Título: Testing The Rationality of Market Expectations on Brazilian

advertisement

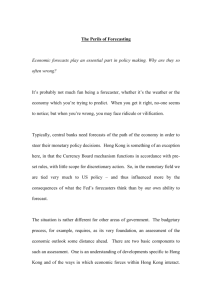

TÍTULO: TESTING THE RATIONALITY OF MARKET EXPECTATIONS ON BRAZILIAN INFLATION: EVIDENCE FROM AN UNBALANCED PANEL Autor: Fabia A. de Carvalho Afiliação: Banco Central do Brasil Endereço para Correspondência: SQS 202 Bloco D Apt 106 Asa Sul – Brasilia – DF 70232-040 61-414-3404 e 61-414-3507 (Fax) fabia.carvalho@bcb.gov.br Key words: Rationality Tests, Rational Expectations, GMM, Unbalanced Panel Data, Serial Correlated and Moving Average Errors JEL: C12, C23, E52 1 TESTING THE RATIONALITY OF MARKET EXPECTATIONS ON BRAZILIAN INFLATION: EVIDENCE FROM AN UNBALANCED PANEL Fabia A. de Carvalho ABSTRACT This paper tests the rationality of inflation forecasts surveyed by the Central Bank of Brazil. It employs panel data techniques to avoid the aggregation bias that usually leads to rejection of the rationality hypothesis. Additional techniques are employed to account for the specificities of the Brazilian panel. Most distinguishably, one procedure for treating unbalanced panel data is extended to the case in which it is necessary to estimate a consistent covariance matrix that accounts for distortions caused by errors that present serial correlation and are also correlated across individuals. For the entire sample available, joint hypothesis tests refute rationality for all forecasting horizons but the very short-term one, in spite of the sharp reduction in test statistics of unbiasedness after the proper covariance matrix is employed. However, after reducing the sample to include only those periods for which information is more reliable, the estimated parameters approach those suggested by unbiasedness. The failure in efficiency tests for all sampling periods and forecasting horizons but the very short-term one indicate that forecasters are not making proper use of important information available. This result may be highly influenced by the fact that under an inflation targeting regime which is still building up reputation, the power of the past to predict the future is very uncertain. Key words: Rationality Tests, Rational Expectations, GMM, Unbalanced Panel Data, Serial Correlated and Moving Average Errors JEL Classification: C12, C23, E52 Research Department. Banco Central do Brasil. E-mail: fabia.carvalho@bcb.gov.br 2 1. INTRODUCTION In an inflation-targeting regime, private forecasts for inflation play a number of important roles. Their behavior is usually seen as a proxy of the dynamics of the expectations transmission channel to inflation. Operationally, private forecasts function as a thermometer that measures the success of the regime in keeping inflation within a desired path. In this sense, central banks use them as an instrument to assess likely sources of friction in the inflation dynamics that may not be encompassed by their own inflation forecasting models. A way to measure the importance of private forecasts to monetary policy decisions is to estimate central banks’ reaction functions. For the Brazilian case, Minella et al. (2003) showed that the coefficient of market forecasts in the reaction function of the Central Bank of Brazil is above two1. The strong reaction to market forecasts proves that “the central bank conducts monetary policy on a forward-looking basis, and responds to inflationary pressures.”2 In Brazil, the most comprehensive survey of private forecasts for inflation has been Central Bank’s Investor Relations Office survey of private forecasts. This survey has been going on daily since June 1999. Figure 1 depicts a sample of daily evolutions of the median forecast in the survey for the Brazilian CPI. After the median response started to strongly decouple from inflation target bands, the survey began to catch more attention of the media, market analysts and the Central Bank of Brazil itself. The median forecasts proved to be unable to anticipate the extent to which inflation would be influenced by the severe sequence of shocks that hit the Brazilian economy, most markedly in 2002. The predictive power of forecasts in the survey was then highly criticized, as they seemed to no longer reflect the real pricing dynamics of the economy. A number of people claimed that market forecasts had become simple representations of Vector Autoregressive models, meaning that they had become strictly backward looking, when inflation itself seemed to still have a significant forward-looking component. 