Tutorial questions for Long-run cost functions, and perfectly

Tutorial questions for long-run cost functions, and perfectly competitive markets

1.

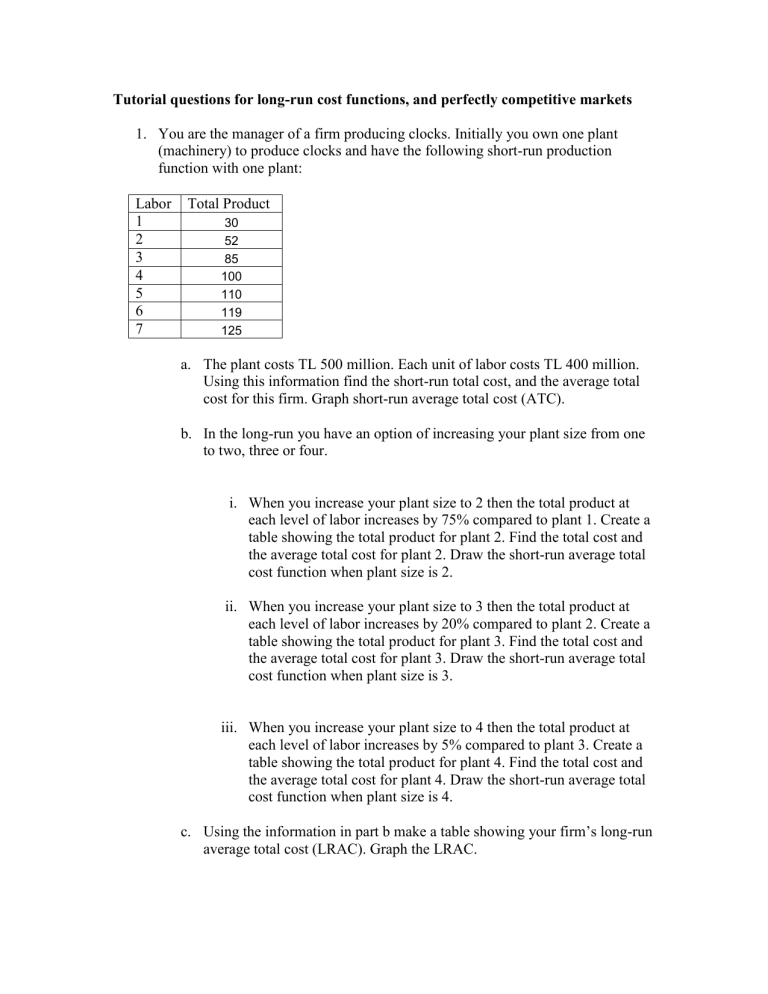

You are the manager of a firm producing clocks. Initially you own one plant

(machinery) to produce clocks and have the following short-run production function with one plant:

6

7

Labor Total Product

1 30

2

3

52

85

4

5

100

110

119

125 a.

The plant costs TL 500 million. Each unit of labor costs TL 400 million.

Using this information find the short-run total cost, and the average total cost for this firm. Graph short-run average total cost (ATC). b.

In the long-run you have an option of increasing your plant size from one to two, three or four. i.

When you increase your plant size to 2 then the total product at each level of labor increases by 75% compared to plant 1. Create a table showing the total product for plant 2. Find the total cost and the average total cost for plant 2. Draw the short-run average total cost function when plant size is 2. ii.

When you increase your plant size to 3 then the total product at each level of labor increases by 20% compared to plant 2. Create a table showing the total product for plant 3. Find the total cost and the average total cost for plant 3. Draw the short-run average total cost function when plant size is 3. iii.

When you increase your plant size to 4 then the total product at each level of labor increases by 5% compared to plant 3. Create a table showing the total product for plant 4. Find the total cost and the average total cost for plant 4. Draw the short-run average total cost function when plant size is 4. c.

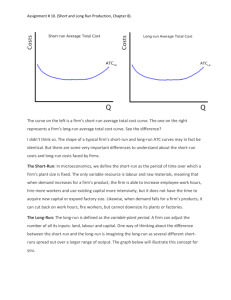

Using the information in part b make a table showing your firm’s long-run average total cost (LRAC). Graph the LRAC.

46

51

31

36

41 d.

Explain the relationship between the short-run and the long-run average cost function. e.

Explain the concepts of increasing returns to scale, decreasing returns to scale and constant returns to scale.

2.

Apples are sold in a perfectly competitive market structure. The demand and supply for the market of apples is given as follows:

Price (millions of TL)

16

Demand (thousands per week)

168,000

Supply (thousands per week)

93,000

21

26

153,000

138,000

103,000

113,000

123,000

108,000

93,000

78,000

63,000

123,000

133,000

143,000

153,000

163,000 a.

Find the free market equilibrium in the market of apples? What is the equilibrium price and quantity? b.

There are 1000 identical firms in this market. Given this information: i.

What is the demand curve an individual producer in the apple market faces? ii.

What is the elasticity of this demand curve that the individual producer faces? Explain why it is so. c.

Assume that the total cost function of each identical firm is given as follows:

Total product (thousands)

0

Total cost

93

0

1488

103 1698

113 1958

123

133

143

153

163

2268

2628

3038

3498

4008 i.

Using this information find the supply curve of the individual firm

(assume that at the points given above the P>AVC). ii.

Explain why this is the supply function of the individual firm. d.

Using the marginal revenue and marginal cost information for the firm, find the profit maximizing output and price for the firm. Explain why this is the profit maximizing output and price. i.

Why isn’t the profit maximizing output higher than what you found? ii.

Why isn’t the profit maximizing output lower than what you found? e.

At this equilibrium price and quantity is the individual firm making profits or losses? Show the profit of the firm graphically as well as in a table format. f.

Given your answer in part (e), will there be entry into this market or exit from the market in the long-run? Explain. g.

Explain the long-run adjustment in the market according to your answer in part (f). Show the effects graphically on the individual firm as well as on the market demand and supply.

5

6

3

4

1

2

3.

Simitci Ahmet, who owns a simit stand in Kizilay, is price taker. His cost function is as follows:

Total cost (thousands of TL) Output (simits per day)

0

28

76

96

124

160

200

250 a.

What is Ahmet’s profit maximizing output and how much profit does he make if the market price for simit is : i.

TL 20 thousand per simit. ii.

TL 28 thousand per simit. iii.

TL 40 thousand per simit. b.

What is Ahmet’s breakeven point? What is his profit at this point? c.

At what prices will firms with the same cost function as Ahmet enter the simit market? Explain. d.

If the fixed cost of Ahmet is TL 28 thousand (as can be seen when he produces zero simits), find the shutdown point for Ahmet. What is his profit at this point?