Gramm Leach Bliley (GLB) Safeguards Rule

advertisement

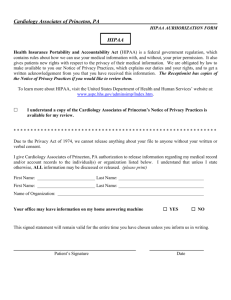

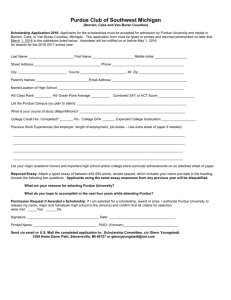

Original Version: May 31, 2004 Revised: December 30, 2006 Purdue University Information Security Program As it pertains to the Gramm Leach Bliley Act and the Health Insurance Portability and Accountability Act of 1996, Safeguarding of Electronic Customer Information and Protected Health Information Objectives of the Information Security Program for the Gramm Leach Bliley Act (GLBA) and Health Insurance Portability and Accountability Act of 1996 (HIPAA): Ensure the security and confidentiality of customer information in compliance with applicable GLBA rules as published by the Federal Trade Commission. Provide administrative, physical, and technical safeguards to ensure compliance with the HIPAA Security Rule.1 Safeguard against anticipated threats to the security or integrity of protected electronic data. Guard against unauthorized access to or use of protected data that could result in harm or inconvenience to any customer. Contents I. Coordination of the Information Security Program II. Risk Assessment and Safeguards2 III. Employee Training and Education IV. Oversight of Service Providers and Contracts V. Evaluation and Revision of the Information Security Plan VI. Definitions VII. Appendices I. Coordination and Responsibility for the Information Security Program The Coordinator of the Information Security Program is the Chief Information Security Officer (CISO) for Purdue University. The Coordinator has also been designated as the HIPAA Security Officer. The Coordinator is responsible for the development, implementation, and oversight of Purdue University’s compliance with the policies and procedures required by the Gramm Leach Bliley Act (GLBA) Safeguards Rule and the Security Rule of the Health Insurance Portability and Accountability Act of 1996 (HIPAA). Although ultimate responsibility for compliance lies with the Coordinator, representatives from each of the operational areas are responsible for 1 Purdue University compliance with the HIPAA Privacy Rule is not covered by this document. This Information Security Program document pertains to the GLBA Safeguards Rule and the HIPAA Security Rule. 2 For purposes of HIPAA, only Security Rule risk assessments are covered by this document. 1 implementation and maintenance of the specified requirements of the security program in their specific operation. See Appendix A-1 for the matrix identifying the GLBA operational areas and their representatives. Appendix A-2 includes a list of areas considered for inclusion in this program, but deemed to be outside the scope of the GLBA Safeguards Rule. A list of Purdue University HIPAA covered components and their representatives may be found at http://www.purdue.edu/hipaa/arealiaisons/arealiaisons.shtml. These lists (GLBA operational areas and their representatives and HIPAA covered components and their representatives) may be updated from time to time. GLBA Committee The GLBA Standing Committee exists to ensure that this Information Security Program is kept current and to evaluate potential policy or procedural changes driven by GLBA. This committee includes the following individuals: Director of Audits, Chief Information Security Officer, Executive Director Financial Aid, Bursar, University Counsel, and representatives from the Calumet, Fort Wayne, and North Central regional campuses. Other individuals may be added as needed. This committee meets biannually and as needed. Questions regarding GLBA impacts on business processes and policies should be directed to the Coordinator of the Information Security Program. HIPAA Steering Committee The HIPAA Steering Committee was created to ensure that activities are sufficient for Purdue University to maintain compliance with the three segments of the HIPAA Administrative Simplification regulations: the Privacy Rule, Transaction and Code Set Standards, and the Security Rule. Changes to the HIPAA Security Rule, which could impact the Information Security Plan will be discussed during the quarterly HIPAA Steering Committee meetings. A roster of HIPAA Steering Committee members may be found at: http://www.purdue.edu/hipaa/administration/hipaasteeringcommrosterforwebsite.pdf Questions regarding HIPAA impacts on business processes and policies should be directed to the Director of HIPAA Privacy Compliance. Questions regarding technical issues, risk assessments, and information technology security policy should be directed to the Office of Information Technology Security and Privacy. This Information Security Program includes input from other Purdue University departments and from the University’s General Counsel. 