Preface - Caribbean Tourism Organization

advertisement

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

CARIBBEAN TOURISM ORGANIZATION

INTRA-REGIONAL

TRAVEL MARKET STUDY

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Table of Contents

Preface ................................................................................................................................. i

Introduction ........................................................................................................................ i

Executive Summary ......................................................................................................... iii

A.

B.

C.

D.

E.

F.

G.

H.

Regional overview............................................................................................................. iii

Travel patterns ..................................................................................................................... v

Intra-regional travel ............................................................................................................. v

Competitive issues affecting the Caribbean ..................................................................... vii

Travel trade structure and distribution ............................................................................ viii

Ideas for proactive marketing .............................................................................................ix

The way forward ................................................................................................................xi

Conclusion ........................................................................................................................ xii

Map of the Caribbean .................................................................................................... xiii

1.

Regional Overview ................................................................................................ 1

1.1

1.2

1.2.1

1.2.2

1.3

1.4

1.4.1

1.4.2

1.4.3

Population of the Caribbean ................................................................................................ 1

Demographic influences ...................................................................................................... 2

Retired persons .................................................................................................................... 2

Family size remains stable or declining .............................................................................. 2

Regional groupings.............................................................................................................. 2

Macroeconomic influences.................................................................................................. 4

Currencies and exchange rates ............................................................................................ 8

Visa requirements ................................................................................................................ 9

Departure taxes and levies ................................................................................................. 12

2.

Travel Patterns .................................................................................................... 14

2.1

2.2

2.3

Growth in intra-regional travel .......................................................................................... 16

Seasonal variations ............................................................................................................ 18

Originating markets ........................................................................................................... 19

3.

Intra-Regional Travel ......................................................................................... 22

3.1

3.2

3.3

3.3.1

3.3.2

3.3.3

3.3.4

3.3.5

3.3.6

3.4

3.5

Use of annual vacation entitlement and public holidays ................................................... 22

Expenditure by intra-regional travellers ............................................................................ 24

Leisure travel ..................................................................................................................... 24

Shopping............................................................................................................................ 25

Sports ................................................................................................................................. 25

Social events and cultural festivals.................................................................................... 29

Medical .............................................................................................................................. 31

Emigration and travel visas ............................................................................................... 31

Education ........................................................................................................................... 32

Business – commerce, meetings and conferences ............................................................. 35

Visiting friends and relatives ............................................................................................. 36

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

4.

Competitive Issues Affecting the Caribbean .................................................... 37

4.1

4.2

4.3

Extra-regional travel by Caribbean residents .................................................................... 37

Main purpose of extra-regional travel ............................................................................... 38

Barriers to more and frequent intra-regional travel ........................................................... 38

5.

Travel Trade Structure and Distribution ......................................................... 40

5.1

5.2

5.3

5.3.1

5.3.2

5.3.3

5.3.4

5.3.5

5.4

Trends in tour operating .................................................................................................... 40

Trends in intra-regional tours ............................................................................................ 40

Travel agency profiles – examples across the region ........................................................ 42

Barbados ............................................................................................................................ 42

Jamaica .............................................................................................................................. 42

Grenada ............................................................................................................................. 42

St. Kitts and Nevis ............................................................................................................. 43

Guyana .............................................................................................................................. 43

Transportation within the Caribbean ................................................................................. 43

6.

Ideas for Proactive Marketing ........................................................................... 47

6.1

6.2

6.3

6.4

6.5

6.6

6.7

6.8

6.9

6.10

6.11

6.12

6.13

6.14

6.15

Role of national tourism organisations .............................................................................. 47

Role of travel agent ........................................................................................................... 48

Role of CTO chapters ........................................................................................................ 49

Selective targeting ............................................................................................................. 49

Attention to product........................................................................................................... 49

Marketing distribution channels ........................................................................................ 50

Fairs and exhibitions ......................................................................................................... 51

Media relations .................................................................................................................. 52

Travel trade advertising ..................................................................................................... 52

Sales missions.................................................................................................................... 53

Special interest tours ......................................................................................................... 53

Use of technology .............................................................................................................. 53

Consumer advertising and promotion ............................................................................... 54

Sales literature ................................................................................................................... 55

In-flight advertising ........................................................................................................... 55

7.

The Way Forward ............................................................................................... 56

7.1

7.2

7.3

7.3.1

7.3.2

7.3.3

7.3.4

7.3.5

7.4

The challenge – to develop awareness .............................................................................. 56

The challenge – to collect and share data .......................................................................... 57

The opportunity ................................................................................................................. 58

CTO Caribbean Chapters .................................................................................................. 58

Awareness ......................................................................................................................... 58

Calendar of Festivals and Cultural Events ........................................................................ 59

Initiatives ........................................................................................................................... 59

Marketing Strategies.......................................................................................................... 60

Conclusion ......................................................................................................................... 61

ii

@

8.

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Glossary ............................................................................................................... 62

APPENDICES

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

Appendix G

Appendix H

Appendix I

Appendix J

Appendix K

Appendix L

Appendix M

Appendix N

Appendix O

-

CTO Members

Ministries of Tourism

Statistical Departments

National Tourism Organisations

Hotel & Tourism Associations

CTO Chapters

Airlines Operating Intra-regionally

Public Holidays

Festivals and Cultural Events

Caribbean News Media

Flight Route – Air Jamaica

Flight Route – LIAT

American Eagle

Helen Air

Air ALM

iii

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

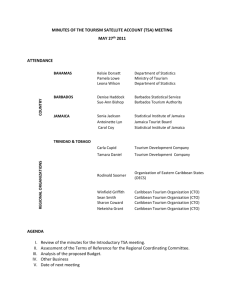

Preface

Against a background of growing international competition in tourism, the Caribbean Tourism

Organization (CTO) compiled this study with a view to identifying the size and scope of the intraregional tourism market. Caribbean governments are committed to creating a network of interest

among tourism personnel, travel agents, and other tourism suppliers within the Caribbean to sell

the Caribbean product to Caribbean nationals, as an alternative to international destinations.

CTO was mandated by member governments to develop and promote a Caribbean Market Guide

similar to those created for other markets, but adapted to suit the Caribbean situation.

The intra-regional market study was compiled by KPMG Management Consultants (KPMG), and

drew from information, statistics, travel trends and other appropriate sources of primary and

secondary data readily available in the industry. The information collected served to highlight

the importance of intra-regional travel to the overall tourism performance of Caribbean

destinations, and presented recommendations to facilitate the growth and the development of this

market.

Our most sincere thanks to our partners KPMG, and the Organisation of American States (OAS),

who contributed to this study, for their support in making this project a reality. We look forward

to assisting with the development of a better understanding and appreciation of the intra-regional

tourism market and Caribbean Tourism.

Luther G. Miller

Director of Finance & Resource Management

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Introduction

The Caribbean draws its visitors from among the world’s largest

originating markets – the United States, Europe, the Caribbean and

Canada. In 1998 the Caribbean received over 19.9 million long stay

visitors, with 1.5 million (7.7%) from the region itself. In comparison

to more distant originating markets, there is still much to learn about

intra-Caribbean travel, which many believe holds tremendous

potential for further development.