1 Punctual coefficient estimation. For more comprehensive studies on the inflation targeting regime in Brazil, refer to Bogdanski,et al (2000, 2001), Alves (2001), Muinhos (2001), Bonomo & Brito (2001), Minella (2001), Minella et al. (2002), and Fraga et al. (2003) 2 3 Figure 1: Market Forecasts vs. Brazilian Consumer Price Inflation (IPCA) August 2002 September 2002 0.80 0.80 0.70 0.60 % 0.60 Sep-02 Sep-02 Jul-02 Aug-02 Jul-02 Jun-02 Apr-02 Apr-02 May-02 Actual November 2002 1.31 3.5 1.20 3.0 1.00 2.5 0.80 % % Mar-02 Median Actual October 2002 1.40 Feb-02 Jan-02 Feb-02 Nov-01 Sep-02 Jul-02 Aug-02 Jul-02 Jun-02 May-02 Apr-02 Median May-02 Mar-02 Mar-02 Jan-02 0.20 Feb-02 0.30 0.20 Jan-02 0.30 Dec-01 0.40 Nov-01 0.40 Dec-01 0.50 Nov-01 0.50 Nov-01 % 0.72 0.70 0.65 3.02 2.0 1.5 0.60 1.0 0.40 0.5 Oct-02 Nov-02 Dec-02 Jun-03 Sep-02 Aug-02 Jul-02 Aug-02 Jun-02 May-02 Apr-02 Apr-02 Mar-02 Feb-02 Median May-03 Actual Jan-02 Dec-01 Nov-01 Nov-01 Oct-02 Sep-02 Aug-02 Jul-02 0.0 May-03 Median Jun-02 May-02 Apr-02 Mar-02 Feb-02 Jan-02 Dec-01 Nov-01 0.20 Actual June 2003 December 2002 1.0 2.5 0.8 2.10 2.0 0.6 % % 1.5 0.4 0.2 1.0 0.0 -0.15 0.5 -0.2 Median Actual Median Apr-03 Mar-03 Jan-03 Feb-03 Dec-02 Nov-02 Oct-02 Sep-02 Aug-02 Jul-02 Jul-02 Jun-02 -0.4 May-02 Jan-03 Dec-02 Nov-02 Oct-02 Sep-02 Aug-02 Jul-02 Jun-02 May-02 Apr-02 Mar-02 Feb-02 Jan-02 Dec-01 Nov-01 0.0 Actual To restore credibility in the targets, the Central Bank of Brazil engaged in a strong effort to coordinate these expectations. Interest rate decisions were made taking expectations strongly into account, as indicated in the minutes of the Monetary Policy Committee meetings throughout the beginning of 2003. However, interest rate decisions were not the sole instrument used by the central bank to get expectations into track again. There was a strong effort to communicate central bank’s forecasts, in addition to the board’s understanding of the inflation dynamics. In particular, a number of verbal and written communications emphasized central bank’s assessment that some unusual 4 phenomena that had been observed in inflation, such as a higher inertia coefficient and asymmetric passthrough of the exchange rate to prices, were temporary. As these phenomena actually proved to be short-lived, expectations quickly returned to the path compatible with inflation targets. Credibility in these forecasts was undermined, though. The question that naturally arises in this context is: are private forecasts to be so much relied upon? Are they really good proxies of future price setting behavior? One way to answer this question is to test the rationality of private forecasts. Muth (1961) argued that expectations are rational when they are formed based on an optimizing behavior of agents within an economic system. Rationality then implies that forecasts are not systematically biased in any direction, or, in other words, that they perfectly predict inflation, and that forecasts are efficient, meaning that forecasts fully employ all available information up to the moment they are made. 3 If the surveyed forecasts are unbiased, central banks have the proper instruments to observe the effects of their decisions on the “expectations transmission channel”. If they are inflation targeting, then it is highly commendable that they react strongly and fast to private inflation forecasts, as they are really good indicators of the future price setting behavior. If forecasts are systematically biased, shouldn’t the central bank attempt to measure the real bias before responding to them? If surveyed forecasts are not unbiased and central banks still react strongly to them, some other way to infer their influence in future price setting behavior should be investigated. If forecasts are unbiased, but are not efficient, are they based on optimizing, and thus, predictable behaviors? At the Central Bank of Brazil, inflation targeting models assume rational expectations upon estimations and employ private forecasts as proxy of rational expectations upon simulations. This paper then attempts to address the issue of whether private forecasts in Brazil are really rational. There is a vast literature on testing the rationality of market forecasts for inflation or price indices. Most of them employ unbiasedness and efficiency tests. The great majority has focused on surveys particular to the USA, and the results obtained most frequently refute the rationality assumption. These papers have, nonetheless, relied upon aggregate measures of forecasts and used simplifications that led the errors 3 Other concepts of rationality are also used in the literature, although to a lesser extent. One example would be tests of the convergence dynamics of forecasts to actual inflation and vice versa This line of rationality test is well exploited by Grant & Thomas (1999). 