AC 320B – Principles of Accounting II

advertisement

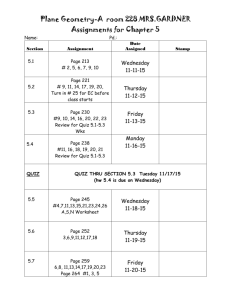

Regis University Regis College Division of Business AC 320B – Principles of Accounting II Fall Term 2004 Instructor: Phone: E-Mail: Web page: J. Daniel Daly, S.J. (303) 964-5113 jddaly@regis.edu academic.regis.edu/ddaly Office: Main Hall 214M Hours: MF 9:00 a.m. – 10:15 a.m. W 2:00 p.m. - 4:00 p.m. TTh 1:30 p.m. – 3:00 p.m. Principles of Accounting II is the second semester of the introductory accounting class. One third of the class completes the broad overview of financial accounting begun in the first semester. Topics considered include the sale of stock, the purchase of investments, and the statement of cash flows. The remainder of the class provides an overview of managerial accounting, which is concerned with the use of accounting information by managers for analysis, planning and control. Topics in managerial accounting include product costing, cost-volumeprofit relationships, cash budgeting, profit planning, and performance evaluation. The textbook used in this course is: Weygandt, Jerry J., Donald E. Kieso, and Paul D. Kimmel. Accounting Principles, Sixth Edition. (New York: John Wiley & Sons, Inc., 2002.) Daily Assignments and Class Participation A schedule of classes and assignments is provided on the following pages. In preparation for class, students should read the assigned material, complete the written work, and prepare an answer to the discussion question by the date indicated. During class students will be asked to contribute to discussions, raise questions and explain their solutions to the assigned exercises. Class Notes PowerPoint slides used in class presentations are available on the web page listed above. These slides are provided as an optional study aid; students are not required to have copies of the slides for class. When printing the slides, it works best to request “Handouts” with 2 slides per page. To save color ink, print using “Grayscale.” Project Each student will be asked to work as a member of a team in preparing a managerial accounting project during the semester. Part 1 of the project is due November 3. Each team will meet with the instructor to discuss the initial submission and to outline a plan for completing the project. The entire project is due November 22. Teams will make project presentations to the class December 1-3. A description of the project will be distributed later in the term. The project provides students with an opportunity to apply accounting skills and insights to a business problem that is more extensive and more complex than those found in the textbook exercises. 1 Quizzes Eight quizzes will be given during the semester. Each quiz will cover the reading material, written work, and discussion questions assigned for that class and the preceding class. For example, the quiz on September 8 will cover the material assigned for September 3 and 8. Students who are unable to take a quiz at the scheduled time due to a pre-excused absence should arrange to take the quiz at another time. Absences are generally pre-excused for schoolsponsored activities, serious illnesses, and personal / family emergencies provided the student talks with the instructor before the class begins. Students who miss the quiz without being excused beforehand will not be able to make-up the quiz. Exams Two midterm examinations are scheduled during class time. The final exam schedule is: Course Class time Final Exam Day Final Exam Time AC320B RU01 AC320B RU02 MWF 10:30 MWF 11:30 Friday, December 17 Friday, December 17 10:10 am – 12:10 am 8:00 am – 10:00 am The exams will consist of multiple choice questions, problems, and short essays based on assignments, lectures, and class discussions. The final exam will be cover all managerial accounting material (covered after the first midterm exam) and will emphasize the last portion of the class. Students unable to take an exam at the designated time must contact the instructor before the exam and make alternative arrangements. Accommodations for Students with Disabilities A student with a documented disability requiring accommodations for this class should meet with the director of Disability Services (303-458-4941). Following the meeting the student should make an appointment with me to discuss the accommodation request. Students are encouraged to self-disclose and request special arrangements as soon as possible because accommodations are not provided retroactively and adequate lead-time is required. Grades In the determination of grades, the following weighting will be used: First midterm examination 20% Second midterm examination 20% Final examination 20% Quizzes 10% Homework 10% Project 10% Attendance and participation 