11676,ice-fili,7,10,"2000-11-28 00:00:00",90,http://www.123helpme.com/ice-fili-and-the-russian-ice-cream-market-view.asp?id=165523,3.9,460000,"2016-01-02 07:42:42"

advertisement

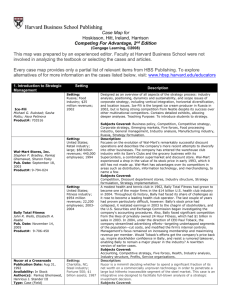

Harvard Business School Publishing Case Map for Hitt, Ireland & Hoskisson Strategic Management: Competitiveness & Globalization, 8th Edition (Cengage/South-Western, ©2009) This map was prepared by an experienced editor. Faculty at Harvard Business School were not involved in analyzing the textbook or selecting the cases and articles. Every case map provides only a partial list of relevant items from HBS Publishing. To explore alternatives of for more information an the cases listed below, visit: www.hbsp.harvard.edu/educators 1. Strategic Management & Strategic Competitiveness Ice-Fili Michael G. Rukstad; Sasha Mattu; Asya Petinova Product#: 703516 Wal-Mart Stores, Inc. Stephen P. Bradley, Pankaj Ghemawat, Sharon Foley Pub. Date: September 18, 2003 Product#: 9-794-024 Bally Total Fitness John R. Wells, Elizabeth A. Raabe Pub. Date: November 14, 2005 Product#: 9-706-450 Setting Setting: Russia; Food industry; $25 million revenues; 2002 Setting: United States; Retail industry; large; $68 billion revenues; 440,000 employees; 1994 Setting: United States; Fitness industry; $954 million revenues; 22,200 employees; 20032004 Description Designed as an overview of all aspects of the strategy process: industry analysis, positioning, dynamics and sustainability, and scope issues of corporate strategy, including vertical integration, horizontal diversification, and location issues. Ice-Fili is the largest ice cream producer in Russia in 2002, but is facing strong competition from Nestle despite its success over other multinational competitors. Contains detailed exhibits, allowing deeper analyses. Teaching Purpose: To introduce students to strategy. Subjects Covered: Business policy, Competition, Competitive strategy, Corporate strategy, Emerging markets, Five forces, Food processing industry, General management, Industry analysis, Manufacturing industry, Russia, Strategy formulation. Description: Focuses on the evolution of Wal-Mart's remarkably successful discount operations and describes the company's more recent attempts to diversify into other businesses. The company has entered the warehouse club industry with its Sam's Clubs and the grocery business with its Supercenters, a combination supermarket and discount store. Wal-Mart experienced a drop in the value of its stock price in early 1993, which it still has not made up. Wal-Mart has advantages over its competitors in areas such as distribution, information technology, and merchandising, to name a few. Subjects Covered: Competition, Discount department stores, Industry structure, Strategy formulation, Strategy implementation. A modest health and tennis club in 1962, Bally Total Fitness had grown to become one of the major firms in the $14 billion U.S. health club industry in 2004. Throughout its history, Bally had faced its share of challenges as it rose to become a leading health club operator. The last couple of years had proven particularly difficult, however: Bally's stock price had collapsed, it restated earnings in 2003 to the chagrin of stockholders, and the U.S. Securities and Exchange Commission began investigating the company's accounting procedures. Also, Bally faced significant competition from the likes of privately owned 24 Hour Fitness, which had $1 billion in sales in 2003. In 2004, under the direction of CEO Paul Toback, the company streamlined advertising efforts--targeting undertapped segments of the population--cut costs, and modified the firm's internal controls. Management's focus remained on increasing membership and maximizing revenue per member. Would Toback's efforts get the company's price back up, inspire stockholder confidence in Bally, and resist a rumored takeover, enabling Bally to remain a major player in the industry? A rewritten version of earlier cases. Subjects Covered: Accounting, Competitive strategy, Five forces, Health, Industry analysis, Industry structure, Profits, Service organizations. Nucor at a Crossroads Publication Date: Aug 31, 1992 Availability: In Stock Author(s): Pankaj Ghemawat, Henricus J. Stander III Type: Case (Field) Product Number: 9-793-039 Revision Date: Jan 20, 1998 Length: 22p Setting: Charlotte, NC; Steel industry; Fortune 500; $1 billion assets; 1987 2. The External Environment: Opportunities, Threats, Industry Competition, and Competitor Analysis. Setting Crown Cork & Seal in 1989 Publication Date: Mar 1, 1993 Revision Date: Jul 26, 2005 Availability: In Stock Author(s): Stephen P. Bradley, Sheila Cavanaugh Type: Case (Library) Product Number: 9-793-035 Length: 21p Teaching Note Setting: United States; Packaging, carton & container industries; Fortune 500; $1.8 billion revenues; 1989 Computer Reservation Systems : An Industry of Its Own Ali F. Farhoomand, Andrew Lee Pub. Date: January 01, 2000 Product#: HKU055 Description Setting: Global; Airline industry; 1998 The Pharmaceutical Industry: Challenges in the New Century Stephen P. Bradley; James B. Weber ©2003 (revision 2004) 32 pages Product#: 703489 Yahoo!: Business on Internet Time Jan W. Rivkin, Jay Girotto Pub. Date: July 10, 1999 Product#: 9-700-013 Description: Nucor is a minimill deciding whether to spend a significant fraction of its net worth on a commercially unproven technology in order to penetrate a large but hitherto inaccessible segment of the steel market. This case is an integrative one designed to facilitate full-blown analysis of a strategic investment decision. Subjects Covered: Capital investments, Competition, Economic analysis, Expansion, Technological change. Assignment Sheet and Assessment Rubric Available Setting: Internet & online services industries; $30 billion market value; 900 employees; 1999 Description: Describes the structure and recent trends of the metal container industry, Crown's successful strategy for competing in the industry, and John Connelly's leadership over more than 20 years. In 1989, William Avery succeeded Connelly as CEO and is forced to consider new strategic options in the face of industry change. May be used with How Global Brands Compete (R0409D) 8p Douglas B. Holt, John A. Quelch, Earl L. Taylor Assignment Sheet and Assessment Rubric Available Computer Reservation Systems (CRS) vendors have enjoyed an indispensable role in the travel industry--75% to 80% of all airline bookings are made by travel agents using CRSs. But by mid-1998, their solid position in the industry is being threatened by two forces: the Web Sites run by airlines that are capable of accepting bookings directly from customers, and a new CRS, supported by travel agencies around the world, called Genesis. It is scheduled to go on trial in fourth quarter of 1998 and for launch in 1999. Subjects Covered: Corporate strategy, Electronic commerce, Five forces, Travel. Provides a broad overview of the numerous internal and external forces that were driving change in the global pharmaceutical industry in 2003. These forces—including downward price pressures, political and social pressures, increased development costs, new technologies, new and different competitors, consolidation, and threats to its basic business models—were changing the way drugs were discovered, developed, manufactured, tested, regulated, marketed, sold, and purchased. A rewritten version of an earlier case. Subjects Covered: Business & government, Competitive strategy, General management, Global Research Group, Industry analysis, Industry structure, Management of change, Manufacturing industry, Organizational behavior & leadership, Pharmaceuticals industry. Description: In the wake of major competitive moves, CEO Tim Koogle and his senior team at Yahoo!, an Internet portal, must decide whether and how to adjust their strategy. Following deals between AOL and Netscape, Excite and @Home, Infoseek and Disney, and Snap and NBS, Yahoo! faces the prospect of being the last portal without a significant partner. Students must grapple with the benefits and costs of integration in the rapidly changing world of the Internet. Special emphasis is given to the interactions among Yahoo!'s functions and the effects of those interactions on firm flexibility. Subjects Covered: Competition, Internet, Search engines, Strategy formulation. 