This report is a collaborative effort between the CTO, KPMG and the OAS. It was developed to

provide an overview of Caribbean travel by Caribbean residents and to assist those involved in

the industry to develop attractive products and to proactively market to this emerging sector. The

report highlights the unique nature of the intra-regional travel market and provides a practical

guide to help market the region to Caribbean residents.

In defining the intra-regional market we consider only travel between distinct jurisdictions,

excluding all cruise traffic to the countries and territories of the region. Travel by residents of a

jurisdiction within that country or politically-linked islands is not addressed in the report. For

example, although residents of St. Kitts may travel to Nevis to visit friends and relatives or to

vacation at a resort, this movement would not be captured in the statistics as an intra-regional

visit and intra-jurisdictional marketing is not specifically considered.

Unlike the single country market reports previously commissioned by CTO, the intra-regional

report considers data from 33 countries and territories, which creates unique challenges for both

data collection and marketing. Although quantitative baseline data is provided for each country

and territory, we discuss trends and marketing approaches using logical groupings and specific

examples.

One of the challenges in developing this report on intra-regional travel was the availability of

comparable statistical data for each country and territory. Where possible we have filled in the

gaps in quantitative data based on the professional judgement of the project team, and have

flagged the data accordingly.

In developing the report tremendous effort was made to solicit both factual information and

perspectives from each destination. National tourism organizations, Ministries of tourism,

statistical departments, hotel and tourism associations, CTO chapters and airlines were contacted

and their input sought. Despite many calls and follow up requests by many members of our

project team, less than half (42%) of those who were asked to provide information responded.

{See Appendices B, C, D, E, F & G.) In some instances this may reflect a lack of interest in intraregional travel, but in most instances we believe it is but a symptom of one of the region’s

systemic weaknesses – the inability to develop and implement tourism related initiatives that

transcend political boundaries.

The information presented in the report is current as of the date of publishing, however you are

encouraged to consult original reference sources whenever up to date information is required.

We have identified the original sources in the tables and graphs to assist you in accessing the

credibility of these references and locating original sources of information. Alternatively,

updated copies of key tables and exhibits from this report can be viewed on the CTO web site

www.caribtourism.com.

i

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

We have provided definitions for all grayed, bold-italicized terms in the glossary at the back of

the report. Except where noted all financial data is quoted in US dollars and “N/A” is used to

indicate that the information is not available.

* * *

Many organizations and individuals have assisted in the development of this report. We would

like to thank the government ministries, tourism authorities, statistical departments, CTO

chapters, industry representatives and all others who contributed to this effort.

ii

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Executive Summary

The 34 countries and territories of the Caribbean region vary tremendously

in terrain, size, economic prosperity and cultural origins. With a total

population of approximately 60.7 million, it is the third largest source of

visitors to the Caribbean behind the United States (263.8mn) and Germany

(81.9mn).

A.

Regional overview

Historically and geographically, the Caribbean can be broken into several distinct groupings of

the Commonwealth OECS, other Commonwealth, the Dutch Caribbean, the French West Indies,

US Territories and others. (See Table 1.) These colonial ties continue to play an important role

in determining both intra-regional and international travel patterns, however, proximity to major

markets and air-lift are also important factors.

Table 1

Regional groupings

Commonwealth OECS Countries

Anguilla

Antigua & Barbuda

Dominica

Grenada

Montserrat

St. Kitts and Nevis

St. Lucia

St. Vincent & The Grenadines

Other Commonwealth

The Bahamas

Barbados

Belize

British Virgin Islands

Cayman Islands

Guyana

Jamaica

Trinidad & Tobago

Turks & Caicos

US Territories

Puerto Rico

US Virgin Islands

Population

GDP @ Factor

Cost

GDP per

capita

(thousands)

(US $ millions)

(US$)

11

70

76

100

5

43

151

111

$71

$489

$206

$259

$35

$222

$488

$240

$6,526

$6,990

$2,715

$2,603

$7,014

$5,213

$3,241

N/A

566

N/A

N/A

288

265

230

19

36

775

2,553

1,270

16

5,452

3,806

117

3,923

$3,939

$1,786

$523

$275

$711

$627

$6,221

$5,424

N/A

N/A

$13,677

$6,739

$2,273

$14,468

$19,791

$808

$2,436

$4,271

N/A

N/A

$48,102

N/A

$12,638

N/A

N/A

N/A

Population

GDP @ Factor

Cost

GDP per

capita

(thousands)

(US $ millions)

(US$)

Dutch Caribbean

Aruba

Bonaire

Curacao

Saba

St. Maarten

St. Eustatius

iii

N/A

N/A

$1,534

N/A

N/A

N/A

N/A

$12,360

N/A

N/A

N/A

N/A

N/A

450

N/A

$789

N/A

N/A

$2,018

N/A

49,280

$14,572

$14,870

$267

N/A

N/A

$434

$55,849

N/A

$1,317

$2,009

$36

N/A

N/A

$1,045

$2,494

N/A

13,843

N/A

N/A

60,360

N/A

N/A

N/A

French West Indies

Guadeloupe

Martinique

1

Other Countries

Cuba

Dominican Republic

Haiti

Cancun

Cozumel

Suriname

Venezuela

CARICOM

CARIBBEAN TOTAL

N/A = Not Available

CARICOM members

1 Guadeloupe includes Les Saintes, Desirade, Marie Galante, St. Barthelemy and St. Martin

Source: CTO Caribbean Tourism Statistical Report 1997

89

15

153

2

38

2

299

391

841

11,066

7,400

7,492

450

60

415

22,396

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Demographic and macro-economic influences

The Caribbean region is expected to increase in population, assuming no significant changes in

immigration and emigration. Important demographic trends that may influence long-term travel

trends include:

As the number of Caribbean retirees with good health and financial savings increases, seniors

could represent an important niche market for intra-regional travel.

Fewer children per household may increase disposable income for travel both for family

vacations and for children as part of, for example, school or sporting groups.

Foreign trade and political alliances create the need for extensive travel across the region.

Caribbean countries and territories are loosely integrated through various regional and

international agreements. Principal regional treaty and trade agreements include the Caribbean

Common Market (CARICOM), the Association of Caribbean States (ACS), and the Organisation

of Eastern Caribbean States (OECS). Principal international treaty and trade agreements include

the ACP Lome Convention, the Caribbean Development Bank (CDB) and the Inter-American

Development Bank (IDB). In addition, myriad special purpose arrangements between certain

countries and territories suggest an emerging trend to greater co-operation across the Caribbean.

According to the CDB, Caribbean economies have achieved real growth in output over the past

several years while keeping inflation in check. New construction is one of the fastest growing

sectors in the region, particularly in residential and commercial accommodation.

