Perfect Competition Market

advertisement

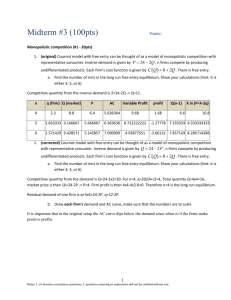

UNIVERSITI TUNKU ABDUL RAHMAN FACULTY OF ACCOUNTANCY AND MANAGEMENT ACADEMIC YEAR 2005/2006 TUTORIAL 11 to TUTORIAL 14: MARKET STRUCTURE: PERFECT COMPETITION True or False Questions: 1. A marginal change is an adjustment (change) to an existing plan of action. (True/False) 2. If the president of Chile commented that “the crime rate in Chile is currently too high,” this would be an example of a normative statement. (True/False) 3. Economic models do not have to completely describe every aspect of the economy in order to be useful. (True/False) 4. The opportunity cost of a particular activity is the sum of the benefits that could have been received from all foregone activities. (True/False) 5. By better utilizing existing resources, an economy can produce at a point outside of its current production possibilities frontier. (True/False) 6. If the demand for new automobiles falls when income falls, automobiles are said to be normal goods. (True / False) 7. When an increase in the price of one good raises the demand for another good, the two goods are called complements. (True/False) 8. If the demand for a good falls when income falls, the good is called inferior good. (True/False) 9. Price elasticity of supply is defined as the percentage change in quantity supplied divided by the percentage change in price. (True / False) 10. A government-imposed price ceiling below the market’s equilibrium price will create an excess demand for the product. (True / False) Essay: 1. (a) Describe briefly about the characteristics of perfect competition market structure. (b) Use a graph to demonstrate the circumstances that would prevail in a perfectly competitive market where firms are experiencing economic losses. Identify costs, revenue, and the economic losses on your graph. Using your graph, determine whether this firm will shut down in the short run, or choose to remain in the market. Explain your answer. (c) If perfect competitive firms are having positive economic profit in the short run, how does free entry and exit help firms to achieve long run equilibrium? Illustrate your answer graphically. 1 2. The table below shows the quantity demanded and quantity supplied of a new apple drink. Based on the table, answer the following questions. Price (RM per unit) 1 2 3 4 5 6 7 3. Quantity demanded (Unit) 60 54 43 31 20 12 6 Quantity supplied (Unit) 7 11 22 31 40 51 66 (i) What is the equilibrium price and quantity of apple drink? (ii) Suppose the current market price for the apple drink is RM6 per unit, what situation is the market experiencing? Explain the adjustments that will bring it to equilibrium. (iii) If the demand for apple drink increases 20 units at every level of price, what is the new equilibrium price and quantity? Why firms maximize profit at marginal cost (MC) equal marginal revenue (MR)? MARKET STRUCTURE: MONOPOLY Structure Questions: 1. A monopoly firm is producing where its marginal revenue is equal to marginal cost. At this level of output, the firm's price is $3.75 and its average total cost is $4.50. Is the firm earning a profit? Explain. How could this firm determine whether it should continue to operate in the short run or if it should shut down? 2. Explain how by restricting output (as compared to perfect competition structure), monopoly is said to cause deadweight loss. Illustrate your explanation with graph(s). 3. What is the different between monopoly and perfect competition market structure? (Use a table to organize your comparison). Essay: 1. (a) Give and explain 4 examples of barriers to entry. (b) Briefly explain the difference between second-degree price discrimination and third-degree price discrimination. 2 (c) Why a natural monopoly is better than many small perfect competition firms if the market has economies of scale? 2. (a) Briefly compare the characteristics of perfect competition market structure with monopoly market structure. Present your answer in a table. (b) In the short-run, a monopoly firm that suffers losses will always shut down. Do you agree? Explain the cases where [(i) P > AVC] and [(ii) P < AVC]. (c) How do you differentiate between “short-run” and “long-run”? MARKET STRUCTURE: MONOPOLISTIC COMPETITION & OLIGOPOLY Structure Questions: 1. Compare perfect competition and monopolistic competition. In what ways are they similar? In what ways are they different? 