RNR Stock Report.doc

advertisement

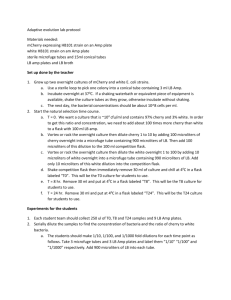

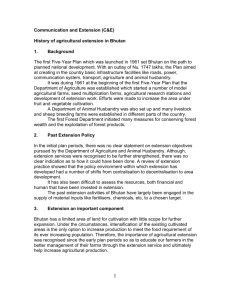

Renaissance Re Holdings Ltd. (NYSE: RNR - $44.31 – Rated 2) ($ in millions; except per share data) Market data (8/13/03): Recent price Dividend yield 52 week high 52 week low Shares outstanding Equity market cap Insider ownership Institutional ownership (1) (2) $44.31 1.34% $48.69 $30.51 69.8 $3,094.6 10.8% 75.7% Company data: Net premium written Combined ratio(1) Net income TRPA EPS Street EPS Operating ROE Book value per share Price to book A.M. Best Rating 2002A $923.7 57.1% 365.2 $5.20 2003E $1,167.7 58.5% 462.5(2) $6.50(2) $6.43 29.0% 26.3% $28.53 1.6x A+ (second highest) 2004E $1,277.6 63.6% 462.9 $6.44 $6.08 20.7% $34.07 1.3x 2005E $1,402.0 63.7% 527.3 $7.98 NA 20.9 $39.46 1.1x Includes JV fee income that is netted against the reported combined ratio of $49 million, $61 million, $56 million, and $56 million in 2002, 2003, 2004 and 2005, respectively. Excludes foreign exchange gains/(losses) ($11.6 million) and realized investment gains/(losses) ($80.2 million). 1. Investment Thesis I believe RenaissanceRe Holdings (RNR) is the best managed reinsurance company in Bermuda. The company has compounded book value at a 26% CAGR since going public in 1995, has never posted an annual loss, and has never posted an operating ROE below 18%. During its July 23rd conference call, RNR’s valuation decreased by 20% due to management’s comments that property catastrophe premium rates were flat to down 10% during the July renewal season (stock price declined 10% while reported earnings grew book value 10%). As a result of the reduced growth expectations, the stock is no longer priced for perfection and creates what I believe is an attractive entry point. RNR’s price to book multiple could contract another 25% if premium rates in the industry decline more than expected (1.2x book value is where RNR’s valuation bottomed during the late 90’s soft market). However, I believe the company will be able to generate a ROE of 20%+. The significant book value growth the next several years will cushion the downside risk caused by potential multiple contraction. At $44, RNR trades at 1.7x book value. I believe the downside is limited to $40 (1.2x 2004E BVPS of $33) versus the upside of $60 (2.2x 2004E BVPS of $28). Given this risk reward trade off I am initiating coverage on RNR with a 2 rating and recommend we purchase below $46. My twelve month price target is $54 (1.6x 2004E book value of $34 for a twelve month gain of 25%). See Section 7, page 11, for a more thorough discussion on how I expect RNR to trade under different premium rate scenarios. 2. Summary & Recommendation: Buy below $46 RNR is a leading provider of excess loss catastrophe reinsurance (over 10% market share) and is expected to generate approximately $1.2 billion in net written premiums in 2003. Generally, the low frequency high severity nature of excess loss catastrophe reinsurance creates highly volatile results. Depending on the weather (hurricanes & earthquakes) or any manmade disasters, earnings can swing wildly from +20% ROE to -20% ROE. While this volatility is reflective of the industry, RNR has been able to differentiate itself with superior operating performance. Since going public in 1995, RNR 1 of 16 has grown book value per share at a 26% CAGR and has never posted an annual loss or negative annual ROE. During the last ten years, RNR’s average ROE of 22%, is more than twice the industry average of approximately 10%. As a result of this growth in earnings and book value per share, RNR has generated compound annual returns for shareholders since going public in 1995 of 27%. Though RNR currently trades at a 20%-30% premium to the industry group (1.7x book value vs. 1.3x book value) I believe that the following factors make RNR an attractive investment opportunity. Growing faster than the competition – I project RNR will generate an ROE of 21% in 2004. This ROE is 50% faster than the average for the industry. I believe RNR is capable of maintaining book value growth at 20%+ rates because, (1) I believe their internal model (REMS) gives them a competitive advantage, (2) RNR is more efficient with their capital structure, and (3) RNR has developed third party arrangements which generate a valuable source of high margin fee income. Proprietary model creates competitive advantage - RNR uses a proprietary model (“REMS”) to aggregate the risk associated with its catastrophe policies. The model allows RNR underwriters to more effectively allocate capital because they can determine how each new piece of business impacts the risk profile of the entire company. This portfolio risk approach allows RNR (1) the opportunity to write more business per dollar of capital and (2) provides RNR a better understanding of the correlations associated with different policies. This is different than many other companies that use less complex approaches when evaluating risk and is the main reason why RNR has been able to avoid large losses suffered by many in the industry. See page 7 for more detail on how RNR has performed during high and low industry loss periods. Low risk fee income is recurring – In 2002, RNR generated $54 million in fee income which improved net income by 15% and added 4% to RNR’s return on equity. These fees are derived through RNR’s joint ventures and consulting arrangements and require no incremental at risk capital. I estimate these fees will peak at $66 million in 2003 (a large component of the fees are incentive based and 2003 was an unusually good underwriting year) and normalize to $61 million in 2004 – 2008. While I am projecting these fees remain flat in the outlying years, RNR has a senior executive dedicated to developing additional partnerships that could potentially add to current fee income. Opportunity for positive catalysts – An industry loss event would create a positive catalyst for RNR. I believe a loss event would drive premium growth. Accelerating premium growth rates generally improve valuation multiples due to higher expected growth in EPS and book value. In addition, I believe there is the potential that RNR forms additional joint ventures which will allow them to grow their high return fee income. I have estimated that fees from joint ventures remain relative flat and would view growth in existing joint ventures or through additional joint ventures as a positive. Sell side sentiment is currently negative – As a result of RNR’s statements about lower than expected property catastrophe premium growth, many on the sell side have downgraded the stock to neutral. The street is currently focused on growth names (EverestRe-RE) that write a majority of casualty policies that are still experiencing significant premium rate growth. I believe the street has over reacted to the conservative statements made about premium growth made by RNR management and eventually will look favorably again on the company as RNR continues to deliver solid book value growth. Strong balance sheet – RNR has one of the strongest balance sheets in Bermuda. Because RNR writes short tailed business reserve estimates are more accurate. There have been no major reserve developments in RNR’s ten year history. In addition, RNR has zero intangible assets and uses a moderate amount of debt to adequately leverage returns to shareholders. At 1.7x book value, RNR trades at a 30% premium