Notwithstanding, forecasters’ expectations for short to mid term growth are dampened by:

Low crop yields caused by drought in the aftermath of El Niño;

Continued pressure on the European Union to reconsider its banana

marketing regime;

Dropping world oil prices, and

The impact of recent hurricanes on infrastructure and tourism facilities and travelers attitudes.

Travel requirements

Virtually every Caribbean destination requires photo identification, usually in the form of a

passport at the port of entry. Many airport entry ports also require proof that the visitor has a

valid return ticket and some confirmation that the visitor has the means to support him/herself

during the visit. Although citizens of CARICOM and OECS countries do not require a visa for

travel between member countries of these groupings, visas are required for intra-regional travel

for citizens of certain countries. For example, Caribbean nationals need visas to travel to any US

territory including travelers making flight connections through a US airport.

Most Caribbean countries and jurisdictions charge a departure tax for visitors over the age of 12

and several impose additional levies. Total departure taxes and levies vary from US$3 to US$25

with most destinations charging in the order of US$10 to US$20. Departure taxes are usually

quoted in US dollars and can be paid in either US dollars or the local currency. A few

destinations offer special rates to certain travelers although the applicability of the rate varies

widely.

iv

@

B.

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Travel patterns

Of the 1.5 million arrivals generated by Caribbean travel across the

region in 1998, the top five Caribbean destinations (i.e., Puerto Rico,

Trinidad & Tobago, Cuba, Venezuela and Barbados) together accounted

for 45% of all intra-regional movements. Puerto Rico’s primary draw is

as a Mecca to Caribbean shoppers. Both Trinidad & Tobago and Barbados are major hubs for

commercial business and attract many shoppers because of the number and variety of duty free

and retail stores. For Cuba, many areas of social and economic cooperation drive substantial

travel. Additionally, relatively low prices and the mystique that has developed during its political

and social isolation have also made Cuba a popular holiday choice for many Caribbean residents.

Growth and variations in intra-regional travel

The relative importance of intra-regional travel varies greatly across the Caribbean from as little

as 0.3% of 1998 annual arrivals to Saba to as much as 54.7% of 1998 annual arrivals in

Dominica. Other islands that rely on intra-regional travel as a substantial component of annual

arrivals include Montserrat (43.1%), St. Vincent and the Grenadines (37.0%), St. Kitts and Nevis

(31.1%) and Guyana (28.5%).

Overall, intra-regional travel has increased by 34% during the five-year period 1994 to 1998.

However, while some destinations such as Venezuela, Cuba and the Cayman Islands have

increased their intra-regional arrivals, others such as Montserrat and St. Maarten, have

experienced declining intra-regional arrivals.

Although seasonal arrivals vary substantially across the region, most destinations receive a

relatively high proportion of intra-regional visitors during July and August when schools are on

summer break and many Caribbean destinations host annual carnival celebrations. Preliminary

data for 1998 suggests that nearly 23% of intra-regional travel occurred during these two months.

Circuits of travel

While it is clear that there are defined circuits of travel between certain Caribbean countries and

territories, many destinations do not have the mechanisms in place to quantify these patterns.

Pairs of countries and territories with substantial reciprocal traffic include, for example:

Jamaica and the Cayman Islands;

Trinidad & Tobago and Grenada;

Antigua & St. Kitts and Nevis;

Trinidad & Tobago and Barbados.

Additionally, tourism statistics show substantial travel between the French territories and the

Creole speaking islands in the OECS (Dominica and St. Lucia) and between residents of the

Netherlands Antilles (Bonaire, Curaçao, St. Maarten, Saba and St. Eustatius) and Aruba.

C.

Intra-regional travel

Sample market surveys indicate that in comparison to other originating markets, intra-regional

long stay visitors frequently spend more in host destinations. In Grenada, for example, the

v

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

average Caribbean visitor spends US$204 per day as compared with the overall average of

US$146. Similar studies in Suriname and Curaçao indicate that Caribbean residents exceed the

overall average daily expenditures by 40% and 80% respectively. In contrast, Caribbean visitors

to Barbados spent US$104 in 1997 compared to an overall average of US$127.

Annual vacation entitlements and public holidays vary across the Caribbean. In most

Commonwealth islands, workers are entitled to a minimum of three weeks annual vacation,

which is extended to four weeks after five years of service. In contrast, in the French West Indies

and the Dutch Caribbean, many residents are entitled to an average of six weeks annual vacation,

while in US territories annual vacation entitlement is much shorter, typically only two to three

weeks.

A variety of public holidays are observed across the Caribbean, many of which are tied to long

weekends and create opportunities for travel. Virtually every Caribbean country and territory

observes Good Friday and Christmas, but the number of other public holidays varies with most

countries and territories observing from 10 to 13 public holidays annually.

Purpose of intra-regional travel

Leisure travel by Caribbean residents accounts for significant movement

intra-regionally. It includes shopping trips, sports, social events and

cultural festivals and personal business requirements such as to obtain

medical treatment or documentation for international travel or to further

one’s education.

Within the Caribbean, certain destinations are positioned as shopping destinations, including

Puerto Rico, St. Maarten, Barbados, Curaçao, Trinidad & Tobago and Venezuela – particularly

Margarita.

Sporting teams generate large blocks of movement across the Caribbean and span the gamut from

professional, to private social clubs and associations and school groups. Associated with any

given sports team will be a large number of competitors, officials, parents/guardians and team

supporters.

The Caribbean is rife with social events and cultural festivals that can substantially boost arrivals

to the host destination. For example, the May 1997 jazz festival in St. Lucia coincided with a

sharp spike in Caribbean arrivals (11.2% of the annual total compared with 7.5% in April and

5.6% in June).

Certain medical treatments and facilities are only available in some of the more developed CTO

member states. Countries such as Barbados, Trinidad & Tobago, Jamaica and Venezuela serve as

regional centres for specialised medical care.

Caribbean residents wishing to emigrate often need to obtain a travel visa or entry permit.

Embassies, commissions and consulates for various countries are located throughout the

Caribbean and timely completion of such entry documents frequently necessitates travel to a

Caribbean destination that hosts the appropriate embassy or commission.

Tertiary educational institutions, such as the University of the West Indies and St. George’s

University, account for much travel by Caribbean residents to Trinidad & Tobago, Grenada,

Jamaica, the Bahamas and Barbados. An estimated 2,500 students move throughout the

vi

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Caribbean at the beginning and end of the school year and up to 95% of these students also return

home for the Christmas holiday.

Business accounts for a good deal of intra-regional travel with Barbados, Jamaica and Trinidad &

Tobago serving as hubs for much of the regional commerce. From a strategically located base in

one or more islands, international agencies coordinate their activities across the region. These

agencies themselves precipitate a good deal of travel to other Caribbean destinations by their

representatives who need to visit the agencies’ offices to complete commercial and personal

business travel across the region.

Meetings and conferences generate extensive travel by Caribbean residents through the region as

well as to various international centres. Major regional and/or international conferences and

meetings are most often held in Aruba, Cancun, Puerto Rico, Jamaica and the Bahamas because

of the availability of large hotels that offer large, on-site conference facilities. Small conferences

and meetings are held in a variety of islands including Antigua, Barbados and Trinidad &

Tobago.

