CHAPTER 6

advertisement

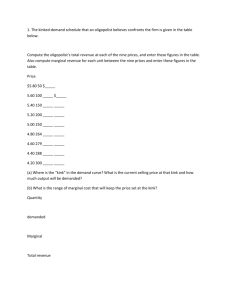

INSTRUCTOR’S MANUAL 18 CHAPTER 6 IMPERFECT COMPETITION CHAPTER GOALS This chapter deals with the market structure of imperfect competition. After reading this chapter, students should be able to: • • • • • • • Explain how concentration ratios relate to the competitiveness of markets. Distinguish between monopolistic competition and oligopoly. Identify the goals and effects of advertising. Explain how a seller successfully practices price discrimination. Discuss the major theories of oligopolistic behavior. Distinguish between a horizontal merger, a vertical merger, and a conglomerate merger. Explain how the threat of potential competition encourages firms to produce a high-quality product and sell it at a reasonable price to consumers. LECTURE HINTS AND IDEAS This chapter focuses on monopolistic competitive and oligopolistic markets, the “imperfect competition” market structures to which most U.S. businesses belong. After looking at how concentration ratios are used to roughly estimate the degree of market power, the standard model of monopolistic competition is presented. Advertising and price discrimination are explained in this section. In the oligopoly discussion, barriers to entry are described, followed by four models of oligopoly behavior: game theory (using a payoff matrix), kinked demand, cartel, and price leadership. Contestable markets and their restrictions on monopoly behavior are covered at the end of the chapter, providing insight that a monopoly or oligopoly market structure does not always ensure economic profits. By now, the students will be quite familiar with the MR = MC profit-maximization approach, so class coverage of the graphical approach should move fairly quickly. Much discussion can be devoted to interesting examples and case studies, such as student discounts as an example of price discrimination and the Microsoft battle for market share. BREAK-THE-ICE DISCUSSION STARTERS 1. “Why is the price of food at airports so high?” This question relates to a number of issues studied so far, including price elasticity of demand, imperfect competition, and differences in costs (higher rents, etc.). 2. “Should it be legal for women to advertise on Internet Web pages so that they can sell their eggs to the highest bidder? How about the selling of human organs this way?” Interesting ethical issues are INSTRUCTOR’S MANUAL 19 raised in this normative economic question, but it also paves the way for discussion about product differentiation, the impact of the Internet on market structure, and economic efficiency. 3. “Is Burger King an example of monopolistic competition or oligopoly?” The answer to this involves an analysis of how a market is defined and the size of the concentration ratio. Look both at product markets (availability of substitutes such as McDonald’s) and geographic markets (how far will people travel to buy a burger?). 4. “Are cereal coupons used by shoppers at grocery stores an example of price discrimination?” By looking at the necessary conditions, we can see that it is price discrimination—two shoppers walk out of the store with the exact same product, but having paid two different prices. Shoppers have different price elasticities of demand, and sort themselves accordingly. Those with elastic demands are the coupon clippers. 5. “Would a merger between Apple Computers and IBM be beneficial to society?” Students should consider both efficiency gains (economies of scale, uniformity of product, maybe more innovation) and the costs of increasing market power (higher prices, lower output, maybe less innovation). BRIEF ANSWERS TO STUDY QUESTIONS AND PROBLEMS 1. A Top 4 concentration ratio of 20 percent means that 20 percent of an industry’s sales are accounted for by the four largest firms in an industry. A Top 4 concentration ratio of 85 percent means that 85 percent of an industry’s sales are accounted for by the four largest firms in an industry. The latter is a much less competitive market. 2. As a monopolistically competitive firm, Don’s Texaco faces a downward-sloping demand curve and marginal revenue curve. In long-run equilibrium, the firm will operate at an output where price equals average total cost, but average total cost exceeds its minimum. The difference between the output corresponding to minimum average total cost and the output produced by the firm is called excess capacity. 3. a b. c. d. Output = 170 radios, price = $36, total revenue = $6,120 Average total cost = $24, total cost = $4,080 Economic profit = $2,040 The demand curve and marginal revenue curve will decrease and economic profits will equal zero. 4. Successful persuasive advertising will shift a firm’s demand curve rightward and also make it less elastic. As an additional cost of doing business, advertising shifts a firm’s average total cost curve upward. Persuasive advertising may result in increases in output that lead to economies of largescale production. If these economies more than outweigh the increase in unit cost as the result of advertising, consumers may purchase the product at a lower price with advertising than they would without. If advertising was informative, the demand curve would become more elastic, rather than inelastic as occurs under persuasive advertising. 5. With price discrimination, Northwest Airlines would charge a higher price to customers with relatively inelastic demand curves (business travelers) and a lower price to customers with relatively elastic demand curves (tourists). 6. a. Output = 9 toys, total revenue = $45, total profit = $27 INSTRUCTOR’S MANUAL b. 7. a. b. c. 20 Output = 9 toys—5 toys sold in the United States and 4 toys sold in Mexico—total revenue = $51, total profit = $33. Because of price discrimination, total profits are $6 greater than that which occurs in the absence of price discrimination. The payoff matrix shows how oligopolies must weigh the impacts of their decisions on other oligopolies and must also anticipate how those other oligopolies will react. The tendency will be a low-price strategy for each firm. With cooperative behavior, each firm will likely adopt a high-price strategy. However, one firm may have the incentive to cheat on this pricing agreement and charge a low price, while its rival maintains a high price, thus earning extra profit. 8. The kinked demand curve theory attempts to explain why prices in oligopolistic industries tend to be relatively inflexible. According to the theory, DaimlerChrysler believes that it will lose considerable amounts of sales if it raises its price because it will be undersold by rivals who do not change their price. Moreover, DaimlerChrysler believes that it will not gain much in sales if it lowers its price, because rivals will match the price cut. The conclusion of the kinked demand curve theory is that prices are quite rigid because the fear of rivals’ actions discourages an oligopolist from either increasing or decreasing its price. 9. Because there are relatively few firms in an oligopoly, there may be an incentive for them to collude and form price-fixing agreements. All members of the agreement maintain a high-price strategy and thus earn more profits than occurs under competitive oligopoly. Among the obstacles that cartels face are a large number of members, cost and demand differences among the members, potential competition, and economic downturn and cheating.