to the industry. However, RNR’s premium to the group is reduced to 20% when comparing tangible book values. I am initiating coverage with a one year price target of $54 (1.6x 2004E BVPS of $34). I believe a reasonable three year target is $75 (1.6x 2006E BVPS of $47). With growth expectations recently revised down I believe we have an opportunity to own one of the best run insurance companies in Bermuda at a reasonable price. The recent reduction in RNR’s price to book multiple limits the downside risk. I am confident that while premium rate growth has slowed, RNR will write an adequate level of business to allow it to generate returns on equity of 20%+. I recommend we buy below $46 and aggressively if the stock falls into the low $40s. 2 of 16 3. Investment Positives: Quality management with heavy insider ownership – I believe the senior management at RNR is the best in the industry. Jim Stanard (CEO), Bill Riker (President & COO) and David Eklund (President & CUO) have been at RNR since the company was founded in 1993. All are heavily compensated with restricted stock that vests over a four year period so they are well aligned with shareholders. Senior management collectively owns approximately 9% (see ownership chart on page 12 for details). Jim Stanard, founder of RNR, owns 4% outright and is the 5th largest shareholder. Proprietary underwriting model – Stanard and his team have built a proprietary model, REMS, that is used to access the risk exposure inherent in RNR’s book of business. Because the model recognizes that not all catastrophe premiums are equally correlated it develops an efficient frontier based off risk return requirements that are used by management as a guide when testing if policy pricing is adequate. The model is consistently being updated and is used as a tool in the underwriting decision making process. Skeptics claim that RNR avoids losses because it is lucky and that eventually the model will fail and RNR will incur large losses. While this scenario is a possibility, I think a RNR blow up independent of an entire industry wide blow up is highly unlikely. After meeting with most of the management teams in Bermuda and learning how each company assesses its risk profile I am convinced that RNR thinks about risk more effectively and accurately than any other company. I have seen a demonstration of the REMS model and have assessed that it is more complete than the third party models used by the rest of the underwriters in Bermuda. See discussion on page 6 and 7, “Why RNR generates a higher ROE than its competitors”, for a direct comparison of RNR’s underwriting performance. Current valuation limits downside – Historically RNR has traded at a valuation between 2.5x and 1.2x book value. RNR currently trades at 1.7x book value. Over the next twelve months, that lack of premium growth could cause RNR’s multiple to contract to 1.2x book value. In such a downside scenario, I believe book value growth of 20% will offset the reduced multiple, limiting the stock price decline to $39 (1.2x 2004E BVPS of $33) or approximately 10%. High returns on equity – RNR has averaged a 22% return on equity since its first full year of operation in 1994 through fiscal 2002. ROE during this same period was 10% for the remaining companies in the Bermuda Reinsurance Industry. RNR has never posted an annual loss and its lowest ROE (13%) posted was in 1998 (RNR posted its worst loss year ever due to a one time write down of $40 million related to an acquisition, excluding this write down ROE was 19%). History of prudent capital allocation – Though RNR has needed to shrink the business during soft market cycles, they have maintained their underwriting discipline. Adherence to the disciplined model has enabled RNR to avoid losses suffered by the industry in high event years (1999 and 2001); thus, allowing them to emerge comparatively stronger and better able to write business and grow when rates improve. See Exhibit #3 History of Efficient Capital Allocation, page 8. Low risk fee income is recurring – Because RNR is regarded as the best underwriter of catastrophe reinsurance, they have been able to establish joint ventures that allow them the opportunity to generate fee income. The third party JV investors (State Farm & MaxRe) pay RNR a fee to underwrite insurance policies with their capital. These joint ventures contributed $54 million in fee income in 2002 (15% of net income) up substantially from the $17 million in fees generated in 2001 and are a great source of low risk income that does not require capital. Through the first six months of 2003, fees generated through these joint ventures were $30 million. A large component of the total fee is based on profit incentives which can vary wildly based on underwriting performance. While it is difficult to predict with accuracy how much these fees will grow (in my model I have estimated they peak in 2003 at $66 million and normalize to $61 million in 2004) I do believe they are sustainable. RNR management talks of these joint venture relationships like they are long term in nature and MaxRe (a name we own that has entered into one of the recent joint ventures with RNR) has confirmed they are happy with the relationship and would like to see it continue. Management has mentioned that there is the possibility that they will form additional joint ventures; however, at this time they are unwilling to make any firm commitments. I would view any additional joint venture relationships that create growth in fee income as a positive catalyst for the stock. 4. Investment Negatives: Black box business – Due to the complexity and lack of public disclosure about aggregate exposure and reserve adequacy, reinsurance is a difficult business to analyze with a high degree of accuracy. It is entirely possible that management at RNR is currently writing business that is poorly priced or too condensed in any one area, and over time as industry loss events occur they will perform much worse than their competitors. Assessing the quality and integrity of management is the only way to really get comfortable. I have spent over 5 hours with two different underwriters from RNR and I have seen a demonstration of their proprietary REMS model. After comparing the risk modeling systems at RNR to the systems used by many of the competitors I believe RNR is the best risk manager in Bermuda. These risk management skills have 3 of 16 lead to a near impeccable track record over the last decade. RNR has generated a 10 year average ROE of 22%, over twice the industry average of 10%. Slowed premium growth limits earnings growth– Property insurance and reinsurance rates experience cyclical swings. Growing rates are positive for valuation because companies are able to reinvest retained earnings and maintain or improve the rate of book value and EPS growth. When premium rate growth slows or absolute premiums decline, valuation multiples are reduced because book value and EPS growth is reduced. While I believe RNR is a long term growth stock, its growth is not stable. Depending upon how attractive premium rates are it may be best to loose business. I believe premium rate growth has peaked and will slow or decline over the next 12 to 18 months. Because RNR is a disciplined underwriter I would expect them to shrink their business if premium rates drop below their return thresholds. RNR’s main business line is property catastrophe