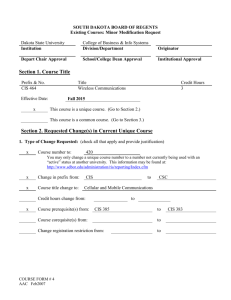

Executive Summary

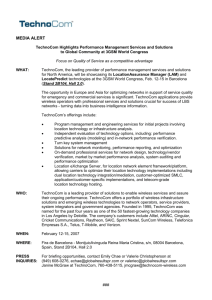

advertisement