Thursday, May 7, 2009 - Fisher College of Business

advertisement

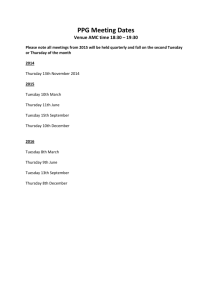

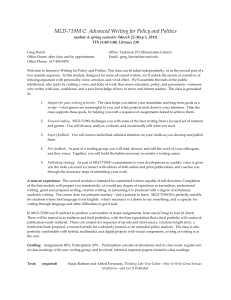

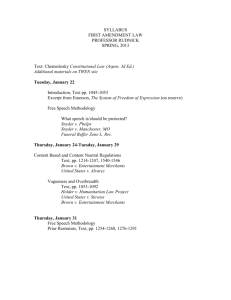

Strategy Formulation and Implementation MBA 980 Spring, 2009 Professor Email Jay Dial dial.12@osu.edu Office Phone 860 Fisher Hall 292-5438 Reading packet There is a required reading packet available at Uniprint-Tuttle Park that includes course readings, cases and lecture notes for classroom discussion. This is copyrighted material and each student must purchase an individual copy of the reading packet. Additional highly recommended readings will be selected from Management Skills: A Jossey-Bass Reader (ISBN # 0-7879-7341-6). It is available from both BarnesandNoble.com and Amazon.com. Course Overview This course is about the creation and maintenance of long term value for the organization. It is concerned with both the determination of the strategic direction of the firm and the management of the strategic process. The course builds on prior studies of functional areas while recognizing that most real business problems are inherently multi-functional in nature. Thus, this course employs an explicitly integrative approach in which we adopt the role of the general manager who has the responsibility for the long-term health of the entire organization. The course would be taught primarily through the case method of instruction. Course Objectives 1. Understand the nature of strategic competitiveness and develop the ability to analyze the competitive environment facing a firm, assess the attractiveness of the industry and isolate potential sources of competitive advantage and disadvantage. 2. Develop business level strategies by defining the type of advantage sought, scope of operations and activities required to deliver the chosen strategy. Assess the likely sustainability of firm strategies and competitive positions. 3. Discriminate among the types of data that general managers need to evaluate alternative scenarios. Make quantitative assessments of strategic alternatives and develop logical, coherent and persuasive analyses for a desired course of action. 4. Consider the actions of competitors and how that impacts your ability to reach your strategic goals. Develop courses of actions that incorporate the actions of multiple players in the marketplace. 5. Integrate knowledge and apply analytical techniques from various disciplines, including finance, accounting, marketing, operations, organization theory and organizational behavior and particularly economics. The goal is to identify and analyze strategic issues and develop solutions in the form of actionable plans with the purpose of developing and sustaining competitive advantage. 6. Consider how to effectively implement plans within the constraints imposed by the complex behavior of individuals within organizations. Each student should be able to effectively communicate his or her conclusions in both oral and written form. 1 7. Assess differing styles of management and leadership and consider the essential role of personal values in leading an organization. 2 Class Format The Case Method: Why We Rely on Discussion Learning Most of our class time will be spent discussing business cases. Why do we rely on the case method so extensively and how do these discussions enhance our learning? The case-study method brings a “real world” approach to business education in at least three important ways. First, case discussions generate a dynamic process of vigorous questioning and responding, examination and debate among students and discussion leader. Because strategy issues are often characterized by ambiguity, complexity or uncertainty, this course is more about asking the right questions than it is about knowing the right answers. Rather than simply lecture about the current state of “best practices,” we recognize that theories change over time but reasoning skills survive. So the case method helps students to refine their skills as insightful questioners, rather than just good answer-finders. In this model of learning, it is the journey more than the destination that matters. In addition, discussion learning requires all students to participate actively in the learning experience. The MBA degree is about more than just acquiring a tool box of analytical skills. It is also about developing the ability to contribute to the group so that we expand the boundaries of everyone’s learning. Just as in management, there is no formula that you can follow for every case. Nevertheless, over the course of the academic quarter, students gradually build on a combination of theory and analysis as well as judgment and experience to acquire important skills that the general manager needs. The case method requires a high level of student commitment where students personally engage the problem and “own” the solution. Consequently, the case method is inherently a student-oriented process. Walter Wriston