reinsurance (60% of gross premiums written). During the Q2 conference call on July 23, management commented that property catastrophe premium renewal rates declined by approximately 10%. These comments signal that short term growth will be slowing for RNR. This news reduced the valuation of the company by 20% (stock price declined 10% while reported earnings grew book value 10%). I view the market reaction to this news as a positive because I do not believe RNR’s long term growth rate has changed. I believe over time they are taking market share (historical 10 year CAGR for net written premiums of 15%, in the future I project a 10% top line growth rate). Though I project growth to be consistent, it will be extremely volatile. Premiums written by RNR could decline until an industry loss event occurs. After several years of below 10% growth, a loss event would drive premium growth and RNR would grow well above 10% (40%-60% a year similar to recent growth however growth will depend on the amount of the industry wide losses). Though premium rate cycles cloud near term growth forecasts, over time I believe RNR will take market share and grow faster than the competition. See Section 7 – Trading Scenarios for more detail on how RNR might trade under different premium rate scenarios, page 11. Interest rate increases could slow book value growth – Rising interest rates hurt the value of existing investment portfolios which slow growth in book value per share. RNR has taken a conservative investment approach to limit this risk. They have limited the duration of their fixed income portfolio to 2.1 years and have completely exited their mortgage backed securities portfolio. I believe rapidly rising rates will hurt RNR’s book value growth which I feel will cause RNR to under perform the market. However, because RNR is more conservatively positioned than most companies in the industry (average duration of 3 years with exposure to mortgage backed securities), I believe RNR will outperform the industry in a rising rate environment. Reinvestment risk –As RNR grows its capital base through retained earnings, it becomes more difficult for them to put the added capital to work at equally high rates of return. Management has offset this by returning capital to shareholders through share repurchases and expanding into new segments which leverage their ability to price catastrophe exposed risks. Ideally, an industry loss event occurs to reduce industry capacity and premium growth accelerates. It is more likely that RNR continues to generate ROE’s of approximately 20% and uses excess capital to repurchase stock. While this is the best thing to do for the long term shareholders, repurchasing stock at a 50% premium to book value reduces book value per share growth. Recent insider selling – In May 2003, Stanard (CEO) sold approximately 15% of his holdings and Riker (COO) sold approximately 25%. Every year the key members of management receive restricted stock that vests over four years. Annual stock grants are a consistent portion of annual compensation so some insider sales by top executives should not be a surprise. Stanard, still owns 4% of the outstanding shares and is the 5th largest shareholder. In addition, I asked what his long term plans were and he commented that he had no plans to leave the company, was looking forward to the challenge of taking RNR to the next level and was selling the shares to diversify his wealth. 5. Company Overview: Past RenaissanceRe Holdings Ltd. was formed in 1993 to capitalize on the hard market for property catastrophe reinsurance created by; (1) large industry losses related to Hurricane Andrew 1992 and (2) the disruption in London related to the restructuring of the Lloyd’s market. Jim Stanard, Chairman and CEO since inception, founded RNR after 13 years at USF&G. Stanard, a math major with a PhD in Finance, built RNR around the concept that catastrophe risk can be modeled. As a result, RNR has a proprietary model that is the backbone of their underwriting and risk pricing process. Through 1996, RNR solely wrote catastrophe reinsurance. In 1997, they began to diversify into Individual Risk Businesses (primary lines) and in 1999 established their first Joint Venture to leverage their catastrophe underwriting expertise. 4 of 16 Present Today, RNR is the leading underwriter of excess of loss catastrophe reinsurance. RNR writes approximately 10% of the market and is respected for having the best underwriting model in the industry. Over the past decade, RNR has posted superior results (ROE’s twice the industry average) because they have (1) avoided industry losses incurred by most in the industry, (2) effectively managed their capital structure to maximize ROE without assuming excess leverage, and (3) leveraged their proprietary underwriting model to generate fee income. As a result of RNR’s successful track record, they have been able to establish joint ventures funded by third party investors (State Farm and MaxRe) to write catastrophe reinsurance which they manage for fee income. In addition, in 1997 they began initiatives to leverage their ability to price catastrophe risk by expanding into direct commercial property lines and other specialty reinsurance lines. In 2002, RNR experienced material growth in several of the business units started in 1997. Managed premium (includes premiums written for RNR’s balance sheet plus the joint ventures) at the core catastrophe reinsurance business has fallen from almost 100% of the business mix to less than 50% in 2002. During this time period overall net premiums written have grown at a 24.5% CAGR. In the last three years, RNR has Exhibit #1 - Gross Managed Premium by Segment diversified their business to limit dependency on catastrophe reinsurance market. $1,400.0 Specialty Reinsurance $1,200.0 Individual Risk $1,000.0 Structured Products Catastrophe Reinsurance $800.0 $600.0 $400.0 $200.0 $0.0 1996 1997 1998 1999 2000 2001 2002 Major Business Lines Reinsurance Catastrophe reinsurance written for own account (41% of GPW in 2002) - Writing excess of loss property catastrophe reinsurance is RNR’s bread and butter. RNR was established in 1993 for this purpose and it is still the largest business segment. Catastrophe reinsurance written for joint ventures “Structured products” (16% of GPW in 2002) - Through the JV’s outlined below, RNR is able to obtain an additional source of capital that can be managed up or down depending on the market. These JV’s represent a source of fee income ($54 million in 2002, 15% of net income) that is incremental because RNR is leveraging its existing catastrophe underwriting and management infrastructure. When I asked management about the expected longevity of these joint ventures, they responded that they viewed them as long term agreements and did not expect to dissolve them in the near future. Jay Nichols (a SVP whom I didn’t get to meet on my management visits) is the fourth or fifth highest paid executive at RNR and is focused on the development of similar arrangements to allow RNR the opportunity to leverage its underwriting expertise. Going forward, it is difficult to predict how much in fees these vehicles will generate because the fees are largely performance based. While I can’t predict the amounts, I believe fees generated through joint ventures or other structured transactions are more likely to increase than decrease. Joint Venture Top Layer Year 