Caribbean nationals often have family ties and friends resident across the region. This dispersion

of families is historically a result of the movement of persons because of

employment and educational opportunities. Personal events such as

weddings, christenings, funerals and family reunions account for a

significant amount of Visiting Friends and Relatives (VFR) travel intraregionally. While qualitative evidence suggests that honeymoons within the

region remain quite appealing for Caribbean residents, statistical data is not

available to quantify the importance of this market.

D.

Competitive issues affecting the Caribbean

Although quantitative data on extra-regional travel is not readily available, industry experts

concur that discernible patterns for extra-regional travel exist. Most extra-regional leisure travel

generally occurs during the summer months and during the Christmas holiday season. Generally,

the greater the distance traveled, the longer the length of stay.

Major extra-regional holiday destinations for Caribbean travelers are the United States – New

York and Miami, Canada – Toronto, and the United Kingdom – London. In 1997, the United

States reported 1.7 million arrivals by Caribbean residents. In 1996, Canada reported 56

thousand arrivals by Caribbean residents and the United Kingdom reported 65 thousand arrivals

by Caribbean residents. These statistics may understate total travel by Caribbean residents as

many Caribbean travelers are citizens of the US, Canada or the United Kingdom, and hence are

not captured in the statistics.

vii

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Extra-regional leisure travel tends to focus around visits to friends and relatives and usually

utilises most, if not all, of the annual holiday from work. Shopping is usually a major component

of these trips even though stand-alone shopping trips are often taken periodically during the year.

Intra-regional travel by Caribbean residents is extensive. However, barriers to more and frequent

holiday travel exist and include the:

Relative difficulty of air access;

High cost of air transport and accommodation; and

Lack of knowledge or awareness of the diversity of the region.

E.

Travel trade structure and distribution

In the Caribbean, national tourism organisations, airlines and travel agents form the

major components of the travel distribution network. While national tourism

organisations are responsible for the generic marketing of the tourism product,

airlines and travel agents often drive the business of intra-regional travel through

their own destination packages which usually include air transport and

accommodation.

The Caribbean tour operator focuses primarily on the provision of local

representation for foreign tour operators, some ground tour operations inclusive of air and sea

port transfers, island tours and inter-island excursions. However, some travel agencies function

to a small extent as tour operators primarily developing extra-regional tours that include air,

accommodation, air transfers and sightseeing.

Regional airlines such as BWIA, LIAT and Air Jamaica function as vertically integrated tour

operators offering vacation packages that are geared to Caribbean residents. Generally, these

packages make use of scheduled flights and include return air travel, hotel accommodation, daily

breakfast, use of hotel facilities, hotel taxes and service charges. Intra-regional tours often focus

on sports although some are organised to coincide with major cultural events and/or long

weekends. These tours often rely on charter aircraft and are usually planned with a view to

ensuring that each leg of the route is fully subscribed.

Regionally owned airlines provide both scheduled and charter services within the region and to

major international destinations. Virtually every Caribbean country and territory is served by at

least a nominal schedule of intra-regional flights.

Some islands are hubs for intra-regional air transport. Puerto Rico and Jamaica facilitate travel to

the smaller islands of the northern Caribbean, while Barbados facilitates reasonably easy travel

amongst the OECS, French West Indies and the southern Caribbean.

Over twenty airlines provide scheduled air service through the Caribbean. Several of the larger

airlines, such as American Eagle, BWIA and Air Jamaica, provide service to all of the larger

destinations throughout the region. In contrast, many of the smaller airlines restrict their service

to a few islands that are relatively close to each other.

viii

@

F.

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Ideas for proactive marketing

An effective intra-regional marketing plan must identify and select those source markets that are

most attractive to the host destination. National tourism organisations, travel agents and CTO

chapters have an important role to play in proactively developing the intra-regional travel market.

ix

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Stakeholder roles

Industry stakeholders have a significant role to play in further developing the intra-regional travel

market. National tourism organisations, travel agents, hotels and airlines can together achieve

this objective.

National tourism organisations have a key role to play in the development of the intra-regional

travel market. They must assess the costs and benefits of further developing the intra-regional

market and must focus their marketing initiatives on selective, high potential, intra-regional

source markets using many of the same approaches that are successfully incorporated into extraregional marketing efforts.

Travel agents can also play a lead role in developing the intra-regional market. They should

actively seek opportunities to package the region to Caribbean residents and develop and

consistently offer rates and packages that meet the needs of the intra-regional traveler and take

advantage of excess industry capacity.

The accommodation sector as a whole must take a more proactive stance

in developing this market. As such, hoteliers must employ more

creativity in packaging, pricing and promoting their product to Caribbean

residents as hotel rooms are perishable commodities.

Airline companies must make use of informal distribution channels and

market directly to the travelers who fill their seats. They must also be

prepared to employ competitive pricing strategies to encourage more and

frequent intra-regional travel.

Marketing strategies

Effective marketing must be founded upon constant attention to product,

including the environment and quality assurance. Quality assurance must

address all elements of the travel experience including those aspects

within Governments’ direct control such as customs, immigration, airport

management, security, health and social infrastructure, as well as those

services supplied by the private sector, such as accommodation, ground

transportation and activities.

Historically, most intra-regional marketing efforts have been relatively soft, employing public

relations and trade shows as principal marketing tools. For example, only a few Caribbean

destinations employ marketing personnel who are dedicated to regional source markets.

Marketing to the intra-regional market should therefore make appropriate use of a full range of

marketing techniques and should focus on both the travel trade and on select end consumers. It

should make appropriate use of:

Fairs and exhibitions to encourage contracting and development of innovative packages;

Media relations strategies to generate interest and favourable press coverage;

Travel trade advertising to increase knowledge and awareness of special events and

destination features;

Sales missions to high potential source markets;

x

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Development of special interest tours;

Use of technology for the development of databases and web sites;

Direct marketing to end consumers in association with industry partners or as part of a

national tourism organisation’s advertising campaign;

Appropriate collateral materials; and

In flight advertising which provides expansive commentary to a captive audience that is

generally pre-disposed to travel.

G.

The way forward

Key to the further development of the intra-regional travel market is the

acknowledgement by individual destinations in the region that the Caribbean

is a viable and lucrative source market. Additionally, Caribbean residents

themselves must see the region as equally attractive as a holiday destination

as all other extra-regional destinations. As such key issues that must be

addressed to grow the intra-regional market are those of awareness, data

collection and marketing – the same issues that are relevant to extra-regional source markets.

Key issues

Caribbean residents need to be made aware that what was learnt in geography classes in schools

across the region about the countries and territories of the Caribbean are the same attributes that

make the region attractive as a tourism destination.

Equally important is information - the basis for decision making. There is therefore a need to

capture and standardise data that can be used to inform decision-makers at national tourism

organisations. Research/data informs the marketing process and requires a commitment of staff

resources that is often overlooked.

