FUNDAMENTALS INDEX

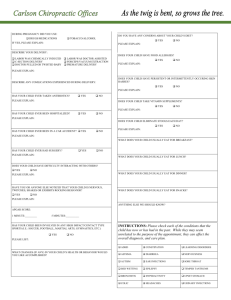

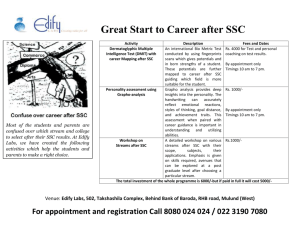

advertisement