1999 DaVinci 2001 Focus Non US, high layer PCAT PCAT Ownership 50% State Farm 50% RNR 50% State Farm 25% RNR 5 of 16 2002 Capital $100 million $585 million Specialty reinsurance(21% of GPW in 2002) – Focuses on writing catastrophe-exposed workers’ compensation and personal accident, aviation, property per risk, surety, finite and terrorism policies. RNR focuses on a small number of transactions to ensure they can stay within their area of expertise (low claims frequency, risk that can be analyzed quantitatively and limited worst case risk exposure). In 2002, they wrote gross premiums of $247 million through 82 programs. Primary Insurance Individual risk business (20% of GPW in 2002) – In late 1996 and through 1997, RNR began a process of “focused diversification”. RNR wanted to enter businesses that would allow them to leverage their proven ability to assess and price risk associated with catastrophe exposures. They did this by establishing a few subsidiaries to write primary policies covering catastrophe related risks. i) Glencoe – Established in Bermuda, provides excess and surplus lines insurance to the U.S. commercial property market and is permitted to write in 51 U.S. jurisdictions. ii) Desoto (a wholly owned subsidiary of Glencoe) – Desoto is licensed to assume and renew homeowners insurance policies held by the Florida JUA, a state sponsored insurance company. iii) Nobel –Nobel, based in Texas, is an insurer licensed in all 50 states that focuses on three key lines: (1) homeowners insurance for dwellings valued at approximately $100,000 or less, (2) commercial casualty insurance made up of commercial auto and general liability, and (3) surety insurance provided to small and mid-sized contractors. iv) Stonington & Lantana – Stonington, Texas based, and Lantana, Bermuda based, were recently established to write business on a taxable basis in the U.S. RNR has not been transparent about how much they plan to grow through these vehicles, and what lines these vehicles will focus on, but they will likely be a focal point for future growth. In addition to the above subsidiaries that were established to write primary policies, RNR writes Quota share reinsurance. Quota share catastrophe reinsurance has a similar risk profile to primary insurance so it is classified as a primary line. Quota share reinsurance implies RNR assumes an equal amount of the premium income (20% as an example) and an equal (20%) amount of the risk. As a result of the risk profile, each individual policy is reviewed and managed at the micro level as if it were a primary policy written directly by RNR. Quota share reinsurance is the largest component of the “Individual Risk” segment and contributed most of the 2002 growth. Summary of Key Business Lines - Historical & Projected Performance 2002 GPW 2003E GPW 2004E GPW Reinsurance Catastrophe Specialty $665.7 $247.0 $706.6 $339.6 $635.9 $407.6 Primary Insurance $260.4 $372.9 $520.9 2002 % of total GPW 2003E % of total GPW 2004E % of total GPW 56.7% 49.8% 40.6% 21.1% 23.9% 26.1% 22.2% 26.3% 33.3% 2002 Combined Ratio* 2003E Combined Ratio* 2004E Combined Ratio* 61.2% 60.4% 61.6% 61.2% 60.4% 61.6% 80.7% 74.8% 81.0% General comments about top line growth Premium rates expected to be flat to down 10%, market share gains could offset this but not expected GPW growth of 20% driven by a combination of rate increases and market share gains GPW growth of 40% driven mainly by expansion of newly established primary divisions. *Excludes JV fee income which is approximately 7%, 5% and 5% of earned premiums in 2002, 2003, and 2004, respectively. Is RNR eventually going to suffer a really big loss? Management at RNR estimates that they will loose money one out of every 15 years. They do not disclose their aggregate loss exposure because they don’t want to be compared to companies that disclose similar numbers calculated with less strict criteria. For example, many companies disclose their probable maximum loss (PML) exposure to just one event with a severity that is likely to occur one out of every 50 years or one out of every 250 years. RNR, looks at 40,000 year scenario events that include the likelihood that more than one catastrophic event happens in a year. As an investor, I believe the best way to get comfortable with RNR’s risk exposure is too look at how they have performed relative to competitors. Below is 6 of 16 a chart that outlines the performance of RNR, IPC Holdings (IPCR) and PartnerRe (PRE). I have shown comparative performance for the third quarter of 2001 (includes 9/11 loss estimates) and the second quarter of 2003 (a low loss quarter where results were above average). In each scenario, RNR significantly outperforms because I believe they are better at managing the aggregate risk associated with differing policies. Notice the superior ROE generated in both big loss periods and low loss periods. Terror attacks on 9/11 create large industry losses. Exhibit #2 – Historical Underwriting Performance vs. Competitors Net premiums earned Operating income Combined ratio Net income Annualized ROE Beginning book capital Net premiums earned as % of book capital Operating Performance Q3 2001 RNR IPCR PRE $79.9 $45.1 $415.5 Q2 was a light loss quarter. Returns were good throughout industry. Operating Performance Q2 2003 RNR IPCR PRE $275.5 $72.3 $862.8 26.0 86.6% $29.9 15.0% (70.4) 273.5% ($69.0) -48.7% (344.9) 201.4% ($343.5) -82.3% 116.8 57.0% $180.2 41.7% 61.7 32.0% $65.6 18.8% 86.2 94.3% $107.3 22.2% $911.9 8.8% $602.0 7.5% $2,299.4 18.1% $2,724.9 10.1% $1,349.2 5.4% $2,380.0 36.3% Superior ROE during favorable and unfavorable loss quarters. Why does RNR generate a higher ROE than competitors? a. Proprietary model creates competitive advantage - RNR uses a proprietary model (“REMS”) to aggregate the risk associated with its catastrophe policies. The model allows RNR underwriters to more effectively allocate capital because they can determine how each new piece of business impacts the risk profile of the entire company. This portfolio risk approach allows RNR (1) the opportunity to write more business per dollar of capital and (2) provides RNR a better understanding of the correlations associated with different policies. This is different than many other companies that use less complex approaches when evaluating risk. For example, IPCR adds up the risk covered in each zone and stops writing policies when any one zone has insured risk with potential losses that exceed 80% of book capital, regardless of whether or not the insured risks are correlated. While this appears to make IPCR more conservative than RNR, I believe IPCR is more likely to incur major losses than RNR because they do not expect more than one catastrophe to happen in a given year. Two large events could wipe out IPCR because they don’t plan for it. RNR models for these types of disastrous scenarios and uses reinsurance to limit its exposure in zones with an uncomfortable amount of loss potential. b. JV’s create source of high margin fee income – In 2002, RNR generated $54 million in fee income which improved net income by 15% and added 4% to RNR’s returns on equity. In the second quarter of 2003, fee income of $17 million improved net income by 10% and added 4% to the ROE. These fees are derived through RNR’s joint ventures and consulting arrangements and require no incremental at risk capital. RNR is able to generate these high-margin, low risk fees because