ENVIRONMENTAL SCANNING, NATURE OF DECISION AND

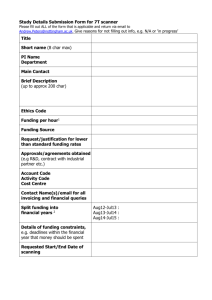

advertisement

DECISION CHARACTERISTICS, EXTENT OF SCANNING AND INFORMATION

PROCESSING CAPACITY RELATIONSHIPS: IMPACT ON INVESTMENT DECISION

MAKING QUALITY

Nik Maheran Nik Muhammad

Universiti Teknologi Mara, Kelantan

nmaheran@kelantan.uitm.edu.my

Norlina Kamudin

norlina@eau.edu.my

Filzah Md Isa

Universiti Utara Malaysia

filzah@uum.edu.my

Abstract

Successful decision-making strategies emerged from a decision making process where individuals

and organizations seek out and process the information effectively in situations of uncertainties.

Hence, decision success requires a keen strategic understanding of external influences, capacity

to process the information and the characteristics of the decision itself. While this research

focuses on strategic investment decision making, the first question arise concerning whether the

decision characteristics influence the quality of decision made and the extent of environmental

scanning behavior of the decision maker? Secondly, will the extent of scanning done give rise to

quality of investment decision? And does the information processing capacity (IPC) enhance the

relationship between environmental scanning and quality investment decision? Decision

characteristics that comprises of decision task (i.e. complexity, difficulty, familiarity and

ambiguity of the decision) and decision situation (i.e. time pressures, irreversibility and

significance of the decisions) may affect the amount of information required to resolve the

decision taken. Therefore to make quality decision in the highly competitive environment today,

decision makers in any organization need to devote a significant amount of information to

managerial decision making. Environmental scanning is one tool in an organization’s arsenal

that can be used to gain this understanding. It is especially helpful when decision is complex

and requires a large body of information. Getting the right information to the right person at the

right time to produce the right processed information is also of critical importance. Thus, the

adaptation of technology, skills and knowledge synthesis within environmental scanning should

occur. Hypothesis testing method of research design was used in this present study. A crosssectional survey through personal contact and personally distributed questionnaires was carried

out to the CEOs and higher level managers of all industries located all over Malaysia. The

usable questionnaire of 118 collected via convenient sampling was used for the analysis of the

study. The result shows that decision characteristics influence the quality of decision but does

not impact scanning behavior of the CEO and higher level managers.

Keywords: Environmental scanning, decision quality, nature of decision, information processing

capacity

1.0

INTRODUCTION

1

Today's corporate world is undergoing unprecedented changes. The accelerating pace of

technology, markets integration, and highly competitive market, place an increasing

demand to get strategic investment decision right. Malaysia like the rest of the world is

doubling its efforts in transforming the economy towards achieving higher valueadded growth. Therefore, more efficient decision mechanisms are required to support this

transformation. Several studies such as Daft and Weick (1984), Hambrick (1981), and

Venkatraman (1989) found a positive relationship between scanning and performance.

According to Dess, (1987) environmental scanning is the primary strategy and is

necessary in establishing organizational goals. In addition, it has been found that

successful firms differ from unsuccessful firms because they do more scanning and they

also have a broader pattern of scanning (Daft, Sormunen, & Parks, 1988) as scanning will

help decision makers to make better decision and ultimately quality decision.

Decision characteristics on the other hand also impact quality of decisions as

according to Rajagopalan, Rasheed, and Datta (1993), relationship exists between

decision characteristics and the decision making process. The more difficult, irreversible

and risky the decision, the more scanning is needed to achieve quality decision. Leonard,

Scholl and Beauvais (2005) added that differences in decision task and decision situation

can be attributed to decision making processes or the environment where the decision

was made. Thus, quality decision-making in a highly competitive environment today,

needs a significant amount of information to resolve different characteristics of the

decision. Environmental scanning is one tool in an organization’s arsenal that can be

used to gain this information. It is especially true when decision is complex and requires

a large body of information. Therefore, getting the right information to the right person

at the right time to produce the right processed information is of critical importance.

Thus, the adaptation of technology, skills and knowledge synthesis within environmental

scanning should occur.

Similar research on environmental scanning and investment decision-making

were found done by Eknem (2005). However his study looked at how investment

decision was made and mainly descriptive in nature. Another study was found done by

Leroy and Bernard (2004), who posited environmental scanning as a moderator to

enhance productive investment decision and reduce the risk-averse attitude of the

managers. Hence, in the knowledge of the researchers, no study was found to directly

relate whether decision characteristics influence decision quality and scanning behavior

and moreover to comprehensively analyze how managers scan the environment, the

source of information they use, the sector of environment they seek out, and the influence

of information processing capacity to enhance their investment decision-making quality.

Therefore, this research aims to fill such gap in the research of strategic decision making

and environmental scanning by investigate how scanning is done by the top management

in all types of firms in Malaysia, and how it should be done to ensure quality decisions.

2.0

LITERATURE REVIEW

2.1

Decision Characteristics

Decision Characteristics encompasses of decision task, decision situations and individual

indifference (Haris, 1998).

2

Decision Task

Decision task would include the dimensions of complexity of the task, difficulty and

familiarity of the task and ambiguity of the task (Leonard et al., 2005). Empirical

findings suggest that an increase in decision time when the task is unfamiliar or

ambiguous, and also an increase in the amount of information needed when the task is

complex or difficult. According to Wood (1986), complex tasks require significantly

more processing of information cues (where the cues are interrelated to decision task)

than simple tasks.

