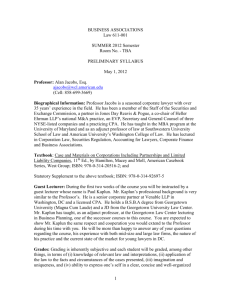

class 1 - Washington University School of Law

advertisement