This paper documents the CEO`s evolving role in strategic planning

THE ROLE OF CEO IN THE STRATEGIC PLANNING SYSTEM IN

NIGERIAN BANKS

BY

DR. (MRS.) S. L. ADEYEMI

DEPARTMENT OF BUSINESS ADMINISTRATION

UNIVERSITY OF ILORIN

ABSTRACT

The purpose of this paper is to analyze the CEO’s strategic role in the strategic planning system in the Nigerian banking industry. 69 Chief bank planners were selected for the study from banks that are generally considered to be at the leading edge of bank strategic planning in Nigeria. The paper explores the key dimensions of CEO’s participation in and relationship to bank strategic planning. First the impact of the rapidly changing internal and external environment on bank planning was examined. The survey findings indicating the current involvement of banks CEOs in specific dimension of corporate strategic planning are evaluated. However, while CEOs recognise the need, strategic planning has never really caught on as a basic bank management tool.

INTRODUCTION

The strategic importance of the Chief executive officer (CEO) in big organization is widely recognized. Lorange, (1986). The magnitude of the CEO’s potential impact on the success of an organization highlights the need to more fully understand the ways a firm may attempt to ensure that CEO acts in a manner that maximizes firm success.

As every banker in Nigeria is well aware today the changes that have occurred in commercial banking over the years, together with emerging trends in “how business is done have added a new challenging dimension to the taste of bank management.

Therefore in any organization the Chief Executive Officer (CEO), has a major responsibility for the degree of success or failure overtime.

1

The Nigerian banking industry over the years has been operating in a highly competitive highly regulated and challenging environment.

Most of the challenges came as a rude shock to most Nigerian banks particularly the recent reforms in the banking industry. This revealed a void in strategic management that deserve critical attention. This reform was something operators in the banking industry probably should have envisaged earlier and prepared for, if only they had been bench making banks outside Africa. So for commercial banks to be successful in Nigeria, banks must pay closer attention to systematic strategic management as a critical tool for a long-term success.

However, while CEOs recognize the need, strategic planning has never really caught as a basic banks management tool in Nigeria banking industry.

Achieving success will therefore become increasingly difficult over the next decade as banks move more and more into a more dynamic competitive and challenging environment.

Strategic positioning relative to evolving environment and consumer financial service needs will require CEO’s to adopt a more systematic strategic long-range planning form of corporate management.

To accomplish this, the CEO must fulfil key dual roles of chief strategist and organization builder. As chief strategist, the CEO is the architect of how the bank positions itself relative to its potential futures. A chief organization builder, the CEO provides leadership to achieve cohesion and direction among the bank’s diverse organizational units and individuals. While there roles apply to all functions and activities of the banks, they are particularly critical in strategic planning. Without the CEO’s guidance and leadership, the attention of other senior managers will focus more on short range concerns and crises.

This paper documents the CEO’s evolving role in strategic planning based on mail survey responses of 69 chief bank planners. The respondents are from banks that are generally considered to be at the leading edge of bank strategic planning in Nigeria. If the views of chief banks planners reflect reality, the survey results indicate a need for further development of strategic corporate planning in the banking industry. The survey suggests that, while

CEO’s recognise the need, strategic planning has never really caught on as a basic management tool, since a majority of CEO’s do not use their long-range plans in management policy decision making. Furthermore, even fewer bank CEO’s actually follow-

2

up and monitor results against the original long-range plan. Other findings of the survey also suggest that majority of CEO’s are not obtaining the maximum potential from their bank’s corporate strategic planning efforts.

This paper explores the key dimensions of CEO’s participation in and relationship to bank strategic planning. First, the impact of the rapidly changing internal and external environment on bank planning is examined. Next, survey findings indicating the current involvement of bank CEO’s in specific dimensions of corporate strategic planning are evaluated.

INTERNAL AND EXTERNAL ENVIRONMENT AS A CATALYST FOR

CORPORATE STRATEGIC PLANNING IN NIGERIAN BANKS

The survey findings concerning current CEO participation in, and relationship to, corporate strategic planning should be viewed against the back-drop of an evolving internal and external banking environment. The realities of this environment have, through the early

1990s largely operated as a restraining factor while shifting in the mid-to-late 1990s to provide a strong motivation to develop effective corporate strategic planning. As the survey found, a majority of bank CEO’s have been only partly successful in meeting this challenge.