2. The firm below sells its output in a monopolistically competitive market. Show the firm's profit-maximizing level of output. Is the firm earning a profit or a loss? Show your answer on the graph and explain what happen in the long-run. MC P ATC CC AVC CC D MR Quantity 3. The matrix below shows the payoff for two advertising strategies for two firms, Firm X and Firm Y. Does Firm Y have a dominant strategy? Explain. Firm X's Strategy Firm Y's Strategy Aggressive marketing Normal marketing Aggressive marketing X's profit = $15,000 Y's profit = $15,000 X's profit = $20,000 Y's profit = $10,000 Normal marketing X's profit = $10,000 Y's profit = $20,000 X's profit = $12,000 Y's profit = $12,000 3 4. The figure below shows a firm that faces a kinked demand curve. Find the profitmaximizing level of output. (Mark it q*.) What price should the firm charge? (Mark it P*.) P MC d1 MR 1 d2 Q MR Essay: 2 1. Based on the following payoff matrix, answer the questions. Firm A Payoff profit (RM’ million): (A, B) Lower price (Top) Maintain price (Bottom) Firm B Lower price (Left) Maintain price (Right) (0, 0) (3, 1) (-3, 0) (5, 5) a. Assume that there are only two firms in the market, which are Firm A and Firm B. Under the Bertrand model and assume both firms aim to maximize profit, what will be the equilibrium? b. Firm A is to choose first and it chooses the “Maintain price” strategy. Then, Firm B chooses the “Lower price” strategy even though “Maintain price” choice will give Firm B higher profit. Briefly explain Firm B “reason” for choosing “Lower price.” c. Firm A is to choose first. If Firm A chooses “Maintain price”, the possibility for Firm B to choose “Maintain price” is 20% (therefore, possibility to choose “Lower price” is 80%). If Firm A chooses “Lower price”, the possibility for Firm B to choose “Maintain price” is 50% (therefore, possibility to choose “Lower price” is 50%). If you were Firm A owner, what strategy should you choose and explain your reason. d. Base on the same situation as in (e), what would be your decision if the possibility for Firm B to choose “Maintain price” is 80% (therefore, possibility to choose “Lower price” is 20%) when you chooses “maintain price” strategy? Explain your reason. e. Base on the same situation as in (e), what would you choose if there are equal chances (50% possibility) for Firm B to choose any strategy, regardless what you choose? Explain your reason. f. What would you choose if you did not know the possibility of Firm B’s choices? Explain your reason. 2. Explain the Kinked Demand Curve model 4 Answers: MARKET STRUCTURE: PERFECT COMPETITION True or False: 1. True 2. True 3. True 4. False 5. False 6. True 7. False 8. False 9. True 10. True Essay: 1. (a) i. Many firms: A single firm’s production is relatively very small compare to the market demand (market share is small). ii. Homogenous product: Product has same characteristics (no quality difference). iii. Price takers: Every single firm has no market power and has to sell at market price. iv. Perfect information: Assume that sellers and buyers are well informed about prices. v. Free entry and exist: No significant legal, technological, capital investment or other obstacles that can prohibit firms from entering and exiting the market. As a result, firms earn zero economic profit in long run. (b) Price Price S Losses MC ATC P1 Revenue SRAC D q Market q* q Individual Firm Losses = TR – ATC. The decision about whether this firm shuts down or remains in the market depends upon the position of average variable cost (AVC). If AVC is below P0 at output level Q0, the firm will remain in the market. If AVC is above P0 at output level Q0, firm will exit the market. (c) 5 Graph: Show MC, SRAC, LRAC, SS0, SS1 & DD, Show positive economics profit Initial equilibrium price is at P0, quantity at Q0 (where SS0 & DD intersect). These yield a positive economic profit (as P0 > SRAC). Positive economic profit encourages entry. Entry causes market supply increase. Thus, supply curve shift to the right from SS0 to SS1. Price drop (from P0 to P1), thus profit reduced. At price = P1, price equal LRAC, thus, firm earns zero economic profit. 