they are recognized as the best underwriter in Bermuda. Management at RNR has not disclosed the details of the term and fee structure of the joint ventures. However, management has commented that they view the joint ventures as long term agreements. c. Efficiently structured balance sheet = lower cost of capital - RNR uses several hybrid securities to leverage its returns on equity. Senior debt to book capitalization is 10%, in line with the 9% industry average. However, total debt (including preferred securities) is equal to 24% of book capital, almost twice the industry average of 12%. Because the hybrid preferred securities used by RNR are treated as equity by the rating agencies (no conversion features and no stated maturity) I do not feel RNR is over leveraged. These hybrid securities yield approximately 7% and are a cheap form of permanent capital. d. History of efficient capital allocation – During the soft market of the late 90’s, RNR repurchased stock rather than underwriting poorly priced premiums. Their adherence to strict underwriting standards, and their pursuit of tangible book value per share growth over market share, has protected them from losses suffered by many in the industry. For example, RNR avoided flood losses in Europe in 1999 and 9/11 losses. The discipline to avoid writing poorly priced policies allows them to protect their capital which creates the opportunity to grow rapidly to capitalize on higher premium rates following an industry loss event. The table below outlines how RNR returned capital to shareholders during the soft market of the late 1990’s and then raised capital to grow its business when the market turned in 2001. 7 of 16 Exhibit #3 – History of Efficient Capital Allocation From 1996-1999, RNR felt premiums were inadequate. They repurchased 25% of the outstanding shares at approximately 1.2x1.4x book value. $150.0 Soft CAT Market $100.0 $50.0 $0.0 1995 1996 1997 1998 1999 2000 2001 2002 ($50.0) After 9/11 when premiums rates improved, RNR issued stock at 2.2x book value and began to rapidly grow. Common stock repurchased ($100.0) Dividends ($150.0) Common stock issued ($200.0) ($250.0) e. Use of retrocession – RNR uses all of three of the models sold by third party vendors and compares them to their proprietary REMS model to assess where risk is mispriced. RNR is able to then identify opportunities where it can buy cheap retrocession coverage (reinsurance bought by a reinsurer). The successful use of retrocession allows RNR three main advantages: (1) retrocession creates a form of flexible capital that allows RNR to write more gross business than its capital could otherwise support when rates are high, (2) retrocession can be used to balance the risk profile of RNR’s book, and (3) RNR can use retrocession to capitalize on inefficiencies it identifies in the reinsurance market to generate “trading profits”. While retrocession has these advantages, it is a form of leverage. If RNR is unable to collect on payments owed to cover losses reinsured then RNR is still responsible for paying the losses. Effectively the reinsured loss recoverable asset on the balance sheet become worthless and is a direct reduction from equity. Currently, RNR has $164 million in uncollected loss recoverables equal to 10% of book equity, such a small amount relative amount with high credit quality reinsurers (rated A or better) does not concern me given. Due to the above factors RNR has generated consistent profitability and book value per share growth well above industry averages. RNR has increased BVPS at a 19% CAGR since going public in 1995. RNR has never posted a loss. Their lowest ROE generated was 13% (in 1998). 1998 was the bottom of the soft market and RNR’s worst loss year ever due to a $41 million charge associated with the 1998 acquisition of Nobel (Nobel was a niche specialty insurance company based in the US). Exhibit #4 – Historical Operating ROE(1) & BVPS $25.00 50.0% BVPS $21.39 Operating ROE $20.00 45.0% 40.0% 35.0% $15.83 $15.00 30.0% $11.91 25.0% $10.17 $10.00 $8.89 $9.43 20.0% $7.74 15.0% $6.33 $5.00 10.0% 5.0% $- 0.0% 1995 1996 1997 1998 1999 2000 2001 2002 (1) Operating ROE excludes realized gains or losses from investments. 1998 excludes a $40.1 million charge related to the 1997 acquisition of Nobel. 8 of 16 6. What happens to RNR stock value during a soft market? Property catastrophe rates have increased the last two years but I believe the rate of increase is slowing. Because the rate of increase is slowing, many fear that rates will soon begin to decline. This is not an unlikely scenario, especially when combined with the fact that since 9/11 the industry has raised over $40 billion of new capital and there have been no major loss events in the last 20 months. As a result of these current conditions, I think it is useful to outline how RNR performed during the soft market of the late 90’s. Exhibit #5 – Relative Change of CAT Premium Rates 60 2.6 50 Catastrophe premium rates have peaked for this cycle. 2.3 40 40 1.9 30 20 15 20 1.5 15 10 3 2 - - 1.1 Price Index relative change of cat XL price (%) 50 0.8 (10) (8) (8) 0.4 (13) (15) (13) (20) Relative Change of CatXL price level 2003E 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 (30) - Price Index Source: Swiss Re, Benfield Blanche, and JP Morgan Estimates From 1996 through 1999, RNR successfully operated through a declining premium rate market. During this period they operated as outlined below and with the same management team in place I would expect them to operate in a similar manner if the market begins to soften. 1. Net premiums written declined (by 30% from peak to trough over a two year period) 2. Combined ratios were maintained 3. Capital was returned to shareholders (over a period of 4 years 25% of the shares were repurchased) 4. ROE’s declined from peaks but remained healthy (ROE’s peaked at 43% in 1995 and bottomed at 19% in 1998) 5. EPS remained flat at approximately $2.00 per share 6. Book value per share growth slowed but remained solid (CAGR of 13% during the 4 year period 1996-1999) At the trough for premium rates in 1998, catastrophe rates were estimated to be approximately 70% of the levels attained in 1995 (1994 and 1995 were hard market years following large industry losses resulting from Hurricane Andrew and the Northridge Earthquake). The chart below shows the relative change in the catastrophe price level and impact on RNR’s net premiums written. Not surprisingly, there is a strong correlation. Soft market years are shaded grey. Growth in Net Premiums Written Change in CAT price level Net Premiums Written Growth in NPW 1995 -8% $290 7% 1996 -13% $252 -13% 1997 -15% $196 -22% 9 of 16 1998 -13% $195 -0% 1999 -8% $214 10% 2000 +2% $293 37% 2001 +20% $340 16% 2002 +15% $924 172% The next chart shows that combined ratios were better than average during the soft cycle. The average combined ratio during the 1996-1999 soft market was 57% (the average of the one year period and two year period before and after the soft market was 64%). Below average loss years help to perpetuate a soft market. Combined Ratios 1995 52% Combined ratio 1996 51% 1997 48% 1998 65% 1999 63% 2000 69% 2001 70% 2002 57% As a result of a shrinking business due to unattractive premium levels, RNR systematically returned capital to shareholders. They actively repurchased shares at prices that were 1.5x book value and became much more committed to