While large non-financial corporations generally adopted strategic planning in the mid-to-late

1980s, banking lagged five to 10 years behind. As a result, formal corporate planning in commercial banks is in a relatively early stage of development. According to some bank managers, the fact remains that after several years of experimenting with long-range planning, few banks have formal or informal planning programs – and many that think they do are really fooling themselves. (Danielson [1978]).

Several major factors have produced this lack of emphasis in Nigeria banking industry. First, traditional bank planning has been largely functional, performed on a departmental rather than a corporate basis. For example, profit planning often rests with the controller’s or treasurer’s department; diversification planning is conducted by a staff group reporting to the

CEo’s or one of the executive vice presidents; and branch planning is performed by the retail banking department (Unterman [1993] p. 58). Thus, planning fragmentation coupled with a lack of proper communication among executives in other departments has led to “bulknized planning” rather than corporate strategic planning.

3

Second, bank corporate strategic planning developed slowly because of the relatively constant regulatory environment in the 1980s – 1990s. Regulation also imposed certain constraints on competition. Result of empirical investigations into the structure of competition in the Nigerian banking industry show that the industry is highly concentrated and oligopelistic in nature – (Uchendu, 1998; CBN, 2001). So the regulation is seen as imposing certain constraints on competition in 1981 when only 26 commercial and merchant banks were operating in Nigeria. Bank CEO’s provided a generally accepted set of products/services major innovations proceeded at a relatively slow pace describes the types of goals which bank CEO’s emphasized in the 1980s and 1990s in this environment as follows:

Probably most important was maintaining market share in terms of deposits. It was also peers and, therefore, share business opportunities with them. Extensive correspondent relationships were carefully cultivated. Net in-come resulted from pursuing these two goals. In fact, many banks only published balance sheets, profit and loss statements were internal documents and year-to-year variations in the profit and loss statements were given little weight in evaluating overall performance of the organization. Since the bank’s primary function was to receive the fund deposits of the community. Its objective was to maintain the confidence of its customers.

Third, bank CEO’s as well as other top managers have tended to focus on short-range operational problems. This focus has also been stimulated by the considerable attention devoted to short-range asset/liability management.

Finally, lack of an adequate information base for corporate strategic planning has both resulted from and contributed to a lack of emphasis on corporate strategic planning. Most information available on operations relates to transactions and required reports rather than to performance, which would be useful for analysis. Only recently have a few banks begun to conduct sophisticated market research to identify customer needs and perceptions and to develop an information base on the future environment. The product/service data base was largely absent until banks identified the profitability of individual products and services as part of their profit planning efforts.

Thus, for numerous reasons, both external and internal, commercial banks have exhibited a lack of emphasis on corporate strategic planning. Yet, during the mid-to-late 1990s, fundamental changes in the environment started to take place which act as a catalyst for bank

4

CEO’s to turn to corporate strategic planning as a primary management tool. The advent of bank holding companies, deposit regulation and recapitalization issues changes adds new dynamic elements to the banking environment.

The relatively limited competitive environment confirmed by government legislation and regulation is giving way to an ever intensifying competitive environment. For example the introduction of six month and four year money market certificates, and the availability of automatic funds transfers are just a few results of government policy changes. In addition, to the increased competition among financial institutions, the growth of non-financial intermediaries in providing consumer loans and other services has been a major factor in the broader financial services market place.

These changes have stimulated banks to un-bundled their services. Informed management decisions now require cost, revenue and profit information by individual products and services in order to make pricing decisions. The ability to measure profitability by product/service and to predict flows of product/service revenues and costs over time is even more essential given the rapid technological changes. The increasing use of ATMs, point-ofsale machines, automatic funds transfer and other computer-communications based technology is beginning to re-shape the way banks relate to evolving consumer needs.

The dynamic elements that have emerged in the 1990s have acted as the catalyst for a fundamental change in the way commercial banks are managed. If the full potential of this new, more systematic and strategic management planning approach is to be realized fully, chief executive officers must play a key role.

THE BANK CEO’S ROLE IN STRATEGIC PLANNING IN NIGERIA

The survey results indicate the current status of the role bank CEO’s are playing in strategic planning. The chief bank planners who responded are from banks which are generally considered to be at the leading edge of bank strategic planning in Nigeria. Thus, if anything, the results may overstate the positive

5

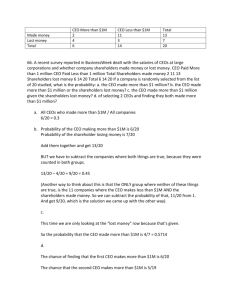

Figure 1: Ideal Allocations of time for Planning in the Average Company

Operations Time

Operation

Planning Time

Planning aspects and understate the negative aspects concerning the current level of CEO’s effectiveness. An extensive literature review and numerous discussions with bank executives also support the survey findings and lead the authors to have a high degree of confidence in the findings and in our analyses of them.