5 covariance to be wrongly specified. In a seminal paper, Keane and Runkle (1990) managed to prove rationality of expectations reported to the ASA_NBER inflation survey of economic forecasters by employing more suitable econometric techniques. In their test, they used individual forecasts in a panel data and estimated an errors covariance matrix that accounted for aggregate shocks that hit all forecasters alike and an autoregressive behavior of the errors that is inherent to most expectations models. In the literature concerning Brazil, the author is unaware of rationality tests of inflation forecasts. Alves (2001) went close to this by assessing the predictive power of Central Bank of Brazil’s inflation model comparatively to benchmark models and median market forecasts for inflation collected by the Central Bank of Brazil. To compare the three types of forecasts, he calculated the average deviation of forecasts to actual inflation outcomes. This paper tests the hypothesis of rationality of Central Bank of Brazil’s inflation forecast survey avoiding the shortfalls identified in Keane & Runkle (1990). The most complex task in this journey was to construct a covariance matrix that accounted for both serial correlation and errors correlated across individuals, with a sample of unbalanced panel data. 4 The standard prescription for treating unbalanced panels —using a subset of data that is balanced —could not be applied here as such subset would be statistically insignificant and thus bias all results. In addition, some forecasters were more active in participating in the survey in different periods and these periods were qualitatively different in terms of economic shocks that hit the economy. The use of the entire available information was then also commendable to assure representativeness of the sample. With the use of appropriate econometric techniques, this paper shows that private forecasts for inflation surveyed since June 1999 by the Central Bank of Brazil are rational only for very short-term forecasting horizons. This result gets weaker, however, when the sample is reduced to include only those periods for which the survey is more reliable. Sampling after July 2001, when quality procedures are adopted to ensure timeliness in survey responses, or after November 2001, when the survey starts to be carried out through the Internet, results in estimated coefficients that converge to those expected in unbiased forecasts. For most forecasting horizons, individual t-tests do not allow for refuting the assumption that forecasts are unbiased. However, if the 4 In unbalanced panel data, there is an unequal number of observations for different individuals. 6 restrictions are jointly tested, using statistics that are more adequate when errors are non-spherical, unbiasedness should be refuted for all forecasting horizons. The sample size may be a drawback here, though, as any of these statistics are more reliable as the sample size increases5. Efficiency tests, in turn, strongly suggest that private forecasters in Brazil are not making proper use of information that is available for any forecasting horizon. This inefficiency may be a natural consequence of an inflation-targeting regime that is still building up credibility. In this circumstance, forecasts will usually be a combination of the past behavior of key observable variables, such as macroeconomic data, and of future unobservable ones, such as the future conduct of monetary policy. Moreover, forecasters, as well as the central bank, are still learning about the workings of each transmission channel, which adds a lot of uncertainty to the forecasts. The organization of the paper is as follows. Section 2 discusses rationality tests in the economic literature. Section 3 describes in details the model used to test the rationality of private forecasts for the Brazilian inflation. Section 4 brings about some important data issues. Section 5 shows the results of the rationality tests and finally Section 6 concludes the paper. 2. RATIONALITY TESTS Rationality tests in Muth (1961)’s sense encompass two criteria: that of unbiasedness and that of efficiency. Suppose that t k is the actual outcome for inflation in period t+k, for k 0 , and Et t k is some sort of aggregate survey response as to the future inflation rate (at period t+k) using information available up to period t. 0 Most of literature then claims that if H o : holds in the following regression, 1 forecasts are unbiased: 1 t k t k Et t k (1) The efficiency criterion tests whether forecasters make efficient use of all information available at period t. Let t be the vector of information available to the 5 For a clear discussion of hypothesis testing when errors are non-spherical, refer to Greene (2001-pp 279281) 7 forecaster up to period t. For forecasts to be efficient, H o : 0 1 0 0' should hold in the following regression: t k 1 Et t k t k t (2) As pointed out by Keane and Runkle (1990, 1998) almost all of the tests conducted in the literature have refuted rationality as a result of one or more of the problems listed below: a) use of some sort of aggregate survey response, such as average or median. Rationality fails in this case because “average forecasts that are conditional