 7. Prepare financial statements. 8. Journalize and post closing entries and prepare a post-closing trial balance UNDERSTANDINGS & GOALS 1. Four special journals: Sales, Purchases, Cash Receipts, and Cash Payments form the framework for computer accounting systems 2. When the accounting cycle is computerized not all steps in the accounting cycle are visible, but they are still performed by the computer. Essential Questions: • What role do the steps in an accounting cycle play? • How and why do we use special journals? • What are subsidiary ledgers and how do they relate to the general ledger? Knowledge from this Unit: Students will know: • Steps in the accounting cycle • Types of transactions recorded in the Sales Journal • Types of transactions recorded in the Purchases Journal • Types of transactions recorded in the Cash Receipts Journal • Types of transactions recorded in the Cash Payments Journal • Types of transactions recorded in the General Journal Skills from this Unit: Students will be able to: • Correctly record transactions in the special journals and the general journal • Prove their special journals • Correctly post from the special journals to the general and subsidiary ledgers • Create and balance a trial balance and complete an 8 or 10 column worksheet • Calculate and journalize end of period adjustments and complete the closing process • Create financial statements ASSESSMENT(S) Assessment Method Type: X Pre-test Objective assessment, multiple-choice, true- false, etc. X Group project X Individual project Self-assessment - May include practice quizzes, games, simulations, checklists, etc. Self-check rubrics X Practice quizzes/tests X Subjective assessment/Informal observations Essay tests X Observe students working with partners X Observe student’s role playing Peer-assessment Peer editing & commentary of products/projects/presentations using rubrics X Dialogue and Discussion Student/teacher conferences Partner and small group discussions Whole group discussions Application of skills to real-life situations/scenarios X Post-test LEARNING EXPERIENCES Prior to the start of the unit, give the students a preview of the unit and provide them with a vocabulary list prior to the start of the unit and have them try to define the terms. Sequence of Instruction Lesson 1 – See Attached detailed lesson. • Essential Question: What are the steps in the accounting cycle? • Review the accounting cycle – Administer a pre-test to check students’ understanding of the accounting cycle and vocabulary. An additional pre-test should be a problem that is for a proprietorship and only uses the general journal. Students may work in pairs or groups with teacher circulating to check individual student understanding. Review the accounting cycle using the PowerPoint provided. Refer to student text for additional review and problems. Pre-Test online at http://highered.mcgraw-hill.com/sites/0073526819/student_view0/chapter3/pre-test.html • Define Vocabulary. o Account – A record of the increases and decreases of the amount of a specified item o Accounting Cycle – Activities the business completes within the fiscal period o Accounting Equation – Assets = Liabilities + Stockholder’s Equity o Adjusting Entries – entries made to update certain accounts at the end of the fiscal period o Assets –Anything of value that is owned or controlled o Cost of Merchandise – Actual cost of items bought to be resold o Credit – right side of an account. o Debit – left side of an account. o Double Entry Accounting – A system where every transaction affects at least two accounts o Expenses – Amount paid for goods and services received o Fiscal period – time covered by the accounting report o General Ledger – All of the accounts of a business o Liabilities –Amount of money owed to the creditors of a business o Merchandise Inventory – items business is holding for resale o Revenue – Income earned from the sale of goods and services o Source Document – Evidence a transaction occurred o Stockholder’s Equity – The amount remaining for the stockholder when all of the liabilities are subtracted from all of the assets. o Trial Balance – Proves the equality of debits and credits o Work Sheet – Allows accountant to calculate and prove adjusting entries so that financial statements can be completed. Lesson 2 – How and why do we use special journals? • Define Vocabulary. o Contra Account – Decreases another account’s balance o Sales Journal – Used to record sale of merchandise on account o Cash Receipts Journal – Used to record all transactions where cash is received o Purchases Journal – Used to record all items bought on account o Cash Payments Journal – Used to record all transactions where cash is paid o General Journal – Used to record transactions not recorded in any of the special journals • Introduce the four special journals. If possible, show students a computerized accounting program like Peachtree and help them to relate the special journals to the parts of the computerized system. o Introduce each of the four special journals. (Use the Accounting – Special Journals PowerPoint). Emphasize to students that if a transaction goes into a special journal it DOES NOT go into the general journal also. After