3. The Internal Environment: Resources, Capabilities, and Core Competencies Setting Description Starbucks is faced with the issue of how it should leverage its core competencies against various opportunities for growth, including introducing its coffee in McDonalds, pursuing further expansion of its retail operations, and leveraging the brand into other product areas. The case is written so that students need to first identify where Starbucks’ competencies lie along the value chain, and then assess how well those competencies can be leveraged across the various alternatives. Also provides an opportunity for students to assess what is driving growth in this company. Starbucks has a tremendous appetite for cash since all its stores are corporate, and investors are betting that it will be able to continue its phenomenal growth so it needs to walk a fine line between leveraging its brand to achieve growth and not eroding it in the process. Starbucks Mary M. Crossan; Ariff Kachra ©1998, 28 pages Product#: 98M006 Documentum, Inc. Rajiv Lal , Sean Lanagan Pub. Date: September 18, 2001 Product#: 9-502-026 Digital Angel Youngme Moon, Kerry Herman Pub. Date: November 09, 2001 Product#: 9-502-021 Adolph Coors in the Brewing Industry Publication Date: Aug 20, 1987 Availability: In Stock Author(s): Pankaj Ghemawat Type: Case (Library) Product Number: 9-388-014 Revision Date: Jun 23, 1992 Length: 21p Setting: Silicon Valley; Software industry; start-up; $2 million revenues; 20 employees; 1993 Setting: Palm Beach, FL; 2001 Setting: United States; Fortune 500; 1975-1985 Subjects Covered: Brands, Competitive strategy, Core competency, Corporate strategy, Entrepreneurship, Fast food industry, Growth strategy, Industry analysis, Marketing strategy, Product management, Service industry. Description: Describes Jeff Miller's attempt to implement Geoffrey Moore's crossing the chasm ideas at enterprise software vendor, Documentum. Subjects Covered: Entrepreneurial management, Information technology, Market selection, Marketing strategy, New product marketing, Sales strategy, Software. Description: Digital Angel is considering the appropriate marketing plan for the launch of its new locator device. The device, a watch and pager worn in combination, provides GPS location information and monitors heart rate and body temperature via body sensors. Parents of young children and caregivers of Alzheimer's patients are the initial target markets for the device, but at least 26 potential markets have been identified for the product. Building a brand and generating positive word of mouth are central to the marketing plan decision. But the technology also raises concerns over privacy issues, and the benefits of the product are complex and challenging to communicate. Subjects Covered: Advertising strategy, Consumer marketing, Innovation, Marketing planning, New product marketing, Product development, Product introduction, Technology. Description: Describes a company that had traditionally followed a strategy quite distinct from its major competitors', its eventual decision to imitate them, and its subsequent performance. Subjects Covered: Beverages, Competition, Industry analysis, Industry structure. Assignment Sheet and Assessment Rubric Available 4. Business Level Strategy Airborne Express (A) Publication Date: Feb 5, 1998 Revision Date: Dec 7, 1999 Availability: In Stock Author(s): Jan W. Rivkin Type: Case (Library) Product Number: 9-798-070 Length: 23p Teaching Note Samsung Electronics Publication Date: Jun 30, 2005 Revision Date: Jul 29, 2006 Availability: In Stock Author(s): Jordan Siegel, James Jinho Chang Type: Case (Field) Product Number: 9-705-508 Language: English Length: 26p Teaching Note Setting United States; Express delivery; $2.5 billion revenues; 20,000 employees; 1997 China; Global; South Korea; Electronics industry; Semiconductor industry; $78.5 billion revenues; 113,000 employees; 2005 Setting: Radio; 2002 XM Satellite Radio (A) David B. Godes, Elie Ofek 25 pages ©2003 (Update 2004) Product#: 9 504009 The Brita Products Co. John Deighton Pub. Date: August 30, 1999 Product#: 9-500-024 Setting: United States; Consumer products; $200 million revenues; 1989-1999 Description In the wake of a highly successful quarter, senior managers of Airborne Express, the third largest player in the express mail industry, review the firm's competitive position. Airborne has survived, and recently prospered, in an industry with significant economies of scale even though it is much smaller than industry giants Federal Express and United Parcel Service. The case challenges students to understand Airborne's unusual position. Detailed data allow students to analyze Airborne's relative cost position, the fit among its activities, the differences between Airborne and its rivals, and the evolution of its industry. Using these analyses, students make recommendations concerning the firm's pricing policy, its globalization efforts, and a partnership with a related company. Designed to be taught in a course on business-unit strategy. May be used with Selected Exhibits from Airborne Express (A), Spreadsheet (9-703-751). When is it possible to create a dual advantage of being both low cost and differentiated? In this case, students assess whether Samsung Electronics has been able to achieve such a dual advantage, and if so, how this was possible. Moreover, Samsung Electronics' long-held competitive advantage is under renewed attack. Students also can assess how Samsung should respond to large-scale Chinese entry into its industry. XM Satellite Radio is a radically new way to listen to radio. Management must develop a marketing strategy to launch the firm and the category. A crucial aspect of the strategy is to determine which of two business models the company will pursue. Should it focus predominantly on charging customers a monthly subscription fee or on selling advertising time to advertisers? This decision is closely related to target market selection and to the choice of optimal price points for subscription fees and radio receivers. Market research commissioned by XM provides rich insights into these issues. In addition, XM management needs to figure out how to establish partnerships with the leading electronics manufacturers. A consideration of its market share and channel presence are essential to XM’s ultimate success in integrating satellite radio into home and car audio systems. As it formulates its plan, XM needs to take into account the competitive landscape, primarily comprised of broadcast radio (AM and FM) that has been in existence for many years and is offered for free, as well as a second satellite radio provider (Sirius). Subjects Covered: Broadcasting industry, Business models, Communications industry, Competition, Competitive strategy, Corporate