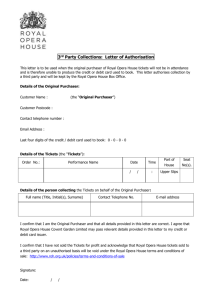

GPP 3 Form Asset Purchase Agreement (Buyer

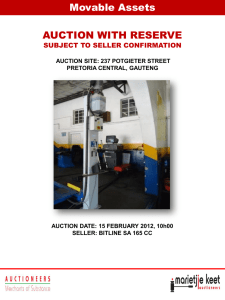

advertisement