10% In determining the quiz average, the lowest two quiz grades will be dropped. A missed quiz, for which no prior arrangements have been made, counts as a zero. 2 Homework assignments will be collected on a random basis. Late assignments will not be accepted. If a student fails to submit an assignment due to a pre-excused absence, that assignment will be dropped in the determination of the homework grade. Otherwise, missed assignments count as a zero. A penalty will be assessed on the grades of those projects submitted late. Attendance will be taken at the beginning of each class. Students that arrive to class after attendance is taken will be marked absent. Academic Integrity Students are expected to maintain high standards of academic integrity in this class. Cheating on a quiz or an exam is a serious violation of these standards. Cheating includes providing or obtaining confidential information about a quiz or an exam to/from another student in Principles of Accounting II. Plagiarism is presenting work done by someone else as one’s own. Submitting a paper written by someone else is a serious violation of academic integrity. Plagiarism also includes copying or paraphrasing written material without proper attribution. Students should clearly distinguish their own ideas from the ideas of someone else. Students who violate integrity standards are likely to lose credit for the quiz, exam, or assignment and may be prohibited from completing the course. AC 320B – Principles of Accounting II Fall Term 2004 Schedule of Assignments Monday 8/30/04 Introduction Wednesday 9/1/04 Chapter 14: Corporate Form of Organization & Issuance of Common Stock READING pp. 558-571 pp. 571-572 The Corporate Form of Organization (entire section) Accounting for Common Stock Issues Issuing Par Value Common Stock for Cash WRITTEN Q14-8, Q14-9, Q14-10, BE 14-2, E14-1 [Part (a) only] QUESTION Which of the following organizations would be more likely to form a corporation: an architectural firm or an Internet startup? Explain. 3 Friday 9/3/04 Chapter 14: Treasury Stock, Preferred Stock, & Statement Presentation READING pp. 574-576 pp. 578-580 pp. 581-585 Accounting for Treasury Stock Purchase of Treasury Stock Preferred Stock Dividend Preferences Liquidation Preference Statement Presentation and Analysis (entire section) WRITTEN Q14-7, Q14-14, E14-5, P14-5A QUESTION Scientific Enterprises has 6,000 shares of 10%, $80 par value, cumulative preferred stock outstanding. What is the annual preferred dividend? Assume that there were no dividends in arrears at the end of 2000 but that the company paid no dividends in 2001 and 2002. If $100,000 in dividends are paid in 2003, how much of that will go to the preferred shareholders? Wednesday 9/8/04 Chapter 15: Dividends and Stock Splits READING pp. 600-609 WRITTEN Chapter 14: E14-11; Chapter 15: Q15-4, Q15-5, E15-1, E15-3, E15-4 QUESTION Holiday Corporation had exceptionally high net income in 2003 and plenty of cash at the end of the year. However, the company declared a cash dividend only slightly higher than the dividend in 2002. What might have been the reason for not declaring a larger dividend? Friday 9/10/04 Dividends (entire section) Quiz #1 Chapter 15: Retained Earnings, Income Statement, Earnings per Share READING pp. 610-614 pp. 615-616 pp. 620-621 WRITTEN Q15-15, Q15-22, E15-8, E15-10, E15-14, P15-1A [Part (a) only] QUESTION Illustration 15-8 shows that Amazon.com had a negative balance for Retained Earnings and a positive balance for cash. How is that possible? Monday 9/13/04 READING Retained Earnings (entire section) Corporate Income Statements (introductory material only) Earnings per Share EPS and Preferred Dividends Chapter 16: Bonds pp. 638-645 pp. 645-650 p. 653 Bond Basics (entire section) Accounting for Bond Issues Issuing Bonds at Face Value Discount or Premium on Bonds Issuing Bonds at a Discount (exclude amortizing discount) Issuing Bonds at a Premium (exclude amortizing premium) Accounting for Bond Retirements Redeeming Bonds at Maturity WRITTEN Chapter 15: P15-3A [Parts (a) and (b) only]; Chapter 16: Q16-5, Q16-6, Q16-8, E16-1, E16-2 QUESTION Which is a thief more likely to steal, registered bonds or bearer bonds? Explain. 