strategy, Decision making, Entertainment industry, General management, Managerial skills, Managers, Marketing strategy, Pricing, Product introduction, Product life cycle, Product management, Service industry, Services, Technology. Description: Clorox's Brita skillfully exploits a tide of water safety concerns, growing a home water (filtration) business from inception to a 15% U.S. household penetration in ten years. The dilemma in the case arises as the period of increasing returns seems to be drawing to a close, and management must use its legacy, an installed based and a strong brand equity, to take the business forward into a less friendly environment. Students can model the relation between the primary demand for pitchers and the derived demand for filters to decide where they want to put future investments. Subjects Covered: Marketing management, New product marketing, Test markets, Water pollution. Assignment Sheet and Assessment Rubric Available Inside Intel Inside Youngme Moon, Christina Darwall Pub. Date: June 05, 2002 Product#: 9-502-083 Callaway Golf Co. Publication Date: Aug 11, 2000 Availability: In Stock Author(s): Rajiv Lal, Edith D. Prescott Type: Case (Field) Product Number: 9-501-019 Revision Date: Sep 26, 2005 Length: 23p 5. Competitive Rivalry & Competitive Dynamics Matching Dell Publication Date: Jun 6, 1999 Availability: In Stock Author(s): Jan W. Rivkin, Michael E. Porter Type: Case (Library) Product Number: 9-799-158 Language: English Length: 31p Teaching Note Setting: California; Semiconductor industry; $26 billion revenues; 83,000 employees; 2002 Setting: Carlsbad, CA; Golf; $800 million revenues; 1999 Setting Global; Computer industry; Fortune 500; $19 billion revenues; 1998 Setting: United States; Global; Beverage industry; Fortune 500; 2000 Cola Wars Continue: Coke vs. Pepsi in the Twenty-First Century David B. Yoffie; Yusi Wang ©2004, 24 pages Product#: 702442 Description: In early 2002, Pamela Pollace, vice president and director of Intel's worldwide marketing operations, is debating whether the company should extend its "Intel Inside" branding campaign to non-PC product categories, such as cell phones and PDAs. The "Intel Inside" campaign has been one of the most successful branding campaigns in history. However, the campaign is more than ten years old, and growth in the PC market appears to be stagnating. In contrast, sales of portable digital devices--such as PDAs and cell phones-appear to be growing at a healthy rate. Pollace is debating whether the "Intel Inside" campaign will work in these other product categories, even though Intel doesn't dominate these other markets like it does the PC market, and it isn't clear that consumers will associate Intel with these other markets. Subjects Covered: Advertising, Brands, Consumers, Direct marketing. Description: Describes a situation faced by Mr. Ely Callaway, the 80-year-old founder, chairman, and CEO of Callaway Golf Co., in the fall of 1999. After a decade of stunning success with the marketing concept, Callaway suffered a significant loss and witnessed a steep decline in sales in 1998. Mr. Callaway had built a $800 million business by making a truly more satisfying product for the average golfer, making it pleasingly different from the competition and communicating the benefits to the consumer. The results in 1998 forced Mr. Callaway to reconsider the marketing program that had successfully supported the product until now. Subjects Covered: Consumer marketing, Distribution channels, Marketing mixes, Marketing strategy. Assignment Sheet and Assessment Rubric Available Description After years of success with its vaunted "Direct Model" for computer manufacturing, marketing, and distribution, Dell Computer Corp. faces efforts by competitors to match its strategy. This case describes the evolution of the personal computer industry, Dell's strategy, and efforts by Compaq, IBM, Hewlett-Packard, and Gateway 2000 to capture the benefits of Dell's approach. Students are called on to formulate strategic plans of action for Dell and its various rivals. Examines the industry structure and competitive strategy of Coca-cola and Pepsi over 100 years of rivalry. New challenges of the 21st century included boosting flagging domestic cola sales and finding new revenue streams. Both firms also began to modify their bottling, pricing, and brand strategies. They looked to emerging international markets to fuel growth and broaden their brand portfolios to include noncarbonated beverages like tea, juice, sports drinks, and bottled water. For over a century, Coca-Cola and Pepsi-Cola had vied for the "throat share" of the world's beverage market. The most intense battles of the cola wars were fought over the $60 billion industry in the United States, where the average American consumes 53 gallons of carbonated soft drinks (CSD) per year. In a "carefully waged competitive struggle," from 1975 to 1995 both Coke and Pepsi had achieved average annual growth of around 10% as both U.S. and worldwide CSD consumption consistently rose. This cozy situation was threatened in the late 1990s, however, when U.S. CSD consumption dropped for two consecutive years and worldwide shipments slowed for both Coke and Pepsi. The case considers whether Coke's and Pepsi's era of sustained growth and profitability was coming to a close or whether this apparent slowdown was just another blip in the course of a century of enviable performance. A rewritten version of an earlier case by Michael E. Porter and David B. Yoffie. Subjects Covered: Beverages, Competition, Competitive strategy, Corporate strategy, Food processing industry, Global business, Industry analysis, Industry structure, International business Assignment Sheet and Assessment Rubric Available Wal-Mart Stores in 2003 Publication Date: Sep 18, 2003 Availability: In Stock Author(s): Pankaj Ghemawat, Stephen P. Bradley, Ken Mark Type: Case (Library) Product Number: 9-704-430 Language: English Revision Date: Jan 30, 2004 Length: 32p Apple Computer—2002 David B. Yoffie, Yusi Wang Product Number: 9-702-469 Apple Computer, 2005 David B. Yoffie, Barbara J. Mack Product Number: 9-705-469 Bitter Competition: The Holland Sweetener Co. vs. NutraSweet (A) Publication Date: Dec 28, 1993 Availability: In Stock Author(s): Adam Brandenburger, Maryellen Costello, Julia Kou Type: Case (Field) Product Number: 9-794-079 Revision Date: Nov 13, 2000 Length: 14p 6. Corporate Level Strategy Cooper Industries’ Corporate Strategy (A) David J. Collis; Toby Stuart 1991 (Update 1995) 26 pages Product#: 391095 Setting: United States; Retail industry; $245 billion revenues; 19652003 Setting: Global; Personal computer industry; Fortune 500; $5.4 billion revenues; 9,600 employees; 1977-2002 Setting: United States; Computer industry; Consumer electronics; $8.2 billion revenues; 11,695 employees; 2004-2005 Setting: Global; Sugars & sweeteners industry; large; $2 billion revenues; 1965-1992 Setting Description: Examine's Wal-Mart's development over three decades and provides financial and descriptive detail of its domestic operations. In 2003, Wal-Mart's Supercenter business has surpassed its domestic business as the largest generator of revenues. Its international operation seems poised to become the next growth driver for the company as it marches toward the trillion dollar sales mark. But problems are starting to surface even as the company is winning recognition as the number one company in the Fortune 500--unions keep pressuring its minimum-wage employees and allegations of gender discrimination are alleged. Teaching purpose: To introduce students