buying back shares at prices that were 1.2x book value during 1999 and early 2000. Capital Returned to Shareholders Amount of buyback ($ in MM) Buyback price per share Price to book value # of shares (in MM) % of total 1995 IPO* 1996 $74 $11 1.5x 6.5 8% 1997 $54 $12 1.5x 4.5 6% 1998 $43 $14 1.5x 3.1 5% 1999 $80 $12 1.2x 6.7 10% 2000 $25 $12 1.2x 2.1 3% 2001 Secondary* *RNR raised $55 million in 1995 through its IPO and raised $233 million through a secondary offering in 2001. While RNR returned capital to shareholders during the late 90’s soft market, they still operated with excess capital and experienced a slower growth rate in BVPS because they were repurchasing shares at a premium to book value. The chart below shows premium leverage (measured by net premiums written / book capital), ROE, EPS, the resulting growth in book value per share and the year end stock price. While RNR generated positive returns, book value growth slowed to a 13% CAGR for the four year period ended 1999. In contrast, during the hard market much of the last three years, RNR has been able to grow BVPS at a 28% CAGR. Premium Leverage, Growth in BVPS & Share Price NPW/Book Capital Operating ROE Operating EPS BVPS Growth in BVPS Year end stock price 1995 49% 43% $2.22 $6.33 $9 1996 35% 30% $2.04 $7.74 22% $9 1997 26% 25% $2.06 $8.89 15% $13 1998 24% 19% $1.81 $9.43 6% $11 *Skewed in 2001 because RNR raised $233 million through a secondary offering in 2001. 10 of 16 1999 23% 20% $1.94 $10.17 8% $13 2000 35% 20% $2.29 $11.91 17% $25 2001 19%* 18% $2.34 $15.83 33% $31 2002 41% 28% $5.15 $21.25 34% $40 7. RNR Trading Scenarios Trading multiples will likely compress if RNR’s gross premiums written decline in 2004 or 2005. However, a loss event could cause premium rates to improve and valuation multiples to expand. In order to outline the favorable risk return currently available with RNR I have outlined how I think the stock will trade over the next 12 to 24 months under the following three scenarios. Worst case = extreme soft market – I would categorize an extreme soft market as a market where premium rates declined by 20%-30% in 2004. In such an extreme downside case, I believe that RNR would not grow revenues in 2004. They would generate GPW that were 20% lower than 2003 (the market share they take would offset some of the policies they do not renew because of unattractive premiums) and their combined ratio would increase by 5% from the mid 60’s to approximately 70. Under this scenario, I believe RNR’s price to book multiple would decline by 25% to 1.2x and the stock would sell for $39. Base case = mild soft market – This is the scenario that I believe is most likely. A mild soft market where premium rate growth slows to a range of 5-10% (implicitly assume industry wide rates increase by 0%-10% and RNR takes some market share). Under this scenario I believe RNR would grow 2004 GPW by 10% and would be able to maintain its combined ratios in the low to mid 60’s. Under this scenario, I project RNR would have BVPS of $34 in 2004 and would trade at 1.6x for a share price in twelve months of $54. Best case = hard market – I would define a hard market as one where premium rates increase by 20%-40%. In order for the industry to enter a hard market phase I believe a major loss event would need to occur to reduce capital. While RNR does not disclose what their maximum probable loss is, management has commented they expect to loss money 1 out of every 15 years. Assuming a $600 million loss event occurs during 2003 (25% of RNR’s book equity), premium rates grow 30% in 2004, and combined ratios improve slightly to low 60’s from mid 60’s, I estimate RNR would end 2004 with BVPS of $27. Due to the increased expectations for book value and earnings growth I believe RNR would trade at 2.2x 2004E BVPS of $27 or $60. Premium rate trends RNR Growth in GPW Combined ratio EPS ROE BVPS Price to book multiple Implied price per share Gain/(loss) from current price Extreme Soft Market 2004 2005 -20%↔-30% -10%↔-20% -20.0% -10.0% 70.2% 71.0% $4.45 $5.04 14.4% 13.1% $32.79 $35.19 1.2x 1.2x $39.35 -11.2% Mild Soft Market 2004 2005 5%↔+10% 5%↔+10% 10.0% 10.0% 63.6% 63.7% $6.44 $7.98 20.7% 20.8% $34.11 $39.54 1.6x 1.6x $42.22 -4.7% 11 of 16 $54.58 23.2% $63.27 42.8% Hard Market 2004 2005 +30%↔+40% +20%↔+40% 30.0% 30.0% 61.0% 60.0% $8.15 $10.99 34.5% 33.8% $27.39 $37.71 2.2x 1.8x $60.26 36.0% $66.60 50.3% 8. Valuation With respect to valuing RNR, I looked at comparable price to book multiples, comparable price earnings multiples and a discounted cash flow analysis. While price to book and PE ratios are the most common valuation measurements, I feel that the price to tangible book value is a useful measure in helping to identify some companies that look deceptively cheap because they have a large amount of intangible assets from past acquisitions. In addition, the premium investors are willing to pay over book value is related to the expected growth in book value as measured by ROE. RNR has a clean balance sheet with no intangible assets so it looks less expensive when compared using price to tangible book value per share. I believe it deserves a premium valuation because it’s projected 2004 ROE of is 30% ahead of the industry average. RNR 1.70x 18.8% 1.70x 6.9x Price to BVPS Estimated 2004 ROE Price to Tangible BVPS Price to 2004E EPS Bermuda(1) 1.31x 14.2% 1.41x 8.1x Premium / (discount) 29.8% 32.4% 20.6% (14.8%) (1) Includes: IPCR, MRH, PXT, MXRE, ORH, PTP, PRE, TRH, ACE, ACGL, AXS, ENH, RE and XL. Measured by price to book values, RNR trades at a 20% -30% premium to the industry comparable group. However, I feel the premium is warranted because I believe RNR will compound book value faster than average (30%-50%) over the next several years. The charts below show absolute and relative price to book values and price to forward EPS values relative to the S&P MidCap index. StockVal® RENAISSANCERE HOLDINGS LIMITED (RNR) Price 42.7 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 HI LO ME CU 2 2.5 0.9 1.6 1.5 1 07-28-1995 08-04-2003 0 PRICE / BOOK VALUE HI LO ME CU 0.9 Absolute and relative price to book values are in line with historical averages. 1.13 0.35 0.59 0.62 0.6 07-28-1995 08-04-2003 0.3 PRICE / BOOK VALUE RELATIVE TO S&P MIDCAP400 COMPOSITE ADJUSTED (SPMCA) M-Wtd HI LO ME CU 10 8 6 11.6 5.6 7.5 6.9 03-13-1998 08-04-2003 4 PRICE / YR-FORWARD EPS ESTS HI LO ME CU 0.6 0.72 0.32 0.46 0.42 Absolute and relative price to forward earnings are at a 10% discount to historical averages. 0.4 0.2 PRICE / YR-FORWARD EPS ESTS RELATIVE TO S&P MIDCAP400 COMPOSITE ADJUSTED (SPMCA) M-Wtd 03-13-1998 08-04-2003 At 1.7x book value RNR is trading at a slight premium to its historical average on an absolute and relative basis. Though current price to book multiples appear a little high, compared to how fast book value is growing I do not believe RNR is expensive. RNR’ price to 2004 estimated book value per share is 1.3x which I believe is an attractive price for a company that has proven it can generate 20%+ ROE’s annually. My twelve month price target of $54, and my three year price target of $74, is based on my belief that RNR will trade at 1.6x 2004E BVPS of $34 and 1.6x 2006E BVPS of $46. I believe RNR deserves a premium price to book valuation because it has proven to be the best underwriter, has built a highly profitable fee income business which will continue to enhance returns above industry averages and it has a very clean balance sheet with no intangible assets. 