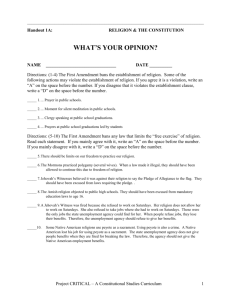

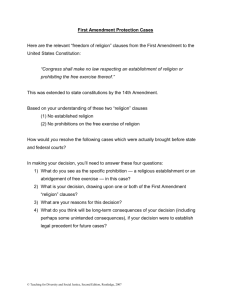

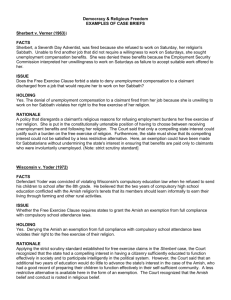

Religion & Antidiscrimination Law

advertisement