4 Wednesday 9/15/04 Chapter 16: Other Long-term Liabilities; Analysis of Debt READING pp. 655-656 pp. 659 Accounting for Other Long-term Liabilities Long-Term Notes Payable Statement Presentation and Analysis (entire section) WRITTEN Q16-15, E16-3 [Part (a) only], E16-4 [Part (a) only], E16-7 [Prepare a installment payment schedule similar to Illustration 16-18 for the first four payments and then prepare journal entries as instructed.] QUESTION Suppose that the debt to total assets ratio for Lands’ End increases from 35% to 40%. Is this good news or bad news for the company? What might have caused the increase? Friday 9/17/04 Chapter 17: Investments and Basic Accounting Why Corporations Invest (entire section) Accounting for Debt Investments (entire section) Accounting for Stock Investments Holdings of Less than 20% Quiz #2 READING pp. 680-684 pp. 684-686 pp. 687-688 WRITTEN Chapter 16: P16-4A; Chapter 17: E17-1, E17-2 QUESTION Some corporations pay their CEOs unreasonably high salaries. Pension fund companies have complained against this practice. Why would pension fund companies care what other firms are doing? Why would these other firms listen to the pension fund companies? Monday 9/20/04 Chapter 17: Investment Valuation & Reporting READING pp. 692-697 WRITTEN Q17-13, Q17-14, E17-8, P17-3A QUESTION If your company had a large, unrealized loss on investments, would you rather record the loss to income or to equity? Explain. Wednesday 9/22/04 Valuing and Reporting Investments (entire section) Chapter 18: The Statement of Cash Flows READING pp. 714-722 pp. 723-727 The Statement of Cash Flows: Purpose and Format (entire section) Indirect Method: First Year of Operations (entire section) WRITTEN E18-1, E18-3 QUESTION Simplicity Corporation had only three transactions for the entire year. The company paid wages of $30,000, sold services on account for $50,000, and bought a car at the end of the year for $15,000 cash. What is the total net income? What is the total increase or decrease in cash? 5 Friday 9/24/04 Chapter 18: Preparing the Statement of Cash Flows READING pp. 727-734 WRITTEN Q18-13, E18-5 [Part (a) only], E18-6 QUESTION Prepare the statement of cash flows (indirect method) for Simplicity Corp. described above. Monday 9/27/04 Chapter 18: Analysis READING pp. 748-750 WRITTEN E18-11, P18-5A Wednesday 9/29/04 Review for midterm exam Monday 10/4/04 Midterm Examination #1 Wednesday 10/6/04 Chapter 20: Overview of Managerial Accounting READING pp. 826-833 WRITTEN Q20-1, Q20-13, E20-1, P20-1A QUESTION A sporting goods store is (1) losing customers because of poor service and (2) losing inventory because of employee theft. How might accounting information direct the owner’s attention to these two problems? Second Year of Operations (entire section) Quiz #3 Analysis of the Statement of Cash Flows (entire section) Friday 10/8/04 Chapter 20: Cost Concepts READING pp. 834-839 WRITTEN Q20-16, E20-5, E20-7, E20-10 [Part (a) only] QUESTION In a potato chip factory what are raw materials purchased, raw materials used, factory overhead, work in process, and finished goods? How would the value of each of these be determined? Monday 10/11/04 Chapter 20: Contemporary Developments in Managerial Accounting READING pp. 839-843 WRITTEN P20-4A QUESTION What information does Boeing need to decide how much to charge for a 737? What information does a hospital need to decide how much to charge for a heart bypass operation? Quiz #4 How is the JIT inventory method different from the conventional inventory method? Explain a potential advantage and a potential disadvantage of JIT. Sunbeam manufactures toasters. Do you think that Sunbeam tries to make toasters of the highest possible quality? Why or why not? 6 Wednesday 10/13/04 Chapter 23: Cost Behavior Analysis READING pp. 944-952 WRITTEN Q23-8, E23-1, E23-2 QUESTION At Southwest Airlines, which costs are likely to increase in proportion to aircraft capacity? Which costs are likely to increase in proportion to the number of passengers? Friday 10/15/04 Chapter 23: Estimating Cost Functions READING Supplemental material WRITTEN Special Assignment QUESTION What are some of the advantages of graphing cost data? Monday 10/18/04 Chapter 23: Cost-Volume-Profit Analysis READING pp. 953-960 WRITTEN Q23-11, Q23-13, E23-3, E23-4, P23-1A QUESTION An entrepreneur has been packaging homemade chocolates for sale in early February. What information does she need to determine the break-even point for her business? Wednesday 10/20/04 Chapter 23: Target Net Income READING pp. 960-966 WRITTEN Q23-16, E23-6, E23-7, P23-2A QUESTION An electronic components supplier plans to automate an assembly line. What impact will this have on variable expenses, fixed expenses, and the break-even point? Quiz #5 Friday 10/22/04 Chapter 21: Job Order Costing READING pp. 862-873 WRITTEN Chapter 23: P23-3A; Chapter 21: E21-1, E21-2 [Do the following only: Prepare journal entries for requisition sheets and time tickets] QUESTION A company manufactures custom-made windows. How does the company keep track of the glass and the labor that go into each job? 7 Wednesday 10/27/04 Chapter 21: Overhead Application READING pp. 873-879 WRITTEN E21-2 [complete the exercise], E21-8, P21-1A [Parts (a), (b), and (c) only] QUESTION A