to creating a competitive advantage. Subjects Covered: Competitive advantage, Corporate strategy, Discount department stores, Distribution planning, Information technology, International business, Management controls, Mass merchandising. Assignment Sheet and Assessment Rubric Available Description: In 1980, Apple was the leader of the personal computer industry, but by 2002 it had suffered heavy losses at the hands of the Wintel camp. This case examines Apple's strategic moves as the PC industry evolves in the 21st century and poses the question: Can Steve Jobs make Apple "insanely great" again? Subjects Covered: Competitive advantage, Corporate strategy, Industry analysis, Strategy formulation. Description: Apple has reaped the benefits of its innovative music player, the iPod. However, its PC and server business continue to hold small market share relative to the worldwide computer market over the past few years. Will the iPod lure new users to the Mac? Will Apple be able to produce another cutting-edge device quickly? Subjects Covered: Computer systems, Innovation. Description: The NutraSweet Co. has very successfully marketed aspartame, a low-calorie, high-intensity sweetener, around the world. NutraSweet's position was protected by patents until 1987 in Europe, Canada, and Japan, and until the end of 1992 in the United States. The case series describes the competition that ensued between NutraSweet and the Holland Sweetener Co. (HSC) following HSC's entry into the aspartame market in 1987. Describes the subsequent move and countermove in both the marketplace and the courts. Also, discusses the business "game" that takes place at both the tactical and value levels. Ends with the final countdown to the expiration of NutraSweet's U.S. patent. Subjects Covered: Beverages, Competition, Food, Game theory, Patents, Strategy formulation. Assignment Sheet and Assessment Rubric Available Description Describes the development of a successful corporate strategy based on the acquisition and subsequent consolidation of low-technology manufacturing companies. Starting with a company history and discussion of current business segments, the case goes on to detail the innovation of corporate headquarters in strategy formulation and operations. Highlights the synergistic possibilities in alike acquisitions and addresses the issue of long-term value creation in acquisition-oriented firms. Emphasis is placed on the systems and procedures installed to implement the corporate strategy. Subjects Covered: Acquisitions, Competition, Competitive strategy, Corporate strategy, Finance, Mergers, Mergers & acquisitions, Strategic planning, Strategy formulation, Strategy implementation. Allianz (A1): An Insurer Acquiring a Bank? Joseph L. Bower, Marc L. Bertoneche, Anders Sjoman, Sonja E. Hout Pub. Date: August 16, 2004 Product Number: 9-305-013 Google, Inc. Publication Date: Jan 12, 2006 Revision Date: Feb 21, 2006 Availability: In Stock Author(s): Thomas R. Eisenmann, Kerry Herman Type: Case (Library) Product Number: 9-806-105 Language: English Length: 34p Teaching Note Newell Rubbermaid: Strategy in Transition Cynthia A. Montgomery, Rhonda Kaufman, Carole A. Winkler Pub. Date: March 23, 2004 Product Number: 9-704-491 7. Acquisition and Restructuring Strategies Hewlett-Packard-Compaq: The Merger Decision Publication Date: Apr 8, 2004 Revision Date: Sep 14, 2004 Availability: In Stock Author(s): Krishna G. Palepu, Jonathan Barnett Type: Case (Library) Product Number: 9-104-048 Length: 32p Setting: Germany; Financial services; 37 billion euros revenues; 2000-2001 Mountain View, CA; United States; Advertising industry; Internet & online services industries; Software industry; $6.1 billion revenues; 5,000 employees; 2005 Description: The deal of the year in 2002, was the acquisition of Dresdner Bank by Allianz. Written from the perspectives of Allianz's CEO, Henning Schulte-Noelle, before and after the deal and a regional manager implementing the concept of a full-line financial service provider. Presents the original question facing Schulte-Noelle: "Should Allianz acquire Dresdner?" Subjects Covered: Acquisitions, Banking, Financial services, Implementation, Insurance, Strategic planning. Describes Google's history, business model, governance structure, corporate culture, and processes for managing innovation. Reviews Google's recent strategic initiatives and the threats they pose to Yahoo, Microsoft, and eBay. Asks what Google should do next. One option is to stay focused on the company's core competence, i.e., developing superior search solutions and monetizing them through targeted advertising. Another option is to branch into new arenas, for example, build Google into a portal like Yahoo or MSN; extend Google's role in e-commerce beyond search, to encompass a more active role as an intermediary (like eBay) facilitating transactions; or challenge Microsoft's hegemony over the PC desktop by developing software to compete with Office and Windows. A rewritten version of an earlier case. Setting: United States; Personal care products; Household product industry; $7.75 billion revenues; 47,000 employees; 2001-2003 Setting Computer industry; $70 billion revenues; 140,000 employees; 20012002 Description: Describes the transformation of a company's corporate-level strategy. Begins by laying out the strategy that brought the Newell Co. stunning success for nearly three decades. The highly integrated, internally consistent strategy was tailored for manufacturing and selling a particular genre of products to a particular kind of customer. In the mid-1990s, Newell encountered some shifts in its competitive environment and a subtle erosion in profits. In 1999, the $3.5 billion company paid a 49% premium to acquire the $2.5 billion Rubbermaid Co., in part for its product development process and strong consumer brands. After the acquisition, the profits of the combined enterprise deteriorated at an accelerated rate and the CEO was replaced. In less than a year, a fundamentally new strategy was announced, profits improved, and both Wall Street and major retailers were encouraged. Some setbacks followed, leading to reduced earnings and revised expectations. Exposes students to the pains and struggles of changing a deeply ingrained and long-lived strategy. Also forces them to confront the question of whether the new strategy is the right one and the markers one should seek to prove the case. Subjects Covered: Acquisitions, Competition, Corporate strategy, Mergers, Mergers & Acquisitions, Strategic planning, Strategy formulation, Strategy implementation. Description Hewlett-Packard's proposed $24 billion acquisition of rival Compaq marked the largest merger in the history of the computer industry. The merger was Hewlett-Packard's response to sweeping changes impacting the technology industry. The severity of the stock market's reaction to the deal's announcement, coupled with a "slim but sufficient" 51.4% shareholder approval margin, left many wondering whether the deal was beneficial for shareholders. The Debate Over Unbundling General Motors: The Delphi Divestiture and Other Possible Transactions Publication Date: Nov 8, 1999 Revision Date: Jun 12, 2002 Availability: In Stock Author(s): Malcolm S. Salter Type: Case (Library) Product Number: 9-800-196 Length: 18p Marks & Spencer: The Phoenix Rises Publication Date: May 2, 2003 Availability: In Stock Author(s): Joseph L. Bower Type: Case (Field) Product Number: 9-303-096 Revision Date: Nov 17, 2005 Length: 29p 8. . International Strategy United States; Automotive industry; Fortune 500; $180 billion