2. (i) Equilibrium price = RM 4 and equilibrium quantity = 31 units. (ii) The market is experiencing excess of supply (surplus) of 39 units. Excess of supply will force the price of the apple drink to decrease, as sellers are willing to sell more at a lower price. As price decreases, the quantity demanded in the market rises while the quantity supplied falls. This lowers / reduces the excess supply in the market. The price will continue to fall until RM4 where all excess supply is fully eliminated (DD = SS). (iii) Equilibrium price = RM 5 and equilibrium quantity = 40 units. π = TR – TC dπ/dq = [d (TR)/dq] – [d (TC)/dq] 0 = MR – MC (»» profit maximize when dπ/dq = 0) MC = MR 3. OR; When MR > MC (»» continue to produce the extra unit as marginal profit is positive) When MR < MC (»» discontinue to produce the extra unit, should reduce output to increase profit) When MR = MC (»» profit is maximized as producing extra unit will cause MR < MC, thus less profit and if reducing extra unit, it will cause MR > MC, thus less profit) Answers: MARKET STRUCTURE: MONOPOLY Structure: 1. The firm is incurring an economic loss. Its price ($3.75) is less than its average total cost ($4.50). In order to determine if the firm should continue operating in the short run, we must compare the firm's price with its average variable cost. As long as the price is greater than average variable cost, the firm should continue to operate. 6 2. Under perfect competition structure, market output and price should be at QC and PC. In monopoly structure, restricting output from QC (as in perfect competition structure) to QM causes under-producing. Monopoly equilibrium price is also higher at PM. Figure: Monopoly & Deadweight Loss Initial consumer surplus (before output is restricted from QC to QM) equal to EGC area. After output restriction, consumer surplus is equal to ABG area. Thus, reduced in consumer surplus equal to ABCE area. Area ABDE has been transfered from consumer surplus to the monopoly (producer) revenue. Area BCD is a reduced from consumer surplus without transferring to anybody, thus is a deadweight loss. Initial producer surplus (before output is restricted from QC to QM) equal to ECFH area. After output restriction, producer surplus is equal to EDFH. Thus, reduce in producer surplus is equal to CDF area. This area is a loss to producer but no other party gain from it. It’s a deadweight loss. Summary, deadweight loss is equal to the sum of BDC area and CDF area or equal to BFC area. 3. 1. Monopoly Many buyer & seller. 2. 3. Homogenous product. No market power: Price taker, therefore horizontal firm’s DD curve. 4. Free entry & exit, therefore firms earn zero economic profit in long-run. 1. 2. Perfect Competition One firm (therefore firm SS = market SS) & many buyer. No substitute. Have market power: Can determine / influence either price or quantity (not both), thus, slopping down DD curve (law of DD). Barrier to entry, therefore monopolist can maintain positive economic profit in long-run. EXTRA: What is the similarity? Profit maximization at MR = MC (only P = MR for perfect competition) Both can achieve positive, zero or negative economic profit in short run and therefore facing the same profit maximization & loss minimization condition. 7 Essay: 1. (a) (i) Copyright patents; (ii) Regulation and laws; (iii) monopoly resources & (iv) Superior technology innovation. (b) Second-degree price discrimination: Different price on different quantity purchases/usages. (Examples: airline ticket pricing or electric usage pricing). Third-degree price discrimination: Different price on different buyers/group of buyers. (Example: ticket discount for senior citizen or students group). (c) Figure 6.5: Natural Monopoly In Figure 6.5, the economies of scale continuously lower the long-run average cost (LRAC), thus pushing the MES to a very high amount of production. This naturally causes a situation where the larger the scale of production, the lower the average cost of production. Example, with one firm producing 500,000 units (at scale 2), average cost is $1 per unit. With five firms each producing 100,000 units (at scale 1), average cost is $5 per unit. Thus, it is more efficient (in term of cost effective) to allow a giant monopoly to serve the market rather than few small competing firms. Furthermore, in some cases where a large amount of capital investment (fixed cost) is needed before starting production, producing in amount like in scale 1 might yield a loss. This kind of situation often arises with public utilities like telephone services. 