2 II. Risk Assessment and Safeguards There is an inherent risk in handling and storing any information that must be protected. Identifying areas of risk and maintaining appropriate safeguards can reduce risk. Safeguards are designed to reduce the risk inherent in handling protected information and include safeguards for information systems and the storage of paper. The GLBA Information Sheet and HIPAA Information Sheet are located in Appendix B. The Coordinator of the Information Security Program must work with all relevant areas of the University to identify potential and actual risks to security and privacy of electronic information. Each representative, or designee, will fully participate in periodic data security reviews as specified by the Coordinator. Each representative, or designee, must also participate in a data security review whenever there is a material system change in that area. Documentation of the review will be retained by the Coordinator for a period of six (6) years from the date of its creation or the date when it last was in effect, whichever is later. III. Employee Training and Education Employees handle and have access to protected information in order to perform their job duties. This includes permanent and temporary employees as well as student employees, whose job duties require them to access protected information or who work in a location where there is access to protected information. Departments are responsible for maintaining a high level of awareness and sensitivity to safeguarding protected information and should periodically remind employees of its importance. Seemingly minor changes to office layout and practices could significantly compromise protected information if a culture of awareness is not present. The department representative is responsible for ensuring that staff are trained in the relevant GLBA and HIPAA concepts and requirements. Training materials relative to GLBA and HIPAA have been developed by the GLBA Committee and the HIPAA Privacy Compliance Office. These training templates and required materials are available on the web (see Appendix C for the websites). Upon approval by the Coordinator for GLBA and Director of HIPAA Privacy Compliance for HIPAA, these training templates and other materials may be tailored by each department to reflect their individual training needs. Training may be delivered in a variety of ways that meet the department’s objectives. Departments are responsible for maintaining records of staff that have received training and must be able to produce written copies upon request. A sample GLBA acknowledgement statement and HIPAA Confidentiality Statement are provided in Appendix G. These statements should be signed by all employees receiving GLBA or HIPAA training. These records should be maintained in departmental files by the GLBA or HIPAA representative. These records need to be maintained and available for audit for a period of six (6) years from the date of the record’s creation or the date when it was last in effect, whichever is later. 3 IV. Oversight of Service Providers and Contracts GLBA requires the University to take reasonable steps to select and retain service providers who maintain appropriate safeguards for covered data and information. GLBA Contracts with service providers entered into prior to June 24, 2002 were grandfathered until May 2004. University General Counsel prepared language to ensure that all relevant service provider contracts comply with GLBA provisions. Contracts should be reviewed to ensure the following language is included: [Service Provider] agrees to implement and maintain a written comprehensive information security program containing administrative, technical and physical safeguards for the security and protection of customer information and further containing each of the elements set forth in § 314.4 of the Gramm Leach Bliley Standards for Safeguarding Customer Information (16 C.F.R. § 314). [Service Provider] further agrees to safeguard all customer information provided to it under this Agreement in accordance with its information security program and the Standards for Safeguarding Customer Information. The GLBA contract addendum and service provider due diligence questionnaire are provided in Appendix H. Similarly, HIPAA allows a covered component to disclose protected health information to a business associate who is providing a particular function for the covered entity only if the covered entity obtains satisfactory assurances that the business associate will safeguard the information appropriately as required by HIPAA. Excluded from this requirement are disclosures for treatment, and other exceptions. Standard contracts have been developed by University General Counsel and such contracts are administered by the HIPAA Privacy Compliance Office. The covered component is responsible for identifying the need for a business associate agreement and should contact the HIPAA Privacy Compliance Office to determine if a business associate's agreement is required and for issuance of the agreement. Purdue Purchasing may issue a business associate agreement in conjunction with a master agreement and will coordinate with the HIPAA Privacy Compliance Office should this occur. These contracts should not be issued by covered components independently from the HIPAA Privacy Compliance Office. V. Evaluation and Revision of the Information Security Program GLBA mandates that this Information Security Program be subject to periodic review and adjustment. The most frequent of these reviews will occur within Information Technology Security and Privacy where constantly changing technology and constantly evolving risks indicate the wisdom of regular reviews. Processes in other relevant offices of the University such as data access procedures and the training program should undergo regular review. It is the policy of Purdue University to conduct yearly security assessment reviews for HIPAA purposes. 