Decision Situation/Environment

Characteristics of the decision situation or decision environment include time pressures,

irreversibility and significance of the decision and accountability of the decision makers.

Time pressures on the decision will lead to a structured, rule based decision process that

will reduce the number of alternatives generated and considered. Irreversibility of the

decision and significance of the decision and accountability of the decision maker are

linked to an increase in decision time (Abelson & Levi, 1985).

2.2

Decision making theory

In strategic decision making model, many theorists see the analysis of the decision

making processes as the key to understanding how organizations function. For a long

time, literature on decision making was dominated by the assumption that decision

making could take place in an entirely rational way. The rationalist perspective, which

was developed in the 1950s and 1960s, has its roots in Weber’s sociological theory in

which he sees the rationalization of decision making within bureaucratic structures as the

dominant approach to organization (Weber, 1947 in Nilsson and Dalkman, 2001). Simon

(1957) introduced rational decision theory into organization theory. He said that the

decision making process is the core of all organization theory, which should therefore

address questions such as “How are decisions made?” and “How can decisions be made

more rationally?” According to rationality theory, the decision making process is goaloriented and rational. However, the rational Model or “economic man” is the ‘ideal’

model for decision making, but it is not practical, because of the limitations in human

information processing capability and the ability to predict all alternatives which is

termed as ‘Bounded rationality’ by Simon (1957).

The concept of bounded rationality suggests that individuals have perceptual and

information-processing limits. Although managers may want to act rationally, they must

accept the limits. This limited function includes acting upon sufficient rather than

complete knowledge. Hence, there’s a tendency for managers to use simple rather than

complex search strategies for problems and consistently using shortcuts (Miller &

Ireland, 2005). Judgmental perspective of decision making was introduced by Simon in

the late 50s. “Intuitive” decision making is the type of decision-making that involves

interpersonal interaction (Simon, 1987). It relates to irrational or judgmental decisionmaking that involves the behavior and emotions of the decision maker.

The need for quick decisions, the need to cope with demands created by complex

market forces, and the assumed benefit of applying deeply held knowledge, create strong

perceived value for the intuitive approach. However, Miller and Ireland (2005) in their

3

study conclude that, drawing from the evidence of behavioral decision making, strategic

decision making, and mental modeling; intuition is a troublesome decision tool unless it

is combined with more orderly sequential analysis of the situation. Many studies also

found that decision-making styles involve an intimate combination of the two kinds of

decision making, analytical and intuitive (e.g. Simon, 1987; Miller and Ireland, 2005).

2.3 Extent of Environmental scanning

Efforts by executives or decision makers to assess uncertainty and identify opportunities

in their environment are called “extent of scanning behavior”. As environmental changes

have increased in their rapidity, scanning has become one of the most important duties

for executives. Many literatures documented that scanning is used for a variety of

strategic purposes; to reduce uncertainty in the environment (Elenkov, 1997; May et al.,

2000), to achieve competitive advantage through superior information gathering (e.g.

Beal, 2000; Kumar, et al., 2001), to gain knowledge about stakeholder priorities and

demands that can be used to develop effective response strategy (e.g. Kumar et al., 2001),

and to develop strategies that improve financial performance (e.g. Kumar and

Subramaniam, 1998; Venkatraman, 1989). Hambrick (1982) was the first who set the

methodological archetype in measuring scanning behavior. He identifies three behavioral

dimensions of scanning; frequency of scanning, managerial/organizational interest in

scanning and time devoted to scanning activity. Researchers after Hambrick (1982) have

tried to empirically identify other dimensions of scanning behavior in order to measure

how scanning was being conducted. Most researchers looked at source or mode of

scanning, and method of scanning. Those attributes are the conceptualization of the

extent of environmental scanning behavior.

Based on Aguilar’s work, Daft and Weick (1984) and Weick and Daft (1983), has

developed a general model of organizational scanning behavior looking at two

dimension; analyzability ('can we analyze what is happening in the environment’?) and

intrusiveness ('do we intrude actively into the environment to collect information?'). Daft

and Weick (1984) suggest that organizations differ in their modes of scanning, depending

on management's beliefs about the analyzability of the external environment, and the

extent to which the organization intrudes into the environment to understand it. An

organization that believes the environment to be analyzable, in which events and

processes are determinable and measurable, might seek to discover the 'correct'

interpretation through systematic information gathering and analysis. Conversely, an

organization that perceives the environment to be unanalyzable might create or enact

what it believes to be a reasonable interpretation that can explain past behavior and

suggest future actions (Choo, 2001). According to Choo (2001), besides environmental

uncertainty, the level of knowledge and information available about the environment may

also be an important factor for choosing the scanning approach. Scanning approach can

be passive, active, formal or informal and an organization that intrudes actively into the

environment is one that allocates substantial resources for information search and for

testing or manipulating the environment. A passive organization on the other hand takes

whatever environmental information comes its way, and tries to interpret the environment

with the given information. Usually it involves informal method of scanning and relies

more on personal sources of information.

4

Amount of Scanning

The amount of scanning done by managers is one of the common dimensions of scanning

behavior used in earlier studies (Elenkov, 1997; May et al., 2000; Sawyer, 1993). Most

of the previous research conceptualized amount of environment scan based on frequency

of scanning, interest in scanning and the time spend in scanning the environment (e.g.

Ebrahimi, 2000; Elenkov, 1997; Hambrick, 1982; May et al., 2000). However, for the

present study, the concept of the amount of scanning is operationalized by measuring the

amount of information the managers scan on each type of information needed for the

decision they have made.