revenues; 350,000 employees; 1999 Setting: London; Retail industry; 8 billion pounds revenues; 70,000 employees; 2000-2002 Setting Description: The great U.K. retailer fell on hard times in 1998. In 2001, a new CEO was recruited who appears to have succeeded in turning around this world-renown company. This case examines the steps he took (strategic, structural, and recruiting key people) and highlights a series of fundamental questions that remain. Can the company regain its premium retail brand given the new competition and given the breadth of market segments that it addresses under one roof? Are the new approaches to sourcing and segmentation sound? Should the firm seriously consider reentering the international retail markets? Subjects Covered: Brands, Corporate strategy, Market segmentation, Teams. Assignment Sheet and Assessment Rubric Available Description In 1998, Newell Co., a manufacturer of low-tech, high-volume consumer goods, acquired Calphalon Corp., a high-end cookware company, and Rubbermaid, a $2 billion manufacturer of consumer and commercial plastic products. The case focuses on Newell’s strategy and its elaboration throughout the organization, as well as the importance of selecting appropriate acquisitions to grow the company. Do Calphalon and Rubbermaid fit with the company’s long-term strategy of growth through acquisition and superior service to volume customers? A rewritten version of an earlier case.. Newell Co.: Corporate Strategy Cynthia A. Montgomery; Elizabeth J. Gordon ©1999 22 pages (updated) Product#: 799139 P&G Japan: The SK-II Globalization Project Christopher A. Bartlett ©2004, 24 pages Product#: 303003 Ever since General Motors (GM) announced in February 1997 its intention to divest Delphi Automotive Systems--its upstream parts manufacturing operations--Wall Street had called for further unbundling, and various stakeholders competed for their claim of value represented by GM. The case presents GM's four options for the Delphi unit and raises valuation and governance issues regarding the remaining corporate assets. A rewritten version of an earlier case. Setting: Japan; United States; Consumer products; $38 billion revenues; 110,000 employees; 1999 Subjects Covered: Acquisitions, Competitive strategy, Consumer goods, Consumer products industry, Corporate strategy, Diversification, Entrepreneurship, Growth strategy, Household products, Manufacturing industry, Mergers & acquisitions, Strategic planning. Traces changes in P&G’s international strategy and structure, culminating in Organization 2005, a reorganization that places strategic emphasis on product innovation rather than geographic expansion and shifts power from local subsidiary to global business management. In the context of these changes introduced by Durk Jager, P&G’s new CEO, Paolo de Cesare is transferred to Japan, where he takes over the recently turned-around beauty care business. Within the familiar Max Factor portfolio he inherits is SK-II, a fastgrowing, highly profitable skin care product developed in Japan. Priced at over $100 a bottle, this is not a typical P&G product, but its successful introduction in Taiwan and Hong Kong has de Cesare thinking the brand has global potential. As the case closes, he is questioning whether he should take a proposal to the beauty care global business unit to expand into Mainland China and/or Europe Subjects Covered: Asia, Consumer products industry, Corporate strategy, Cosmetics, General management, Global business, Globalization, Innovation, Innovation & entrepreneurship, International business, International management, International marketing, Japan, Manufacturing industry, Marketing, Multinational corporations, Operations management, Organization, Organizational structure, Product development, , Strategy implementation, Subsidiaries. Lincoln Electric: Venturing Abroad Christopher A. Bartlett, Jamie O'Connell Pub. Date: January 14, 1998 Product Number: 9-398-095 Atlas Electrica: International Strategy Michael E. Porter, Arturo Condo Pub. Date: November 07, 2003 Product#: 704435 Philips versus Matsushita: A New Century, a New Round Christopher A. Bartlett Pub. Date: September 21, 2001 Product Number: 9-302-049 Setting: Asia; Europe; United States; Welding; $1.1 billion revenues; 6,300 employees; 1988-1997 Setting: Appliance industry; $43 million revenues; 850 employees; 2000 Setting: Global; Europe; Japan; Electronics industry; large; $40 billion-$60 billion revenues; 270,000 employees; 19702001 Description: Lincoln Electric, a 100-year-old manufacturer of welding equipment and consumables based in Cleveland, Ohio, motivates its U.S. employees through a culture of cooperation between management and labor and an unusual compensation system based on piecework and a large bonus based on individual contribution to the company's performance. Despite opening a few international sales and production ventures in Canada, Australia, and France, Lincoln remained focused on manufacturing in the United States until 1988. At that time, the company's new CEO expanded manufacturing through acquisitions and greenfields in 11 new countries, attempting to transfer its unique management philosophy to each. However, Lincoln was unable to replicate its highly productive system abroad. Operational problems led to a major restructuring in the early 1990s, supervised by Anthony Massaro, a newcomer to the company. In 1996, Massaro was named CEO and set about expanding the company's manufacturing base through a new strategy. The case concludes in Asia, where Lincoln's regional president is trying to decide whether and how to establish a manufacturing presence in Indonesia, and in particular whether to try to transfer Lincoln's unique incentive-driven management system. Subjects Covered: Incentives, International business, International operations, Manufacturing, Multinational corporations, Strategy implementation. Description: Atlas must decide whether to acquire La Indeca, increasing its Central American presence, or to focus on larger Latin American markets where higher growth is possible. In the year 2000, Jorge Rodriguez was in charge of Atlas Electrica, the largest home appliance firm in Central America. Although it had almost doubled its sales in the 1990s, by the end of the decade Atlas was experiencing a declining market share in its home region and facing increasing competition from outside the region, especially from Mexican and Korean multinationals. At the time, Atlas' main competitor in Central America, El Salvador-based Indeca, was up for sale. Atlas Electrica, based in Costa Rica, served more than a dozen Latin American countries. Since its establishment in 1961, it had served Central American markets with different types of home appliances, later focusing on white-goods for middle-income segments of Central American consumers. In the mid-1990s, through a strategic alliance with Sweden's AG Electrolux, Atlas had expanded to Latin American markets beyond Central America. Subjects Covered: Alliances, Competitive advantage, Developing countries, Emerging markets, Globalization. Description: Describes the development of the international strategies and organizations of two major competitors in the global consumer electronics industry. The history of both companies is traced and their changing strategic postures and organizational capabilities are documented. Particular attention is given to the major restructuring each company is forced to undertake as its competitive position is eroded. A rewritten version of an earlier case. Subjects Covered: Competition, Electronics, International operations, Multinational corporations, Organizational change, Organizational structure, Strategy implementation. 