The Structural Budget Institutions Pioneered by Chile

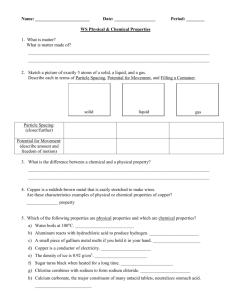

advertisement