The following dimensions of CEO’s role in strategic planning were examined:

1.

The time the CEO devotes to corporate strategic planning

2.

CEO management style

3.

CEO recognition of need fore and commitment to planners

4.

CEO use of planning in decision making

5.

CEO monitoring of actual results compared with the original long-range plan

6.

CEO rewards and recognition for the strategic long-range planning efforts of subordinates.

PLANNING TIME

Planning has long been considered an essential management function for all managers regardless of their position in an organization. In general, the proportion of time ideally devoted to planning versus operations increases as the manager is positioned higher in the corporation. For example, as figure 1 illustrates, group supervisors may spend virtually all their time on extremely short-rang, operations-oriented matters. At the other extreme, chief

6

executive officers or M.D should spend approximately 80% of the time on planning beyond this year. Although the definition of “long-range” and the allocations of time vary across different types of industries, this premise is fundamental: the higher the manager, the greater the proportion of time that should be devoted to planning.

According to the survey results, the actual time allocations of bank CEOs appear to diverge from this generally accepted premise. Approximately 61% of the banks CEOs were spending less than 20% of their time directly on strategic long-range planning activities, with 30% spending less than 10% on planning. Approximately 26% were estimated to spend between

20 and 20% of their time on corporate long-range planning, while 13% devoted more than

30% of their time.

The survey strongly suggests that bank CEO’s devote relatively less time to planning than non-bank CEO’s. figure 2 illustrates the degree to which this is true.

The nature of banking and the traditional role of bank CEOs may largely explain the operations focus. Bank CEOs, in contrast to non-bank CEOs, have had a much more active involvement in day-to-day business transactions involving customers and credit approvals.

Consequently, the bank’s customers have become accustomed to dealing with the chief executive officer. The bank-customer relationship is one of “lending money to leading citizens in the bank’s home town; to people who will take their business across the street if the bank’s top management does not involve itself”.

While the survey analysis reflects only one point in time, it is probable that during the last

7

Figure 2: Actual Allocations of Bank CEO Time Devoted to Strategic Long-range

Planning

CEO-President

Other Top Management

Middle Management

Lower Level Managers

Bank Management Operations Time

Operations

Bank Management Planning Time

Strategic Long-range

Planning decade the amount of CEO time devoted to corporate long-range planning has increased substantially. The new, rapidly emerging, highly competitive financial services in the market place requires that an increasing amount of the CEOs time, thought and energy be devoted to strategic planning.

CEO MANAGEMENT STYLE

To be successful, strategic planning must be compatible with the CEO’s management style and aspirations for the bank. Hence, some parallel evolution in the management style of bank

CEOs must accompany the dynamic changes in the banking environment.

Strategic planning implies a distinct style of management requiring acceptance of the CEO, the planner, the executives and managers. It is participative. Furthermore, it requires a career commitment from the CEO, the planner and the executives of the firm (Johnson [1973]).

Those who have relied largely on short-range, intuitive and primarily verbal planning may feel more comfortable with an informal planning process, but the same fundamental planning questions must be answered to position the bank strategically for the future.

8

20%

The survey results shown in figure 3 indicates that a slight majority of chief bank planners believe their CEo’s management styles are compatible with systematic long-range planning.

Yet, it is noteworthy that almost half the CEO’s management styles either are not compatible or have questionable compatibility with more systematic long-range planning.

This finding becomes even significant when viewed from two additional perspectives. First, the banks surveyed are generally considered leaders in the use of strategic planning in

Nigeria. Even among this group there appears to be a significant problem of compatibility between CEO management style and systematic long-range planning. Second, for banks to be successful in the more competitive and dynamic environment of the 1990s – 2000s, systematic strategic planning must become a reality. For this to occur, the management style of bank CEO’s must undergo rapid and significant modification.

The survey reflects the substantial diversity of CEO management styles found in the banking industry. It may reflect as well the perceptions of the chief bank planners responding to the survey, who are, of course, influenced by their own management styles. Nevertheless, successful bank planning must achieve a workable compatibility between the CEO’s management styles and whatever degree of formality or informality is finally selected for the strategic long-range planning process.

