FUNDAMENTALS INDEX

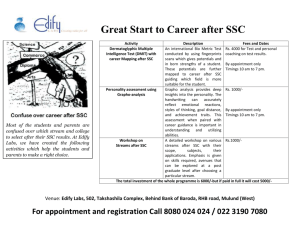

advertisement