Method of Scanning

According to many researchers, the method of scanning will impact the quality of

decisions made (e.g. Subramanian, Fernandez, and Harper, 1993). The popular

dimension used to measure method of scanning is formal versus informal systems and

regular versus irregular basis. The formal system consists of a specialized unit and

personnel dedicated to the tasks of acquiring, interpreting, and internally communicating

information on different aspects of the firm’s environment (May et al., 2000). With

formal system, scanning is usually done on routine or regular basis where the information

will be stored and used whenever needed. An informal system is built around the day-today scanning activities of individual managers and is done on an ad-hoc basis by either

middle or top level executives in the organization. The information that is obtained on a

non-routine or informal basis and it is usually gained through chance encounters that do

not seek comprehensive hard data. Information seeking is thus casual and opportunistic,

relying more on irregular contacts and casual information from external, people sources

(Choo, 2000).

Sources of Scanning

Another dimension of environmental scanning behavior is sources of scanning used.

Many literatures have identified several sources of information that can be drawn on in

the scanning process. Typically, the sources can be categorized as internal and external

sources and personal and impersonal sources (Aguilar, 1967). Internal sources of

information about the external environment includes memos, output from management

information systems, and direct contact with managers and employees within the

organization (McGee & Sawyer, 2003), while external sources of information includes

trade publications, direct contact with customers, suppliers, and executives from other

companies as well as attendance at industry-related meetings and seminars as well at the

internet (Wood, 1997). Personal and impersonal sources on the other hand, are

operationalized by looking at the types of contacts. Personal sources of information

originate from personal contacts involving direct communication with other individuals

either within or outside of the organization, such as friends, family members, and close

business associates. On the other hand, impersonal sources originate from non-personal

sources typically written communications such as formal reports, trade publications,

newspapers, government reports, output from management information system and etc.

(Aguilar, 1967; Daft & Weick, 1984).

5

2.4 Information Processing Capacity

Information processing approaches to modeling organizations have been extensively

developed in organization theory (Daft & Weick, 1984; Egelhoff, 1988, 1991, 1992;

Galbraith, 1973; Huber, 1991; Tushman & Nadler, 1978), but this work has had little

influence on the environmental scanning literature. Although a great deal of exploratory

research exist on environmental scanning, it is generally difficult to integrate them with

information processing capacity because there is lack of underlying theoretical

framework that facilitates both situations. Organizational information processing, views

organizations as a system that need to balance the organization’s information processing

capacities against the information-processing requirements inherent in its strategy and

environment. It encompasses organizational structure and organizational design. Given

the high level of uncertainty, complex decisions and the shortage of useful information,

there is often considerable need for “cognitive elaboration” on the part of decision maker

that is skill and experience and decision support systems (Egelhoff & Sen, 1992).

Information processing in organization is generally defined as data gathering,

transformation of data and communicating data into information. An organization

processes information to make sense of its environment, to create new knowledge, and to

make decisions (Choo, 1998). Information processing is also defined as how the

information is modified so that it eventually influences the decision making. Most

empirical research identifies four dimensions of IPC, namely organizational structure

(e.g. Galbraith, 1973; Ochi, 1981; Wiliamson, 1981;) decision experience and skill (e.g.

Flynn and Flynn, 1999; Kraiger, 1988; Levitt and March, 1988; Nass, 1994) managerial

style (e.g. Driver et al.,1996); and decision support systems (e.g. Culnan and Markus,

1988; Daft and Lengel, 1986; King, 2006). However, since the main focus of the study

is on the impact of scanning on decision making quality and not on the manager or the

organization, only two dimensions is appropriate to be used, that is decision experience

and skill and decision support system brought to bear on the decision made.

Decision Experience, Knowledge Skill and Decision Support System

IPC can be operationalized by looking at decision experience and skill - that is the ability

of each person to intelligently process information to provide useful knowledge for

decision-making. This skill and ability is dependent on individual/group experience.

Experienced administrators will have greater levels of knowledge and skill from learning

by doing as they have been exposed more frequently to the intelligence of the

organization.

As the amount of information increased and the firm’s environment and the

decision become more complex, automation and the use of information technology is

needed to make it possible to efficiently analyze the data and trends and process

information accurately on the timely basis.

2.5 Investment Decision Quality

In measuring or evaluating capital investment decision, there are many techniques

currently being discussed in the literature such as traditional mainstream techniques

(discounting cash-flow (DCF) and payback period) which are said to be inadequate in

certain situations especially for the evaluation of investment in research and development

6

(R&D) and technological innovations (Ekanem, 2005). Both situations are intangible in

nature in terms of the benefits involved and the environmental uncertainties that need to

be dealt with (Thomas, 2001). Study by Demeyer, Nakane, Miller, and Ferdows (1989),

found considerable evidence available to support the claim that the financial appraisal

methods (e.g DCF, payback) used by industry to evaluate capital investments may be

inappropriate for today’s high technology business environment. A manufacturing

strategy survey of senior managers of large manufacturers in Europe, North America and

Japan revealed that the competitive priorities of those executives are dimensions of cost

(productivity), quality, flexibility, and dependability/delivery (Demeyer et al., 1989).

Other surveys (e.g. Proctor and Canada. 1992) also indicate product quality as a top

priority in America. According to Proctor and Canada, other less tangible benefits most

widely cited are: (1) improved competitive position, (2) increased manufacturing

flexibility, (3) reduced delivery time, and (4) reduced product development time.

