Economics X Creativity Multimedia Case 5: The Only Girl in Boys

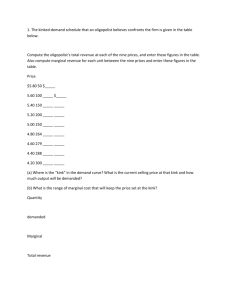

advertisement

Economics X Creativity Multimedia Case 5: The Only Girl in Boys' School Case Study prepared by: Prof. Michael FUNG Dr. Fred KU Dr. David CHOW Mr. Sam KONG Miss Cindy LAU Mr. Patrick CHEUNG Video produced by: Evangel College (2012) * Should you have any comment, please email Prof. Fung (creative.econ@cuhk.edu.hk) P. 1 Introduction This is a story about girls in a boys’ school. Molly studied at a boys’ school for some reasons. Since she was the only girl around, the boys were all enchanted, sending her a smart phone, a car and a (toy) house, hoping to catch her attention. Knowing that she was the only girl at school, Molly rejected every single present from the boys, in the hope of receiving even bigger ones. After a while, another girl Golly was also admitted. She joined forces with Molly to reject the boys’ gift-giving, wishing for better presents. Sadly, the morning sun never lasts a day. Golly started to speak ill of Molly behind her and receive the boys’ presents in secret. Molly’s charm vanished quickly. Later, the school decided to turn co-educational. The boys found it easier to find a date with numerous girls around. What would happen to Molly in the end? The story used courtship to introduce the concept of market structure. One can learn about the market power of a monopolist, the collusion and its break-down among oligopolists. This story illustrates economic concepts in a youthful and funny way. Key Question How would changes in a market structure affect firms’ strategies? Key Concepts 1. Maximum willingness to pay 2. Monopoly 3. Oligopoly and strategic behaviour 4. Monopolistic competition Learning Outcomes Understand competition, market structures and their applications in daily life. P. 2 Note: Questions with asterisk “*” are related to the contents covered in Elective Part I. True / False Questions 1. Perfectly competitive firms are price takers. 2. If a large number of firms enter into a perfectly competitive market, the product’s price will rise. 3. An oligopoly market refers to a market in which there are a few dominating sellers. 4. The amount of market power that a monopolist has depends on the availability of close substitutes for its products in the market. *5. Sellers practicing price discrimination is due to difference in cost of serving different customers. 6. Under perfect competition, firms sell heterogeneous products and market information like price, quality and quantity of products are unknown. 7. There are usually strong barriers to entry (e.g. high set-up cost or patents) in a monopoly market. *8. There must be differences in the willingness to pay among groups of consumers for a monopolist to price discriminate. *9. Collusive agreement to raise price is usually unstable because firms have incentive to cheat. 10. There is a trade-off between the price set by a monopolist and the quantity it can sell. MC Questions 1. In the video, when Golly is admitted into the school, the market structure changes from _______ to _______. The price charged for a date (the value of gifts) will be _______, assuming there is no collusion between Molly and Golly. A) monopoly; oligopoly; higher B) monopoly; oligopoly; lower C) monopoly; perfect competition; unchanged D) oligopoly; monopoly; lower 2. Under perfect competition, which of the following statements is correct? A) Products sold by all sellers are homogeneous. B) A single seller may lower the price of his product, but he has no incentive to do so. C) There is free entry and exit of firms. D) All of the above. P. 3 3. An imperfectly competitive firm is one A) that attempts but fails to compete perfectly. B) that possesses certain degree of control over its price. C) with the ability to set price at any level it wants. D) that faces perfectly inelastic demand. *4. If a monopolist charges a uniform price for every unit of products it sells, A) there may be underproduction and deadweight loss. B) marginal revenue is smaller than marginal cost at the profit-maximizing quantity of output. C) marginal revenue equals the price at the profit-maximizing quantity of output. D) economic efficiency is attained. 5. A firm may become a monopolist if A) its average total cost is increasing over the entire relevant range of output. B) it faces a perfectly elastic demand curve. C) its technology is out of date. D) it is geographically isolated from other sellers. 6. Consumer surplus will be fully captured by a firm if A) all consumers are charged at a uniform price. B) there is any form of price discrimination. C) all consumers are charged at their maximum willingness to pay. D) the seller is a monopolist. 7. A major difference between oligopoly and perfect competition is that oligopolistic firms A) sell totally unrelated products while competitive firms do not. B) are price takers while competitive firms are not. C) have direct impact on the profit of other firms in the market, while firms in competitive markets do not affect each other directly. D) sell their products at a price equal to the marginal cost while competitive firms do not. *8. As a group, oligopolists would be able to earn the maximum profit if they would A) produce the perfectly competitive quantity of output. B) operate according to their own individual self-interests. C) produce more than the perfectly competitive quantity of output. D) enter into a collusive agreement to restrict their output to the monopoly level. 