Figure 3: CEO Management Style

Strongly Agree Un-certain Disagree Strongly

Agree Disagree

33% 24% 17% 6%

0

20%

0

33%

0

24%

0

17%

0

6%

9

CEO RECOGNITION OF NEED FOR AND COMMITMENT TO STRATEGIC

PLANNING

If long-range planning is to be successfully initiated and effectively used by a commercial bank, the CEO must both recognize a need for, and a strong commitment to do it. Otherwise, formal efforts may disintegrate or, if started, may well languish.

Planners surveyed confirmed that CEOs seem to recognize the need for long-range planning.

Responding to the statement that their CEO does recognize the need for long-range planning,

66% marked “strongly agree” and 26% “agree” only 8% were “uncertain” and none of the bank planners disagreed that their CEOs recognize the need for long-range planning. See figure 4.

Recognition of the need for long-range planning is essential, but recognition alone is not sufficient to produce the action that results in the development and use of an appropriate long-range planning process and long-range plan. The bank’s CEO must be fully committed to planning. Equally important, that commitment must be effectively communicated to all levels of management. “line officer” are reluctant to devote the effort and time to planning and will set the project aside if an interesting transaction arises. They must be persuaded to contribute because they can lend knowledge and credibility to the project. (Johnson [1973].

The CEO’s unswerving commitment, his effectiveness in communicating the crucial importance of strategic planning to lower-level executives and his active involvement in planning provide the necessary foundation for building essential commitment and participation throughout the bank. “Down through the operating units, top management’s commitment to planning has to be matched with a sense of participation – a kind of involvement that generates the feeling at the program level that the plan is the product of those who have to make it work. Planning is most effective when top management is committed to the process, and the success of the entire effort will be proportion to the depth of conviction of top management. (Smith [1971].

While planners generally agree that CEOs recognize the need to do long-range planning, they are less certain about their actual commitment, as shown in figure 4. of the bank planners,

17% are “uncertain” and 2% believe the CEO is not fully committed to long-range planning.

10

The strength of agreement as to the CEO’s full commitment to long-range planning also diminished: 49% responded “strongly agree” and 32% responded “agree”.

The CEO’s management style and commitment to planning merge to create the right climate for planning and to function as a catalyst for planning efforts. A recent Conference .

Figure 4a: CEO Recognition of Need for and Commitment to Long-range Planning

Strongly

Agree

Agree Un-certain Disagree Strongly

Disagree

The CEO recognizes the need to do long-range planning

Figure 4b

The CEO is fully

Committed to

Long-range

Planning

66%

26%

8% 0% 0%

49% 32% 17% 2% 0%

11

study indicated that CEOs have accomplished this task through various means, such as:

Written communications. Such communications include manuals prescribing planning procedures, statements of corporate objectives and goals, and annual planning letters or memos that get into more specific subjects.

The corporate planning director. Usually one of this executive’s key responsibilities is to offer, as requested, planning guidance to line executives.

Consultants. As noted, consultants are sometimes called in when a formal planning system is launched; but some firms keep them on retainer to provide ongoing education on planning concepts and techniques.

Formal education. Several study participants have encourage their executives to attend conferences, seminars, courses and university programs devoted to planning and/ or have provided in-house classes and workshops. (Egerton [1972].), Ogunleye,

G. A. (1999).

Regardless of the approaches used in establishing the proper planning climate, CEO leadership must be joined with knowledge of corporate strategic planning to achieve the greatest success. Once the strategic planning process is established, do the CEOs use the results in their decision making and do they compare actual results to the plan?

CEO USE AND MONITORING OF LONG-RANGE PLANS

The perception of the depth and strategic long-race planning is closely linked to the perception of whether or not CEOs actually use the plans once they are developed. “If the chief executive officer does not stake his career on the success of planning at critical points in the development, the remainder of the organization will conclude that he does not use planning effort” (Johnson [1973].)

Do bank CEOs rely on and use the long-range plan in management policy decision making?

The survey results, shown in Figure 5, reveal substantial doubt that the long-range plans are actually used and even greater doubt that the plans are monitored.

12

Figure 5. CEO Use and Monitoring of Long-Range Plans.