4 This Information Security Program, as well as the related Data Retention Policy, should be reevaluated annually in order to ensure ongoing compliance with existing and future laws and regulations. VI. Definitions Covered Component means any area of Purdue University, which is required to be compliant with either GLBA or HIPAA regulations. Customer Information means any record containing nonpublic personal information as defined in 16 C.F.R. § 313.3(n), about a customer of a financial institution, whether in paper, electronic, or other form, that is handled or maintained by or on behalf of [the financial institution] or [its] affiliates. Financial Product or Service means (i) any product or service that a financial holding company could offer by engaging in a financial activity; and (ii) Financial Service includes your evaluation or brokerage of information that you collect in connection with a request or an application from a consumer for a financial product or service. Non-Public Personal Information means (i) Personally identifiable financial information and (ii) Any list, description, or other grouping of consumers (and publicly available information pertaining to them) that is derived using any personally identifiable financial information that is not publicly available. 16 C.F.R. § 313.3(n) (1). Personally Identifiable Financial Information means any information: (i) A consumer provides to you to obtain a financial product or service from you; (ii) About a consumer resulting from any transaction involving a financial product or service between you and a consumer; or (iii) You otherwise obtain about a consumer in connection with providing a financial product or service to the consumer. Protected Information refers to either personally identifiable financial information or protected health information, which is covered by either the Gramm Leach Bliley Act (GLBA) or the Health Insurance Portability and Accountability Act of 1996 (HIPAA). Protected Health Information (=individually identifiable health information) is information that is a subset of health information, including demographic information collected from an individual, and: (i) Is created or received by a health care provider, health plan, employer, or health care clearinghouse; and 5 (ii) Relates to the past, present, or future physical or mental health or condition of an individual; the provision of health care to an individual; or the past, present, or future payment for the provision of health care to an individual; and a. That identifies the individual; or b. With respect to which there is a reasonable basis to believe the information can be used to identify the individual. Examples of Activities the FTC is Likely to Consider as a Financial Product or Service include: Student (or other) loans, including receiving application information, and the making or servicing of such loans Financial or investment advisory services Credit counseling services Tax planning or tax preparation Collection of delinquent loans and accounts Sale of money orders, savings bonds or traveler’s checks Check cashing services Travel agency services provided in connection with financial services Real estate settlement services Money wiring services Issuing credit cards or long term payment plans involving interest charges Personal property and real estate appraisals Career counseling services for those seeking employment in finance, accounting or auditing Services provided by a principal, broker or agent with respect to life, health, liability or disability insurance products Obtaining information from a consumer report Providing or issuing annuities Last revised: 12/30/2006 6 VII. Appendices A. A-1: Business Processes Identified for Risk Assessment Under Gramm Leach Bliley - Matrix as of August, 2004. A-2: Business Processes Considered Out of Scope Under Gramm Leach Bliley – Matrix as of August, 2004. B. B-1: GLBA Information Sheet. B-2: HIPAA Information Sheet. More information on Purdue University’s HIPAA compliance program can be found at: http://www.purdue.edu/hipaa/. C. GLBA and HIPAA Training Templates (departments are responsible for maintaining records of staff that have received training). Note: Either training template may be used or departments may adapt, with permission, the training template relative to departmental needs. 1. http://www.itap.purdue.edu/security/policies/GLB_Safeguards_Rule_Training_Business_Office.pdf 2. http://www.itap.purdue.edu/security/policies/GLB_Safeguards_Rule_Training_General.pdf 4. http://www.purdue.edu/hipaa/stafftraining/stafftraining.shtml D. Legal References (citations) 1. 15 USC, Subchapter I, §§ 6801-6809 (Gramm-Leach-Bliley Act) 2. Pub. L. No. 104-191, 110 Stat. 1936 (codified in scattered sections of 18, 26, 29, and 42 U.S.C.). (Health Insurance Portability and Accountability Act of 1996) 3. 