company manufactures custom-made windows. Each new batch of windows requires a new set-up for the cutting and assembly machines. The company applies overhead to batches at $1300 per set-up plus $2.20 per window. How did the manufacturer determine these rates? Friday 10/29/04 Chapter 21: Reporting Job Cost Data READING pp. 879-884 WRITTEN E21-5, P21-1A [complete the problem], P21-4A QUESTION What does it mean for a window manufacturer to overapply overhead during the year? How does such a thing happen? Monday 11/1/04 Quiz #6 Chapter 22: Just-in-Time Processing and Activity-Based Costing READING pp. 917-921 pp. 925-928 Contemporary Developments Appendix: Case Example of ABC WRITTEN E22-11 QUESTION A plant manager determines the following manufacturing costs per bag: potato chips=$0.33, pretzels=$0.28. The company treasurer determines different amounts: potato chips=$0.35, pretzels=$0.39. Who cares? What difference does it make? The purpose of JIT process is to reduce or eliminate manufacturing inventories. What costs are associated with keeping inventories on hand? Illustration 22-25 lists a number of business activities. What are the costs associated with ordering raw materials, machine setups, and machining? Wednesday 11/3/04 Chapter 22: Activity-Based Costing (cont.) WRITTEN P22-7A Friday 11/5/04 Review for midterm exam Monday 11/8/04 Midterm Examination #2 8 Part 1 of Project Due Wednesday 11/10/04 Chapter 24: Operating Budget READING pp. 980-992 WRITTEN Q24-10, Q24-11, Q24-12, Q24-13, Q24-14, E24-2 Friday 11/12/04 Chapter 24: Cash Budget READING pp. 993-998 WRITTEN Q24-18, E24-4, E24-5, E24-9 QUESTION A ski resort in Utah prepares a budgeted income statement each September. All the resort’s customers pay with cash or credit card. Is there any reason for the resort to prepare a cash budget? Explain. Monday 11/15/04 Chapter 24: Budgeting in Nonmanufacturing Companies READING pp. 998-1001 WRITTEN P24-2A, P24-4A QUESTION In December, the manager of a courier service sets the monthly expense budgets for the upcoming calendar year. The budgets are set equal to the actual expenses for November of the current year. What’s wrong with this procedure? Quiz #7 The director of a soft drink bottler will almost certainly earn a bonus this fiscal year (ending March 31) because she is significantly under budget. Among other things, her purchases of computers and supplies were far less than anticipated. What might she want to do before the end of March? Explain. Wednesday 11/17/04 Chapter 25: Budgetary Control READING pp. 1018-1029 WRITTEN Q25-7, Q25-8, E25-1, E25-2 [Part (a) only] Friday 11/19/04 Chapter 25: Budgetary Control (cont.) READING pp. 1029-1030 WRITTEN E25-6, P25-1A [Part (a) only] Monday 11/22/04 Chapter 25: Responsibility Accounting READING pp. 1030-1039 WRITTEN E25-8, P25-3A [Parts (a) and (b) only], P25-4A 9 Part 2 of Project Due Monday 11/29/04 Chapter 25: Measuring Performance READING pp. 1039-1045 WRITTEN E25-10, P25-5A QUESTION For an Applebee’s Restaurant some marketing and purchasing decisions are best made by the local manager. Others are best made by the corporate offices. Give an example of each. The owner of a transmission repair shop pays the shop manager a small base salary plus a fixed percentage of shop income. What are the advantages and disadvantages of this pay scheme? Wednesday 12/1/04 Project Presentations Friday 12/3/04 Project Presentations Monday 12/6/04 Chapter 27: Management Decision-Making READING pp. 1102-1110 WRITTEN E27-1, E27-2, E27-3 QUESTION Two years ago a Littleton fitness center purchased 10 treadmills at a cost of $32,000. The treadmills perform poorly and have required numerous repairs. They can be replaced with much better ones for $58,000. What information is relevant in deciding whether or not to replace the treadmills? Wednesday 12/8/04 Chapter 27: Incremental Analysis READING pp. 1110-1114 WRITTEN E27-4, E27-5, E27-6, P27-1A QUESTION An office furniture manufacturer sells a complete line of products in Colorado. Management of the company is considering dropping office chairs from its product line since fierce competition in this segment of the market keeps profit margins relatively low. What information should be considered before making the decision? Quiz #8 Friday 12/10/04 Chapter 27: Evaluating Capital Investments READING pp. 1114-1116 (including “Cash Payback”) WRITTEN E27-7, P27-3A[Parts (a) and (b) only] QUESTION A shoe manufacturer is planning to replace one of two identical machines, both purchased seven years ago. One machine cost $300,000 and has accumulated depreciation of $210,000. The other machine cost $320,000 and has accumulated depreciation of $224,000. Which machine should be replaced if neither has any salvage value? Explain. 10