The private sector too must weigh the time spent compiling data against the benefits to be derived

by the industry as a whole and understand the value that is ultimately derived when data is

provided. And, government agencies must rationalise their data collection processes and

collaborate on the information required from the industry in order to facilitate and encourage the

sharing and collection of information.

The initiatives to drive the change process are marketing oriented and must be led by the CTO as

the organisation charged with increasing the value and volume of tourism flows to member states.

The CTO and the Caribbean tourism industry must implement a number of measures as a matter

of urgency. These initiatives should encompass:

A demonstrated commitment to sustainable tourism development operated in harmony with

the environment, local communities and cultures;

A commitment to expanding the flow of information between destinations and an increased

awareness of the Caribbean as a product;

The dedication of marketing resources – human and financial;

xi

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

The development of market research – demographic and psychographic on the Caribbean

traveler;

Further development of the CTO Caribbean Chapters;

The development and packaging of tours in response to market demand with special pricing discounted airfares and accommodation – for Caribbean residents;

The transition of regional travel agents and ancillary service providers to vertically integrated

tour operators;

Sustained marketing programmes;

Access to and availability of air transport – and the further development of natural hubs;

A commitment to co-operation with regard to the compilation and sharing of data;

Implementation of the United Nations, World Tourism Organisation recommendations on

tourism statistics;

The development of a MIS system for tourism that highlights key tourism statistics and

indicators that is not focused on the immigration card, but on all data as it relates to tourism.

H

Conclusion

The intra-regional travel market is an important and viable one. Many countries and territories in

the Caribbean recognise this and actively pursue the further development of this market.

However, for this market to grow and for the countries and territories of the region to realise its

significant potential, there is a need for a greater level of commitment by industry players in the

public and private sectors of the region.

In 1995, the Declaration of Principles of the Association of Caribbean States was approved.

Caribbean leaders, in making specific reference to tourism stated…”Convinced that with its

natural riches, diversity and cultural patrimony, the Caribbean is an attractive tourism

destination comprising a vital sector for the economy of our States, Countries and Territories, we

are committed to UNIFYING EFFORTS AND ACTIVITIES to increase the flow of tourism

towards and within the Caribbean,…” 1

This is the basis on which the Caribbean tourism industry must move forward.

1

Co-ordination between regional and international organisations for the establishment of the sustainable

tourism zone. Carlos J. Dávila, Senior Professional, ACS, in Proceedings of the Caribbean Tourism

Organisation 2nd Annual Conference and Trade Show on Sustainable Tourism Development, April 15-19,

1998.

xii

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Map of the Caribbean

xiii

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

1.

Regional Overview

The Caribbean – for the purpose of this study - is defined to include the 34 CTO

member countries and territories located in or bordering on the Caribbean Sea. (See

Appendix A for a listing of CTO members.) Caribbean countries and territories

vary tremendously in terrain, size, economic prosperity and cultural origins. This

diversity creates a wide and exciting range of vacation experiences, with something to offer the most

discerning of international and intra-regional travelers.

1.1

Population of the Caribbean

The population of the Caribbean is approximately 60.4 million, with the five largest jurisdictions

(Venezuela, Cuba, Dominican Republic, Haiti and Puerto Rico) accounting for approximately 86%

of the total population. (See Table 1.1.)

Table 1.1

Population estimate, 1997 mid-year

Population Percent of regional

(thousands)

population

Commonwealth OECS Countries

Anguilla

Antigua & Barbuda

Dominica

Grenada

Montserrat

St. Kitts and Nevis

St. Lucia

St. Vincent & The Grenadines

TOTAL

Other Commonwealth

The Bahamas

Barbados

Belize

British Virgin Islands

Cayman Islands

Guyana

Jamaica

Trinidad & Tobago

Turks & Caicos

TOTAL

US Territories

Puerto Rico

US Virgin Islands

TOTAL

11

70

76

100

5

43

151

111

566

0.0%

0.1%

0.1%

0.2%

0.0%

0.1%

0.2%

0.2%

0.9%

Population Percent of regional

(thousands)

population

Dutch Caribbean

Aruba

Bonaire

Curacao

St. Maarten

Saba

St. Eustatius

89

15

153

38

2

2

299

0.1%

0.0%

0.3%

0.1%

0.0%

0.0%

0.5%

450

391

841

0.7%

0.6%

1.4%

TOTAL

11,066

7,400

7,492

450

60

415

22,396

49,280

18.2%

12.2%

12.3%

0.7%

0.1%

0.7%

37.5%

81.8%

CARICOM

13,843

22.7%

60,360

100.0%

TOTAL

French West Indies

Guadeloupe

Martinique

288

265

230

19

36

775

2,553

1,270

16

5,452

3,806

117

3,923

0.5%

0.4%

0.4%

0.0%

0.1%

1.3%

4.2%

2.1%

0.0%

9.0%

6.3%

0.2%

6.5%

1

1

TOTAL

Other Countries

Cuba

Dominican Republic

Haiti

Cancun

Cozumel

Suriname

Venezuela

CARIBBEAN TOTAL

Guadeloupe includes Les Saintes, Desirade, Marie Galante, St. Barthelemy and St. Martin

CARICOM members

Sources: CTO Caribbean Tourism Statistical Report 1997, Caribbean Development Bank Annual Report 1998

1

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Of the ten largest sources of stay-over visitors to the Caribbean in 1997 the Caribbean (60.4mn) itself

ranked third in population, behind the United States (263.8mn) and Germany (81.8mn), and ahead of

the United Kingdom (58.7mn), France (58.3mn), Italy (57.3mn), Spain (39.2mn), Canada (28.4mn),

Holland (15.5mn) and Sweden (8.8mn).

1.2

Demographic influences

Based on demographic projections for Caribbean countries and territories, the population of the

Caribbean region can be expected to increase over both the mid and long term, assuming no

significant changes in immigration and emigration. Projections for population growth vary

considerably across the region but generally average between 0.4% and 1.7% per annum. The two

largest contributors to the forecasted growth are:

fertility rates are expected to remain at or above the replacement rate in many parts of the region;

improved health care and medical research should continue to extend the average life expectancy

of Caribbean residents.

1.2.1 Retired persons

As baby boomers age and improved health care extends average life expectancy, the elderly will

become an increasingly dominant component of the regional population. According to the World

Bank, the proportion of Caribbean populations that exceeds the defined age for retirement is

expected to double over the next 25 years from about 8% to 16% of the population. Although the

age of mandatory retirement varies somewhat across the region, it is generally between 60 and 65

years of age and after 30 to 35 years of employment.

As the number of Caribbean retirees with good health and financial savings increases, seniors could

represent an increasingly important niche market for intra-regional travel.

1.2.2 Family size remains stable or declining

In most parts of the Caribbean fertility rates are currently above the replacement rate of 2.1, although

certain islands are now below the replacement rate (for example, Barbados). Other islands are

expected to fall below the replacement rate over the next 10 (Jamaica and Trinidad & Tobago) to 20

years (St. Lucia).