has said, “Good judgment comes from experience. Experience comes from bad judgment.” As in the “real world,” the case method replicates the trial-and-error experience of seasoned managers, thereby deepening judgment. It also does so in the low risk environment of the classroom where career casualties are not at stake. Second, the case method trains students to think as administrators (rather than as scholars), so that they: (1) see a problem looking for solutions rather than a concept looking for applications, (2) focus on defining and prioritizing a maize of tangled problems and determining which one(s) to attack with the limited time and resources available, (3) appreciate differing agendas and points of view, and (4) take action, not just report findings. Third, by linking analysis with individual action, the case method encourages moral awareness by requiring students to take a stand. The give-and-take of case discussion often brings to the surface subtle ethical dilemmas that might otherwise be missed. The case method helps students learn to assess and embrace the tradeoffs among different stakeholders’ interests. The case method requires students to use all of their knowledge, skills and experience to respond in real time to the questions raised in class and to effectively communicate their ideas to classmates to create a greater shared understanding of the problem at hand. Thus, students also become the teachers as well as learners. In sum, we teach with case studies because the method embodies important values of professional education. The case method is not simply a technique; it is a rich philosophy about judgment, analysis, action and learning. (The preceding was adapted from an article by Robert F. Bruner) While our applications will emphasize exercise of judgment, by no means is this course “theory free.” We will learn to break down complex problems into manageable analytical issues where we can then apply a rigorous set of theoretical tools. The analytical approaches in our “strategy tool kit” will be covered in the required readings prior to each case. These readings have been carefully selected to convey often complex topics in a concise, understandable manner. In general, I have assigned managerially-oriented readings and spared you the pain of reading pointy-headed, scholarly-type articles. Since these readings articulate much of the theoretical content of the course, they will be crucial to your comprehension of our course concepts. It is extremely important that you read, study and discuss the articles with each other when assigned so that you will be able to apply the concepts to our case discussions. 3 The key requirement of this course is that you THINK. This course requires that you synthesize material that you have learned in prior classes in your business education in conjunction with new concepts we will introduce. I will ask that you add a dose of common sense and filter these ideas through your own experiences and “world view.” We will reach consensus on some issues, yet many among you will have differing interpretations as we proceed through the course. This is the nature of strategy and policy issues. You may find yourself occasionally frustrated by the ambiguity and the difficulty of assimilating conflicting points of view. Welcome to real life. Our readings and case discussions are designed to help you understand how firms formulate and implement strategies under the impetus of competition, technology, government action, and other important contextual forces. This, in turn, requires a deep understanding of the functional strategies associated with economics, marketing, operations, finance and human resources. Our challenge in this course will be to integrate your learning from other courses in a synthesis with new material introduced here to see how general managers develop functional strategies into overall business and corporate strategies and to see how their chosen strategies are implemented. While this may not happen overnight, over the course of the quarter, you can expect to begin to see how the “pieces fit together.” You will be better prepared to enhance your careers with a more comprehensive vision of the firm as a whole and your role in it. Requirements and Evaluation Criteria Class Contribution Written assignments Final Exam 40% 30% 30% Total 100% Class Contribution Most of your learning will occur in preparation for and participating in the case discussions. To enhance your preparation and learning, I strongly encourage you to use study groups to discuss the cases prior to class. To guide you in your preparation, this syllabus includes preparation questions for each case. As noted earlier, the complexity of the course material relies heavily on discussion learning. This process allows the cumulative insights of your colleagues to contribute to the evolution of the class’s learning. Thus, the entire class learning experience relies on each of you taking responsibility for