Therefore, strategic evaluation of capital investment which used to be performed by top

management beyond the range of financial appraisal are now brought in line with

justification of investment in advanced manufacturing system and other high technology,

long-range capitalization projects.

Leroy and Bernard (2004) on the other hand added that in an uncertain

environment, that is when the parameters that influenced the future states of nature are

unforeseeable, the question is not so much whether it is profitable to invest but whether it

is opportune to invest immediately instead of waiting. According to them, “decision is

not whether to invest, but also when to invest”. Environmental scanning is a tool that can

be used to identify the opportunities and prospects available.

Quality investment decision is a decision that: (1) meets (or contributes to the

achievement) the objectives of the organization; and (2) gives rise to positive outcome to

the decision maker. Therefore investment decision quality is operationally defined by

looking at decision-making outcome in differentiating between good decision and bad

decision and whether it has met the goal and objective of the organization. To measure

investment decision quality, the respondents were asked to evaluate their specific

investment decision that they have selected and rate how they perceive the outcome of

the decision that they have made, whether it has met their objectives or not.

3.0

THEORETICAL FRAMEWORK AND RESEARCH METHODOLOGY

The theoretical framework of the current study has five major relationships. It is

decision characteristics as independent variables, environmental scanning as intervening

variables, information processing capacity as moderating variables and decision quality

as dependent variable. The framework started by exploring the relationship between

decision characteristics and decision quality. The second part of the analysis examined

the relationship between decision characteristics and environmental scanning. The third

part of the analysis examined the mediating effect of environmental scanning and

decision quality, the fourth analysis examined the decision characteristics and the

inclusion of the mediating variable of environmental scanning with decision quality and

the final analysis is on the moderating effect of Information Processing Capacity on the

environmental scanning and decision quality The five main hypotheses of this study

attempt to answer the central research issue of whether the characteristics of the decision

7

influence the decision quality and whether it is mediated by the scanning behavior of the

decision maker. Furthermore the current study also interested to know if information

processing capacity enhances the environmental scanning behavior and the decision

quality.

The data in the current study relates to capital investment decision, which

therefore forms our unit of analysis. Capital investment involves decision that relates to

the purchase of plant, machinery, building, business, market expansion and product

development. Therefore, information about specific decision made by the decision maker

is crucial for this study. The respondents were asked to choose only one specific decision

that they have made within the last two years. This specific decision that they have

selected will be the main focus of the analysis. The quality of the decision by the

respondents depends on two factors. One is the importance of achieving each of the

listed objectives, and secondly the extent the objectives were achieved. The Decision

Quality Index (DQI) measure used is a weighted sum of the achieved objectives, where

the weights were represented by the importance attached to the each of the objectives.

We measured the importance (rank 1 to 10) by forming the weights attached to each of

the quality. Since the ranks differ from decision to decision, the quality of the decision

was rated based upon the respondent's importance attached. Since the weights summed

up to 55 (10+9+8+7+6+5+4+3+2+1 = 55), the denominator is 55. Therefore the Quality

index formula is as below:

DQI

(importance

(importance

of objective i x achievemen t of objective i)

importance

of objective i

of objective i x achievemen t of objective i)

55

This unit of analysis is also chosen to enhance internal validity as choosing the

manager or the organization making the decisions will only confuse the issues to be

addressed. This is due to the fact that managers and organizations make many decisions,

some would involve a great amount of scanning, and some none at all, and the associated

quality is high for some and low in others. Therefore, isolating the focus on a specific

decision, measuring the associated scanning behavior and quality, will strengthen the

validity of the relationship thus established.

The population of the study is the investment decision per se which is in the

researcher point of view, cannot be easily identified. It is due to the fact that the

decisions were made by almost every executive. Due to the unidentified population and

sampling frame as well as the nature of the study itself, the most appropriate sampling

method to be used was convenient sampling. The data was obtained from various

sources based on the researcher’s personal contact and networking.

According to

McGrath (2001), the major advantage of using personal contacts and the promise of

useful feed back was that, the respondents were professionally interested in the results

and committed to making sure the data were accurate. Moreover, convenient sampling is

also used commonly in many marketing and strategic management studies (e.g.

Annamalai, 2006; Chan, 2005; Jaworski and Kohli, 1993; McGrath, 2001; Syed

Mohamed, 2004). Based on that argument, the researcher has the confidence to proceed

8

with the convenient sampling although the generalizability of the findings might be

limited as it may be valid only for the sample we have obtained. Therefore the 345

questionnaires were sent to the decision maker of all industry sector all over Malaysia.

4.0

FINDINGS

Various levels of decision makers who make capital investment decisions in the last two

years from various types of companies were analyzed. Out of 345 questionnaires

distributed, 126 were received and 118 were usable. Thus, the total response rate was

37%. The achieved response rate compares favorably to other studies in environmental

scanning conducted in other countries, where it ranges from 17% to 30% only (e.g. Choo,

1993; May et al., 2000).

4.1

Sample Profile

Respondent profile

In terms of who made the decision, the majority of the decision-makers in our sample

hold managerial position (39%) designated in most of the business units such as, regional

manager, branch manager, operation manager, financial manager and etc. followed by

CEOs (33%). 58% of them have a Bachelor’s degree and about 32% holds Masters and

Doctorate degrees. The majority of them have management and business background,

but there are also a significant number of respondents with IT and engineering

background. Thus, we can conclude that the respondents are sufficiently well versed

with their company operations and are able to comprehend the needs of the questionnaire.