9. Cooperative Strategy The Renault-Nissan Alliance Publication Date: May 9, 2003 Availability: In Stock Author(s): Michael Y. Yoshino, Perry L. Fagan Type: Case (Field) Product Number: 9-303-023 Length: 26p Honda-Rover (A): Crafting an Alliance Publication Date: Mar 1, 1999 Revision Date: Nov 6, 2001 Availability: In Stock Author(s): James K. Sebenius, Ashish Nanda, Ron S. Fortgang Type: Case (Library) Product Number: 9-899-223 Length: 28p Millennium Pharmaceuticals, Inc. (A) Stefan Thomke; Ashok Nimgade Pub. Date: December 21, 1999 Product#: 600038 Setting Japan; France; Automotive industry; $36 billion revenues; 140,000 employees; 20022003 United Kingdom; Europe; Automotive industry; large; $7 billion revenues; 40,000 employees; 1979-1993 Description On Wednesday, May 29, 2002, the board of directors of Renault-Nissan BV (RNBV) met for the first time to discuss the state of the alliance between Renault SA and Nissan Motors-two of the world's largest automakers. RNBV was a 50/50 joint venture company established in March of that year to oversee the strategy of the alliance and all activities undertaken jointly by Renault and Nissan. The new company would "steer alliance strategy and supervise common activities on a global level, while respecting the identity and culture of each company and not interfering in operations." Executives at both companies believed much had been accomplished in the first three years of the alliance. Nissan, under Carlos Ghosn's leadership, had improved its finances dramatically and was rapidly reemerging as a major player in the global auto industry. Moreover, the alliance partners were in line with their initial forecast of $3.3 billion in cost savings and synergies promised by 2002, according to their internal reporting. As the board prepared to meet, Louis Schweitzer and Ghosn believed the alliance faced difficult challenges ahead. To what extent would the two companies be able to realize further savings and synergies, particularly in the areas of manufacturing and additional sales? How should the RNBV board address issues that had surfaced as employees of the two firms worked together across disparate corporate and national cultures, functions, and geographies? Ultimately, would the two firms be able to strike a balance between deepening their alliance while "respecting the identity and culture of each company and not interfering in operations?" Faced with vexing financial challenges in 1993, British Aerospace (BAe) is determined to shed its loss-making automaker, Rover. It offers to sell its stake in Rover to Honda, Rover's partner since 1979, but Honda is reluctant to raise its stake in Rover. Meanwhile, BMW approaches BAe with a confidential bid to buy out Rover. This case places these developments within the context of the history of the British auto industry, Rover's heritage, evolution of the Honda-Rover partnership, and the rationale for BMW's interest in Rover. The case series describes subsequent developments. Focuses on Millennium’s strategy to grow and revolutionize drug development through the use of new technologies such as genomics. Describes how Millennium Pharmaceuticals—a fast-growing biotechnology firm in Cambridge, MA—has used strategic alliances to finance the development of technology platforms based on the latest breakthroughs in genomics. As the firm considers developing pharmaceutical drugs itself, they face a number of challenges: 1) Can they revolutionize drug development by making it more predictable, faster, and less costly? 2) How should they select their alliances such that they move closer to becoming a pharmaceutical firm and still attract the funding needed for their strategy? 3) How can they continue to grow rapidly and attract and retain some of the best minds in the pharmaceutical industry? Subjects Covered: Alliances, Biotechnology, Competitive strategy, Corporate strategy, Employee retention, Entrepreneurship, Financing, Innovation & entrepreneurship, Marketing, Operations management, Pharmaceuticals, , Product development, Product life cycle, Strategy implementation. Migros Forest L. Reinhardt, Vincent Dessain, Anders Sjoman Pub. Date: December 14, 2005 Product Number: 9-706-028 Setting: Switzerland; Agribusiness; Food industry; Retail industry; $4.2 billion Swiss francs revenues; 9,700 employees; 2005 Setting: Global; Coffee; 2002 Starbucks and Conservation International James E. Austin, Cate Reavis Pub. Date: April 01, 2003 Product Number: 9-303-055 10. Corporate Governance Vivendi: Revitalizing a French Conglomerate (A) Cynthia A. Montgomery, John M. Turner ©1998 (Update 2003) 21 pages Product#: 799019 The Case for Contingent Governance Paul Strebel Product Number: 9-SMR-127 Setting Description: In October 2005, Urs Riedener, head of marketing at Swiss retailer Migros, is contemplating the company's competitive position. Primarily a retailer for foods and near-foods products, the cooperative Migros, with close to 600 retail outlets in Switzerland (but only four outside its domestic market), is facing stiffer competition, both from existing competitors (such as Coop) and new arrivals (such as hard discounters Lidi and Aldi). Riedener and Migros management have so far always had faith in Migros' position in the marketplace, built around its governance structure (the customers were also the owners, creating a close link between the retailer and the market) and its emphasis on never selling harmful products. Socially, ecologically, and ethically produced products was a key aspect of Migros' product offering. Riedner knows that Migros benefited from a unique position--and he wants to make sure that Migros defends it from both new and old competitors. Subjects Covered: Agribusiness, Competitive advantage, Competitive environment, Cooperatives, Corporate governance, Environmental protection, Food, International business, Product differentiation, Social enterprise, Strategy, Supply chain. Description: Starbucks, the world's leading specialty coffee company, developed a strategic alliance with Conservation International, a major international environmental nonprofit organization. The purpose of the alliance was to promote coffee-growing practices of small farms that would protect endangered habitats. The collaboration emerged from the company's corporate social responsibility policies and its coffee procurement strategy. The initial project was in the southern Mexican state of Chiapas and resulted in the incorporation of shade-grown coffee into the Starbucks product line, providing an attractive alternative market for the farmer cooperatives at a time when coffee producers were in economic crisis due to plummeting world prices. Simultaneously, the company had to deal with growing pressures from nonprofit organizations in the Fair Trade movement, demanding higher prices for farmers. Starbucks was reviewing the future of its alliance with Conservation International and its new coffee procurement guidelines aimed at promoting environmentally, socially, and economically sustainable coffee production. The nature of the industry puts the case in the global context from both the supply and demand sides. Subjects Covered: Agribusiness, Beverages, Corporate responsibility, Social enterprise, Strategic alliances. Description Examines corporate strategy for a diversified firm in the French business context. Issues include corporate governance, vision, and the management of unrelated diversification. After the company’s first loss