on different information sets are not rational forecasts conditional on any particular information set”. In addition, aggregate forecasts neutralize the biases that some analysts may have and that may provide valuable information for the econometrician; b) use of revised data when indeed the forecaster was attempting to predict the unrevised number or was using unrevised available data to predict the future; c) use of predictions made by forecasters who are not professional and thus have no costs in providing imprecise information; and d) failure to account for the proper covariance structure of the errors. The procedure adopted in this paper overcomes all of these sources of improper rationality rejection. The data used are a panel of consumer price inflation (IPCA) forecasts surveyed by Central Bank of Brazil’s Investor Relations Group since 1999. As there is no revision in the figures released for the IPCA, the second source of problems identified by Keane and Runkle (1990,1998) is not an issue here. The issue regarding the professionalism of forecasters should be carefully addressed. In a technical paper released by the Brazilian Institute of Applied Economics (IPEA), the professionalism of Central Bank of Brazil’s survey was questioned on the grounds of a game theory argument: if economic agents perceive their power to affect the monetary policy decision, they will have incentives not to disclose their correct forecast. However, in Central Bank of Brazil’s survey, at least three strong incentives are in place for analysts to report their “true” forecasts. 8 First, more than 90% of the participants in the survey are chief economists of either financial institutions or economic consultancies, who thus receive monetary rewards to produce accurate forecasts. Second, the participants in the survey either sell their projections on the market or disclose them publicly as a means to add value to the products and services sold by the institutions to which they are affiliated. Therefore, the accuracy of their projections can be easily verified by the Central Bank of Brazil. Third, the Central Bank of Brazil has been frequently publishing the rank of the best forecasting institutions during a time range. Some financial institutions are beginning to reward their forecasting teams whenever they are ranked as top 5. The last source of improper rationality rejection pointed out by Keane and Runkle (1990) is the misspecification of the covariance structure of the forecast errors across forecasters. Some forms of misspecification may be outlined. First, employing OLS errors estimates to test the rationality hypothesis in the presence of non-spherical errors yield inconsistent error covariances and thus may render the tests invalid. In a panel of inflation forecasters, aggregate shocks are likely to affect all cross sections, and thus errors will not be independent across forecasters (Zarnowitz (1984, 1985)). Shocks may also be a source of auto correlation of the errors. As Grant & Thomas (1999) argue “because of overlapping forecast intervals, agents are frequently unaware of the stochastic nature of the inflation-generating process. If shocks to inflation are assumed to be temporary when in fact they are permanent, agents may consistently under- or overpredict inflation for several consecutive forecast periods”. Under overlapping forecast intervals and uncertainty in regard to the persistence of a certain shock, “the structure of autocorrelated errors may yield valuable information that can be used to confirm agent’s rationality” rather than refute it. 6 The sample period used to perform rationality tests for the Brazilian case includes a number of shocks that most likely affected all cross sections. Most of them were originally supply or cost shocks whose intensity could be hardly ever anticipated, and thus could not be in the information set of the forecaster, such as the energy rationing, the Argentine crisis and the September 11th attacks in 2001, a confidence crisis in 2002 regarding the future conduct of economic policy in Brazil, and the accounting problems in large American companies also in 2002. 6 Grant & Thomas (1999) 9 In order to treat the auto correlation that arises from overlapping forecast intervals, one procedure has been more advocated in the literature. If one samples a variable xt at every kth integer, the regression equation will present a serially uncorrelated disturbance term. The drawback of this procedure is to use only a part of the sample at the cost of missing relevant information. The sample may thus cease to be representative. In fact, on comparing both suggestions for treating auto correlation, Hansen & Hodrick (1980) show that, under a sample size T, hypothesis testing on the parameters using the entire sample dominate the sampling procedure. Auto correlation can also arise due to the fact that when the forecaster is predicting inflation for period t+k with information available up to period t, the specific information on inflation at period t may not be available. This presence of auto correlation should not be considered a failure in the rationality test as the forecast error ti,k t k Et tik should not be orthogonal to ti . Estimating and employing the correct covariance matrix will not necessarily yield valid test statistics. The use of GLS, which is the “standard econometric technique for estimation in the presence of serially correlated errors”7, requires the regressors to be exogenous, meaning that E ti,k / xt , xt 1 , xt 1 ,... 