introducing the four special journals, explain what transactions would still go to the general journal: sales returns and allowances, purchase returns and allowances, correcting entries, adjusting entries and closing entries. Demonstrate how to prove the journals and how to post amounts to the general ledger and the subsidiary ledgers. • Supplemental Activities – Using a comprehensive problem from the text, divide students into groups of four. Have each student be responsible for ONE special journal in this team activity. The student would be responsible for recording on his/her journal only. After students have gone through the problem and recorded only their transactions have them prove their journals, then post their totals to the general and subsidiary ledgers. (Any transactions that go the general ledger will be done as a team, including adjusting and closing entries). Have students prepare a trial balance when all posting is done. This will apply to all of the students in the class. • Extension Activity – Have students complete a computerized accounting practice set, from handouts or from the text. Lesson 3 • Essential Question: What are subsidiary ledgers and how do they relate to the general ledger? • Define Vocabulary. Subsidiary Ledger – Contains detail data summarized in the control account in the general ledger Control (ling) Account – Balance in this account equals the total of all of the accounts in the subsidiary ledger Posting – Transferring amounts from a special or the general journal to the subsidiary and/or general ledger • Introduce subsidiary ledgers and control accounts using explanation from the book and portions of the special journals PowerPoint. Help students to understand that subsidiary ledgers are necessary so that we don’t have to record every single thing on the financial statements. Explain that there are jobs associated with subsidiary ledgers – accounts payable clerks, accounts receivable clerks, inventory clerks, etc. Describe the posting process from each of the special journals to the subsidiary ledgers and the control account. Show students how to complete a Schedule of Accounts Receivable and a Schedule of Accounts Payable and how to compare them to the control accounts in the general ledger. • Supplemental Activities – Have students pair up and work on problems that require posting from the special journals to the subsidiary ledger and the general ledger. Have one student post the general ledger entries. Have the other student post to the subsidiary ledger and prepare a Schedule of Accounts Receivable and a Schedule of Accounts Payable. Have the students compare their results. • Extension Activities – Have students work with the interactive activities on www.collegecram.com Supplemental Activities: • Have students do the drop and drag activity found online at http://www.wisconline.com/objects/index_tj.asp?objID=ACC2105 • Have students review the closing process at http://www.wisconline.com/objects/index_tj.asp?objID=ACC1604 • Have students review the Income Statement and Balance Sheet with a drag and drop activity at http://www.wisc-online.com/objects/index_tj.asp?objID=ACC2305 Extension Activities: • Have students review the Accounting Cycle at www. Collegecram.com • Have students individually complete a comprehensive accounting cycle problem from their text. Notes: Peachtree Accounting offers a free site license to educational institutions - see http://www.peachtree.com/training/educational_partnerships.cfm. Peachtree is preferable to QuickBooks when teaching Principles of Accounting because QuickBooks is designed for use among non-=accountants and does not always follow GAAP. It is strongly advised that students complete at least one computerized accounting cycle problem during this unit. It may be useful to have students complete a cycle problem manually and then the same problem on the computer. Lesson 4 Monopoly Game See attached lesson. We have all played the game monopoly in our childhood. We have played this game for entertainment. We are now going to play this game and tie it with our class work. You will see how this game can be used as a learning experience to gain knowledge in the financial world for real life experiences. (Note: Ask students questions about their past gaming experiences with monopoly to get them engaged.) Presentation: Teacher Activities OBJECTIVES 1. Student will apply what has been learned about the accounting cycle and record daily business transactions and adjusting entries in the General Journal and General Ledger. 2. All daily transactions will come from playing the game. 3. Student will prepare the Trial Balance, Income Statement, Statement of Retained Earnings and Balance Sheet for the months of Oct and Nov. Note: For this practice set only, the company has only two months in its year. 4. Student will prepare closing entries after the second month and a post-closing trial balance. STEPS TO START THE MONOPOLY GAME 1. Get into groups of four and choose your game piece. 2. Assign duties: a) Banker that will handle the money, b) The County Clerk will handle the Title Cards for the real estate until purchased, c) The timer- keeps the turns moving. . d) Inventory control - makes sure all the pieces are there at the end of the game. See the inventory control sheet. 