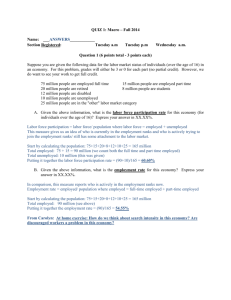

Week 3 Practice Quiz d Answers

advertisement

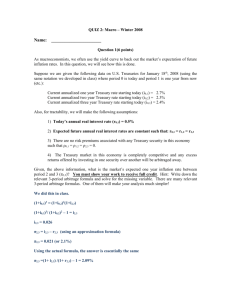

QUIZ 1: Macro – Winter 2012 Name: ___ANSWERS________ Section Registered: Morning Evening Question 1 (5 points): There are lots of pundits talking about how the current policies of the Federal Reserve and the federal government (Congress and the President) will result in inflation in the near term. By looking at the yield curve, we can see whether market participants hold this view. Here is the relevant information for the current yield curve in the U.S. as of late June. One Year Treasury (i0,1) = Three Year Treasury (i0,3) = Five Year Treasury (i0,5) = 0.120% 0.400% 0.890% Two Year Treasury (i0,2) = Four Year Treasury (i0,4) = 0.270% 0.600% For tractability, we will make the following assumptions: 1) The one year real interest rate in all periods is zero (r0,1 = r1,2 = .. = r4,5 = 0). 2) There are no risk premiums associated with any Treasury security in this economy such that ρ0,1 = ρ1,2 = …. = ρ4,5 = 0. 3) The Treasury market in this economy is completely competitive and any excess returns offered by investing in one security over another will be arbitraged away. Given, the above information, what is the market’s expected one year inflation rate between periods 3 and 4 (π3,4)? You must show your work to receive full credit. Hint: Write down the relevant arbitrage formula and solve for the missing variable (it will be one equation and one unknown. This is nearly identical to the questions on the practice quizzes). Express your answer to at least three significant digits (i.e., x.xx%). We want to solve for π3,4 and we know r3,4 (more on that in a bit) but we don’t know i3,4. We have a tool we can use to find i3,4 (I even gave you a hint in the set up). Arbitrage implies: (1+ i0,4)4=(1+i0,3)3 (1+i3,4)1 As an investor, you should be indifferent between investing in a four year security starting in year 0 (today) or investing in a 3 year security in year 0 (today) and then re-investing in a one-year security beginning in year 3 and ending in year 4. Using the arbitrage equation above, we can solve for i3,4: (1.006)4 = (1.004)3 (1+i3,4) 1.02422 = 1.0120 (1+ i3,4) i3,4= .01203 or 1.20% From the assumptions, we know that r3,4 = 0 and that ρ3,4 = 0. This implies that i3,4 = π3,4 = 1.20% That was the only tricky part of this question! Question 2 (3 points) In the Economist article entitled “Botox and Beancounting” (4/30/2011), the author talked about how Europe and the U.S. report similar economic concepts using different metrics. One focus in the article was the measurement of productivity growth. List one way in which the U.S.’s measure of productivity growth differs from Europe’s measure of productivity growth. (Note: the article listed two reasons, you need only recount one). Your answer should not be more than 12 words (tops). U.S. differs from Europe in measuring productivity growth in 2 ways: 1. We base productivity growth on output per man-hour (instead of output per worker) 2. We exclude the public sector (which is less efficient) Either answer would have received full credit. Question 3 (8 points – 2 points each) For each of the following questions, CIRCLE the answer that makes the statement true. There is only ONE true answer to each of the following question stems. A. Consider the Cobb-Douglas production function put forth in class. capital, labor, and TFP will cause aggregate production to: i. ii. iii. iv. A doubling of Not Change Increase, but by less than double Exactly double More than double Remember, the formula for Cobb-Douglas production function: Y= A(K)0.3(N)0.7 By doubling each input, we can re-write our production function Y= 2A(2.3K.3)(2.7N.7) which is equivalent to: Y= 4AK.3N.7 Y has increased by a factor of 4 B. Consider the Cobb-Douglas production function put forth in class. A doubling of capital and labor will cause the marginal product of labor to: i. ii. iii. iv. Not Change Increase, but by less than double Exactly double More than double Let’s solve for marginal product of labor (MPN): From our Cobb-Douglas production function : Y= A(K)0.3(N)0.7 As we discussed in class, we obtain the marginal product of labor by taking a partial derivative of the output function with respect to labor: ∂Y/∂N = .7A(K)0.3(N)-0.3 or MPN = .7A (K/N)0.3 Now, let’s double K and N and see what happens: MPN = .7A(2K/2N).3= MPN = .7A (K/N)0.3 Therefore, doubling K, N will not change the MPN. C. Consider the Cobb-Douglas production function put forth in class. A doubling of TFP, capital, and labor will cause labor productivity to: i. ii. iii. iv. Not Change Increase, but by less than double Exactly double More than double As we discussed during Topic 2, we define labor productivity as Y/N. Let’s take our CobbDouglas production function: Y= A(K)0.3(N)0.7 and divide by N: Y/N = A(K/N)0.3 Now, let’s see what happens when we double A, K, and N: Y/N = 2A(2K/2N)0.3 So Y/N= 2A(K/N)0.3 We can see that labor productivity has exactly doubled. D. According to the Cobb-Douglas production function, TFP (A) and labor (N) are: i. ii. iii iv. Substitutes Complements Neither substitutes or complements Either complements or substitutes, depending on the levels of A and N This is directly from Supplemental Notes 3 about the Aggregate Production Function. There is complementarity between A,K, and N. With a little math, we can prove this to ourselves. Let’s revisit the marginal product of labor (MPN): MPN = .7A (K/N)0.3 An increase in A will increase the MPN (labor productivity). That means the extra output we get from the marginal worker will be higher if we experience a surge in TFP (some kind of technology gain). Question 4 (4 points – 2 points each) List two reasons discussed in class why policy makers may prefer a stable target inflation rate greater that is greater than zero. For each reason, limit your answer to one well constructed sentence. (Hint – we only discussed two reasons in class). A. Keeping the inflation rate above zero helps to keep nominal interest rates from hitting the zero lower bound (when nominal interest rates hit the zero lower bound, the Fed gets handcuffed and cannot lower nominal interest rate to jump start the economy). B. Create a little inflation so real wages can fall to clear the labor market even though nominal wages are downward sticky. Something vaguely related to either answer will earn full credit.