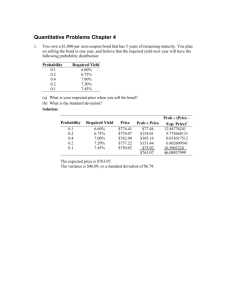

Chapter 7

advertisement

Chapter 6 The Keynesian System(II) The IS—LM curves The Keynesian money demand function Remember that interest rates were determined in the classical model in the loanable funds market. This market not only determined the interest rate but household savings and by implication household consumption. This clearly will not do in the Keynesian view where income chiefly determined consumption and then savings. First consider Keynes view of the demand for money. In the classical model people only held money because it was useful to have in making purchases(as opposed to barter or selling bonds every time you wanted something). If one held more money than needed for those purchases one lost interest payments. Hence households would not hold any money in excess of that needed for typical payments. Remember the relationship between bond prices and interest rates? If interest rates increase then bond prices decrease. Suppose bond prices were very high at the moment. Might it not make sense to sell the bonds, hold on to the proceeds and wait for the prices to fall again. In other words buy low and sell high. In the simple Keynesian model of money demand people will hold onto the money for selling the bonds because Keynes does not allow them any alternative –it’s bonds or money. So if you sell a bond you hold on to the money until bond prices fall. Then you buy bonds anew when the prices fall. Bond prices high Interest rates low Sell bonds Bond prices low Interest rates high Buy bond Take capital gain, hold money, wait for bond prices to fall Get rid of money, buy bonds Money demand high Money demand low The Keynesian money demand function is M d M 0 M yY M r r where M yY is called the transactions demand for money M r r is called the speculative demand for money M 0 is autonomous money demand (precautionary demand is part of this) Note that the transaction demand for money term is similar to the Cambridge equation M d kPy M yY M y Py and has the same meaning—this is the amount of money that households keep on hand to facilitate regularly occurring purchases. The speculative demand for money represents the amount of money household keep on hand waiting for bond prices to fall (Keynes got rich do this and thought it to be fairly common practice). The precautionary demand for money represents money kept on hand for emergencies. The coefficients of the money demand function should have the following signs: (a) M y will be positive so that an increase in Y will cause household to hold more money for transactions (they buy more things as Y goes up) and (b) M r is negative (if interest rates go up, bond prices go down and people will want to buy bonds). Another way of looking at this is to say the classical economists believe people used money mostly as a medium of exchange (the use it to facilitate regularly occurring purchases). Keynes believed they used is both as a medium of exchange and as a store of wealth (holding the wealth in the form of money until bond prices fall). Figure 6—1 shows the Keynesian money demand function for a fixed level of income. In this figure the amount of money households decide to hold will be represented by the Money axis. Interest rates are on the vertical axis. At interest rate r1 households decide to hold M 1 of their assets as money. As the interest rate falls to r2 bond prices rise, so some households will decide to sell their bonds and hold on to that money until bond prices fall. M 2 is the new, larger amount of money they desire to hold. To show the effect of an increase in is the new, larger amount of money they desire to hold. To show the effect of an increase in Y we use the same graph but hold interest rates fixed. Such an increase is shown in Figure 6—2. As income increases households desired money holdings increase from M1 to M 2 . We will assume that the central bank (the Federal Reserve Bank in the U.S.) can control the money supply completely. This is shown as the vertical line in Figure 6—3 labeled M s . The equilibrium rate of interest is determined in the money market by the supply and demand for money. Suppose the money market was not in equilibrium but that somehow interest rates were at r2 in Figure 6—3. In that case M d M s at that interest rate. Household want more money. They sell bonds. This decreases bond prices and raises interest rates until M d M s . At an interest rate higher than the equilibrium rate money supply would exceed money demand (household have more money than they want, so they buy bonds reducing interest rates). Figure 6—1. They Keynesian demand for money funtion Figure 6—2. An increase in household income shifts the money demand function to the right. Figure 6—3 Equilibrium in the money market. So we can now determine how interest rates are changed in the Keynesian model. Suppose that the money market is in equilibrium at interest rate r1 when the money supply is at M 1s as shown in Figure 6—4. Suppose that the central bank increases the money supply to M 2s as shown in Figure 6—4. The central bank increases the money supply by buying bonds P B r . So the effect of the money supply increase is to lower the interest rate. If the central bank sell bonds, bond supply increases, bond prices decrease and interest rates increase. So interest rates are controlled in the Keynesian model by the central bank not by the loanable funds market. Figure 6—4. An increase in the money supply The LM curve. The LM curve is a set of points ri , Yi where the money market is in equilibrium. We can generate an LM curve by taking the graph in Figure 6—4 and letting the income level vary and noting how the interest rate changes. This situation is depicted in Figure 6—5. Figure 6—5. The derivation of the LM curve. Suppose the money market is initially in equilibrium at r1 , Y1 as shown on each of