Cheque Fraud Protection Service Positive Pay User Guide

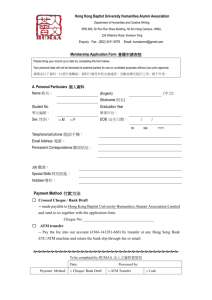

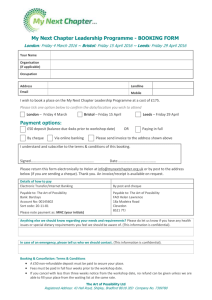

advertisement