9. If a market changes from an oligopoly to a perfectly competitive market, A) products can be heterogeneous. B) every seller will become a price taker who can only sell at the current market price. C) sellers can engage in non-price competition. D) the market would still have imperfect information. P. 4 *10. Generally speaking, the equilibrium price in an oligopoly market is A) lower than that in monopoly markets and lower than that in perfectly competitive markets. B) higher than that in monopoly markets and higher than that in perfectly competitive markets. C) higher than that in monopoly markets but lower than that in perfectly competitive markets. D) lower than that in monopoly markets but higher than that in perfectly competitive markets. Discussion Questions 1. In the video, the boys discuss their maximum willingness to pay for a date in term of gifts. What is maximum willingness to pay? What are the determinants of their willingness to pay? *2. A monopolist has market power, which means that it can set its price above the marginal cost to maximize the profit. At the beginning of the video, Molly is a monopolist in the dating market. Suppose next to the boys’ school, a new girls’ school is just open. How does this affect Molly’s market power? Would Molly remain as a monopolist? *3. An oligopoly market is in general more competitive than a monopoly market. However, in an oligopoly dating market with only Molly and Golly, there is an opportunity for anticompetitive collusion. (a) If there is no collusion between Molly and Golly, will the dating price (i.e., the value of gifts received) remain the same as if it is in a monopoly market? How does this change in market structure affect the girls’ and the boys’ welfare? (b) Suppose Molly and Golly agree to collude and set the price of a date at a high level. If Molly abides by the agreement, does Golly have any incentive to cheat and lower her price of date? 4. Under monopolistic competition, firms face more competition than they do in a monopoly or oligopoly market. (a) In general, how can sellers differentiate their products or services from their competitors? In the video, the boys’ school changes into a co-educational one. Thus the dating market changes from an oligopoly into a monopolistic competition. (b) Consider only the value of gifts as a girl’s benefits of dating. Ignoring the time cost and other costs involved in dating, how does the change of market from an oligopoly to a monopolistic competition affect the welfare of Molly? (c) Suppose a girl can only choose one boyfriend and valuable resources such as time are spent for courting a girl. Consider from the perspective of market structure only, P. 5 how would the boys be benefitted when competitions in the dating market become more intense comparing with the case of monopoly? 5. There are two free-to-air television stations, TVB and ATV, offering free television programme service in Hong Kong. A potential entrant must obtain a free-to-air television license from the government to enter the market. (a) What is the market structure of the free-to-air television market in Hong Kong? Explain your answer. Recently, the government would like to open up the market and grant new free-to-air television licenses to three more companies. (b) As TVB has a much larger market share than ATV, some consider it a monopoly. Suppose it is the only firm in the market and the only revenue source is from advertisements. Does TVB still face competition? Explain. (c) Mr. Lee Po-on, TVB’s executive director claimed that new stations could push existing players out of the market as the overall value of the television advertising sales had remained flat for the past 15 years. (South China Morning Post, 23rd May, 2012.) Do you agree? Explain. *6. Suppose there are three tutorial schools operating in 3 distant towns and thus they can be regarded as a monopolist in the local town. They operate with 3 different objectives. School A aims at maximising the number of students subject to without an economic loss. School B tries to maximise its profit, while School C targets at maximising the total revenue. Draw a diagram and show the points the three schools are operating at. Challenging Question *7. In early 1990s, Hong Kong Government banned all cigarette advertisement on all kinds of media. Do you think this policy must lower the profit of cigarette manufacturers? (For simplicity, assume that there are only two cigarette producers in the market.) P. 6 Suggested Answer True/False Questions: 1. T 2. F 3. T 4. T 5. F 6. F 7. T 8. T 9. T 10. T MC Questions: 1. B 2. D 3. B 5. D 6. C 7. C 8. D 9. B 10. D 4. A Discussion Questions: 1. The maximum willingness to pay is the maximum amount of money that a buyer is willing and able to pay for a good. Determinants of their willingness to pay include the followings: i. The value of the date they perceive; ii. Their financial conditions (budget constraint). 2. Since there are more choices (substitutes) besides Molly, she loses her monopoly status in the dating market. 3. (a) No. In general, competition between producers pushes down the price. Thus the price in an oligopoly market is expected to be lower than that in a monopoly market. Consider only the values and costs of the dating gifts, the boys will face a lower cost for their date and be better off. The girls will receive gifts of lower values for a date, and thus will be worse off. (b) Yes. If Golly lowers her price of dating, she can win all boys’ attention and gifts. Note that it is a one-shot game so Molly therefore cannot penalise Golly even if she cheats. In a repeated setting, however, it is possible for one to penalise the cheating party. Collusion generally is more probable. 4. (a) Sellers may advertise their products to attract people to buy more of their products. (b) The value of the gift received decreases. The welfare of a girl will be lower. (c) Boys will face a lower price (cost) in dating a girl in the market and be better off. 5. (a) Oligopoly. It is because there are only two players, TVB and ATV in the market. In an oligopoly market, one’s action will have tremendous impact on the payoff of the other. (b) Yes. TVB still faces competition from other media such as newspapers and internet. (c) The entry of new free-to-air station raises the supply of timeslots for advertisement. Given a relative stable demand and ignore the first-mover advantages, a lower price for advertisement can be expected. It is likely that the revenue of existing players will be lower after the entry. However, whether the new stations could push existing players out of the market depends on the change P. 7 in the market price and the relevant cost of production for the existing firms. 6. P MC B ATC A D MR C Q 7. Advertisement is common in the cigarette industry. If one firm advertises, it is likely that another one will follow. The reason is that if it doesn’t, the result may be a significant loss in market share. Thus, in order to enhance demand and protect their own share, cigarette producers usually spend a sizable amount on advertisements. However, when both advertise, the increase in the total revenue for both firms may not justify the spending. It is known as Prisoners’ Dilemma in game theory. If the government steps in and prohibits advertisement, it may actually benefit the cigarette producers by stopping them from engaging in the advertisement competition. P. 8