16 CFR, Part 313 (Privacy Regulations, see reference to Family Educational Rights and Privacy Act (FERPA).) 4. 20 USC, Chapter 31, 1232g (FERPA) 5. 34 CFR, part 99 (FERPA regulations) 6. 16 CFR, part 314 (Safeguard Regulations, as published in the Federal Register, 5/23/02) 7. 45 CFR, parts 160 & 164; 68 Fed. Reg. 8334 (Feb. 20, 2003) (HIPAA Security Regulations) 8. NACUBO Advisory Report 2003-01, issued 1/13/03 9. FTC Facts for Business: Financial Institutions and Customer Data: Complying with the Safeguards Rule, published September 2002 E. Selected University Policies, Executive Memoranda (referenced) No. B-50, Terms and Conditions of Employment of Faculty Members, http://www.purdue.edu/oop/policies/pages/human_resources/b_50.html No. B-55, Terms and Conditions of Employment of Administrative and Professional Staff, http://www.purdue.edu/oop/policies/pages/human_resources/b_55.html No. C-2, Disclosure of University Records: Procedures for Use in Connection with the “Access to Public Records” Law, and in Response to Third-Party 7 Subpoenas, http://www.purdue.edu/oop/policies/pages/human_resources/c_2.html No. C-8, Policy for Security Standard Practice Procedures, http://www.purdue.edu/oop/policies/pages/records/c_8.html C-10, Delegation of Administrative Authority and Responsibility to Officers Reporting to the President of the University, http://www.purdue.edu/oop/policies/pages/governance/c_10.html No. C-34, Data Security and Access Policy Statement, http://www.purdue.edu/oop/policies/pages/information_technology/c_34.html No. C-41, Assignment of Authority and Responsibility for the Retention and Disposal of University Records, http://www.purdue.edu/oop/policies/pages/records/c_41.html No. C-51, University Policy Regarding the “Family Educational Rights and Privacy Act of 1974” (as amended), http://www.purdue.edu/oop/policies/pages/records/c_51.html IT Resource Acceptable Use Policy (V.4.1), http://www.purdue.edu/policies/pages/information_technology/v_4_1.html Social Security Number Policy (V.5.1), http://www.purdue.edu/policies/pages/information_technology/v_5_1.html Authentication and Authorization (V.1.2) http://www.purdue.edu/policies/pages/information_technology/v_1_2.html Incident Response (V.1.4) http://www.purdue.edu/policies/pages/information_technology/v_1_4.html Privacy for Electronic Information (V.1.3) http://www.purdue.edu/policies/pages/information_technology/v_1_3.html HIPAA Covered System and Application Logging (V.1.7) Interim http://www.purdue.edu/policies/pages/information_technology/v_1_7_interim .html Proper Disposal of Electronic Media (V.1.5) Interim http://www.purdue.edu/policies/pages/information_technology/v_1_5.html Remote Access to IT Resources (V.1.6) Interim http://www.purdue.edu/policies/pages/information_technology/v_1_6_interim .html Electronic Mail (V.3.1) http://www.purdue.edu/policies/pages/information_technology/v_3_1.html F. Selected Purdue Information Technology Administrative Computing Guidelines or Policies (referenced) 1. Standards http://www.purdue.edu/securepurdue/standards/ 2. Best Practices http://www.purdue.edu/securepurdue/bestPractices/ G. G-1: Example GLBA Acknowledgement Statement G-2: Example HIPAA Confidentiality Statement 8 H. GLBA Contracts Addendum and Service Providers Questionnaire I. GLBA Quick Reference Checklist 9 Appendix A-1 Business Processes Identified for Risk Assessment Under the Gramm Leach Bliley Act Matrix as of August 2004 Process Area - West Lafayette Campus Division of Financial Aid WL Area Contact Regional Campus Contact Rationale Financial Aid Director Financial Aid Director Loans – Purdue and Perkins/Health Profession/Nursing (application). Loans – Purdue and Perkins/Health Profession/Nursing (servicing and collection) Loans – School as Lender Deferred fees Division of Financial Aid Financial Aid Director Financial Aid Director Involves collection of student and parent personal financial information in conjunction with potentially being offered student loans as part of the aid package. Student loans are a financial product or service. Loan Operations Manager, Loan Program N/A Student loans are a financial product or service. Bursar Bursar Bursar Bursar Bursar Bursar Installment plan Bursar Bursar Bursar Budget plan Bursar Bursar Bursar Accounts Receivable University Collections Manager, UCO Comptroller Credit bureau reporting University Collections Manager, UCO Comptroller Collection agency referrals University Collections Manager, UCO Comptroller Student loans are a financial product or service. Represents offering “credit” for tuition and fee payments through deferment of amounts due beyond due date. Includes fee for service. Represents offering “credit” for tuition and fee payments through deferment of amounts due beyond due date. Includes fee and truth in lending disclosures. Up front financing for tuition and fees. Includes fee for service. CARS system used to bill for tuition and fee amounts past due or due to bad checks or failed ACH payments. Student loans and tuition debts are reported to credit bureaus. Student loans and tuition debts are