Long Term Objectives

advertisement

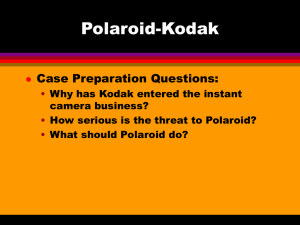

CHAPTER 6 SETTING OBJECTIVES AND MAKING STRATEGIC CHOICES OBJECTIVES After studying this chapter, you should be able to: Understand how strategic objectives are stated Apply various techniques for generating strategies Recognize the criteria that companies can use to select a strategy Understand the key concerns in developing and choosing a global strategy Discuss how behavioral dimensions of the organization affect strategic choice TOPICS COVERED Setting Objectives Strategic Choice Tools for Corporate Level Strategic Choice Tools for Business Level Strategic Choice Global Dimensions of Strategic Choice Behavioral Aspects of Strategic Choice Conclusion Key Terms and Concepts Discussion Questions Experiential Exercise SUMMARY OF KEY POINTS Setting Objectives Objectives define what the organization wants to achieve while strategies represent the pathways by which the organization will achieve the objectives. Objectives are targets set to both motivate and direct organizational activity. They represent levels of performance we wish to achieve, within a defined time frame, as well as standards of performance against which we can evaluate our progress in achieving the organizational mission and vision. Long-term and Short-term Objectives Long-term objectives broadly specify the major direction of the organization and link the mission of the organization to organizational actions. The specific numbers are derived from past performance or based on the external and internal audits. Strategies are then 38 developed to achieve the long-term objectives. The long-term objectives also form the basis for strategy implementation, especially when used to set short-term objectives. Short-term objectives or annual objectives establish specific performance targets for a period of one year. They may focus on the rate of sales growth, market share targets, profitability measures, or other targets. Writing Strategic Objectives Objectives can be effective in their various roles only if stated properly. The SMART format is one way to state objectives in a clear, action-oriented way. Objectives must be specific, measurable, aggressive, realistic and time-bound. Performance Areas Managers set long-term objectives in several key performance areas, including profitability, productivity, growth, market position, shareholder wealth, technological position, employees, organizational reputation, and social responsibility. Strategic Choice Strategic choice involves identifying alternative courses of action designed to move the firm toward its strategic objectives, and selecting the course(s) of action deemed most appropriate. These courses of action are known as strategic alternatives. These alternatives do not just materialize; the company’s existing strategies, mission and vision, objectives, and understanding of both the internal and external environments guide the creation of strategies. Strategic choice requires a consideration of six elements or dimensions of strategy: 1) the product market, 2) the level of investment, 3) the functional area strategies needed to compete in a market, 4) the strategic assets or competencies, 5) the allocation of financial and non-financial resources, 6) the development of synergistic effects across business. Tools for Corporate Level Strategic Choice In virtually every organization, an underlying bias toward growth exists and drives strategic choice, at least in the long run. Most organizations, particularly those in rapidly changing markets, follow the philosophy “grow or die.” However, external conditions and internal realities sometimes create a scenario in which the firm may be more interested in attaining or maintaining stability. Fundamental relationships exist between business units in a diversified organization. These units rarely stand completely alone. Top management must promote cooperation among business units in order to achieve synergy and improve the overall position of the organization. Portfolio Models Portfolio models of strategic management rely on certain principles from the finance discipline as tools of strategic choice. For example, portfolio models treat business units as investments, and therefore can be used to guide decisions related to allocation of investment capital and other organizational resources, and the overall achievement of a balanced portfolio. 39 The Boston Consulting Group (BCG) Matrix The BCG Growth-Matrix uses single criterion dimensions of market growth rate and relative market share. Market growth rate is defined as the growth rate of the industry. Market growth rate is a surrogate indicator of the attractiveness of an industry. Implications Businesses labeled as Stars are in high relative share positions in high growth markets, implying that while such businesses are profitable, they need heavy infusions of investment capital to continue strengthening their competitive position and take advantage of possible cost economies due to both scale and experience. As the industry matures, the Star will move down and become a Cash Cow, provided that the business maintains its relative market share. The GE-McKinsey Business Screen The GE-McKinsey Model is also known as the Market Attractiveness-Business Strength Matrix. This model is similar to the BCG Matrix in theory but uses composite dimensions and a three-by-three matrix for a more comprehensive analysis of both internal and external factors. Summary and Evaluation The BCG model highlights the cash flow, investment needs and