EsRev Issue Alert

advertisement

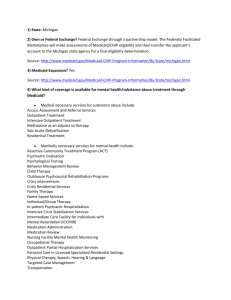

Date: June 2, 2011 Program Area: Medicaid (MA) Issue Summary: Michigan has recently released new policy guidelines, effective July 1, 2011, for the federally mandated estate recovery program, which requires reimbursement for certain Medicaid services the individual received. Persons Affected: Individuals receiving or expecting to receive Medicaid long term care services. For More Information: Michigan Poverty Law Program; 220 East Huron St., Suite 600A, Ann Arbor, MI 48104, (734) 998-6100, (734) 998-9125 Fax; or 3490 Belle Chase Way, #50, Lansing, MI 48911, (517) 394-2985 x231, (517) 394-4276 Fax. Background Estate recovery is a federally mandated program requiring reimbursement from the estates of deceased beneficiaries to the government for certain Medicaid long term care services the individual received. Although the federal government required each state to develop an estate recovery plan in 1993, Michigan is the last state to do so. In 2007, after much prompting by the federal government, the Michigan legislature enacted the Michigan Medicaid estate recovery program. However, the act could not be implemented until the state plan submitted to the federal government was approved by the administrator of the Medicaid program. CMS (the Center for Medicare and Medicaid Services) did not approve the initial proposed amendments to the state plan and requested additional information. The recently released Michigan Medicaid State Plan published by MDCH and the amendments to the Bridges Administrative Manual published by DHS include several new details explaining the program and outlining exceptions when recovery will not be undertaken. What’s Happening? The new estate recovery policy goes into effect July 1, 2011. State Senator Kahn introduced SB 404 on June 7th that would eliminate many of the enumerated exceptions to estate recovery from the original legislation. This bill was referred to the Committee on Appropriations. Even if SB 404 is passed substantially as written, MDCH would have to amend their state plan and obtain approval of those changes from CMS before those changes could be implemented. Thus, it will be important to understand the policy currently in place but also to continue to monitor the legislation as it moves through the Michigan Senate. The policy will apply only to Medicaid beneficiaries who are age 55 years or older and received Medicaid funded long term care and only to those assets in the probate estate. If a beneficiary has a surviving spouse, the state will not pursue a recovery claim until after the spouse has died. All claims will be subject to review by the Probate Court. MI Medicaid State Plan at 582. Unlike other states, Michigan can only impose a lien on real and personal property after the recipient dies. See MCL §400.112g , MI Medicaid State Plan at 94. The state will send an estate recovery notice to the recipient’s estate representative informing him or her that the state plans to file a claim. The notice will include information about the amount of the claim and how the representative can file for exceptions. The state can ask for repayment of nursing facility services, MI Choice home and community based waiver services, home health, home help, and hospital or prescription drug services made on or after July 1, 2010, and made after the recipient has reached the age of 55 years. MSA Bulletin 11-20. The request for an exception must be filed within 60 days of the estate recovery notice. The policy exceptions are consistent with the language in the original state legislation, making estate recovery in Michigan fairly generous as compared to the program in other states. Two types of exceptions may be found: if there is an undue hardship and if there are survivors living in the home at the time of the death who fall within certain criteria. The limited explanations provided in the policy seem to give the department much leeway in determining when a beneficiary will be given an exception. While these policy changes are expected to go into effect in July of this year, the state has not released the information that will be included in the notice packets and neither the website nor the address for submitting undue hardship waiver applications is up and running. Because the state legislation allows the recovery to be avoided if the costs of pursuing recovery exceed the benefit to the department, the exceptions may remain flexible as they are implemented. MCL §400.112g. What Should Advocates Do? Explain to clients that there are exceptions to estate recovery and that, with proper planning, their assets may be preserved for their heirs. Because this is a new program, we do not know how strictly the state will implement it. In some cases, it may be true that it is simply not worth the state’s effort to try to recover from small estates. To submit a comment to MDCH, write to: Eligibility Policy, Michigan Department of Community Health, Medical Services Administration, P.O. Box 30479, Lansing, MI 48909-7979, or send an email with "Estate Recovery" in the subject line to eligibilitypolicy@michigan.gov. If you have concerns about SB 404, contact your senator. What Should Clients Do? Speak to an attorney about the best way to preserve your assets for your heirs. An attorney should explain the exceptions to estate recovery and which exceptions may apply to your situation. Finding Help Most legal aid and legal services offices handle these types of cases, and they do not charge a fee. You can locate various sources of legal and related services, including the free legal aid office that serves your county, at MichiganLegalAid.org. You can also look in the yellow pages under "attorneys" or call the toll-free lawyer referral number, (800) 968-0738. Michigan Medicaid State Plan available at http://www.michigan.gov/mdch/0,1607,7-1322943_4860-225474--,00.html (see pages 94-100 and Attachment 4.17 A at page 582). DHS Bridges Administrative Manual available at: http://www.mfia.state.mi.us/olmweb/ex/html/ (see section 400). SB 404 available at: http://www.legislature.mi.gov/ (search for “SB 404”).