Strongly

Agree

Agree Un-certain Disagree Strongly

Disagree

The CEO relies on and utilizes the long-range plan in management policy decision making

18%

29%

30% 18% 5%

The CEO follows up and monitors actual results compared with the original long-range plan

18% 28%

25% 26% 3%

Approximately 18% of the respondents “disagree” and 5% “strongly disagree,” feeling that their CEOs do not actually use the long-range plans in making decisions. Uncertainty as to the actual use of long-range plan is indicated by 30%. Thus, over half the bank officers responding to the survey are “uncertain” or feel that the long-range plan is not used to make decisions. Only 18% “strongly agree” and 29% “agree” that their CEO actually does use the long-range plans.

While bank CEOs recognize the need to plan and are committed to it (even though less so), a substantial number of planners are either “uncertain” or feel that their CEOs do not actually

13

use the long-range plans to make decisions. Assuming that the bank’s long-range plan is well developed, it would seem that a valuable input to the CEO’s decision making involving significant resources allocation decisions is tremendously under utilized. Furthermore, if chief planners and top, senior and middle managers are investigating sizable amounts of time to develop the long-range plan.

Effective bank strategic planning that strategic planning is a decision making process-not merely an academic exercise that management supports, condones or tolerates, but never acts upon. Moreover, top management must insist that important decisions be planned strategically. For example, proposals to introduce a new service or to establish a new branche must be evaluated not solely in terms of their own economic justification, but also in terms of their long-term implications. Finally, top management must demonstrate its willingness to commit the organization to a clear course of action over the coming year.” Akingbola E. B

(2006).

The survey also attempted to asses whether CEOs follow up the planning efforts by monitoring results against the long-range plan. A majority participating in the study were either uncertain (25%), disagreed (26%) or strongly disagreed (3%) with the statement that the CEO ever compares results to the long-range plan. On the4 other hand, 18% “strongly agree” and 28% “agree” that their CEOs do compare results to the plan.

The implication (from the perspective of chief bank planners) seems to be that, while CEOs may exert significant effort creating the plan, many devote minimal, if any effort in verifying its accuracy. In contrast, detailed review and analysis are given both positive and negative actual results which are compared to the annual budget. This check is typical in virtually all banks.

The banking industry is not unique in its lack of emphasis on formal monitoring Holberg S.

R. 1984. In his earlier study 61.3% of the electric, natural gas and telephone public utility companies in the United State do not formally compare results with their corporate plan.

Other studies of manufacturing and services industries reveal a similar lack of formal monitoring. (Vancil [1970] and Brown, Sands and Clark [1966].) In attempting to determine why there are so few formal review, this earlier survey discovered that my respondents sighted the frequent changes in their long-range plans and in the business environment as

14

reason for not conduction formal audits. A number of respondents indicate that they obtain what are, in effect, audits of their long-range plans when they prepare new ones. As one company president puts it: “In drawing up a new plan there is, to a degree, an automatic audit of the performance against previous plans, since we naturally compare the new plan with the previous one and note the differences reasons for deviation.” (Brown, Sands and Clark [1966] p. 9-10.)

Although this same informal comparison of plans and results quite likely takes pace in the banking industry, the majority of planners perceive that their CEOs do not compare results to plans. This finding is significant. Improvement’s of the planning process as well as management to planning would be enhanced by a more formal view process.

REWARDS AND RECOGNITION FOR PLANNING

An important follow-up to planning and reinforcement of the value of planning to the organization is to reward managers for their only on their efforts. If managers are rewarded only on their short-run performance, they naturally concentrate their energies on achieving short-run success. Only minimal efforts are expended on long-range planning.

Consequently, the survey questioned whether CEOs reward and recognize individual managers for their long-range planning efforts. The results, shown in Figure 6, indicate that

48/ of bank planners are “uncertain” as to the rewards and/ or recognition of managers by the

CEO for performance in the planning area.

The negative responses are perhaps even more significant: 27% “disagree” and 7% “strongly” that there are any CEO-based rewards or recognition. Only 9% “strongly agree” and 9%

“agree” that their CEOs do, in fact, consider contribution to the bank’s planning efforts in rewarding and recognizing individual managers.

Reluctance of bank executives to devote ad adequate time and effort to long-range planning may stem largely from their perception of CEOs’ reward and recognition criteria. “The practice in banking has been to promote on the basis of

15

Figure 6. Rewards and Recognition for Planning.

