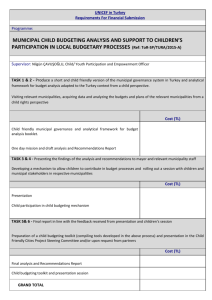

the municipality and the brazilian fiscal federalism

advertisement