performance of various business units. Strategists can use the model to identify how corporate resources can best be deployed to maximize future growth and profitability. The GE-McKinsey model is more comprehensive than the BCG model, but is more subjective and qualitative. Both models suffer from the same drawback in that the performance analysis is static – a view of internal and external factors at one point in time. Portfolio models treat businesses as relatively independent units. In reality, firms with multiple business units typically require some type of organized process to facilitate exchange of technologies, skills, assets and people across both functions and divisions. Overall, these models are useful as analytical tools to help guide corporate and business unit strategy. The visual representation of business units reveals some useful insights. However, the weaknesses of portfolio analysis mean they should be used along with other considerations and tools, and should not be relied upon in isolation. Tools for Business Level Strategic Choice Business level strategy focuses on how to compete within an industry. The goal is to gain a competitive advantage that allows a firm to outperform its competitors and achieve aboveaverage returns. As we know from Chapter 3, achieving a competitive advantage depends, in part, on the firm’s ability to realize a position of either cost leadership or differentiation. Failure to achieve on of these positions leaves a company “stuck in the middle,” with no real advantage over competitors. The SWOT Matrix The SWOT Matrix is a simple tool that may be used to generate alternative business level strategies. Constructing the matrix is a straightforward process of listing the organization’s key strengths, weaknesses, opportunities and threats. These factors were identified during the situation analysis. Matching strengths and weaknesses with opportunities and threats may generate four different sets of strategic alternatives. We formulate SO strategies by 40 considering ways in which our relative competitive strengths can be used to exploit opportunities. By contrast, ST strategies incorporate ways by which we can use our strengths to avoid threats. We generate WO strategies to take advantage of opportunities by addressing weaknesses. In attempt to minimize our weaknesses and avoid threats, we generate WT strategies. Scenario Planning Royal Dutch/Shell pioneered scenario planning before the oil crisis of the early 1970s. This technique is a tool to generate strategic alternatives based on varying assumptions about the future. One advantage of scenario planning is that it helps organizations prepare for different contingencies, including the unexpected. Criteria for Strategic Choice The search for strategic alternatives is guided and constrained, yielding a set of options, not all of which we either can or want to implement. Once we have generated the strategies we wish to consider, we are faced with the task of evaluating and selecting strategy. To do so, we need a set of criteria to screen and test our strategic alternatives, including: fit with company mission, vision and objectives consistency with the realities of the external audit feasibility, given the firm’s internal audit and its competencies and resources ability to leverage and build upon competitive advantage vulnerability to changes in the environment potential rewards (i.e., the return) appropriate level of risk for the company Global Dimensions of Strategic Choice Firms that source, manufacture or distribute in countries beyond their home base must employ either a global or a multinational strategy. A global strategy differs from a multinational strategy. A multinational strategy means that separate strategies for different countries or parts of the world are developed and implemented autonomously. A multidomestic operation involves a portfolio of independent businesses, with separate investment decisions made for each country or region. A global strategy, by contrast, involves coordinated rather than independent strategies for different countries or parts of the world. This coordination can relate to the choice of target countries or regions, degree of standardization of products, services, brands and marketing campaigns across countries, and location of value-added activities such as research and development, production and service, with global customers and worldwide competitors in mind. Why Firms Choose Global Strategies Numerous forces exist today that make global competition a reality. Mature markets in developed nations exert pressure for companies in those countries to expand into foreign markets. The economic development of other countries may also create opportunities in these new markets. Many firms expand internationally to exploit current competitive 41 advantages in new markets or locate activities in countries that offer lower costs or have favorable government policies or regulations. Standardization Versus Customization Companies that compete globally face two types of potentially conflicting competitive pressure: pressure for cost reductions and pressure to be locally responsive. Pressure for cost reductions causes companies to seek out low-cost locations for value-added activities, and to standardize products and marketing tactics across countries in order to achieve scale and experience efficiencies. Pressure for local responsiveness leads to differentiation of products and marketing tactics in order to meet individual country demand patterns as well as market and competitive