0 when xt Et t k or any variable in the information set of forecaster i. As Hansen & Hodrick (1980) argue, “the strict exogeneity assumption is a claim that knowledge of future xt ’s would be useless in determining the optimal forecast for ‘ t k ’8. That is clearly not the case here. If forecasters knew with certainty the future stance of the output gap, for instance, it would be much likelier that their inflation projections would be more accurate. When the exogeneity assumption fails, an alternative estimation method is through GMM. Estimation of a covariance matrix in the case of auto correlation of the errors and aggregate shocks is a straightforward extension of the techniques proposed in Keane and Runkle (1990) and Hansen & Hodrick (1980). However, with an unbalanced panel, this estimation becomes very cumbersome. The procedures for estimating in this environment are described in the following section. 7 Hansen & Hodrick (1980) 10 3. THE MODEL The model for testing the hypothesis of rationality of the Brazilian inflation survey is an extension of the techniques proposed by Keane and Runkle (1990) and Hansen & Hodrick (1980) to the unbalanced panel data case. Let Yraw be a tx1 vector of actual inflation, in which t represents the total time period considered for sampling expectations. Let X raw be the matrix built from the inflation forecasts of each of the n cross sections formed throughout the t months. The columns of this matrix refer to observations in each cross section. In each column there is a number of missing information that varies throughout cross sections. For computational purposes, the cells where there is missing information should contain a non-numeric entry, which will be later considered “invalid observation”. The total number of valid observations in X raw will be denoted by S. Note that if the panel was balanced, S would equal nt. Let Ti be a vector of length S in which cell (i,1) contains the number of valid information for cross section i, denoted by t i . By pooling all the information, valid and invalid, in X raw , replicating Yraw , and grouping the two resulting matrices into one matrix of size nt x 2, one can exclude the lines that contain missing information for expectations and proceed with the estimations. (The resulting matrix, hereafter referred to as DATA, will be of size S x 2). For OLS estimations, the procedure is straightforward. Letting t be the first column of DATA, and xt be an S x 2 matrix of ones in the first column and the second column built with the second column of DATA, the system is ready for the regression in (1). The construction of the covariance matrix that is consistent in the case of serial correlation across individuals and moving average errors is an extension to the unbalanced case of the technique proposed by Keane & Runkle (1990). In order not to exhaust the number of degrees of freedom in the data, some assumptions need to be made: i, t , l , m, s.t. l m k E til ,k ti m,k l m , otherwise 0, (3) and 8 In their paper, t k is replaced by y t k as they are testing the zero rate of return hypothesis in forward exchange markets. 11 i, h, t , l , m, s.t. i h and l m k E til ,k th m,k l m , 0, otherwise (4) The first restriction is only a translation to panel data sets of the result of the application of the technique proposed by Hansen & Hodrick (1980) to consistently estimate a covariance matrix in time series models in the presence of MA errors. The second restriction assumes that the data are not conditionally heteroskedastic. This assumption may be unrealistic as an important source of heteroskedasticity in forecasters panels is the fact that different cross sections may present asymmetric loss functions, in the sense that one analyst may be more penalized for underprediction of inflation than others, for instance, or contrarily forecasters could have the relationship they built with policymakers jeopardized by being labeled “too pessimistic”. However, considering these biases in the covariance matrix would not be consistent with the rationality assumption. Computationally, to derive the covariance matrix of equation (1) for the unbalance panel data case, a number of steps should precede9. A matrix of dates should be constructed by indexing each line of X raw . After X raw is pooled, the matrix of dates should be replicated until the size equals that of the pooled X raw . Afterwards, the lines in the matrix of dates corresponding to those in the pooled X raw in which information is missing should be deleted. A second matrix should be constructed to index the information belonging to each cross section in DATA. The system will thus be: 1 E1i 1 k x1 . . . . assuming, for ease of exposition, but not X S . , in which x i . . . . 