8 2. (a) Firms: Product: Market power: Entry & Exit: Profit: Information: Perfect Competition Market Many firms Homogenous & many substitutes No. Price taker Monopoly Market One firm only No substitutes Free Zero econ profit in long run Restricted / Barriers May earn zero, positive or negative econ profit in long run. May not be perfect info. Perfect info Yes. Price maker (b) Graph: show MR, Demand, ATC & MC curves show economic losses area Position of AVC1 and AVC2 Loss is minimized when produced at MR = MC. P < ATC Economic losses If P > AVC Continue to operate If P < AVC Shut down (c) Differentiate with ability to change fixed cost. In “short-run”, cannot change fixed cost but in “long-run”, can change fixed cost. Answers: MONOPOLISTIC COMPETITION & OLIGOPOLY Structure: 1. Because of freedom of entry, economic profits are zero in the long run both for perfect competition and monopolistic competition. But firms in monopolistic competition charge a price greater than marginal cost. This implies that monopolistically competitive industries do not produce the efficient level of output. Also, firms in monopolistic competition do not realize all the economies of scale available. In addition, another difference is that firms in monopolistic competition produce differentiated products. Firms in perfect competition only produce homogenous goods. 9 2 The firm will maximize profit by choosing the level of output where marginal revenue is equal to marginal cost. The firm will earn a negative profit (loss) as shown by the shaded area. Due to its price is less than average variable cost, it suffers operating losses. Thus, the firm will exit the market. MC Price ATC AVC CC P* D Q* Quantity MR 3. Yes, Firm Y has a dominant strategy. If Firm Y assumes that Firm X will use an aggressive marketing strategy, Firm Y will earn higher profit by doing aggressive marketing itself as well. If Firm Y assumes that Firm X will not use an aggressive marketing strategy, Firm Y will earn higher profit if it starts its aggressive marketing. Thus, regardless of the strategy followed by Firm X, Firm Y will choose the aggressive marketing strategy. 4. The firm will set marginal revenue equal to marginal cost to determine its profitmaximizing level of output. Therefore, it will produce Q* units of output. The demand curve indicates the highest price the firm can charge (P*) and still sell Q* units. P MC d1 P* MR 1 d2 Q* * Q MR 2 10 Essay: a. (Maintain price, Maintain price) or (Bottom, Bottom). His is dominant strategy equilibrium. b. Predatory pricing. Firm B might want to drive out Firm A and monopoly the market after Firm A exit. c. Expected payoff for Firm A choosing “Lower price” is [(0 X 0.5) + (3 X 0.5) = 1.5]. Expected payoff for Firm A choosing “Maintain price” is [(-3 X 0.8) + (5 X 0.2) = -1.4]. Thus, better for Firm A to choose “Lower price”. d. Expected payoff for Firm A choosing “Maintain price” is now [(-3 X 0.2) + (5 X 0.8) = 3.4]. Thus, better for Firm A to choose “Maintain price”. e. Expected payoff for Firm A choosing “Lower price” is [(0 X 0.5) + (3 X 0.5) = 1.5]. Expected payoff for Firm A choosing “Maintain price” is [(-3 X 0.5) + (5 X 0.5) = 1.0]. Thus, better for Firm A to choose “Lower price”. f. To choose “Lower price” (the maximin strategy) >> could be due to risk adverse characteristic. To choose “Maintain price” >> could be due to risk neutral/lover (expecting Firm B to rationally maximizing its profit by choosing “Maintain price”). 2. Kinked Demand Curve: The general assumption in the kinked demand curve model of oligopoly is each firm believes that if it raises its price, its competitors will not follow, but if it lowers its price all of its competitors will follow. If the equilibrium price is P* and there is a price increase by one firm (Firm A) above P*, competitors will not follow. Results: demand is relatively elastic at price above P*, thus increase in price would lead to a fall in the total revenue for Firm A. If one firm (Firm B) decrease price below P*, competitors follow. Results: demand is relatively inelastic at price below P*, so the Firm B does not gain as much quantity demanded as demand is inelastic at price below P*. Thus, the firms perceived the demand is kinked at the initial price of P* and the corresponding marginal revenue (MR) curve is discontinuous (there is a gap). 11