contributing to the discussion. In order to do so, it is imperative that each of you is present and fully prepared each day. In order to emphasize the necessity to be prepared for and to contribute to each class, class contribution will comprise a significant portion of your grade. As is the case with real world work environments, you are judged not by what you know but by what you contribute. Note that this is distinct from merely participating in the discussions. Even if you feel that you know the material, unless you share your insights with the class, I cannot adequately evaluate your preparedness and contribution. Students are never penalized for making comments which don’t appear to be the “right answer.” It is only through consideration of many diverse opinions and viewpoints that we will move toward a greater shared understanding of the multi-dimensional material which this course entails. Each day, I will ask one or more individuals to “open” the case with a summary of the key issues along with his or her analysis of those issues. It is important that each of you be prepared to respond to the invitation to open the discussion. In the unlikely event that you are not prepared for class, then please let me know beforehand so that I might spare both of us the embarrassment of my calling on you. You should be able to identify the key issues, problems and opportunities facing the central case protagonists, to articulate and 4 evaluate alternative approaches to problems, and to describe the course of action that you recommend and the reasons for yours recommendations. I may begin the discussion with one of the questions in the syllabus or with another question. It is important to appreciate that every student is an important cog in the class discussion, and that it is equally important that each of us listen carefully to one another and attempt to build on or constructively critique prior comments. Please resist the temptation to jump to topics that are not specifically open for discussion. Some of the specific things that will have an impact on effective class contribution and on which you will be evaluated include: Is there a willingness to take intellectual risks and test new ideas or are all comments “safe”? (For example, repetition of case facts without analysis or conclusions or repeating comments already been made by someone else do not represent intellectual risk-taking nor do they earn credit towards your class contribution evaluation.) Is the contributor a good listener? Are the points made relevant to the discussion? Are they linked to the comments of others and to the themes that the class is exploring together? Do the comments add to our understanding of the situation? Are they incisive? Do they cut to the core of the problem? Is there a willingness to challenge the ideas that are being expressed by discussants or the professor? Does the contributor integrate material from past classes or the readings where appropriate? Do the comments reflect cumulative learning over the strategy course and the MBA curriculum or does the contributor merely consider each case in isolation? Finally, I understand that participating in class can be an intimidating experience initially, and I will try to help you in any way that I can. I will evaluate each person’s contribution for each and every class and keep a running score on class contribution. In addition, I will request volunteers to be peer evaluators for each class period. Those students will offer a confidential interpretation of the quality of class contribution that I will use to supplement to my own evaluation. It is through the combined effort of the class that we develop an open environment for discourse and examination of ideas and experience tells us that this is where a substantial amount of your learning will occur in this class. With that in mind, your commitment to contributing to this environment not only determines the success of the class, but also helps to define your grade in the course. Consequently, your attendance is vital and will affect your contribution score. While it is your business whether you want to attend class and contribute, your classmates also bear the cost when you fail to do so. Thus, in an effort to internalize the externality arising from absences from class, you will bear the cost to your contribution score when you choose to miss a class. Interviews are not excused absences. As required by school policy, grading will be based on relative rather than absolute standards. A B average in core courses and overall is required to earn the Fisher College MBA degree 5 Written Assignments There will be several written assignments, most performed in groups. Groups will consist of the study groups that you have been assigned for your first year. The assignments are listed in the syllabus. Each group will turn in three of the five total written assignments in addition to one individual assignment. I also reserve the right to add additional