ever, the Vivendi board elected a new chairman who completed a financial restructuring and articulated a new corporate strategy. His actions were in part determined by the French business environment, which does not easily permit staff reductions, and by the increasing importance of foreign investors in France. Subjects Covered: Business conditions, Competitive strategy, Conglomerates, Corporate culture, Corporate governance, Corporate strategy, Diversification, Economic conditions, Europe, France, General management, Leadership, Manufacturing industry, Organizational structure, Service industry, Vision Description: Many corporate boards adopt a one-size-fits-all approach to governance. Instead, they should consider that their primary role must shift depending on various conditions, both internal and external. Boards have four main functions--auditing, supervising, coaching, and steering--each with a different perspective and behavior. The roles reflect two main differences in board culture. The first type of board concerns itself mainly with shareholder interests or shareholder plus other stakeholder interests. The focus is on externalities. The second type of board either monitors executives' activities or gets actively involved in the conduct of the organization. Here the focus is on handling ineffective management. The basic role types are not mutually exclusive; instead they reflect different board cultures that result from different emphases on decision making and resource allocation. During any time period, a board must determine what its dominant role should be, given the current conditions. Subjects Covered: Corporate culture, Corporate governance, Corporate strategy, Leadership, Organizational behavior, Shareholders relations. The Board of Directors at the Coca-Cola Co. Jay W. Lorsch, Rakesh Khurana, Sonya Sanchez Pub. Date: August 11, 2003 Product Number: 9-404-039 11. Organizational Structures & Controls Setting: Atlanta, GA; Soft drink industry; $20 billion revenues; 2002-2003 Setting Sampa Video, Inc. Publication Date: Jun 13, 2001 Availability: In Stock Author(s): Gregor Andrade Type: Case (Gen Exp) Product Number: 9-201-094 Revision Date: Oct 7, 2003 Length: 3p 12. Strategic Leadership GE’s Two-Decade Transformation: Jack Welch’s Leadership Christopher A. Bartlett; Meg Wozny ©1999 24 pages Product#: 399150 Description Describes the development of the international strategies and organizations of two major competitors in the global consumer electronics industry. The history of both companies is traced and their changing strategic postures and organizational capabilities are documented. Particular attention is given to the major restructuring each company is forced to undertake as its competitive position is eroded. A rewritten version of an earlier case. Philips vs. Matsushita: A New Century, a New Round Christopher A. Bartlett ©2003, 20 pages Product#: 302049 Massport (A): The Aftermath of 9/11 Michael A. Roberto, Erika M. Ferlins Product#: 304081 Description: Provides a history of the board of directors of the Coca-Cola Co. through 2003. Describes the evolution in the board's membership, practices, and structure and the role it played in the company's governance. Questions are raised about the relationship between the board and top management, especially how the board is carrying out its responsibilities in the 21st century. Subjects Covered: Beverages, Corporate governance. Setting: Boston, MA; Transportation industry; $180 million revenues; 1,000 employees; 2001-2004 Setting: 2001 Setting Setting: United States; Global; $100 billion revenues; 293,000 employees; 19811998 Subjects Covered: Competition, Competitive strategy, Corporate strategy, Electronics, Globalization, High technology, International business, International operations, Manufacturing industry, Multinational corporations, Organization, Organizational change, Organizational structure, Strategy implementation. Description: This case looks at the turnaround at the Massachusetts Port Authority after the 9/11 terrorist attacks. It begins with the situation during the immediate aftermath of 9/11 and then describes how the new CEO restructures the public agency to operate much more like a business organization. Subjects Covered: Business government relations, Change management, Corporate culture, Leadership, Organizational design, Organizational structure, Public sector, Security, Transportation. Description: A video rental store is considering offering home delivery service. Management must value the project under different financing strategies and methods, specifically adjusted present value (APV) and weighted average cost of capital (WACC). Subjects Covered: Capital budgeting, Capital investments, Cash flow, Debt management, Financial strategy, Financing, Present value, Valuation. Assignment Sheet and Assessment Rubric Available Description GE is faced with Jack Welch’s impending retirement and whether anyone can sustain the blistering pace of change and growth characteristic of the Welch era. After briefly describing GE’s heritage and Welch’s transformation of the company’s business portfolio of the 1980s, the case chronicles Welch’s revitalization initiatives through the late 1980s and 1990s. It focuses on six of Welch’s major change programs: The “Software” Initiatives, Globalization, Redefining Leadership, Stretch Objectives, Service Business Development, and Six Sigma Quality Subjects Covered: Business policy, Competitive strategy, Conglomerates, Corporate culture, Corporate strategy, Executives, General management, Leadership, Management of change, Manufacturing industry, Organizational behavior & leadership, Organizational change, Organizational development, Service industry, Strategy implementation, Upper management. Howard Schultz and Starbucks Coffee Company Publication Date: Feb 13, 2001 Revision Date: Sep 30, 2005 Availability: In Stock Author(s): Nancy F. Koehn Type: Case (Pub Mat) Product Number: 9-801-361 Length: 40p Teaching Note Bennie Wiley at The Partnership, Inc. Laura Morgan Roberts, Victoria W. Winston Pub. Date: October 24, 2005 Product Number: 9-406-012 Bill Belichick and the Cleveland Browns John R. Wells, Travis Haglock Product Number: 9-706-415 Seattle, WA; Retail industry; $2.2 billion revenues; 37,000 employees; 1982-2001 Setting: Boston, MA; United States; 5 employees; 2005 Setting: Cleveland, OH; Sports industry; $100 million revenues; 200 employees; 1995 Investigates the entrepreneur's strategic initiatives to develop a mass market for specialty coffee in the 1980s and 1990s. These initiatives included the development of premium products, rapid expansion of companyowned stores--each with attractive retail environments and responsive customer service--and, especially, the creation of a strong brand. Also devotes considerable attention to how Schultz built the Starbucks organization, examining the consistent emphasis that he and his colleagues placed on the company's relationship with its employees, how Schultz financed Starbucks' early expansion, how vertical integration ensured quality control, and how--strategically and operationally--the company managed its phenomenal domestic and international growth after 1993. Description: Benaree Wiley, an African American, female HBS graduate (class of 1972), was appointed CEO and president in 1991 of The Partnership, a Boston-based nonprofit dedicated to developing leadership potential in professionals of color and in increasing their representation in area businesses and institutions. The organization suffered from a lack of unity among the board, an