1 E ii i x n t t k necessarily in the calculations, that the observation in period 1 is always available for each cross section. Letting the estimate of lm be 1 S i i t j t ,k t j ,k , in which is the number of observations available for the cases in which l m 0 , and l m be 1 S i h t j t ,k t j ,k , 12 i h, the R A B R ˆ form B R estimated covariance matrix of size SxS will have the RB RB RA RB , in which R A will have the elements ̂ lm allocated B R R B R A according to the time period to which they belong and R B will have the elements ˆ l m allocated also according to the time period to which they belong. The GMM estimation will be based on this estimate of . In fact, ˆ GMM 1 X ' Z Z ' ˆ Z Z ' X S S S 1 1 X ' Z Z ' ˆ Z Z ' Y where the Z’s are instruments S S S that are expected to be correlated with X but not with the errors. For the estimations in this paper, the Z’s were chosen from the information set available to the forecaster at time t. Modified t- and 2 statistics can then be calculated for to test the hypothesis in (1) and (2). t and F-tests are not usually recommended when the errors are not normally distributed, in which case they are only asymptotically valid. However, if the regression coefficients are looked at individually rather than jointly, the t-statistics do not allow for rejection of H 0 in (1) in reasonable levels of significance for most cases analyzed here. By looking only at the 2 -statistics, rationality can be refuted in all cases, in spite of the fact that the results are much closer to accept rationality had the covariance matrix not been properly estimated. 10 9 The covariance matrix for equation (2) is a straightforward extension. The computation of the robust covariance matrix alongside with all estimations was carried out in the Matlab environment, as Beck & Katz (1995) advise. As they argue “many standard packages, such as RATS or SHAZAM compute robust standard errors based on White’s method; none of these take into account the panel structure of the errors, even within a panel estimation module.” Their Monte Carlo simulations for testing their proposal of a covariance matrix “show that researchers should not use robust standard errors calculated by typical computer packages to approximate ‘panel corrected standard errors’”. 10 13 4. THE DATA At this point, a few remarks on the data sampled for this paper are necessary. Central Bank of Brazil’s Investor Relations Office has been surveying private forecasts for inflation on a daily basis since June 199911. The professionalism of forecasts informed to the Central Bank of Brazil at the beginning of the survey is not immune to criticism. In the period prior to July 2001, although participants belonged to a selected group of chief economists, very few qualitative procedures were adopted to assure the timeliness of the information input as these forecasters’ expectations. During this period, private forecasts were obtained through sporadic client reports, phone calls or spreadsheets sent to the Central Bank of Brazil through fax or e-mails. There was no established routine to update these expectations on a frequent basis. From July 2001 to November 2001, the quality of the survey enhanced through significant efforts by the Central Bank of Brazil to contact all participants and update the series as timely as possible. The participants also played an important role in improving quality of the survey. With more importance being attributed to the Top 5 ranking of forecasters, published monthly by the Central Bank of Brazil, the participants became more active in making sure that their forecasts had been input correctly in the survey. However, as the database was in Excel and participants’ access to the entries that corresponded to their forecasts was not instantaneous, besides being available only upon request, input problems might have occurred. After November 2001, these problems were highly reduced as the database started to be fed through the Internet directly by the survey’s participants. Monitoring the timeliness of the information was also enforced with the procedure of excluding a participant’s forecast from the current sample in case it had not been updated —which does not mean ‘altered’— within the past 30 days. Additionally, some upper and