written assignments during the semester, particularly if I feel that the class is failing to prepare adequately for case discussions. Final Exam The final exam will be given during the University’s scheduled exam period. You will receive a case to read and prepare approximately one week prior to the final exam. On the day of the exam, you will be given the exam essay questions and will have two hours to complete the questions. The exam is open book and open note and you may work with classmates to prepare for the exam. 6 TOPIC COURSE CALENDAR Mon 3/30 Tuesday 3/31 Building 1 Competitive Advantage Wed 4/1 Course Introduction and Industry Structure Lecture Mon 4/6 Industry Structure 2 and Strategic Positioning Tuesday 4/7 Wed 4/8 Mon 4/13 Tuesday 4/14 Wed 4/22 Husky Injection Molding Systems* Mon 4/27 Tuesday 4/28 5 Building Sustainable Advantage Mon 5/4 Wed 4/29 Tuesday 5/5 Wed 5/6 Mon 5/11 Tuesday 5/12 8 British Satellite Broadcasting versus Sky Television Wed 5/20 Wed 5/27 Mon 6/1 Tuesday 6/2 Wed 6/3 Asahi Breweries, Ltd. * Written Assignment 7 Fri 5/1 Thursday 5/7 Fri 5/8 Thursday 5/14 Fri 5/15 Thursday 5/21 Fri 5/22 Thursday 5/28 Fri 5/29 General Electric: Jack Welch’s Leadership Kathy Levinson and E*Trade Leadership and 10 Transformation Thursday 4/30 RTE Breakfast Cereal Industry* Matching Dell* Mon 5/25 Tuesday 5/26 Fri 4/24 Adobe Systems Incorporated Competitive Dynamics Leadership and 9 Transformation Thursday 4/23 Capital One Financial Corp. Wed 5/13 Mon 5/18 Tuesday 5/19 Fri 4/17 Performance Indicator U.S. Toy Industry* Building Sustainable 7 Advantage and Competitive Dynamics Thursday 4/16 Airborne Express* Delta Airlines: LowCost Carrier Threat 6 Building Sustainable Advantage Fri 4/10 Zara: Fast Fashions Lincoln Electric 4 Building Sustainable Competitive Advantage Thursday 4/9 A Hundred Year War: Coke & Pepsi, 1890s-1990s Wed 4/15 Mon 4/20 Tuesday 4/21 Fri 4/3 Intel Corporation: 1968-1997 Crown Cork & Seal in 1989* 3 Sustainability of Strategic Position Thursday 4/2 Thursday 6/4 Course Wrap-up & Evaluations Fri 6/5 READINGS, ASSIGNMENTS AND PREPARATION QUESTIONS SESSION 1 Tuesday, March 31, 2009 TOPIC: Course Introduction and Lecture on Industry Structure READINGS: Michael E. Porter, “What Is Strategy?” Harvard Business Review, Nov/Dec, 1996 Chapter 1, “Leadership Is Authenticity, Not Style,” Bill George, Management Skills: A Jossey-Bass Reader Chapter 34, “If Not Me, Then Who? If Not Now, When?” Bill George, Management Skills: A Jossey-Bass Reader CASE: none SESSION 2 Thursday, April 2, 2009 TOPIC: Building Sustainable Competitive Advantage READINGS: Michael Porter, “The Five Competitive Forces That Shape Strategy,” Harvard Business Review (Reprint R0801E) Joan Magretta, “Why Business Models Matter” Harvard Business Review, May 2002 CASES: Intel Corporation: 1968-1997 PREPARATION QUESTIONS: 1. What was Intel’s strategy in DRAMs? What accounts for Intel’s dramatic decline in market share in the DRAM market between 1974-1984? To what extent was Intel’s failure a result of its strategy? 2. What strategy did Intel use to gain a competitive advantage in microprocessors? What threats has Intel faced in sustaining its competitive advantage in microprocessors and what strategies has it used with each? Why has Intel been able to sustain its advantage in microprocessors, but not in DRAMs? 3. Assess the future prospects of Intel. What is the biggest threat it faces? Whom should it be most worried about? Put yourself in the position of Intel senior management and craft a strategy to deal with these threats. 8 SESSION 3 Tuesday, April 7, 2009 TOPIC: Industry Structure and Competitive Positioning READING: Chapter 2, “Credibility Is the Foundation of Leadership,” James S. Kouzes and Barry Z. Posner, Management Skills: A Jossey-Bass Reader Chapter 28, “Overcoming the Five Dysfunctions of a Team,” Patrick Lencioni, Management Skills: A Jossey-Bass Reader CASE: Crown Cork and Seal in 1989 GROUP ASSIGNMENT (for all groups): Complete the matrix in the course pack which analyzes the industry structure for the metal container industry. Answer in 3-4 double-spaced pages: 1. Is the metal container industry an attractive industry? Why or why not? 2. Describe how Crown Cork and Seal how has strategically positioned itself to deal with key industry forces. Explain why they have made those choices and how their actions respond to industry structure issues. (Hint: Evaluate Crown’s positioning in the context of the firm’s functional area strategies: product choices, marketing and service, production process, research and development, finance and international strategy.) PREPARATION QUESTIONS: 1. What are the key strategic issues that Avery needs to consider? What strategic options are open to him? 2. If we are going to analyze the industry that Crown Cork competes in, what is the appropriate industry to analyze? 3. How attractive has the metal container industry been over the years? 4. How well did Crown Cork do under John Connelly? 