12 of 16 In addition, I performed a DCF based on my 2003-2008 financial projections. The key assumptions in the DCF were the WACC which I estimated to be 10.2% and the 2008 terminal value multiple which I estimated to be 1.6x 2008 book value. Based off these key inputs, I estimated RNR’s stock price at $67 per share. While a DCF is generally a helpful analysis, I feel that my DCF overestimates RNR’s value for two reasons: (1) the future is very difficult to predict due to the highly volatile nature of the industry so my projections will likely prove to be inaccurate (RNR’s growth will not be smooth and could be back end loaded), (2) due to the volatile nature of the business and the risk of large losses, the cost of capital is potentially higher than estimated under the traditional CAPM. A copy of my DCF analysis and summary valuation matrices which show changes in share price at different discount rates and exit multiples is included in the Appendix. 9. Management RNR is regarded as being the best in the industry at modeling excess loss catastrophe risk. Stanard (CEO), is a math major, has a PhD in Finance and is trained as an actuary. He has been modeling risk for over twenty years (started back in the early 80’s with USF&G) and has used his ability to model complex risk scenarios to help RNR become a leader in the market. On a recent phone call with Stanard, I confirmed that he is committed to RNR long term and sold shares recently to diversify his personal wealth. His long term vision for the company is to continue to build out the Individual Risk, Specialty Reinsurance and Structured Products divisions until they are as dominant globally as RNR’s primary Catastrophe Reinsurance division. Based off our conversation, I do not believe RNR is going to experience a rapid shift in strategy. However, I believe that over time RNR could evolve into a much more diverse company that generates much more than 15% of its net income from low risk fees or other third party relationships. Stanard commented they are working to grow fee based relationships but he didn’t provide specifics about how future deals might be structured. John Lummis (CFO) does a very good job of allocating capital. He uses an appropriate mix of securities to lower RNR’s cost of capital; yet, he has not limited RNR’s flexibility by burdening the company with restrictive bank debt covenants. Overall, my assessment of management is that they are extremely capable of managing the business. On Friday August 8th, I received a demonstration of RNR’s proprietary model, REMS. The key takeaways were that REMS adjusts for demand surge (spike in replacement costs that occurs due to spikes in demand), and unusual loss events (such as snow storms in California) that many of the third party models undervalue or ignore completely. In addition, the model, which is a database of RNR’s existing policies and loss exposures, reveals whether or not the current policy being priced is in a “hot zone” with existing exposure that may put too much capital at risk. Each of the approximately 12 underwriters at RNR are trained extensively in how to use the model. RNR hires and trains from within and prefers not to bring in underwriters from the outside that may have developed bad habits. Key Officers of RenaissanceRe Own 9% (includes restricted stock & options) Name Title Age/Exp. Ownership Previous Experience Jim Stanard Chairman & CEO 54/10 3,654,400 USF&G (F&G Re) Bill Riker President & COO 43/10 1,121,330 American Royal David Eklund EVP & CUO 43/10 593,399 Berkshire & Old Republic John Lummis EVP & CFO 45/6 540,112 USF&G (x lawyer) Jay Nichols SVP (focus on JVs) 42/7 474,989 Hartford Steam & Monarch Cap. Executive Compensation In 2002, executive officers received a base pay ranging from $485,000 (Stanard) to $235,000 (Nichols). Their annual compensation includes a bonus and a LT compensation component that is calculated based off a four year rolling average. Both are tied to ROE and EPS objectives set by the compensation committee. Executives have the option of accepting annual bonus payments in the form of cash or stock, with incentives in place to encourage employees to take stock. In 2002, many accepted most of their annual bonuses in stock and RNR issued approximately 100,000 shares to the named officers above. The shares vest in one year. In addition, under the long term compensation plan, RNR issued 68,000 shares that vest ratably over four years to the above officers. RNR has over 4,000,000 shares available for issue under the Long Term Equity Compensation Plan (representing approximately 6% of diluted shares outstanding). Though the shares are ultimately dilutive, the restricted stock awarded will help keep management focused on building shareholder value. The executive officers at RNR are very well paid. Including all forms of compensation, Stanard, Riker, Eklund, Lummis, and Nichols in 2002 made approximately $4.0 million, $1.8 million, $1.6 million, $1.2 million and $0.9 million, respectively. In May 2003, Stanard, Eklund and Lummis sold approximately 15%, 25% and 10% of their holdings. While the insider sales are definitely not a positive sign, each person still holds a considerable amount of stock. For Eklund and Nichols, a large portion of their remaining holdings is in unvested restricted stock or options. Stanard owns 2.6 million shares outright and is one of the largest holders. 13 of 16 Employee Agreements All of the senior executive officers, all other officers and other professional employees have entered into employee agreements. I consider this to be a wise move because it protects their proprietary model, RMS, from being poached if key employees are hired away. 10. Review of Recent Financial Performance Income statement Gross premiums written – RNR has capitalized on the recent hard market by growing its gross premiums written by 130% in 2002 over 2001. The six months growth in 2003 was 23%. Based off managements comments about pricing trends in several of their business segments, which are confirmed by others in the industry, I expect RNR to grow gross premiums written in 2003 by approximately 20%. Combined ratios – Combined ratios represent the costs incurred by an insurer to underwrite a policy. It includes losses (incurred and estimated), acquisition costs (brokerage commissions) and operating expenses. Since inception, RNR has operated at a combined ratio of 63%. This implies they make 37 cents on every dollar of premium they write, excluding investment income. Combined ratios in 2002 and the first half of 2003 were 59% and 55%, respectively. Recent combined ratios were ahead of past averages due to light periods of catastrophe event driven losses. I am projecting that combined ratios increase slightly going forward (64% in 2003 up to high 60’s over next several years). The increases are caused by a mix shift into higher frequency lower catastrophe premiums that are currently experiencing faster growth than RNR’s traditional catastrophe business. Operating EPS – In 2002, RNR generated $5.20 in operating EPS (earnings excluding gains or losses from investments) which is expected to grow to approximately $6.00 per share in 2003. For the six months ended June 30, 2003, RNR posted operating EPS of $3.39 which puts them ahead of the $6.00 pace for the year. Management recently raised guidance to a range of $6.30 to $6.65. I currently estimate RNR reports 2003 EPS of $6.50. ROE –RNR, has generated an average ROE of 27% since going public 10 years ago. Recent performance was slightly ahead of this average due to lower combined ratios related to unusually low loss years. Going forward I estimate that RNR’s ROE will be at the low end of historical ranges (approximately 20%) because I am not confident premium growth will exceed 10%. As a result, I believe RNR will operate with excess capital and begin buying back stock until a loss event occurs to drive premium growth. Balance sheet (Total Assets of $4.7 billion at 6/30/03) Invested assets –RNR had invested assets of $3.9 billion. The majority is invested in high quality fixed income securities with a low duration. The table below details the investment portfolio: Asset Amount Yield Comments Cash $60 1% Fixed maturity 2,350 3% Gov’t bonds (55%), MBS & ABS (28%) & corp. bonds (17%) – 2.25 year duration, all items rated AA or higher by S&P ST investments 1,150 2% Reflects desire to reduce exposure to interest rates High yield & other 170 NA Non-investment grade corporate securities, hedge funds & private equity Platinum 130 1% Own 9.2% of Platinum and warrants to buy another 6% at $27. Loss expenses recoverable – RNR has $165 million in reinsurance receivables. These receivables are owed to RNR by third party reinsurers. Some companies that use retrocession frequently (ACE) have reinsurance recoverables that are 180% of book equity. The average for the Bermuda reinsurance industry is 30%. The receivables represent 10% of RNR’s book equity, which is not an unusually high amount. At December 31, 2002, RNR had booked a $8 million valuation loss allowance against these receivables. Premiums receivable – RNR’s is able to collect payments from customers in a timely manner. The premiums receivable balance of $450 million is up on an aggregate basis but in line with past trends when compared to net premiums written. 14 of 16 Leverage – RNR effectively utilizes a mixture of securities on their balance sheet to lower their cost of capital. They do this by using a mixture of straight debt and hybrid securities as outlined below. Total debt (senior debt + hybrid MRPS) is 14% of book capital (industry average is 9%). This debt leverage is not conservative but reasonable given their excellent track record and ability to manage risk. Security Bank credit facility (undrawn) Senior debt Amount $310 275 % NA 11% 85 3% 8.5% coupon (treated as equity by rating agencies) Preferred stock Common equity Total book equity 250 1,825 2,075 10% 75% 85% 7.3% coupon (treated as equity by rating agencies) Total book capital $2,435 100% Mandatory redeemable PS Comments ($250 million in LOCs outstanding) 7.0% coupon Reserve adequacy – At June 30, 2003, RNR had gross reserve loss liabilities totaling $930 million. Loss liabilities net of the $165 million in reinsurance receivables equal $765 million, or 37% of book equity. This ratio is in line for companies that write similar types of policies. Given that the nature of the business RNR is insuring is short tailed, legacy risk is not material. The last three years their development for prior years has been a net reduction in required reserves of $8 million. Many other firms (ACE) that write casualty lines have been incurring negative reserve developments due to unexpected losses associate with asbestos related claims. Cash flow The main components of operating cash flow are net income (driven by earned premiums) and the amount of claims paid in the current year. Because RNR does not pay 100% of the claim reserves charged to the income statement in the current year, cash flow often exceeds net income when the business is growing. If the business ever begins to shrink or growth slows, the cash paid out for past claims relative to current reserves added in the year will potentially be a drag to operating cash flow and operating cash flow per share could trail earnings per share. As a result of RNR’s rapid growth and their low paid to incurred claims ratio (approximately 30% in 2002), 2002 operating cash flow was 200% of net income. The paid to incurred ratio is currently low because RNR is growing rapidly. Over the next couple of years, if RNR growth slows and the book of business becomes mature I expect the paid to incurred ratio for RNR to approach 60%-80%. As the paid to incurred ratio increases, operating cash flow will move closer to net income. In my model, based off the assumptions I have made for premium growth and the timing of estimated losses, operating cash flow is approximately 115% of net income in 2005-2008. 11. Financial Projections Catastrophe reinsurance is a highly volatile business. Predicting the timing of loss events and their magnitude is impossible. While these factors make this a difficult business to accurately model, a model does provide a useful framework for analyzing the business under various scenarios. For RNR, I assumed that premium growth would be 2/3 of their historical 10 year CAGR of 15%. Premiums increase 2-3% due to GDP (loss cost) growth plus an additional 7-8% percentage points because RNR is taking market share (growth is being driven by the direct business that is relatively new and ramping up). 10% premium growth is slower than the growth in RNR’s book equity. As a result, I assumed RNR buys back stock with the excess capital. While a more aggressive case could be modeled with faster premium growth, I felt the assumptions outlined below provided a more realistic outlook on the business. Major Model Assumptions Underwriting income (long term growth of approximately 7-10%) Gross premium written growth of 21% in 2003 leveling off at 10% in 2004-2008 Net premium written growth of 26% in 2003, leveling off to 10% in 2004 and beyond (typically RNR cedes approximately 20% of its gross premiums written) Combined ratios (excluding fees from JV’s) of 64% in 2003, increasing slightly to 68% in 2004 (large increase from 2003 to 2004 is a result of light loss activity in 2003) Note: RNR’s 10 year average combined ratio is 63%. Investment income (long term growth of 3-5%) Yields of 3.5% on invested assets Invested assets to book equity of 1.9x in 2003 falling to 1.6x by 2008 (assume claims are paid out quicker than current rates as business matures, assume RNR repurchases stock) 15 of 16 Stock buyback assumptions RNR likes to maintain a low dividend ratio of approximately 10% so that they can retain capital in good years to write premiums. As a result, I assume capital is returned to shareholders through share repurchases and maintain a dividend payout ratio of approximately 8%-10%. RNR targets net premium written at 40% of book capital. With book capital growing faster than 10% due to increased retained earnings, I assume RNR buys back stock. Shares are repurchased at Stock prices equal to 1.6x tangible book value beginning in 2005 through 2008. During the four year period beginning in 2005, RNR buys back $1.1 billion in stock at an average price of $66 per share (represents 16.4 million shares or 24% of current shares) Other Fees from JV’s peak at $60 million in 2003 and normalize to $56 million in 2004 and beyond Top Layer income & other CAT consulting fees generated are estimated to be $28 million annually Appendix Earnings model Summary assumptions and output DCF 2004 EPS and ROE matrices IS/BS/CF (2003-2008) Institutional shareholders 16 of 16