In terms of their experience, the majority of the decisions are made by

respondents who have been in the industry for more than 6 years (32%). The important

trend is that slightly more than 50% of them have more than 10 years of experience in the

industry. Although 65% of the respondents have been in their position for less than 5

years, most of them have been with their respective companies for more than 6 years

(40%). It can be seen here that generally the decisions involved in this study are made by

people with long tenure and vast experience in their respective businesses and companies.

Company Profile

In terms of where the sampled decisions are made, 64% are made in the services sector,

which includes trading, tourism, property development, construction, plantation, finance

company, telecommunication industry, education and government agency; while the

remaining 36% are made in the manufacturing sector, such as automotive, petroleum, gas

and biotechnology. Various types of companies are expected to be more representative

of the scanning behavior among Malaysian firms.

Furthermore, 45% of the sampled decisions are made in companies that have been

in operation for more than 15 years but there are also an equal proportion of those which

have been in operation between one to fifteen years. Thus, our sampled decisions are

appropriate for the current study to investigate the environmental scanning behavior in

relation to their investment decision quality. In terms of the size of the companies that

made our sampled decisions, there are also a sufficient number of small and large

responding companies. About 34% are small enterprises and 30% are moderate in size.

9

The remaining 36% are large companies with the number of employees exceeding 500,

lending credence to subsequent results from analysis.

Decision Profile

It was argued that different decisions need different types of information involving

different methods and sources. Therefore, it is crucial to scrutinize the decision profile

as it might point towards different scanning behavior. The data shows that most of the

decisions in the sample are related to capital acquisitions (35%) involving decisions to

acquire plant, machinery, building, land, computers, and etc., and 28% are related to

decisions about research and development, developing new product and new market and

etc. Another 22% are decisions related to business acquisition and mergers while 14%

are related to market expansion. Hence, the study covers a whole spectrum of decisions

which hopefully will reflect the various types of scanning behavior.

The size of investment involved in the decisions was seen to be more on the low

end, with 40% involving an investment of RM1 million or less, and only 20% are of

investments value RM20 million or more.

Decision Objective

Table 1 displays the importance of the objectives of the capital investment decisions

involved in this study. Improving profitability through enhancing product quality and

cost efficiency are the three most important objectives of the decisions made. Improving

knowledge development and the dissemination was the least important consideration of

the decisions.

Table 1

Profile of importance of the objectives achieved

Decisions (N=118)

Objective

Improve quality of product

Improve cost efficiency

MEAN RANK

3.84

3.90

Improve production time

Improve productivity

Improve profitability

Enlarge market share

Develop new product

Enhance employee motivation

5.58

4.19

3.61

5.36

7.19

6.70

Increase innovation capacity

7.12

Develop and disseminate knowledge

7.49

Note: Rank of 1 = most important; 10 = least important

In summary, it can be concluded that the sampled decisions in the study are quite varied

not only in terms of its nature (objectives, investment value, etc.) but also in terms of

where and who made these decisions. It therefore provides useful basis for the subsequent

analysis and inference.

10

4.3

Descriptive analysis

Overall Descriptive Analysis

The main objective of the survey is to have a broad overview of how investment decision

was made among Malaysian decision makers. Decision makers use various information

sources and various scanning methods for decision making and different decision

characteristics will lead to different level of decision quality. Descriptive statistics for the

final list of variables of the study are shown in Table 2.

Table 2

Descriptive statistics of Moderating, Control and Dependent variables

Decision N =118

Variables

Mean

X1: Decision situation

X2 : Decision task

Y1: Extent of scanning

Y2: Method of scanning

Y3: Source of scanning (Personal/Impersonal)

Y4: Source of scanning (External/Internal)

M: Information Processing Capacity

Z: Decision quality

Notes:

X

Y1

Y2

Y3

Y4

M

Z

3.36

2.90

3.32

3.46

2.97

2.93

3.87

3.73

Std.

Deviation

0.67

1.38

0.76

0.62

0.65

0.64

0.61

0.71

scale range:1 (less complex) to 5 (very complex)

scale range: 1(not at all) to 5 (great amount)

scale range:1 (informal) to 5 (formal)

scale range: 1(impersonal) to 5 (personal)

scale range: 1(external) to 5 (internal)

scale range: 1(low) to 5 (high)

scale range: 1(low) to 5 (high)

In gaining insight into how and how much of the business environment was scanned

when making investment decisions, the overall sample was examined. The mean level

of environment being scanned and its dimensions are slightly above 3 indicating a

moderate level of scanning behavior (mean = 3.32). Similarly, the methods used to scan

the environment are moderately formalized (mean = 3.46). Thus, one can conclude that

a combination of both formal and informal methods was used to scan the environment.

Sources used to gather information indicates that slightly more impersonal and external

sources was used to gain the information.

For the level of information processing capacity brought to bear on the decisions,

the complexity of the decision made and the extent of the decision achieved its

objectives, the result shows that decisions made by the decision maker having high

capacity in processing the information (mean = 3.87), the characteristics of the decision

(decision situation/decision task) was perceived to be moderate (mean=3.3) and the

quality decision was rated high with the average mean of 3.73.

11

4.4 Validity and Reliability test

Result from the preliminary analyses to determine the goodness of data on the

independent, mediating and moderating variables obtained from the application of factor

analysis and scale reliability testing gave satisfactory output.

4.5

Multiple Regression analysis

Determinants of Decision Characteristics, Extent of Scanning and Decision Quality

Overall, the model depicting the framework representing the interrelationships between

the study variables is strongly supported by the data for extent of scanning behavior and

information processing capacity acting as the moderator to decision quality. It explained

a high proportion of the variations in the investment decision quality. However, for

decision characteristics, the results concluded that a model does not exist as no significant

relationships were found between the variables. Table 3 below depicted the result.