the panels in Figure 6—5. Suppose that the income level rises to income level Y2 . At this higher level of income households will purchase more things and having money makes it easy to purchase these things. So households attempt to get money by selling bonds. This reduces bond prices and forces interest rates up. Of course with higher bond prices some households will sell bonds to take capital gains. This will continue until the money market is back in equilibrium at r2 , Y2 . Both of these equilibrium points are shown in the rightmost panel of Figure 6—5. Shifts in the LM curve A change in the money supply will shift the LM curve as shown in Figure 6—6. Suppose the money market is in equilibrium at r1 , Y1 as shown in the leftmost panel in Figure 6—6. Because this is an equilibrium point it is a point on an LM curve, in this case LM1 on the rightmost panel of Figure 6—6. Let the central bank increase the money supply As shown in Figure 6—4 this will lower the rate of interest in the money market.. But note that there has been no change in the income level. Now we have a new equilibrium point at r2 , Y1 . But this must have meant that the LM curve has shifted, and has shifted down in this case. So an increase in the money supply will shift the LM down. A decrease in the money supply would shift it up. Figure 6—6. A change in the money supply shifts the LM curve. An autonomous change in money demand will also shift the LM curve. This is shown in Figure 6—7. Recall that the money demand equation is M d M 0 M yY M r r Figure 6—7. The effects of an increase in autonomous money demand where M 0 represents autonomous money demand. If autonomous money demand increased, households will want to hold more money even though interest rates and income have not changed. Suppose that the money market is initially in equilibrium with money demand represented by M d r , Y1 and the equilibrium values given by r, Y1 . If the households experience an endogenous increase in money demand they want to hold more money. This shifts the money demand curve to M d r , Y1 . Households will sell bonds to increase their money holdings. This lowers bond prices and raises interest rates. Now we have, in the money market, a case where interest rates have increased but income has remained constant. This is represented by an upward shift in the LM curve. Note: and increase in the money supply shifts the LM curve down but an increase in money demand shifts the LM curve up. Investment spending in the Keynesian model. Business investment spending in the Keynesian model is similar to that in the classical model (there will be certain differences in emphasis). We will write the investment spending function as I I0 Ir r Ir 0 where r is the interest rate. The negative sign on I r means that investment spending will decline if interest rates increase. We have a different graphical representation in the Keynesian scheme – here Y rather than r is the critical variable. Figure 6—8. The investment spending function in the Keynesian model The Keynesian view of the investment spending function is shown in Figure 6—8. At interest rate r1 firms spend I1 . Suppose that interest rates rise to r2 . In that case firms will decrease spending to, say, I 2 . Because investment spending does not depend on Y the curve is a horizontal line. Increases or decreases in investment spending are represented by shifting the I+G curve up or down. The IS curve. The IS curve is a set of combinations of values Yi , ri where the product market is in equilibrium. The product is the market where goods and services are bought and sold. This is distinct from the money market where financial instruments are bought and sold. We will derive the IS curve using the I+G=S+T relationship. Suppose the product market is initially in equilibrium at r1 , Y1 . This is shown in the leftmost panel where I r1 G S Y1 T . Suppose that interest rates increase to r2 . If so, investment spending will decline I r2 I r . This shift the I+G curve down so that a new equilibrium is determined where I r2 G S Y2 T . Both equilibrium points are shown on the rightmost panel of Figure 6—9. The curve in the right most panel is called an IS curve. Figure 6—9. The IS curve Another way to look at the IS curve is by considering the Another way to look at the IS curve is by considering the Y=AE relationship Y1 C Y1 I r1 G r I r I r2 I r1 Y1 C Y1 I r2 G (more output being produced than being sold) Y ? C Y I r2 G (income and consumption both fall) Y2 C Y2 I r2 G (until a new equilibrium is established with higher r and lower Y) The IS curve is a set of combinations of r and Y where the product market in in equilibrium. Things that shift the IS curve. Anyhing that changes a spending component (other than r or Y) will shift the IS curve. r and Y don’t shift the curve—they are the curve. Figure 6—10. An increase in autonomous savings shifts the IS curve. Consider the situation in Figure 6—10. The product market is in equilibrium with the combination r1 , Y1 . Suppose now that households decide to save more (an autonomous savings increase). The autonomous increase in savings shifts the S+T curve up ( S Y1 S Y1 ). Because of the increase in savings less is now being consumed and more is being produced than is being bought. This, as usual, will decrease employment and household income until a new equilibrium exists at r1 , Y2 . Because the interest rate has no changed but income has decreased we must have a leftward shift in the IS curve. It is interesting to note what has finally happened to savings. Households tried to save more but have they succeeded? S Y2 T S Y1 T I r1 G The attempt to increase savings created a decrease in income. The decrease in income reduces savings. But in any case since S+T=I+G and since I+G haven’t changed, then S won’t either. Autonomous savings increased but endogenous savings decreased.