lower limits were programmed to help avoid input mistakes, such as switched signs. In regard to the data used in this paper, in order to simplify operational procedures, one representative day in every month was selected for sampling. To avoid unnecessary sources of heteroscedasticity, the day chosen would have to be the one in which the information set of forecasters were similar. Some institutions have their own price surveys and therefore have more timely information regarding the evolution of 14 prices in the month, prior to the publication of the index. In order to eliminate this bias of direct available information on price behavior for only a part of the cross sections, the day chosen for sampling forecasts for inflation in month t was the last day of the month t-1. As an illustration, for the IPCA of January, which is usually published on the first half of February, and refers to the evolution of prices throughout January, the sampling day chosen was December 31st.1213 Outliers or forecasters that scarcely participated in the survey were not removed from the sample used in this paper so as to preserve representativeness of the sample. 5. TEST RESULTS Table 1 shows the results of the tests of unbiasedness of inflation forecasts for the current month ( t ), the following month ( t 1 ), accumulated in the following three months ( 3 m ), six months ( 6 m ), and twelve months ( 12m ). Figures in parenthesis right below the estimated parameters are t-tests for 0 . The t-tests for 2 1 are presented below the tests for 2 0 . Sampling from June 1999 on14, t-ratios do not validate the rejection of unbiasedness for t . For all other forecast horizons, unbiasedness should be rejected. If the sample is reduced to begin in July 2001, when quality procedures to assure the timeliness of the information provided to the survey were enforced, unbiasedness can not be rejected with 95% of significance in forecasts for t , 3 m , and 6 m . For the sake of comparison, estimations were carried out for 3 m and 6 m sampling from November 2001 on, the month in which the database was transferred to the Internet and monitoring was enhanced. In all these cases, t-ratios could not refute unbiasedness. 11 Marques et al. (2003) provide more details on the operational aspects of this survey as well as an analysis of the reasons for the recent behavior of the aggregate responses. 12 Some files in the database were corrupted. Information for the IPCA projections on the last business days of March, April, May and June 2000 was not available. In March, the latest information available referred to the 24th of the month. In April, it was the 18th of the month, which was too far away from the last business day of the month. The files for the first business days of May were also corrupted, the first reliable one being that of the May 4th, which was what was used here. In May, the information available was for the 25th of the month. In June, the information used was that of the 28th of the month. 13 Some banks that participated in the survey were either acquired by other banks or merged. For simplification, they were considered different forecasters as long as they participated in the survey separately, as the teams projecting were different. After the acquisition or merging, the forecaster was the institution that continued to participate in the survey and “missing information” was used for the other. 14 Information on expected inflation in the next twelve months was available only from November 2001 on and the number of cross sections in the survey was smaller. 15 The use of standard t or F-tests is, nonetheless, questioned in the literature when the errors are non-spherical. In this case, the use Wald tests based on 2 distributions is advisable, but the test resuts are still more reliable as the sample enlarges. The first important conclusion of inference with 2 statistics is that for all forecasting horizons, the use of the correct model specification, namely, an estimated covariance matrix that accounts for errors that are correlated across individuals and serially correlated, renders much lower 2 ratios. The 2 ratios suggest that private forecasts surveyed by the Central Bank of Brazil are unbiased only for forecasting horizons no longer than 30 days and when the sample covers June 1999 through March 2003. For longer forecasting horizons, except that of 12-month ahead inflation, as the sample reduces to begin in July 2001 or November 2001, the estimated punctual parameters approached those suggested by unbiasedness, but asymptotic variance of the parameters do not allow for accepting the unbiasedness hypothesis. These results suggest caution when using the entire series available from the survey to infer any future behavior of price setters. Strictly speaking, private forecasts are systematically over- or underestimating