Table 3: Multiple regression: Contextual factors and extent of environmental scanning behavior

(Beta Coefficient)

X1 Decision Task

X2 Decision Situation

Extent

.054

-.036

Mediating Variables

Method

Source(P/IP)

.009

-.074

-.075

.000

Source (I/E)

.011

-.091

R

R square

F value

.064

.004

.233

.075

.006

.329

.091

.008

.484

Independent variables

.074

.005

.313

With regards to extent of scanning behavior, result of regression analysis indicates that

extent of scanning was significant and has positive relationship with investment decision

quality. Further, the higher beta value shows that amount of scanning has significant

impact in explaining the variance in decision quality. Its positive direction indicates that

the more amount of scanning done; the better will be the quality of decision. Method of

scanning and sources of scanning either personal/impersonal or external/internal on the

other hand shows no significant relationships. Therefore, what ever method or sources

used to get the information, will not influence the quality of the decision. The most

important factors influencing decision quality is only how much information being

sought (see Table 4).

Table 4: Multiple Regressions: Extent of environmental scanning and quality of decision

Mediating Variables

Decision Quality

Extent of Scanning

Method of Scanning

Source of scanning (Personal/Impersonal)

Source of Scanning (External/internal)

R

R square

F value

.264***

.172

-.128

-.020

.422

.178

6.108***

***significant at the .001 level ** significant at the .05 level * significant at the 0.1 level

12

Mediating Effect of Extent of Scanning, Method of Scanning and Sources of scanning to

Decision Quality

Our framework posits that the extent of environmental scanning does not mediate the

relationships between contextual factors and the quality of the decision although the

mediating variables affect the dependent variable. This is due to Baron and Kenny’s

condition (1986) that the independent variable must affect mediating variable and the

dependent variables in order to hold the mediation effect. Table 5 to 8 depicts the result

of mediating effect. Therefore, the level of decision complexity either task or situation

does not influence the amount, method and sources of scanning. Furthermore, it will not

also influence the decision made.

Table 5: Hierarchical Regression : Mediating of extent of scanning

DECISION QUALITY

Independent

Unstandardized

R square

R square

Effect

variables

Beta

change

Step 1

Step 2

Decision task

.018

.008

.001

No effect

Extent

.350***

.141***

.139

Decision situation

.127

.140

.014

No effect

Extent

.355***

.158***

.143

***significant at the .001 level ** significant at the .05 level * significant at the 0.1 level

Table 6: Hierarchical Regression : Mediating of method of scanning

DECISION QUALITY

Independent

Unstandardized

R square

R square

Effect

variables

Beta

change

Step 1

Step 2

Decision task

.018

.017

.001

No effect

Method

.339***

.090***

.089

Decision situation

.127

.151

.014

No effect

Method

.352***

.109***

.095

***significant at the .001 level ** significant at the .05 level * significant at the 0.1 level

Table 7: Hierarchical Regression : Mediating of source of scanning (Personal/Impersonal)

DECISION QUALITY

Independent

Unstandardized

/mediating

R square

Beta

R square

Effect

variables

change

Step 1

Step 2

Decision task

.018

.011

.001

No effect

Source (P/IP)

-.213**

.039**

.038

Decision situation

.127

.126

.014

No effect

Source (P/IP)

.214***

.053***

.039

***significant at the .001 level ** significant at the .05 level * significant at the 0.1 level

13

Table 8: Hierarchical Regression : Mediating of sources of scanning (External/Internal)

DECISION QUALITY

Independent/mediating

Unstandardized

R square

variables

Beta

R square

Effect

change

Step 1 Step 2

Decision task

.018

.019

.001

No effect

Source (E/I)

-.150

.019

.018

Decision situation

.127

.115

.014

No effect

Source (E/I)

.138

.029

.015

***significant at the .001 level ** significant at the .05 level * significant at the 0.1 level

Moderating Effect of Extent of Scanning, Method of Scanning and Sources of scanning and

IPC to Decision Quality

To test the moderating effect of information processing capacity on the relationship of

environmental scanning and decision quality, model 2 and 3 display the result of

hierarchical regression analysis (refer to Table 9). The test for moderating influence to

the environmental scanning and quality decision relationship, model 2 upon inclusion of

information processing capacity variable is analyzed. The results indicates that the model

is highly significant (F-change=9.40; p-value=0.003) and the R square improved by

6.4%. With the inclusion of interaction variables in model 3, R square improved only

0.05%, which indicates that the moderating variables have little influence on the

relationship between the extent of scanning and the decision quality.

Hence, the

moderator acts more as a predictor variable with the dependent variable.

The regression coefficient measured by the standardized (β) coefficients indicates

that moderating variables was not significant for the interaction variable of IPC with the

extent of information scan, method and sources used to decision quality. This indicates

that the relationship of extent, method and source with decision quality was not

influenced by the inclusion of moderating variable. Thus, IPC was not a moderator but a

predictor variable.