With fewer children per household, available income for travel may increase for both family

vacations and for the children as part of, for example, school or sporting groups.

1.3

Regional groupings

Historically and geographically, the Caribbean can be broken into several distinct groupings of the

Commonwealth OECS, other Commonwealth, the Dutch Caribbean, the French West Indies, the US

Territories and others. (See Table 1.2.)

2

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Table 1.2

Regional groupings, 1997 mid-year

Commonwealth OECS Countries

Anguilla

Antigua & Barbuda

Dominica

Grenada

Montserrat

St. Kitts and Nevis

St. Lucia

St. Vincent & The Grenadines

Other Commonwealth

The Bahamas

Barbados

Belize

British Virgin Islands

Cayman Islands

Guyana

Jamaica

Trinidad & Tobago

Turks & Caicos

US Territories

Puerto Rico

US Virgin Islands

Population

GDP @ Factor

Cost

GDP per

capita

Population

GDP @ Factor

Cost

GDP per

capita

(thousands)

(US $ millions)

(US$)

(thousands)

(US $ millions)

(US$)

11

70

76

100

5

43

151

111

$71

$489

$206

$259

$35

$222

$488

$240

$6,526

$6,990

$2,715

$2,603

$7,014

$5,213

$3,241

N/A

566

N/A

N/A

288

265

230

19

36

775

2,553

1,270

16

5,452

3,806

117

3,923

$3,939

$1,786

$523

$275

$711

$627

$6,221

$5,424

N/A

N/A

$13,677

$6,739

$2,273

$14,468

$19,791

$808

$2,436

$4,271

N/A

N/A

$48,102

N/A

$12,638

N/A

N/A

N/A

Dutch Caribbean

Aruba

Bonaire

Curacao

Saba

St. Maarten

St. Eustatius

89

15

153

2

38

2

299

N/A

N/A

$1,534

N/A

N/A

N/A

N/A

$12,360

N/A

N/A

N/A

N/A

N/A

450

N/A

$789

N/A

N/A

$2,018

N/A

49,280

$14,572

$14,870

$267

N/A

N/A

$434

$55,849

N/A

$1,317

$2,009

$36

N/A

N/A

$1,045

$2,494

N/A

13,843

N/A

N/A

60,360

N/A

N/A

N/A

French West Indies

Guadeloupe

Martinique

1

Other Countries

Cuba

Dominican Republic

Haiti

Cancun

Cozumel

Suriname

Venezuela

CARICOM

CARIBBEAN TOTAL

391

841

11,066

7,400

7,492

450

60

415

22,396

N/A = Not Available

CARICOM members

1 Guadeloupe includes Les Saintes, Desirade, Marie Galante, St. Barthelemy and St. Martin

Source: CTO Caribbean Tourism Statistical Report 1997

Within the Caribbean, regional groupings reflect colonial influences, which in part have determined

language, currency, and political and administrative frameworks. These colonial ties continue to

play an important role in determining trade and travel patterns. However, proximity to major

markets and air-lift are also important in determining intra-regional travel patterns.

Many foreign nationals visit Caribbean destinations that are politically linked to their homeland. As

such, the country of origin often accounts for a large proportion of visitors in those destinations. For

example2 in 1997, 31.5% of US visitors to the Caribbean traveled to US territories and accounted for

81.9% of long-stay visitors to Puerto Rico and 80.0% of long-stay visitors to the US Virgin Islands.

Similarly, 59.6% of French visitors to the Caribbean traveled to the French West Indies and

2

Source for the subsequent information: CTO Caribbean Tourism Statistical Report 1997

3

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

accounted for a large proportion of visitors to Guadeloupe3 (44.8%) and Martinique (78.0%). And

finally, 53.5% of visits to the Caribbean by Dutch nationals were to Aruba and the Netherlands

Antilles and represented a relatively large proportion of visitors to certain islands of the Dutch

Caribbean (Bonaire 25.9% and Curaçao 30.0%).

The mass-market appeal of certain Caribbean destinations, such as the Dominican Republic, Cuba

and Cancun, transcends colonial and economic ties. These destinations receive a notable number of

visitors from many major markets regardless of origin.

The level of economic activity and the distribution of income/wealth are among the many factors that

influence travel by Caribbean residents. Although the level of economic activity is in part reflected

by the GDP per capita, this fails to give a sense of income/wealth distribution, which is an important

factor in determining the propensity for leisure travel.

1.4

Macroeconomic influences

Caribbean countries and territories are loosely integrated through various

regional and international treaty and trade agreements. (See Table 1.3.)

Principal among these agreements are:

The Caribbean Common Market (CARICOM) was established in 1973 to

replace the Caribbean Free Trade Association to provide a framework for regional political and

economic integration.

CARIFORM is an expansion of CARICOM for LOME purposes to include Dominican Republic,

Haiti and Suriname.

The ACP Lome Convention is a non-reciprocal agreement to promote and accelerate the

economic, social and cultural development of African, Caribbean and Pacific countries. It is

supported by the European Union and its member states and the African, Caribbean and Pacific

Countries, and provides financial, technical and emergency aid and establishes a preferential

system for trade.

The Organization of Eastern Caribbean States (OECS) was established in July 1991,

superseding the West Indies Associated States. The OECS seeks to promote cooperation and

economic integration, harmonization of foreign policy and establishes arrangements for joint

overseas representation among member states.

The Caribbean Development Bank (CDB) was established in 1969 for the purpose of

contributing to the harmonious economic growth and development of the member countries in the

Caribbean and promoting economic cooperation and integration among them.

The Association of Caribbean States (ACS) was created in 1992 to establish an area of free trade

for goods, services, and capital. It also provides a vehicle for unified negotiation with other

economic blocks and international organizations.

3

Throughout this report Guadeloupe statistics include Guadeloupe and the neighbouring islands of Les

Saintes, Desirade, Marie Galante, St. Barthelemy and St. Martin.

4

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

The Organization of American States (OAS) dates back to 1889. Its purposes include

strengthening and ensuring the security of the continent; promoting and consolidating

representative democracy; socio-economic objectives such as resolving political and economic

problems.

The Inter-American Development Bank (IDB) was established in 1959 to help accelerate

economic and social development in Latin America and the Caribbean. Presently, IDB

membership totals 46 nations. In addition to the bank, the IDB group consists of the InterAmerican Investment Corporation and the Multilateral Investment Fund (MIF), which was

established in 1993 to accelerate private sector development and help improve the climate for

private investment in Latin America and the Caribbean.

The Canadian International Development Agency (CIDA) is responsible for delivering

Canada’s official development assistance program. Its main purpose is to support sustainable

development, via partnerships in the public and private sector in Canada and developing countries

in order to reduce poverty and to contribute to a more equitable and prosperous world.

The CARIBCAN agreement was officially adopted in June 1986 and principally features the

unilateral extension by Canada of preferential duty free access to the Canadian market for almost

all imports from the Commonwealth Caribbean. Its basic objectives are to enhance the

Commonwealth Caribbean’s existing trade and export earnings; improve the trade and economic

development prospects of the region; promote new investment opportunities; and encourage

enhanced economic integration and co-operation within the region.