Strongly

Agree

Agree Un-certain Disagree Strongly

Disagree

The CEO rewards and recognizes individual managers for their long-range planning efforts

9% 9% 48% 27% 7%

demonstrated ability [in the short run] in loan or investment transactions, administration and control.” A conference Board survey of non-financial corporation CEOs reveals that the people problems associated with planning largely result because line managers believe that:

Their performance is being judged and rewarded on the basis of what they accomplish today and tomorrow, not what they propose to accomplish one year or five years hence. This year’s botton line remains the decisive test of their abilities, no matter what lofty statements about the need to be future orientated top management may make.

Their day-by-day responsibilities-getting out production, making sales, dealing with quality control, supplier, or manpower problems, etc. –cannot be ignored or even postponed. This means that, even with the best intentions, planning occupies a secondary place among their priorities. “Not more than 2% of modern managers think beyond tomorrow,” one company head complains.

Planning is an academic exercise and thus of little value to them because the plans they draw up are often severely modified by their superiors, or uncontrollable or unforeseeable events can make shambles of them.

Planning constitutes a threat to them. It may bring to light that their particular businesses face a declining future relative to others the company is engaged in and so should be phased out.

Or may force relaxation of their tight control over respective profit centers or functions as the

16

planning process makes more information about the centers or functions available to top management, or brings their subordinates into more intimate and frequent contact with the chief executive and other corporate officers than they had in the past. These new interchanges can be viewed by the “men in the middle” as a dilution of their authority and stige. Egerton and Brown (1972).

Consequently, if line top and middle managers are to participate actively in long-range planning, the CEO must specifically tie the quality of their planning efforts to line management compensation, recognition and support of their area’s projects.

Conclusions

The Nigerian Banks are fairy a more highly competitive and challenging environment. For commercial banks to be successful, systematic strategic planning must become a reality. For this to occur, CEO;s role in their banks’ strategic planning must undergo a rapid and significant modification.

A survey of the current role of CEOs in the long-range planning process indicates that they recognize the need for and, in fact, are committed to doing strategic planning. In addition, their management styles, for the most part, seem consistent with a more formal approach to chief bank planners who participated in the survey are about evenly split between those who feel the time the CEO devotes to long-range planning is sufficient and those who feel the

CEO should devote additional time.

However, the survey results reflect substantial uncertainty about actual use of the strategic plan and a belief that CEOs do not compare actual results with the long-range plan.

Finally, the majority of chief bank planners were uncertain or felt that the CEO did not reward or recognize individual managers for their contribution to the bank’s planning efforts.

The implication is that the effectiveness of bank planning could be enhanced greatly if the

CEO would incorporate an appropriate weighting for planning efforts in the appraisal of each manager’s performance. Greater use of plans in decision making and increased monitoring of plans against performance would not only enhance the effectiveness of planning but also help develop a managers’ perceptions of strong CEO commitment.

17

REFERENCES

Brown, James K., Saul S. Sands and Thompson G. Clark. “The status of Long-Range

Planning.” The Conference Board Record III (September, 1996).

Cledenin, William D., “Better Strategic Planning Now for Bigger Bank Profit Tomorrow.”

The Bankers Magazine (1972).

Danielson, Amold G., “ Keys to Successful Long-Range Planning.” Banking (April 1978).

Egerton, Henry C. and James K. Brown. “Planning and the chief Executive”, New York: The

Conference Board (1992).

Haberlin, William E., “Strategic Planning Is Growth Insurance. “Banking (July 1970)

Holmberg, Stevan R., “Monitoring Long-Range Plans. “Long-Range Planning. (June 1974)

Johnson, Herbert F., “Strategic Planning for Banks.” Journal of Bank Research (Summer

1973)

Lorange, P. M. (1986). Strategic Control Systems West. St. Paul. MN.

Ogunleye, G. A. (1999) “A Review of Banking Activities and its Regulatory Framework in

Nigeria: The Past, Present and Future” NDIC Quarterly, Vol. 9 No. 4.

Smith, Everett, “Strategic Planning for Banks Profits. “The Magazine for Bank

Administration (February 1971)

Unterman, Israel, “Strategic Planning in Banks “The Banker Magazine (Spring 1993).

Uchendu, O. A. (1998) “Concentration in the Commercial Banking Industry in Nigeria”.

Economic and Financial Review, Vol. 40 No. 3 Central Bank of Nigeria.

Vancil, Richard F. “The Accuracy of Long-Range Planning. “Harvard Business Review.

(September-October 1970).

Zwick, Charles J., “Strategic Planning and Its Role in the Banking Environment of the 70s.

“Journal of Bank Research (Summer 1983).

18