Table 9: Hierarchical Regression – Environmental scanning and investment decision

making quality

DECISION QUALITY

Model 1

Model 2

Model 3

Model Variable

Extent of scanning

Method of scanning

Source of scanning (P/IP)

Source of scanning(E/I)

Moderating variable

Information Processing Capacity (IPC)

Interaction Variable

IPC_Extent

IPC_ Method

IPC_Source(P/IP)

IPC_Source(E/I)

R square

R square change

F value

F change

.264***

.172

-.128

-.142

.178

.178

6.108***

6.108***

14

.178*

.072

-.065

-.014

-.121

.407

.427

-.871

3.068***

.130

.242

.064

7.132***

9.410***

.423

-.520

-.545

.990

.246

.005

3.923***

.174

5.0

DISCUSSION AND CONCLUSION

The data of the present study found that there are significant and positive relationships

between environmental scanning and investment decision quality. What this means is

that the more scanning is done in making the decisions, the better is the decision made.

However, the analysis suggests that this is only true for amount of scanning done and not

for method and source of scanning when measured simultaneously (i.e multiple

regression). However, when tested the mediating effect of each variables, all the

variables are significant accept for sources (external vs. internal) of scanning; Three

possible reasons why this happened is that; firstly the IV itself has little variation (SD

small) therefore statistically it is impossible for it to explain why the DV varies from unit

to unit; may be due to unit are similar with the IV in the sample questions; Secondly, if

the particular (insignificant IV) is significantly correlated with another IV (that is

significant); in multiple regression, once one variable is significant; the significance of

another IV is evaluated on the additional predictive power that the new IV brings to the

relationship; This situation can be seen by correlation between X1 and X2; in other

words the effect of X2 on Y is subsumed (captured) within X1; much like mediating.

Third possible reason is that the relationship between the IV with Y is non-linear

(suggesting) that the impact of the IV on Y may be moderated by some other variable i.e.

effect of the IV on Y may be contingent on some other factors.

Results of the moderated regression analyses provide no support for hypothesis

concerning the environmental scanning behavior, information processing capacity and

investment decision quality. IPC was found to act as predictor variables and not

moderating variables. This means that IPC does not enhance decision quality, but act as

an influential factor for high quality decision. The reasons for this scenario as explained

by many researchers (e.g. Fahey and King, 1977; nik muhammad et. al 2007) are due to

two reasons. One is either the information is very complex to process or the information

is common knowledge and therefore cannot be used to differentiate between low and

high quality decisions. In both these situations, the need for IPC is minimal. The second

reason is the information may not be relevant to the business decisions involved;

therefore having the capacity to process the information (high IPC) will not make an

impact on turning data into information.

In addition to all the plausible reasons being mentioned, the insignificant results

could also be attributed to a number of influential factors as well. Among the factors that

may influence the level of decision quality are the differential natures of the

organizational culture, structure, leadership style, and business sector or operation of the

organizations involved in the study. Most probably, these factors could directly or

indirectly shape or mold the characteristics of decision; the extent, method, and source of

environmental scanning; and also the information processing capacity of a decision

maker. Since quality of decision is rather subjective in nature, then the way it is being

measured may not be similar. Therefore, further studies should be carried out by taking

into consideration the influential capacity of these factors and other potential factors on

decision quality.

REFERENCES

15

Abelson, R.P. and Levi, A. (1985). Decision making and decision theory. In Lindzey, G.

and Aronson, E (Eds), the handbook of Social Psychology, 3rd Ed. New York:

Random House, 231 – 309.

Aguilar, F.J., (1967). Scanning the business environment. New York: McGraw-Hill.

Beal, R. M., (2000). Competing Effectively: Environmental Scanning, Competitive

Strategy, and Organizational Performance in Small Manufacturing firms. Journal

of Small Business Management, 27-45.

Choo, C.W., (2001). Environmental scanning as information seeking and organizational

learning. Information Research, 7(1). http://InformationR.net/ir/7-1/paper112.html]

Culnan, M.J., (1983). Environment scanning: the effect of task complexity and source

accessibility on information gathering behavior, Decision Science, 14(2), 194-206.

Daft, R. L., and Lengel, R. H., (1986). Organizational Information Requirements, Media

Richness and Structural Design. Management Science 32(5), 554- 571.

Daft, R.L., Sormunen, J. Parks, D., (1988). Chief executive scanning, environmental

characteristics, and company performance: an empirical study.

Strategic

Management Journal 9, 123-139.

Daft, R.L. and Weick, K.E., (1984). Toward a model of organizations as interpretation

systems. Academy of Management Review, 284-295.

Demeyer, A., Nakane, J., Miller, J.G. and K. Ferdows (1989). Flexibility: The Next

Competitive Battle. The Manufacturing Futures Survey," Strategic Management

Journal 10, 26-37.

Dess, G.G., and Davis, P.S., (1984). Porter’s Generic Strategies as Determinants of

Strategic Group Membership and Organizational Performance. Academy of

Management Journal 27, 467-488.

Driver, M.J., Svenson, K., Amoto, R.D., and Pate, L.E. (1996). A Human-InformationProcessing Approach to Strategic Change. Altering Managerial Decision Style.

International Studies of Management and Organization 26(1), 41-58.

Ebrahimi, B.P., (2000). Perceived Strategic Uncertainty and Environmental Scanning

Behavior of Hong Kong Chinese Executives. Journal of Business Research 49(1),

67-78.

Egelhoff, W.G., and Sen, F., (1992). An Information-Processing Model of Crisis

Management. Management Communication Quarterly: McQ (1986-1998), 5(4),

443-484.

Egelhoff, W.G. (1991). Information-Processing theory and the multinational enterprise.

Journal of International Business Studies, 22(3), 341-368.

Egelhoff, W.G. (1982). Strategy and structure in Multinational corporations: An

information processing approach. Administrative Science Quarterly, 27, 435 – 458.