5. What significant changes are taking place in the industry? How should the new CEO Bill Avery respond? 9 SESSION 4 Thursday, April 9, 2009 TOPIC: Industry Analysis and Sustainability of Competitive Position READING: Kevin Coyne, “Sustainable Competitive Advantage: What It Is, What It Isn’t,” Business Horizons, Jan/Feb 1986 Ken Corts and Jan Rivkin, “A Note on Microeconomics for Strategists” CASE: A Hundred Year War: Coke and Pepsi, 1890s-1990s PREPARATION QUESTIONS: 1. Why is the soft drink industry so profitable? 2. Compare the economics of the concentrate business to the bottling business: why is the profitability so different? 3. Why do concentrate producers want to vertically integrate into bottling? 4. Are the international businesses likely to evolve with a similar industry structure? Why or why not? 10 SESSION 5 Tuesday, April 14, 2009 TOPIC: Sustainability of Strategic Position READING: Barney, “Looking Inside for Competitive Advantage,” Academy of Management Executive Ghemawat and Rivkin, “Creating Competitive Advantage” CASE: Lincoln Electric PREPARATION QUESTIONS: 1. How would you describe Lincoln Electric’s approach to the organization and motivation of their employees? 2. What role do you think this approach has played in Lincoln’s performance over the last 25 years? Have any other factors been more important? 3. What factors will be critical to Lincoln’s continued success? What recommendations would you make to Mr. Willis? 4. What is the applicability of Lincoln’s approach to motivation to other companies and situations? Why don’t more companies operate like Lincoln? 11 SESSION 6 Thursday, April 16, 2009 TOPIC: Building Sustainable Advantage READINGS: Chapter 5, “The New Managerial Work,” Rosabeth Moss Kanter, Management Skills: A Jossey-Bass Reader CASE: ZARA: Fast Fashion PREPARATION QUESTIONS: 1. With which of the international competitors listed in the case is it most interesting to compare Inditex’s financial results? Why? What do comparisons indicate about Inditex’s relative operating economics? Its relative capital efficiency? 2. How specifically do the distinctive features of Zara’s business model affect its operating economics? Specifically, compare Zara with an average retailer with similar posted prices. In order to express all advantages / disadvantages on a common basis, you may find it convenient to assume that on average, retail selling prices are about twice as high as manufacturers’ selling prices. 3. Can you graph the linkages among Zara’s choices about how to compete, particularly ones connected to its quick-response capability, and the ways in which they create competitive advantage? What does the exercise suggest about such capabilities as bases for competitive advantage? 4. Why might Zara “fail”? How sustainable would you calibrate its competitive advantage as being relative to the kinds of advantages typically pursued by other apparel retailers? 5. How well does Zara’s advantage travel globally? 12 SESSION 7 Tuesday, April 21, 2009 TOPIC: Building Sustainable Advantage READING: none CASE: Husky Injection Molding Systems GROUP ASSIGNMENT (For “A” Groups): Answer the following in 3-4 double-spaced pages: 1. What is Husky’s strategy (i.e., type of advantage sought)? What is the fundamental logic by which Husky makes money? Describe Husky’s choices in regard to breadth of scope in terms of customers, products/services, geography and degree of vertical integration. 2. Quantify the willingness to pay for a Husky machine relative to a competitor’s machine. In other words, how much would a customer have to spend to replace one Husky PET perform system. (Hint: Use assumptions found on page 4 and in Exhibits 6 and 11. In making the comparison, consider input costs and other operating costs including floor space. Take into account the amount a customer would have to spend to get comparable production as well as the ongoing operating costs to determine a customer’s upper bound for willingness to pay.) Hand in your analysis separately from questions 1 and 3. 3. What recommendations would you make to Schad to turn around the company’s performance? Be specific in regard to scope, pricing and anything else you deem relevant. PREPARATION QUESTIONS: 1. What is Husky’s strategy? Why has the company been so successful in the period prior to the recent problems? 2. Are Husky injection molding systems worth the premium price the company charges? Be precise and support with quantifiable analysis. 3. What has caused Husky’s current difficulties? 4. How should Schad and the company respond? 