referred to third party agencies for collection. Receipt and processing of applications for financial aid 10 Process Care Credit in Vet Teaching Hospital – “looks” like regular merchant card activity. We have app forms available, but don’t make credit decisions Downloads of mainframe or client server data to Access or other query databases Lockbox processing Planned Giving Area - West Lafayette Campus Credit Card Operations WL Area Contact Regional Campus Contact Credit Card Operations Manager N/A Bursar Computing Mgr of Systems and Office Automation Comptroller Includes student loans, accounts receivable, tuition and fee payment plan information. Credit Card Operations/Bursar Bursar & Credit Card Operations Manager NA General Counsel, Office of Planned Giving General Counsel, University Development Office General Counsel, University Development Office Student loan payments and deferred fee payments are processed through the lockbox. Staff with access to lockbox information system (LOIS) can view statements and invoices imaged by bank. Planned Giving maintains tax information for certain individuals as part of recommending a particular deferred gift option. 11 Rationale Appendix A-2 Business Processes Considered Out-of-Scope under the Gramm Leach Bliley Act Matrix as of August 2004 Process Area - West Lafayette Campus Compensation and Benefits Reason for Exclusion Rationale Not applicable under Act Purdue University does not provide financial or investment advice. University Tax Group Not applicable under Act Purdue University does not provide tax advice or return preparation. Boiler debit card Card Office Not applicable under Act Purdue University is not providing credit, nor is confidential information collected.٭ Transmission of student information to National Clearing House Salary and travel advance promissory notes (in foundation) Affiliated organizations’ investments in CMIP and UEP Faculty editorships Division of Financial Aid/Registrar Not applicable under Act Task is not in conjunction with customers obtaining financial products or services. Purdue Research Foundation Investments/Ac counting Out of Scope Process resides in foundation. Not applicable under Act Investments are not for individuals and customer information is not captured. Various academic areas Out of Scope Limited tax return (for student orgs) preparation by Tax Group Verification of employment/salary by banks for purposes of employees obtaining loans Direct deposit (PEFCU file transmission) University Tax Group Not applicable under Act Services are not provided to individuals; should be cautious about assessing fees for this service as other regulations applicable to banks may apply. Services are not being provided to individuals. Payroll/Investm ents Not applicable under Act Direct Deposit of Financial Aid (PEFCU file transmission) ACH Activities: Bursar Not applicable under Act. Remittance of withholdings University Tax Group/Investme nts Not applicable under Act Financial counseling by Compensation and Benefits Tax treaty analysis by University Tax Group Payroll Not applicable under Act 12 Incidental process; not involved in University providing financial products or services. However, good business practices for safeguarding information apply if copies are kept. Transactions involving payroll appear outside of scope of Act. Rational is that if the FTC intended to include these activities, they would not have limited GLBA to “financial institutions” only. Task is not in conjunction with customers obtaining financial products or services. See above. Process Area - West Lafayette Campus Payroll/Investm ents Reason for Exclusion Rationale Not applicable under Act See above. Remittance of PERF/TIAACREF/and other SRA’s Dean of Students Emergency Loan Fund Compensation and Benefits/Invest ments Dean of Students/Loan Operations Not applicable under Act See above. Not applicable under Act Loans are short term and interest free. Check cashing service Fiscal Administrator PMU Not applicable under Act Purdue-pay (similar function at regionals, if applicable) Bursar & Credit Card Operations Manager Director/Center for Career Opportunities Not applicable under Act Customer information not collected or maintained. Fee is $1.00 based on showing PUID card. FTC rules envisioned “payday” loan operations.٭ For tuition and fee payments, no different than any other payment mechanism. Not obtaining a financial process or service.٭ Not applicable under Act Customer information is not collected or maintained.٭ e-Commerce & Credit Card Operations Not applicable under Act Comptroller.٭ Remittance of child support payments to State of Indiana Career counseling for students interested in financial services industry New uses of Purduepay for gifts, deposits, etc. (similar function at regionals, if applicable) ٭Denotes rationale that was verified with the Federal Trade Commission. 