Ekamen, I., (2005). ‘Bootstrapping’: the investment decision-making process in small

firms. The British Accounting Review, 1-2

Elofson, G., and Konsynski, B. (1991). Delegation Technologies: Environmental

Scanning with Intelligent Agents. Journal of Management Information Science, 8(1),

37-62.

Elenkov, D.S. (1997). Strategic uncertainty and environmental scanning: The case for

institutional influence on scanning behavior. Strategic Management Journal, 18,

287-302.

16

Fahey,l. and King, W. (1977).

Business Horizon, 61-71

Environmental Scanning for corporate planning.

Flynn, B.B., and Flynn, E. J., (1999). Information-Processing Alternatives for Coing

with Manufacturing Environment Complexity. Decision Science 30(4), 1021-1051.

Galbraith, J.R. (1973). Designing complex organizations. Reading, MA: AddisonWesley.

Hambrick, D.C. (1981). Specialization of environmental scanning activities among upper

level executives. Journal of Management Studies, 18(3), 299-320

Harris, R., (1998). Decision Making Techniques. http: //www.virtualsalt.com/

crebook6.htm

Huber, G.P., (1991). Organizational Learning: The Contributing process and the

literatures. Organization Science, 2(1), 88 – 115.

King, W.R., (2006). The Critical Role of Information Processing in Creating an Effective

Knowledge Organization. Journal of Database Management 17(1), 1-15.

Kraiger, K., (1988). Implication of Research on Expert/Novice Differences for Training

Assessment and Design. Paper presented at the Annual meeting of the Society of

Industrial/Organizational Psychology, Dallas, TX.

Kumar, K. and Subramaniam, R. (1998). Porter Strategic types: Differences in internal

process and their impact on performance. Journal of Applied Business Research,

14(1), 107-124.

Kumar, K., Subramaniam, R., Strandholm, K., (2001).

Competitive Strategy,

Environmental Scanning and Performance: A Context Specific Analysis of their

Relationship. International Journal of Commerce and Management, 11., 112-142.

Leonard, N.H., Beauvais, L.L., and Scholl, K.W., (2005). A multi-level Model of Group

Cognitive Style in Strategic Decision Making. Journal of Managerial Issues 27(1),

119-138.

Leroy, S., Bernard, J., (2004). Managers and productive investment decisions: the impact

of uncertainty and risk aversion. Journal of Small Business Management.

Levitt, B. and March, J.G., (1988). Organizational Learning. Annual Review of

Sociology, 14, 319 – 340.

May, R.C., Stewart, W.H.J., and Sweo, R., (2000). Environmental scanning behavior in a

transitional economy: evidence from Russia. Academy of Management Journal,

43(3), 403-427.

McGee, J.E.,and Sawyerr, O.O., (2003). Uncertainty and Information Search Activities:

A study of owner-managers of small high-technology manufacturing firms. Journal

of Small Businesses Management 41(4), 385-401.

Miller, C.C., and Ireland, R.D., (2005). Intuition in Strategic Decision Making, Friend or

foe in the fast-paced 21st Century? Academy of Management Executive 19(1), 1930.

Nass, C., (1994). Knowledge or Skills: Which Do Administrators Learn from

Experience?. Organization Science, 5(1), 38-50.

Nillson, M., and Dalkmann, H., (2001). Decision making and Strategic Environment

Assessment. Journal of Environmental Assessment Policy and Management 3(3),

305-327.

17

Ouchi, W.G (1980). Markets, bureaucracies and clans. Administrative Science Quarterly

25 (March), 129 – 41.

Rajagopalan, N., Rasheed, A.M.A., and Datta, D.K. (1993). Strategic Decision

Processes: Critical Review and Future Directions. Journal of Management 2, 349384.

Simon, H.A. (1957). Administration Behavior. Macmillan New York.

Simon, H.A. (1987). Making management decisions: The role of intuition and emotion.

Academy of Management Executive, 1, 57-64.

Sawyerr, O.O., Ebrahimi, B.P., and Thibodeaux, M. S., (2000). Executive Environmental

Scanning, Information Source Utilization, and Firm Performance: the case of

Nigeria. Journal of Applied Management Studies, 9(1), 95-115

Sawyerr, O.O., (1993). Environmental uncertainty and environmental scanning activities

of Nigerian manufacturing executives: a comparative analysis.

Strategic

Management Journal, 14(4), 287-299.

Sawyerr, O.O., Ebrahimi, B.P., Thibodeaux, M.S., (2000). Executive Environmental

Scanning, Information Source Utilization, and Firm Performance: the case of

Nigeria. Journal of applied Management studies 9(1), 96-115.

Subramaniam, R., Fernandez, N., Harper, E., (1993). Environmental scanning in US

companies: their nature and their relationship to performance. Management

International Review, 33(3), 271-286.

Subramaniam, R., Kumar, K., Yauger, C., (1994). The scanning task environments in

hospitals: An empirical study. Journal of Applied Business Research 10(4), 104115.

Tushman, M.L., and Nadler, D.A., (1976). Information Processing as an Integrating

Concept in Organizational Design. Academy of Management Review 3, 613-624.

Venkatraman, N., (1989). Strategic Orientation of Business Entreprises: The Construct,

Dimensionality and Measurement. Management Science 35(8), 942-962.

Weick, K.E., (1988). Enacted sense making in crisis situation. Journal of Management

Studies, 25, 305-317.

Williamson, O.E., (1981). The economic organization: the transaction cost approach.

American Journal of Sociology 87, 548 – 577.

Wood, R. E., (1986). Task complexity: Definition of the construct. Organizational

Behavior and Human Decision Processes 37, 60-82.

18