13 SESSION 8 Thursday, April 23, 2009 TOPIC: Competitive Dynamics READING: Yoffie & Cusamano, “Judo Strategy,” Harvard Business Review, Jan-Feb, 1999 Chapter 15, “Artful Listening,” Steven B. Sample, Management Skills: A Jossey-Bass Reader CASE: Airborne Express (A) GROUP ASSIGNMENT (For “B” Groups): 1. Using the data provided in Exhibit 3 in the case as a starting point, calculate the cost structure for Airborne relative to the competitor shown on a per package basis. To the extent possible, focus on estimating marginal costs rather than simply dividing total cost for a category by quantity shipped. Complete the cost structure comparison included in the course pack. Respond in about 2-3 double-spaced additional pages to the following: 2. Describe how Airborne’s activities (and particularly its choices in regard to scope) shape their cost structure. Does Airborne have a sustainable advantage? 3. What would you recommend to Robert Brazier, Airborne’s President and COO, in regard to the two issues posed in the case: a) should Airborne shift to a distance-based pricing model and b) should they pursue to alliance with RPS? What risks do they face? PREPARATION QUESTIONS: 1. How and why has the express mail industry structure evolved in recent years? How have the changes affected small competitors? 2. How has Airborne survived, and recently prospered, in its industry? 3. Quantify Airborne’s source of advantage. 4. What must Robert Brazier, Airborne’s President and COO, do in order to strengthen the company’s position? 14 SESSION 9 Tuesday, April 28, 2009 TOPIC: Sustaining Competitive Advantage READING: Chapter 16, “Establish Competence and Build Trust,” Terry Pearce, Management Skills: A Jossey-Bass Reader CASE: Delta Air Lines: The Low-Cost Carrier Threat (A) PREPARATION QUESTIONS: 1. During the 1990s, none of the five largest air carriers in the United States earned its cost of capital. Why do such low rates of return on investment persist in the airline industry? 3. Despite the challenging industry environment, airlines like Southwest Airlines and JetBlue earn enviable returns. How? 4. Why have all of the low-cost substitutes of legacy airlines, including Delta Express, failed? 5. What will happen to Delta Air Lines if it continues to respond to low-cost airlines in the way it has in the past? Can you size up, roughly, the financial consequences of continuing with the status quo? 6. What are the strategic options available to the cross-functional team that Mark Balloun co-leads? What steps should the team take to choose among the options? What recommendation should they make to Delta’s board? 7. Based on the information available to you, what course of action would you recommend to Delta’s board? 15 SESSION 10 Thursday, April 30, 2009 READING: none CASE: Performance Indicator PREPARATION QUESTIONS: 1. Why has it been so difficult for Osinski and Winskowicz to get a golf ball manufacturer to sign a contract for their new technology? 2. How much do you think a potential customer (that is, a golf ball manufacturer such as Bridgestone or Acushnet) should be willing to pay for Performance Indicator’s technology? 3. Which of the potential customers should Osinski and Winskowicz focus on? Should they offer their product exclusively to one of the major golf ball manufacturers? 3. In light of your analysis, what should Osinski and Winskowicz do? 16 SESSION 11 Tuesday, May 5, 2009 TOPIC: Industry Structure, Industry Attractiveness and Strategic Positioning READING: Chapter 31, “Leading From Within,” Parker J. Palmer, Management Skills: A Jossey-Bass Reader CASE: The U.S. Toy Industry INDIVIDUAL ASSIGNMENT: 1. Complete the matrix for the two segments in the U.S. Toy Industry and hand in a hard copy with your assignment. Be sure that you briefly describe each factor that you consider relevant within the box provided. Fill in each box as best you can with either a +, - or ? for each factor you identify. There may be more than one than one factor affecting price, cost, quantity or risk for each industry force, and they may be inconsistent so that opposing forces create counterveiling effects. For example, under Buyer Power, you will list who the likely buyers are in each segment. In other words, what distribution channel will the toy company use to distribute its products? How powerful are those buyers? Why are they powerful (or not) in regard to the price? How might each distribution channel affect the toy firm’s costs, quantities or sales volume? Each industry force will not necessarily affect every driver (price, cost, quantity, risk). 2. Next (this is exciting, isn’t it?), develop a detailed business plan (3-4 double-spaced pages of text) for the toy company. a.) Develop a positioning strategy to deal with the industry structure. b) Describe how your strategy responds to the opportunities and threats created by the industry structure you analyzed for Q. 1. As you describe the activities in this system, consider how each might either reduce power of industry forces or add value. c) Explain how your strategy will create a competitive advantage for your firm. Note: Stick to the facts as they are written. The case is set in 1980. Do not suggest an internet-based strategy if you want a passing grade. Stick to one of the two products suggested in the case, either the poseable action figures or the large molded toys. This assignment allows you build important skills that relate to strategy formulation and implementation. This represents an important step in moving from retrospective analysis of actions taken (as we have seen in prior cases) to developing your own sets of action moving forward. Moving from analysis to action is a crucial element in building your general management skill set and developing your ability to integrate key concepts in a realistic business setting. 