unclear mission, and financial challenges, including debt in excess of $100,000. Starting with only an administrative assistant, Wiley built the organization from the ground up, using her ability to develop and nurture relationships as the basis for growth. In December 2004, Wiley announced her impending retirement, leaving the organization with the strategic challenge of moving its programs and services to a level of greater impact (beyond the Boston community), without the leadership of its heralded CEO. Subjects Covered: African Americans, Business models, Careers & career planning, Diversity, General management, Growth strategy, Leadership, Minority & ethnic groups, Nonprofit sector, Power & influence, Women in business. Description: Genius? That is not what they were calling Bill Belichick in Cleveland. Why? Four losing seasons in five years. Fans hurled trash and insults. The media resented him. Ownership abandoned him. Players quit on him. Very different from the three Super Bowls in five years Belichick would win with the New England Patriots a few years later. Different players? Different ownership? Different management styles? Different strategies? Different coach? Find out. What happened when the Browns hired a man who began studying football strategy at the age of six? A man with a degree in economics who almost became an MBA candidate before accepting a job in football that paid $25 a week. A man who was long recognized as one of the best assistant coaches in the NFL. Learn how Belichick managed the players, the coaches, the owner, the media, etc. Subjects Covered: Business history, CEO, Human resources management, Leadership, Management philosophy, Strategy formulation, Strategy implementation. 13. Strategic Entrepreneurship Internal Entrepreneurship at the Dow Chemical Co. Publication Date: Jan 1, 2003 Revision Date: Jul 29, 2003 Availability: In Stock Author(s): Bala Chakravarthy, Hans Huber Type: Case (Field) Product Number: IMD145 Source: IMD - International Institute for Management Development Length: 13p Teaching Note Ingvar Kamprad and IKEA Publication Date: May 7, 1990 Revision Date: Jul 22, 1996 Availability: In Stock Author(s): Christopher A. Bartlett, Ashish Nanda Type: Case (Field) Product Number: 9-390-132 Language: English Length: 20p Teaching Note The Path to a Spin-off-Nortel Networks to NetActive: One Form of Corporate Entrepreneurship Publication Date: Jan 1, 2004 Revision Date: Feb 9, 2004 Availability: In Stock Author(s): Gina Colarelli O'Connor, Mark P. Rice Type: Case (Field) Product Number: BAB067 Language: English Source: Babson College Length: 14p Setting Description Europe; United States; Chemical industry; $28 billion revenues; 2000-2001 Describes how a corporate entrepreneur shapes an internal growth venture within the company, mobilizes the resources that are needed to implement the venture, and achieves success. Complementing his entrepreneurial behavior, however, is the support that he receives from several senior managers in the firm. Allows a careful examination of the challenges for corporate entrepreneurship in a large multinational firm and the roles that senior executives have to play to support it. Europe; Global; Stockholm; Sweden; Zurich; Furniture industry; Retail industry; large; $2.5 billion revenues; 1989 Traces the development of a Swedish furniture retailer under the leadership of an innovative and unconventional entrepreneur whose approaches redefine the nature and structure of the industry. Traces IKEA's growth from a tiny mail order business to the world's largest furniture dealership. Describes the innovative strategic and organizational changes Kamprad made to achieve success. In particular, focuses on his unique vision and values and the way they have become institutionalized as IKEA's binding corporate culture. The trigger issue revolves around whether this vital "corporate glue" can survive massive expansion into the United States and the Eastern Bloc and Kamprad's replacement as CEO by a "professional manager." Describes the exploratory learning processes a new venture undergoes as it evolves its breakthrough/radical innovation--an algorithm that makes software rentable--within Nortel Network's Business Venture Group. Details the challenges of managing under high uncertainty and within a white space opportunity. Focuses on the project leader and the leader of the Business Ventures Group as she evolves her processes for managing a portfolio of potential breakthrough innovations. Highlights the following key issues: exploratory marketing, business model creation, team composition within the venture, and the venture's relationship to the mother organization. Guidant: Radiation Therapy Publication Date: Jul 25, 2000 Revision Date: Sep 12, 2005 Availability: In Stock Author(s): Michael J. Roberts, Diana Gardner Type: Case (Field) Product Number: 9-801-040 Length: 24p Teaching Note Charles Schwab in 2002 Lynda M. Applegate; F. Warren McFarlan; Jamie Ladge ©2002, 29 pages Product#: 803070 Indiana; Medical equipment & device industry; $930 million revenues; 1996 Setting: United States; Financial services; $2 billion revenues; 2002 Setting: Sweden; Petroleum industry; 19001937 Ivar Kreuger and the Swedish Match Empire Geoffrey G. Jones, Ingrid Vargas Pub. Date: November 04, 2003 Product#: 804078 Describes a potential new approach to treating cardiac disease--radiation therapy. Guidant, a leading medical device maker, faces a choice about whether to pursue this new and risky technology and, if so with what strategy. Details the evolution of the Charles Schwab business model, from its founding in 1975 to October 2002. The protagonist, David Pottruck, is faced with re-inventing the firm as a full-service brokerage at a time of tremendous industry instability as the industry reels from the effects of deregulation, consolidation, global economic downturn, and investor lack of confidence. Teaching Purpose: To illustrate the process of building businesses and evolving business models. Subjects Covered: Business models, Competitive strategy, Electronic commerce, Entrepreneurship, Financial services, Growth strategy, Information age, Leadership, New economy, Organizational behavior, Service industry, Technology. Description: Taught in Evolution of Global Business. Globalization and corporate fraud are the central themes of this case on the international growth of Swedish Match in the interwar years. Between 1913 and 1932, Ivar Kreuger, known as the "Swedish Match King," built a small, family-owned match business into a $600 million global match empire. Despite the economic and political disruptions of the interwar period, Swedish Match owned manufacturing operations in 36 countries, had monopolies in 16 countries, and controlled 40% of the world's match production. Kreuger companies lent over $300 million dollars to governments in Europe, Latin America, and Asia in exchange for national match monopolies. Relying on international capital markets to finance acquisitions and monopoly deals, by 1929 the stocks and bonds of Kreuger companies were the most widely held securities in the United States and the world. After Kreuger's 1932 suicide, forensic auditors discovered that Kreuger had operated a giant pyramid scheme. His accounts were ridden with fictitious assets, the truth hidden in a maze of over 400 subsidiary companies. Swedish Match's deficits exceeded Sweden's national debt. Subjects Covered: Business government relations, Business history, Cartels, Entrepreneurship, Ethics, Fraud, Globalization, International business, Multinational corporations.