In addition to these more formal ties, myriad special purpose arrangements between certain countries

and territories suggest an emerging trend to greater co-operation across the Caribbean. Specific

examples of such agreements can be found in many sectors of society including education, tax

treaties and reciprocal health care agreements.

5

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Table 1.3

Formal economic ties, as at February, 1999

CARICOM

ACS

1

Anguilla

Antigua & Barbuda

Aruba

The Bahamas

Barbados

Belize

3

CARIBCAN

1

Bonaire

British Virgin Islands

Cayman Islands

Cuba

Curacao

Dominica

Dominican Republic

Grenada

Guadeloupe

1

124

2

5

Haiti

Jamaica

Martinique

1

1

12

(Mexico)

Cancun

(Mexico) Cozumel

Montserrat

Puerto Rico

Saba

OECS

1

Guyana

ACP LOME

1

1

1

1

1

St. Eustatius

St. Kitts and Nevis

St. Lucia

25

9

1

St. Maarten

St. Vincent and The Grenadines

Suriname

Trinidad & Tobago

Turks & Caicos

US Virgin Islands

Venezuela

1

1

No. of members

15

19

14

Hold observer status in CARICOM.

2

Associate members of the ACS.

The Bahamas is a member of the CARICOM community but not the common market

4

Guadeloupe includes Les Saintes, Desirade, Marie Galante, St. Barthelemy and St. Martin

5

Haiti has provisional membership in CARICOM pending settlement of terms and conditions of accession.

Source: CARICOM, OECS, ACS.

3

6

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Countries and territories of the Caribbean export a wide range of raw and processed materials,

agricultural crops, processed foods and manufactured products to both regional and international

markets. (See Table 1.4) Foreign trade in a variety of goods and services throughout the region

creates the need for extensive travel across the region.

Table 1.4

Primary intra-regional trading partners and exports, 1999

Intra-regional trading partners

Exports

Seafood

Aruba

Puerto Rico, US Virgin Islands, Trinidad

& Tobago

OECS, Barbados, Guyana, Trinidad &

Tobago

Netherland Antilles and Venezuela

The Bahamas

Primary extra-regional

Pharmaceuticals, petroleum products, shellfish, salt, cement, rum, food

Barbados

CARICOM

Belize

Mexico and CARICOM

Sugar, apparel electronic components, cement, food, rum, chemicals,

pharmaceuticals, plastics and handicrafts

Sugar, Citrus, seafood, bananas, apparel, vegetables and lumber

Bonaire

British Virgin Islands

Cayman Islands

N/A

US Virgin Islands, Puerto Rico

Netherland Antilles

Aggregates, bananas, fish and rum

Seafood

Cuba

Curaçao

Dominica

Dutch Antilles, Venezuela

Caribbean

OECS, CARICOM, French West Indies

Sugar, nickel, citrus, shellfish, tobacco, coffee, pharmaceuticals

Mineral fuels, rice, apparel, footwear, gift items

Fruits, food, soaps, craft, cigarettes, tobacco, water, beer, plastics and solar

water heaters

Dominican Republic

Primarily extra-regional

Grenada

Trinidad & Tobago and St. Lucia

Guadeloupe

Martinique, French Guiana

Apparel, footwear, bauxite, beef, cigars, food, ferronickel, gold, silver, sugar,

dasheen and textiles

Nutmeg, cocoa, bananas, mace, fruit, vegetables, fish, food products apparel,

pains and varnish

Bananas, sugar, boats, food products, flowers, rum, mineral water, electrical

equipment

Guyana

CARICOM, Venezuela

Haiti

Dominican Republic

Jamaica

CARICOM

Martinique

(Mexico)

Cancun 1

Guadeloupe

Primary extra-regional

Anguilla

Antigua & Barbuda

Cozumel 1

(Mexico)

See Cancun

Montserrat

Puerto Rico

CARICOM

Dominican Republic, Venezuela, Mexico

Saba

N/A

St. Eustatius

St. Kitts and Nevis

St. Lucia

N/A

CARICOM

CARICOM

St. Maarten

St. Vincent & The Grenadines

Suriname

N/A

CARICOM, Trinidad & Tobago

Venezuela and Trinidad & Tobago

Trinidad & Tobago

CARICOM, Puerto Rico, and the US

Virgin Islands

N/A

St. Lucia, Barbados, Netherland Antilles

Primary extra-regional

Turks & Caicos

US Virgin Islands

Venezuela

1 Exports

Chemicals, food, live animals, misc. mfg. Goods, petroleum products

Petroleum products

Bauxite, alumina, sugar, rice, shrimp, rum, molasses, timber, gold and

apparel

Sporting goods, textiles, apparel, electronic toys, coffee, mangoes, sisal,

essential oils and cocoa

Bauxite, alumina, apparel, sugar, bananas, coffee, citrus, rum and cocoa

Bananas, petroleum products, rum and pineapples

Electric/electronic equipment, crude oil, automobiles and transport

equipment, chemical products, textiles, leather goods, iron, steel, machinery

parts, plastic and rubber products, oil derivatives.

See Cancun

Electronic components, plastic bags, semi-processed rice

Manufactured goods, pharmaceuticals, chemicals, apparel, food,

electrical/electronic machinery, petroleum products, professional and

scientific instruments.

Sugar, beer, lobster, electrical equipment and margarine

Bananas, apparel, cardboard boxes and coconut products

Apparel, wooden toys, plastic, root crops, flowers and mariculture

Alumina, aluminium, bauxite, rice, bananas, shrimp, wood and wood

products, fish, crude petroleum, oil and vegetables

Petroleum products, chemicals, iron and steel, fertilizers, gas, beverages,

sugar, paper, cereals and Misc. manufactured goods

Lobster, conch, fish and financial services

Petroleum products, watches and parts, chemicals and Jewelry

Petroleum products, aluminum, steel, iron ore, coal, gold, coffee, cocoa,

automotive spare parts and accessories

and trading partners are for Mexico as a whole

N/A = Not Available

Source: 1999 Caribbean/Latin America Profile

7

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

According to the Caribbean Development Bank, Caribbean economies have achieved real growth in

output over the past several years while keeping inflation in check. New construction is one of the

fastest growing sectors in the region and is driven primarily by strong demand for residential and

commercial accommodation. New residential and commercial construction has been particularly

high in Barbados, Cayman Islands and St. Lucia, for example, and major hotel projects have begun

in destinations such as the Bahamas, St. Lucia and St. Kitts and Nevis. In several of the countries,

the offshore financial services industry has been driving a substantial amount of economic activity,

particularly in Barbados, Bahamas, Antigua, Anguilla, BVI, Turks & Caicos Islands, Cayman

Islands. Several of the other countries such as St. Lucia, St. Kitts, St. Vincent and the Grenadines,

and Belize are also seeking to expand their offshore business services industries.

However, the region continues to face a number of challenges that continue to dampen forecasters’

expectations for short to mid term growth.