conditions, distribution channels, business practices and government policies. Differentiation involves smaller levels of and duplication of activities, which in turn lead to higher costs. Behavioral Aspects of Strategic Choice Strategic choice on any level requires the contribution and consideration of people inside the organization. As a result, human behavior has a profound influence on strategy. Senior Management Team The highest ranked executives of the organization, often referred to as the senior management team, are ultimately responsible for determining the firm’s strategic direction. These individuals include the Chief Executive Officer and those individuals that report directly to him/her. In most cases, this will include other chief officers, like the Chief Operating Officer, the Chief Financial Officer and the Chief Information Officer, as well as any number of other senior executives such as Senior Vice President of the firm’s various functional areas. Personal Attributes Personal attributes include demographic characteristics of the senior management team members themselves. Factors such as a team member’s age, education, gender, work experience, and firm tenure affect how he/she gathers and processes information and ultimately makes decision with other team members. The Organizational Context Senior management teams are also affected by contextual conditions when making strategic decisions. The impact of these conditions varies from one organization to the next, but some common examples are organizational resources (financial, physical and human resources), the industry in which the firm operates, and the firm’s performance record. Decision-Making Process When making strategic decisions, senior management teams, like any teams, must go through a process. As explained in Chapter 1, the strategic decision making process involves several steps which require the senior management team to work together to identify and clarify strategic issues and then generate and choose among alternative solutions. Senior Management Team and Organizational Culture Senior management teams are interesting because, unlike other teams in the organization, they set strategy. In so doing, 42 the team can have a long-term impact on organizational outcomes like financial performance, employee satisfaction, and societal well-being. Organizational Culture Every organization possesses a unique culture, consisting of “shared values, beliefs, attitudes, customs, norms, personalities and heroes that describe a firm.” Culture is learned, shared, and passed down from generation to generation with the firm. Culture shapes the behavior of both individuals that make up the firm and the firm itself. Personal Ethics and Social Responsibility Organizations have a responsibility to serve the interests of customers, employees and shareholders, but the responsibility does not stop here. The behavior of organizations impacts the communities in which they operate and the broader framework of society. The organizational culture is influenced by the personal ethics of the people inside it. Personal ethics are the moral principles that define the behavior that a person believes is acceptable or “right.” One person’s ethics often differ from another person’s ethics, as people tend to consider situations differently. When assessing situations, individuals often adopt an ethical framework of reference. Business ethics are the moral principles that define the behavior that the organization as a whole view as acceptable. Business ethics drive an organization’s sense of Corporate Social Responsibility, which is the obligation that it feels toward its stakeholders. Economic responsibilities refer to an organization’s obligation to be profitable and stay in business. Legal responsibilities refer to an organization’s obligation to obey the law and other external regulators. Conclusion Strategies specify the actions organizations want to take in order to reach predetermined objectives. Objectives should be stated in terms that are actionable and measurable, and must be set so that the achievement of a sequence of short-term objectives will move the firm toward achievement of long-term objectives. For multiple business firms, strategies are established at the organizational as well as the business unit level. At the organizational level, portfolio models provide guidance for strategy creation. At the business unit level, techniques such as the SWOT Matrix and scenario planning help managers create strategies that are appropriate given the organization’s situation analysis. SUGGESTED ANSWERS TO DISCUSSION QUESTIONS: 1. You have just been appointed Vice President of Baseball Operations for the most longsuffering franchise in MLB – the Chicago Cubs, a team that has not won a world championship since 1908. Using the SMART Format discussed in the chapter, develop a set of both long-term and short-term objectives for the franchise. 43 Objectives stated in SMART format are: Specific Measurable Aggressive Realistic Time-bound Examples of Short Term Objectives Hire two free agent pitchers before the start of next season. Select a left-handed outfielder in the upcoming draft. Increase fan attendance by 10% in the upcoming season. Hire a new manager before spring training. Long Term Objectives Increase number of wins by 10% per year for each of the next 3 years. Make it to the National League Championship by year 3. Win the World Series by year 5. 