17 SESSION 12 Thursday, May 7, 2009 TOPIC: Sustaining Competitive Advantage READING: Chapter 30, “Building Companies Where Innovation Is a Way of Life,” Robert I. Sutton, Management Skills: A Jossey-Bass Reader CASE: Capital One Financial Corporation PREPARATION QUESTIONS: 1. What distinguishes Capital One from the many other companies that use and exploit information in their interactions with customers? How is this strategy different from other mass customization strategies? 2. What are the effects of mass customization strategies on industry structure? 3. What are the limits to sustainability of such a strategy? 4. What are the consequences of an information-based strategy for expansion into different segments of the credit card industry, and into other industries? 5. How well positioned is Capital One to leverage its skills to compete via the Internet? 18 SESSION 13 Thursday, May 8, 2009 TOPIC: Competitive Dynamics: Imitation READING: Carl Shapiro and Val Varian, “The Art of Standard Wars,” California Management Review, Winter 1999 CASE : British Satellite Broadcasting versus Sky Television PREPARATION QUESTIONS: 1. How might BSB have been able to identify News Corporation as a potential competitor prior to Rupert Murdoch’s announcement of the launch of Sky Television? 2. What might BSB have done differently before Sky’s entry announcement? Following the announcement? 3. What should BSB do in 1990? In particular, what share of a possible merger pie would you hold out for, as BSB? 4. Why did this competitive battle turn out to be so costly for both parties? SESSION 14 Thursday, May 14, 2009 TOPIC: Building Sustainable Advantage and Exploiting Network Externalities READING: Carl Shapiro and Val Varian, “The Art of Standard Wars,” California Management Review, Winter 1999 CASE: Adobe Systems Incorporated PREPARATION QUESTIONS: 1. How was Postscript established as a de facto standard? How did Adobe make money from Postscript, despite its being an “open” standard? 2. Which firm is currently in a stronger position to control de facto standards in the eBook space: Adobe or Microsoft? 3. What should Adobe do? How can they win the standards war? Should they focus on eDocs or eBooks? Will the eBooks market tip or will there be multiple standards? How can Adobe make money in this market? 19 SESSION 15 Tuesday, May 19, 2009 TOPIC: Threats to Sustainability and Competitive Dynamics READING: Peter J. Coughlan, “The Leader’s (Dis)Advantage, Harvard Business School note Chapter 33, “From Success to Significance,” David Batstone, Management Skills: A Jossey-Bass Reader CASE: Matching Dell GROUP ASSIGNMENT (For “A” Groups): Respond in about 1-2 double-spaced pages to the following: What is your assessment of the industry attractiveness of the personal computer industry (focusing on the manufacturers of personal computers)? Discuss the key forces which create this situation. Respond in about 1-2 additional double-spaced pages to the following: What are the key activities Dell pursues? Why is each of these activities advantageous for Dell? How do these activities fit with the rest of what Dell does? How do these activities respond to the PC industry’s structural characteristics you identified above? Respond in about 2-3 additional double-spaced pages to the following: Perform the analysis on Dell’s and competitors’ cost structures using the assumptions indicated in the one page handout included in the course pack (use Compaq for the comparison). Using this information and the average price per quarter data on PC prices (Exhibit 10b), what does this tell you about the nature of Dell’s competitive strategy and importantly, the decisions they have made about how to compete in the industry? Has it changed between 1996 and 1998? Focus on Dell and Compaq for your explanation of cost and pricing decisions. (Also hand in your cost structure analysis with your answer.) PREPARATION QUESTIONS: 1. How and why did the personal computer industry evolve into this situation? 2. Why has Dell been so successful? 3. Prior to the recent efforts by competitors to match Dell (1997-1998), how big was Dell’s competitive advantage? 