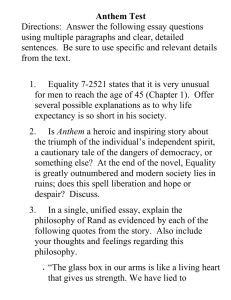

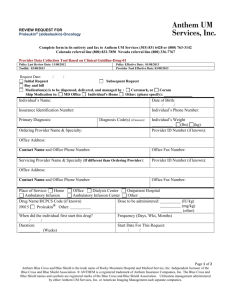

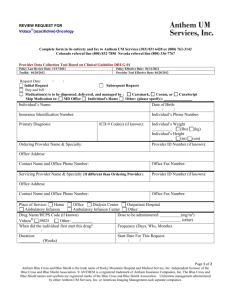

Provider Complaint and Appeals Process

advertisement