2. Compare and contrast the BCG and GE-McKinsey portfolio models in terms of (a) how they are constructed and (b) their implications for strategic choice. Boston Consulting Group (BCG) Matrix Businesses are measured on market growth rate and relative market share and then placed onto a two-by-two matrix. o Market growth rate evaluates external factors and general attractiveness of industry. o Relative market share is considered internal, indicating general strength relative to competitors. Circles denote businesses, with the size of the circle corresponding to the size of the business. Businesses fall into four categories as follows: o Stars – high growth, high share o Cash cows – low growth, high share o Question marks – high growth, low share o Dogs – low growth, low share The GE-McKinsey Business Screen This method uses a three by three matrix for a more comprehensive internal and external analysis of the business. o One axis measures Industry Attractiveness varying from low to medium and high. o The business strength is measured on the other axis ranging from weak to average and strong. Various criteria are used to evaluate the business on each axis. For example, when evaluating a pharmaceutical firm, regulatory compliance would be an important criterion to consider when measuring the overall strength of that business. 44 BCG vs. GE-McKinsey Both BCG and GE-McKinsey highlight cash flow and investment needs and are used primarily to decide how to allocate resources effectively for the organization as a whole. GE-McKinsey is more detailed and looks at the business on a broader scale. BCG is very easy to use. Coinciding with this, however, is the fact that it can be too simple and fail to provide accurate or sound results. Conversely, GE-McKinsey, taking more variables into consideration, is less likely to be influenced by a random variable or ambiguous result. BCG assumes firms can increase efficiency as they get more experience. However, with the development of computer aided design software and other technological platforms, it is not always necessary to have that experience to be successful. 3. Assume you are the president of a company with three major product divisions. Division A is in a low growth market, and has a low market share position. Divisions B and C are both market share leaders in their respective markets. Division C is in a high growth market and Division B is in a market that is growing at a rate of 2% per year. Sales and income figures for the three Divisions are shown below. Use the Boston Consulting Group Matrix to diagram your portfolio of product divisions and discuss the implications of your diagram (identify any assumptions you find necessary). Label your axes. Product Division A B C Sales (in millions $) 250 200 50 Operating Profits (in millions $) 25 35 10 To develop a BCG Matrix using this data we need to calculate the percent of sales and profits generated by each division, and use the data on market share and market growth rates given above. The following table summarizes that data. Product Division Sales (in millions $) % of Sales Operating Profits (in millions $) % of Operating Profits Relative Market Share Market Growth Rate A B C 250 200 50 50% 40% 10% 25 35 10 36% 50% 14% Low High High Low Low High Given this information, we have the following diagram: High star A. C 45 Market Growth Rate C. Low B Cash cow High E. A dog Low Relative Market Share If we follow strictly the prescriptions of the BCG Matrix, we would want to invest money and other resources in the star (Division C) using money generated by the cash cow (Division B). Division A, the largest, is a dog and would need to be evaluated for its long-term strength and viability. 46 4. Kodak is a company that exemplifies how fundamental change in technology can severely affect corporate performance. Using the business periodical literature, perform a SWOT analysis for Kodak’s photography business, and use your SWOT matrix to generate four strategies that Kodak might pursue to enhance the firm’s ability to create value for its customer’s, employee’s and shareholders. Kodak Photography Business Strengths Brand recognition Leader in field Diversity of product line (Professional, “Advantix”, Digital, Disposable) Partnerships o Lexmark – to offer better quality, more affordable digital picture printing (EDGE: Work-Group Computing Report, October 18, 1999, www.findarticles.com) o AT&T – to transfer digital images across networks (Cambridge Telecom Report, April 3, 2000, www.findarticles.com) Weaknesses Pressure to increase return on equity. (L.Ambio, “Kodak faces some difficult competition.” Fallingshort.com, October 18, 1999) Needs “financial flexibility to take advantage of possible acquisition opportunities.” (Press Release, March 2, 2001, www.kodak.com) Opportunities “Infoimaging” – the fusion of information technology and image science (Dan Carp, Chairman and CEO, Eastman Kodak Company, “Message from the CEO,” www.kodak.com) Research reveals that consumers want to do more with pictures on the Internet than ever before. This number will increase from 1.7 billion uploads in 2000 to over 6 billion in 2003. (“Kodak Launches New Online Photo Web Site at Kodak.com.” Business Wire, September 26, 2000, www.findarticles.com) Threats Fuji o Major competitor of Kodak in traditional film business o Concerned more on market share than return on equity Despite strong brand name, high end products will suffer in an economic slump. Consumers will choose low cost alternatives or, perhaps, not buy at all. Continued growth of digital technology will not only negatively affect sales of film, but it will also impact camera sales. (L.Ambio, “Kodak faces some difficult competition.” Fallingshort.com, October 18, 1999) 47 SWOT MATRIX Strengths Brand Leader Diversity Partnerships Opportunities “Infoimaging” Consumers on Internet Weaknesses Pressure from US investors to increase return on equity vs. Fuji’s Needs financial flexibility Threats Fuji Economic downturn affects sale of high end products Growth of digital technology vs. traditional cameras and film Strategies 1. Continue to focus on building financial flexibility. Kodak must be able to act upon or react to consumer preferences and trends. The financial strength and flexibility will be needed to partner with or acquire aligned businesses. 