The agricultural sector has been particularly hard pressed with drought

conditions precipitated by El Niño continuing to reduce yields of key crops. The

US led challenge to the World Trade Organization’s ruling on the European

Union’s banana marketing regime continues to have a negative impact on the

primary banana producing economies of the Caribbean.

Additionally, declining oil prices had a negative impact on countries that are

major exporters from the region, most notably Trinidad & Tobago and Venezuela. Note however

that oil prices had been increasing again in recent months.

As in other parts of the world the Caribbean region is vulnerable to weather phenomena. Some

countries in the region lie within the hurricane belt and damage to infrastructure and disruption of

vital economic sectors can occur if directly affected by a hurricane. For example, damage to

infrastructure and tourism facilities was caused in Antigua & Barbuda and St. Kitts and Nevis by

hurricane Georges. In St. Kitts and Nevis, for example, one quarter of the sugar cane crop was

destroyed. Subsequently, substantial rebuilding has taken place affording the opportunity to upgrade

tourism plant and urban infrastructure.

1.4.1 Currencies and exchange rates

Throughout the Caribbean some 18 different currencies are in use. In most of the English speaking

Caribbean, the US dollar is widely accepted in trade in addition to the local currency. (See Table

1.5.)

8

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Table 1.5

Currencies, as at June 30, 1999

Currency

Commonwealth OECS Countries

Anguilla

Antigua & Barbuda

Dominica

Grenada

Montserrat

St. Kitts and Nevis

St. Lucia

St. Vincent & The Grenadines

East Caribbean $

East Caribbean $

East Caribbean $

East Caribbean $

East Caribbean $

East Caribbean $

East Caribbean $

East Caribbean $

Other Countries

Cuba

Dominican Republic

Haiti

Cancun

Cozumel

Suriname

Venezuela

Cuba Peso

Dominican Republic Peso

Haiti Gourde

Mexico Peso

Mexico Peso

Suriname Guilder

Venezuela Bolivar

US Territories

Puerto Rico

US Virgin Islands

United States $

United States $

Per $ US

Currency

2.53

2.53

2.53

2.53

2.53

2.53

2.53

2.53

22.90

13.57

16.28

9.23

9.23

691.27

485.26

1.00

1.00

Per $ US

Other Commonwealth

The Bahamas

Barbados

Belize

Bermuda

British Virgin Islands

Cayman Islands

Guyana

Jamaica

Trinidad & Tobago

Turks & Caicos

Bahamas $

Barbados $

Belize $

Bermuda $

United States $

Cayman $

Guyana $

Jamaica $

Trinidad & Tobago $

Unites States $

Dutch Caribbean

Aruba

Bonaire

Curacao

St. Maarten

Saba

St. Eustatius

Aruba Florin

Netherland Antilles Guilder

Netherland Antilles Guilder

Netherland Antilles Guilder

Netherland Antilles Guilder

Netherland Antilles Guilder

1.61

1.70

1.70

1.70

1.70

1.70

French West Indies

Guadeloupe

Martinique

France Franc

France Franc

6.24

6.24

1.00

1.88

1.93

1.00

1.00

0.79

173.02

34.16

5.41

1.00

Note that Guadeloupe includes Les Saintes, Desirade, Marie Galante, St. Barthelemy and St. Martin

Source: www.accu-rate.ca

The relative cost of intra-regional travel depends in part on the comparative strength

of the currencies in the countries of origin and destination. Countries that have

experienced substantial devaluation of the local currency sometimes enjoy a shortterm boost in tourism arrivals, as the destination is viewed as good value for money.

Conversely residents of a country that has suffered substantial devaluation find it

increasingly expensive to visit Caribbean destinations whose currencies are pegged to the US dollar.

1.4.2 Visa requirements

Virtually every Caribbean destination requires photo identification, usually in the form of a passport,

at the port of entry. Many airport entry ports also require proof that the visitor has a valid return

ticket and some confirmation that the visitor has the means to support him/herself during the visit.

Visas are not required for travel between CARICOM member countries and residents of CARICOM

countries do not require a visa to visit Aruba and the Netherlands Antilles. (See Table 1.6.) Travel

by OECS residents throughout the OECS requires photo identification only.

Visas are required for intra-regional travel for residents of certain countries and territories. Most

notably all Caribbean nationals need visas to travel to the French West Indies and any US territory

except residents of the British Virgin Islands traveling to the US Virgin Islands.

9

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Additionally, Caribbean nationals making flight connections through a US airport require a US visa

in order to move without escort through the airport.

Suriname has the most restrictive entry requirements. All visitors must have a three-day travel visa

and for longer periods are required to apply at the immigration office once they arrive in the country.

Although not a visa per say, travelers to certain countries, such as Venezuela and Cuba, are required

to complete a tourist card before they are granted entry. These cards are usually provided through

the travel agent or airline at check in.

10

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

Table 1.6

Visa requirements for Caribbean destinations, 1999

Countries and territories whose citizens require visas

Anguilla

None identified

Antigua & Barbuda

None identified

Aruba

Cuba, Dominican Republic and Haiti

The Bahamas

None identified

Barbados

Dominican Republic, Haiti

Belize

All Caribbean except Trinidad and Tobago, Turks and Caicos and US Virgin Islands

Bonaire

Cuba, Dominican Republic and Haiti

British Virgin Islands

None identified

Cayman Islands

None identified

Cuba

All Caribbean except Barbados and St. Lucia

Curacao

Cuba, Dominican Republic and Haiti

Dominica

None identified

Dominican Republic

All Caribbean

Grenada

None identified

Guadeloupe

All Caribbean except French West Indies

Guyana

French West Indies, Netherlands Antilles, Cuba, Dominican Republic, Haiti and Mexico

Haiti

All Caribbean

Jamaica

None identified

All Carribean except French West Indies

Martinique

(Mexico)

Cancun

All Caribbean

(Mexico)

Cozumel

All Caribbean

Montserrat

None identified

Puerto Rico

All Caribbean countries and territories except US Virgin Island

Saba

Cuba, Dominican Republic and Haiti

St. Eustatius

None identified

St. Kitts and Nevis

None identified

St. Lucia

None identified

St. Maarten

Cuba, Dominican Republic and Haiti

St. Vincent & The Grenadines

None identified

Suriname

All Caribbean countries and territories

Trinidad & Tobago

None identified

Turks & Caicos

None identified

US Virgin Islands

All Caribbean countries and territories except Puerto Rico and British Virgin Islands

Venezuela

Guyana, Suriname and French West Indies

Source: Consulates, high commissions and embassies

11

@

Caribbean Tourism Organization

Intra-Regional Travel Market Study

1.4.3 Departure taxes and levies

Most Caribbean destinations charge a departure tax for visitors over the age of 12 and several impose

additional levies. Total departure taxes and levies vary from US$3 to US$25 with most destinations

charging in the order of US$10 to US$20 per person. (See Table 1.7.) An example of an additional

charge imposed by some Caribbean destinations is an environmental levy, which varies with the