13 Appendix B-1 Gramm Leach Bliley Act (GLBA) Information Sheet Introduction The Gramm Leach Bliley Act (GLBA) is a comprehensive law affecting institutions and departments that deal with financial information which includes nonpublic personal information such as addresses and phone numbers; bank and credit card account numbers; income and credit histories; and Social Security numbers. Due to the fact that Purdue University does significantly engage in student loan making and provides other financial services that use nonpublic personal information, Purdue falls within the definition of “financial institution” under GLBA regulations. For these reasons, Purdue University will be reviewing policies and systems to ensure compliance with the requirements of the GLBA Safeguards Rule. Purdue’s current Family Educational Rights and Privacy Act (FERPA) initiatives will ensure compliance with the Privacy Rules required by the GLBA, limiting the scope of this assessment to the Safeguards Rule. Requirements The GLBA includes requirements to protect the security, integrity, and confidentiality of this consumer information. To be GLBA compliant, organizations must develop, implement, and enforce a comprehensive information security program including administrative, technical, and physical safeguards as determined appropriate for the institution and data. In addition to developing their own safeguards, organizations are responsible for taking steps to ensure that their affiliates and service providers safeguard customer information in their care. Due to these requirements, the IT Security and Policy group will be performing risk assessments on all areas that must meet GLBA compliance requirements. Actions required The following basic actions must be taken to satisfy GLBA requirements: Assess risk Manage and control risk Oversee service provider arrangements Adjust the program to work with new technologies. More information on risk assessments generally can be found at: http://www.itap.purdue.edu/security/services/assessment.cfm 14 Appendix B-2 HIPAA Information Sheet Introduction The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a comprehensive law affecting institutions and departments that deal with protected health information. University policy defines this as: Individually identifiable health information, in any form received or created as a consequence of providing healthcare services or health plan benefits (including demographic information). Protected health information may include information used for research purposes, if that information identifies or could be used to identify a human research subject. Because most, if not all of this information is stored, transmitted, and/or processed by various information systems, ITaP Security and Privacy (ITSP) assesses the compliance and risk of various departments within not only ITaP but the rest of the University. Requirements HIPAA includes requirements to protect the security, integrity, and confidentiality of this healthrelated information. These requirements apply to departments at Purdue that have been officially designated by the HIPAA Privacy Compliance Office as covered by HIPAA. To be HIPAA compliant, departments must develop, implement, and enforce a comprehensive security program including administrative, technical, and physical safeguards as determined appropriate for the institution and data. In addition to developing their own safeguards, departments are responsible for taking steps to ensure that their affiliates and service providers safeguard customer information in their care. Actions Required The following basic actions must be taken to satisfy HIPAA requirements: Assess risk to information systems, applications, and the HIPAA covered data it must protect. Manage and control these risks. Identify business associates in your area and communicate them to the HIPAA Privacy Compliance Office prior to sharing protected health information with them. Adjust new technologies and programs to satisfy HIPAA requirements. A full risk assessment and compliance recommendation for your department will be performed by ITSP to accomplish these goals. 15 Appendix G-1 GLBA Acknowledgement Statement I acknowledge that I have participated in training concerning the Gramm Leach Bliley Standards for Safeguarding Customer Information on the following date: _________________________ ___________________ Signed ___________________________ Printed ___________________________ Department 16 Appendix G-2 HIPAA Confidentiality Statement Certain employees of Purdue University may encounter health information protected by the Health Insurance Portability and Accountability Act of 1996 through various sources including, but not limited to, interoffice communications, data or software maintenance, electronic media, verbal interactions, health plan claims or medical records. Employees with access to such information shall not discuss, disclose, or give access to confidential health information except as needed to perform an essential job function or to those having a legal right to such information. They must further agree to access, use and disclose only the minimum protected health information necessary to perform their job functions and to follow the University policies and procedures that address the technical, physical and administrative safeguarding and security of protected health information. Any breach of confidentiality