2. Continue to develop “Infoimaging” and the value it provides to consumers. 3. Exploit the consumer trend toward Internet imaging activities by developing services and capabilities to become the single source for digital imaging needs. 4. Find new segments for traditional camera / film sales and developing services. For example, market disposable cameras to elementary schools for beginner level photography instruction. These future consumers would become acquainted with photography on low cost, disposable equipment that is very simple to operate. As they grow, they would then be exposed to more complex cameras and ultimately become digital camera and services customers. This would expand the traditional camera/film and developing markets while growing the future digital market by developing a strong, familiar relationship with these future customers early in their lives. 5. The genesis of Nike was collaboration between Bill Bowerman, who knew how to create high-performance running shoes, and Phil Knight, who understood how offshore production could yield a major cost advantage. Discuss Nike’s current global strategy and the extent to which Nike is/should be globalizing/standardizing or localizing/customizing its strategies. Effective December 8, 2000, Nike announced that Eunan McLauglin would assume the Vice Presidency of Global Sales. Utilizing a global sales force, he is being tasked with developing and implementing a global strategy that “positions, promotes and strengthens the Nike brand worldwide.” (Source: Nikebiz.com accessed 7/2/01) 48 This declaration indicates Nike’s desire to be recognized worldwide. In order to accomplish this goal, Nike must develop a strategy that combines aspects of globalization and localizing. I do not believe their goals can be accomplished by selecting any one extreme. Financially, they need to take advantage of their size and mass to standardize certain aspects of their value chain. For example, research and development and purchasing activities should be centralized to obtain the maximum return on investment. However, sales and marketing initiatives should be focused on the local or regional level. In order to be recognized in every region, Nike needs to offer products that appeal to each segment and then proceed to market them in a way that fits in with their respective cultures. I do not believe the differences in the products themselves would be so significant that the global R&D and purchasing benefits could not be realized. Plants may need to have lines that can run more than one product. However, with planning and engineering support, these lines can be set up to easily change from one product to another and scheduled in such a way that they would maximize the line run time per product. 6. What is the relationship between the behavioral aspects of strategic choice and value creation for employees, customers, and shareholders? Choosing and implementing a strategy to create value for employees, customers, and shareholders is somewhat dependent upon certain behavioral attributes. The most profound of these are the personal attributes and attitudes of the senior management team and the corporate culture in which they work. The senior management team is a unique set of individuals who, together, create a dynamic just as unique as they are individually. As a group they comprise a set of values that helps to shape their decisions. For example, a group with an older average age may not be as willing to take as many risks as a younger group. A group made up of individuals with similar personalities will make decisions quickly, but may not stray too far from the norm of their group. They would be efficient but not necessarily effective, especially if the matter at hand called for some creative risk taking. Likewise, a non-homogeneous group may make good decisions as a result of careful and thorough debate; however, it may take them too long to reach that consensus. They would be effective but not efficient. Their combined attitudes about life, work, values and social responsibility will mold the future direction of the company. If they are efficient and effective, they will certainly create value. In addition, the culture of the organization impacts the outcome of their decisions. A culture encouraging risk taking may yield negative results if the external environment is signaling a more conservative approach. Likewise, if it becomes necessary to grow the organization and create a shift in corporate culture, a group firmly entrenched in the existing culture would have a very difficult time in effectively managing that change. The senior management team and the corporate culture need to be in sync with the goals and strategies of the organization. If they are not, it will be extremely difficult for the actions of 49 the team to be successful in positioning the firm to create value for its employees, customers and shareholders. 50