3. The Banker hands out the cash of $1500 (2 EACH OF $500, $100, $50, 6 – $20s 5 EACH OF $10, $5, $1)* 4. The County Clerk will shuffle the Title Cards then pass out five to each player. 5. The name of your company is "Your Name" Consulting, this will appear on all the Financials. 6. Record the first transaction in the General Journal. Receipt of cash from bank $1,500 and the five properties in return for Common Stock. The property value is the price on the board. The cash and the price of the five properties should equal the amount of common stock. *Journal Entry is Dr Cash for $1500 and Credit Common Stock for $1500. **Journal Entry is Dr Property/Railroads and Credit Common Stock. Use the value on the front of the card for the cost of the property. Running the Game: Set up should take about twenty minutes. This is to set out the board, choose the game piece, and receive the money. The banker should set up the money and the county clerk should set out the title cards during this 20 minutes. Transactions: The first 10 rolls will be for the month of Oct. The first roll would use the transaction date of Oct 1, the second roll, Oct 2, the third roll, Oct 3. etc. Record these in the General Journal. You can have more than one journal entry in a day. Count your cash and write it down. Rolls 11-20 will be Nov transactions and recorded in the same way as Oct. Note: The rolls are your entry but can cause another player to have an entry. Same applies if someone rolls and lands on your property then you get rental revenue. If you land on their property it is rent expense to you. Leave space on the General Journal to enter adjusting entries for the month. Always record the name of the property when purchased, paying rent, and receiving rent. Adjusting entries can be entered at home. Remember adjusting entries are internal transactions and are not part of the rolling of the dice. Application: (Student Activities) SUMMARY OF ACTIVITIES 1. Choose the player piece. 2. Get money and property from the bank. Record the transaction. 3. Roll the 10 times for each person recording the transactions as they occur. 4. Make note of your cash after every one has had 10 rolls. This is the end of the Oct. 5. Post the journal entries to the General Ledger if you have not done it when entering the journal entries. 6. Prepare a Trial Balance for Oct. 7. Make the adjusting entries for depreciation and if you have prepaid insurance or supplies. 8. Prepare Oct. Adjusted Trial Balance. 9. Prepare Income Statement, Statement of Retained Earnings and Balance Sheet. 10. Roll 10 times again for November. 11. Make note of your cash after every one has had 10 rolls. This is the end of the Nov. 12. Post the journal entries to the General Ledger if you have not done it when entering the journal entries. 13. Prepare a Trial Balance for Nov. 14. Make the adjusting entries for depreciation and if you have prepaid insurance or supplies. 15. Prepare Nov. Adjusted Trial Balance. 16. Prepare Income Statement, Statement of Retained Earnings and Balance Sheet. 17. Prepare the closing entries on the general journal 18. Post the entries to the general Ledger. 19. Prepare Post Closing Trial Balance. Closure: The students upon completion of this lesson will be able to effectively prepare a financial statement for various business entities, and understand the fundamentals of double entry accounting. The students will also be able to apply what has been learned about the accounting cycle and record daily business transactions and adjusting entries in the General Journal and General Ledger. Culminating Unit Performance Task Description/Directions/Differentiated Instruction: Lesson 5 The Accounting Cycle PowerPoint Presentation Activity with Grading Rubric See attached lesson Three class periods will be used for this lesson. Key Concepts: • The student will be able to define, describe, and understand the interdependence of the steps in Accounting Cycle. • The student will be able to give a presentation to the class in the student group on one step of the (accounting cycle - how to post to Ledger Accounts). Performance Objectives: Student will create a PowerPoint Presentation that demonstrates and explains one of the steps involved in the accounting cycle (ex. posting transactions to the General Ledger Account.) UNIT RESOURCES Drop and drag activity found online at http://www.wisconline.com/objects/index_tj.asp?objID=ACC2105 The closing process at http://www.wisc-online.com/objects/index_tj.asp?objID=ACC1604 Income Statement and Balance Sheet with a drag and drop activity at http://www.wisconline.com/objects/index_tj.asp?objID=ACC2305 Peachtree Accounting offers a free site license to educational institutions. http://www.peachtree.com/training/educational_partnerships.cfm Monopoly Game http://www.bused.org/lessons/institute/AccountingMonopolyLessonPlan.pdf College Cram Account Exercises www.college-cram.com College Cram – Sales Journal College Cram – Purchases Journal College Cram – Cash Receipts Journal College Cram – Cash Payments Journal Online Pre-Test http://highered.mcgraw-hill.com/sites/0073526819/student_view0/chapter3/pre-test.html