in violation of University policies, professional standards or state and federal laws and regulations governing protected health information, may result in applicable sanctions and/or university disciplinary action against the responsible employee. By signing below, I certify that I have received and reviewed training concerning the HIPAA Privacy Regulations and that I will abide by the Purdue policies and procedures to ensure appropriate confidentiality and security of the health information that I encounter to do my job. ________________________________ Signed ______________ Date ________________________________ Printed _________________________________ Department 17 Appendix H ADDENDUM TO SERVICE PROVIDER AGREEMENT This Addendum to Service Provider Agreement is entered into by Purdue University (“Purdue”) and ________________________ (“Service Provider”) this ___ day of __________, 200__. WHEREAS, Purdue and Service Provider executed dated_________________________________________, ____________ for _________________________________________ (“Original Agreement”). an the Agreement purpose of WHEREAS, the Original Agreement contemplates that “Customer Information” (as the term is defined in the Gramm Leach Bliley Safeguards Rule, 16 C.F.R. § 314) may be provided or exchanged with Service Provider in connection with a financial product or service; WHEREAS, the Gramm Leach Bliley Safeguards Rule requires Purdue to ensure, by contract, that Service Provider implements and maintains appropriate safeguards for Customer Information provided to Service Provider. NOW THEREFORE, the parties agree to add the following requirements to their Original Agreement: 1. Service Provider agrees to implement and maintain a written comprehensive information security program containing administrative, technical and physical safeguards for the security and protection of Customer Information and further containing each of the elements set forth in § 314.4 of the Gramm Leach Bliley Standards for Safeguarding Customer Information (16 C.F.R. § 314). 2. Service Provider further agrees to safeguard all Customer Information provided to it under the Original Agreement and this Addendum in accordance with its information security program and the Gramm Leach Bliley Standards for Safeguarding Customer Information. 3. All other provisions of the Original Agreement between the Parties shall remain in full force and effect. IN WITNESS WHEREOF, the parties have executed this Addendum to Service Provider Agreement on the date and year first written above. Purdue University __________________________ “Service Provider” By:___________________________ Printed:_______________________ By:_________________________ Printed:______________________ Title:_________________________ Title:________________________ #341217.1 18 Gramm Leach Bliley (GLB) Safeguards Rule Service Provider Due Diligence Company name: ___________________ Company Federal ID#: _________________ Completed by (name, title): ___________________ Contact information (phone, fax, e-mail, address): Please answer the following questions regarding your firm’s implementation of the GLB Safeguards Rule: 1. Does your firm have a written information security program that contains administrative, technical, and physical safeguards appropriate to the size and complexity of the firm, the nature and scope of its activities, and the sensitivity of customer information at issue? (circle one) YES NO If no, please explain. 2. Has your firm designated an employee or employees to coordinate the information security program? (circle one) YES NO If no, please explain. 19 3. Has your firm undergone an assessment to identify reasonable, foreseeable internal and external risks to the security, confidentiality, and integrity of customer information that could result in the unauthorized disclosure, misuse, alteration, destruction, or other compromise of such information? (circle one) YES NO If no, please explain. 4. At a minimum, did the risk assessment include consideration of risks in the following areas: employee training and management; information systems including network and software design, as well as information processing, storage, transmission, and disposal; and detecting, preventing, and responding to attacks, intrusions, or other systems failures? (circle one) YES NO If no, please explain. 5. Has your firm taken steps to select and retain service providers that are capable of maintaining appropriate safeguards for customer information? (circle one) YES NO If no, please explain. 6. Has your firm included appropriate language in service providers’ contracts requiring them to implement and maintain appropriate safeguards? (circle one) YES NO If no, please explain. 