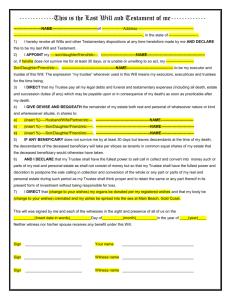

Order of Operations (Will) • Problems with the will itself o Facts

advertisement