20 SESSION 16 Thursday, May 21, 2009 TOPIC: Competitive Dynamics READING: Brandenburger and Nalebuff, “The Right Game: Use Game Theory to Shape Strategy,” Harvard Business Review CASE: The Ready-to-Eat Breakfast Cereal Industry in 1994 GROUP ASSIGNMENT (for “B” Groups): 1. How significant have the barriers to entry been in the RTE cereal industry? Calculate what the cost of entry would be for a major branded cereal entrant and for a private label entrant. (Cost of entry means the cost to get up and running for a new player not currently operating in the industry—these costs do not include raw materials costs but would include other costs related to advertising or slotting required to gain entry into the marketplace.) Assume that each entrant wants to operate at minimum efficient scale and that new product introduced attains an average market share of 0.2%. Show the total cost of entry for a both major branded cereal and a private label entrant. (Hint: Given those two assumptions, how many product launches will it take for a new entrant to reach efficient scale?) 2. How do the cost structures of private label and branded cereal manufacturers differ? Complete the value chains included in the course pack to estimate the margins for the branded versus the private label competitors. 3. Calculate on a per pound basis what the operating profit impact will be for General Mills’ reduction in trade promotions. How will total operating profit be impacted? Assume that market shares remain unchanged for the major players. What will the impact be for the other players? Hand in your analyses for the above three questions. Then respond in 2-3 pages or less to the following questions. State your rationale for your answers. 2. What does General Mills hope to accomplish with its April 1994 reduction in trade promotions and prices? Under what conditions would the stable market share assumption (above in question #3) be true? Is that realistic? Is that General Mills’ goal? 3. What are the risks associated with these actions? How do you expect General Mills’ competitors to respond? Be specific about the expected actions of each of the other three major players (Kellogg, General Foods/Post, Quaker) and explain why. Look forward and reason back. PREPARATION QUESTIONS: 1. Why has RTE cereal been such a profitable business? What changes have led to the current industry crisis? 2. Why have private labels been able to enter this industry successfully? How do the cost structures of private label and branded cereal manufacturers differ? 21 3. What does General Mills hope to accomplish with its April 1994 reduction in trade promotions and prices? What are the risks associated with these actions? How do you expect General Mills’ competitors to respond? What should General Mills do? 22 SESSION 17 Tuesday, May 26, 2009 READING: Robert E. Quinn, “Moments of Greatness: Entering the Fundamental State of Leadership,” Harvard Business Review, July-August 2005. Joseph Badaracco, jr. “Personal Values and Professional Responsibilities,” Harvard Business School note Chapter 34, “If Not Me, Then Who? If Not Now, When?” Bill George, Management Skills: A Jossey-Bass Reader CASE: The Individual and the Corporation: Kathy Levinson and E*Trade PREPARATION QUESTIONS: 1. What are Kathy Levinson’s obligations? 2. What factors should she weigh in deciding what to do? 3. What are Levinson’s options? Which one should she choose? 4. As an investor in E*Trade, what decision would you want her to make? 23 SESSION 18 Thursday, May 28, 2009 TOPIC: Leadership and Transformation READING: Kotter, “What Leaders Really Do,” Harvard Business Review, May/June 1990 Chapter 3, “Management versus Leadership,” Warren Bennis and Bert Nanus, Management Skills: A Jossey-Bass Reader CASE: GE’s Two Decade Transformation: Jack Welch’s Leadership PREPARATION QUESTIONS: 1. How difficult a challenge did Welch face in 1981? How effectively did he take charge? 2. What is Welch’s objective in the series of initiatives he launched in the late 1980s and 1990? 3. How does such a large, complex diversified conglomerate defy the critics and continue grow so profitably? 4. What is your evaluation of Welch’s management approach? How important is he to GE’s success? What implications are there for his replacement? 5. GE has been a source of management innovation for decades. What is it that you learned, if anything, from the experience of Jack Welch? 24 SESSION 19 Tuesday, June 2, 2009 TOPIC: Leadership and Transformation, Competitive Dynamics / Putting it all together READINGS: Chapter 12, “How Change Really Comes About,” Rosabeth Moss Kanter, Barry A. Stein and Todd D. Jick, Management Skills: A Jossey-Bass Reader CASE: Asahi Breweries, Ltd. PREPARATION QUESTIONS: 1. Is Asahi a successful enterprise? By what standard? 2. Define the corporate strategy of Asahi Breweries, Ltd. as of 1989. What competitive concepts, economic and non-economic objectives, key operating policies, and timed sequence of moves characterize the strategic logic of this enterprise? 3. What specifically did Messrs. Murai and Higuchi bring to Asahi? How would you characterize their policies, behavior and contributions? 4. What is your assessment of Asahi’s investment and profit plan presented in Exhibit 1? SESSION 20 Thursday, June 4, 2009 Wrap-Up Lecture Course Evaluations Final Exam (date and time to be announced) 25