20 I certify that the information provided above is true and correct to the best of my knowledge. Signature Date 21 Appendix I GLBA Quick Reference Chart Item: Comment: Objectives of Information Security Program Ensure the security and confidentiality of customer information. Operational Areas Impacted Date / Timeframe, if applicable: Responsible Party Coordinator Protect against anticipated threats to the security or integrity of customer information. Guard against unauthorized access to or use of customer information that could result in harm or inconvenience to any customer. Comply with applicable Gramm Leach Bliley rules as published by the Federal Trade Commission. Includes but not limited to The Division of Financial Aid, Office of the Bursar, University Collections, The Office of Planned Giving (see appendix A-1 for Matrix Identifying Operational Areas). GLBA Standing Committee Coordinator responsible for specific operation Chief Information Security Officer. Coordinator must work with all relevant areas of the University to identify potential and actual risk to security and privacy of information. Coordinator Offices deemed outside GLBA safeguard rules (refer to appendix A-2) GLBA Standing Committee Standing Committee Director of Audits, Chief Information Security Officer, Bursar, Executive Director of Financial Aid, representatives from the regional campuses, University Counsel. Meetings biannually and as needed. Rep or Designee Responsible to conduct a periodic data security review, with guidance from the coordinator. Must retain assessment data for a period of two (2) years including the most recent assessment. Retain two (2) years. Directors & supervisors responsible for ensuring compliance with information security practices. Training template on the web at: 1. http://www.itap.purdue.edu/security/policies/GLB_Safeguards_Rule_Training_Business_Office.pdf 2. http://www.itap.purdue.edu/security/policies/GLB_Safeguards_Rule_Training_General.pdf 22 GLBA Standing Committee Coordinator Item: Comment: Date / Timeframe, if applicable: Maintain records that staff have received training (see Appendix G-1 for sample training statement). Retain records for six (6) years including most recent training year. (Includes permanent, temporary, and student employees whose jobs require them to access customer information or they work in a location where there is access to customer information.) Retain proof of training six (6) years. Responsible Party Questions regarding technical issues, risk assessment, and information technology policy Questions on business policy and processes Contact Office of Information Technology Security and Privacy ITSP Contact Coordinator of the Information Security Program Coordinator Service Providers Requirement (Contracts) Must include specific language in third party service in contracts relative to compliance with GLB, Reference Item IV, page 4, GLB policy for specific language and Appendix H. Department and General Counsel Periodic review required GLB mandates that Information Security Programs be subject to periodic review and adjustment. Customer Information Any record containing nonpublic personal information as defined in 16 C.F.R. 313.3(n), about a customer of a financial institution, whether in paper, electronic, or other form, that is handled or maintained by or on behalf of [the financial institution] or [its] affiliates. Financial Product or Service Financial Product or Service means any product or service that a financial holding company could offer by engaging in a financial activity. Financial Service includes your evaluation or brokerage of information that you collect in connection with a request or an application from a consumer for a financial product or service. (i) Personally identifiable financial information, and (ii) Any list, description , or other grouping of consumers (and publicly available information pertaining to them) that is derived using any personally identifiable financial information that is not publicly available. 16 C.F.R. 313.3 (n) (1). Non-Public Personal Information PersonallyIdentifiable Financial Information Means any information: (i) A consumer provides to you to obtain a financial product or service from you; (ii) About a consumer resulting from any transaction involving a financial product or service between you and a consumer; or 23 Plan to be evaluated annually. GLBA Standing Committee Not Applicable Item: Examples FTC considers a financial product Examples FTC considers a financial product or service. Comment: Date / Timeframe, if applicable: Responsible Party (iii) You otherwise obtain about a consumer in connection with providing a financial product or service to the consumer. Student (or other) loans, including receiving application information, and the making or servicing of such loans Financial or investment advisory services Credit counseling services Tax planning or tax preparation Collection of delinquent loans and accounts Sale of money orders, savings bonds or traveler's checks Check cashing services Travel agency services provided in connection with financial services Real estate settlement services Money wiring services Issuing credit cards or long term payment plans involving interest charges Personal property and real estate appraisals Career counseling services for those seeking employment in finance, accounting or auditing Services provided by a principal, broker or agent with respect to life, health, liability or disability insurance products Obtaining information from a consumer report Providing or issuing annuities 24 Not Applicable