future inflation, even after the average effect of aggregate shocks to forecasts is controlled for. For any analysis of this series, it is more advisable to use information available after July 2001 or November 2001. For this sample, unbiasedness could not be strictly accepted, but as the time series enlarges with time going by, it seems likely that unbiasedness will not be rejected. For the past two years, the central bank has been attempting to shift the focus of market analysts’ and society’s attention to twelve-month ahead inflation instead of inflation accumulated at the end of a certain year. Therefore, private forecasts for twelve-month ahead inflation have also been in the spotlight. In simulations, this forecast horizon is also the one that is mostly used. However, for 12-month ahead inflation, the tests run here suggest that forecasts are strongly biased. The sample size is very small, which does not allow for any extreme advice. The least that the Central Bank of Brazil is advised to do is then to add high doses of caution when dealing in any sense with these forecasts. 16 Table 1 – Tests for Unbiasedness of Expectations for the Brazilian CPI inflation (IPCA) Dependent variable: t Sample: June 1999 to March 2003 N. of cross sections: 47 N. of observations: 513 OLS 2SLS GMM 0.03 1.05 27.66 (1.40) (41.47) (1.82) 0.03 (1.40) 1.05 (41.47) (1.83) 25.86 0.03 1.05 3.77 (0.55) (15.65) (0.68) Dependent variable: t Sample: July 2001 to March 2003 N. of cross sections: 31 N. of observations: 283 OLS 0.12 1.01 (4.25) (38.85) (0.37) 60.49 2SLS 0.12 (4.25) 1.01 (38.87) (0.38) 60.20 GMM 0.14 0.99 9.31 (1.95) (15.21) (0.15) Dependent variable: t 1 Sample: June 1999 to March 2003 N. of cross sections: 46 N. of observations: 491 OLS 2SLS GMM 0.13 1.22 (2.99) (18.27) (3.27) 0.13 1.22 (2.99) (18.27) (3.27) (0.21) 1.82 (1.81) (10.60) (4.77) 145.84 164.05 37.41 17 Dependent variable: t 1 Sample: July 2001 to March 2003 N. of cross sections: 30 N. of observations: 266 2SLS GMM 0.10 1.48 (1.48) (4.66) (1.50) 0.11 179.96 1.48 25.96 (7.61) (2.45) Dependent variable: 3 m Sample: June 1999 to February 2003 N. of cross sections: 45 N. of observations: 439 OLS 2SLS 0.32 1.18 2.81 22.09 (3.35) 0.91 0.87 (4.83) (9.08) 153.81 133.14 (1.40) GMM 0.91 (2.38) 0.87 (4.87) (0.75) Dependent variable: 3 m Sample: July 2001 to February 2003 N. of cross sections: 29 N. of observations: 237 2SLS GMM 0.68 1.20 (3.65) (14.34) (2.39) 0.68 (1.62) 1.20 (6.97) (1.16) 12.07 206.00 22.60 18 Dependent variable: 3 m Sample: November 2001 to February 2003 N. of cross sections: 20 N. of observations: 205 2SLS GMM 0.77 1.18 (3.65) (13.04) (2.00) 0.77 (1.59) 1.18 (6.34) (0.97) 185.42 19.32 Dependent variable: 6 m Sample: June 1999 to November 2002 N. of cross sections: 38 N. of observations: 304 OLS 1.85 1.01 135.48 (3.94) (7.38) (0.10) 2SLS 7.24 (6.74) (0.67) (2.03) 5.07 112.27 GMM 7.24 (3.97) (0.67) (1.28) (3.20) 17.14 Dependent variable: 6 m Sample: July 2001 to November 2002 N. of cross sections: 29 N. of observations: 179 2SLS GMM 1.26 1.62 (2.08) (8.64) (3.30) 1.26 (0.90) 1.62 (3.96) 233.61 26.86 (1.51) 19 Dependent variable: 6 m Sample: November 2001 to November 2002 N. of cross sections: 19 N. of observations: 150 2SLS GMM 1.70 1.57 (2.58) (8.05) (2.92) 1.70 1.57 (1.07) (3.57) (1.30) 224.89 25.02 Dependent variable: 12m Sample: November 2001 to July 2002 N. of cross sections: 16 N. of observations: 83 OLS 2SLS 17.38 (0.65) (6.76) (1.29) (3.27) 46.24 (6.37) (3.53) (2.46) 650.53 227.55 (2.84) GMM 46.24 (6.37) (11.34) (8.31) (9.62) 174.52 Table 2 shows the results for the efficiency tests made for the previous prediction error, the lagged exchange rate and the lagged real interest rate. As unbiasedness was strongly refuted for inflation accumulated in the next 12 months, efficiency tests for this sample are not shown here. Through t-tests, efficiency can not be refuted only for t . Joint tests also do not allow for refuting efficiency in this forecast horizon, except for when the regressors include lagged exchange rate values, which may bear unit root problems. As the forecast horizon enlarges, 2 statistics worsen. Refuting efficiency implies that forecasters are not making proper use of information available to them at the time they make their forecasts. This issue should be carefully addressed, however, when monetary policy is guided through an inflation-targeting regime. In a regime that is still building 20 up reputation, the failure in efficiency tests may be due to the high uncertainty prevailing among forecasters in regard to the extent that the past influences future inflation. These uncertainties stem not only from shocks, which were controlled for through the use of the estimated covariance matrix, but also from how credible the inflation targeting regime is. If it is fully credible, inflation forecasts will always converge to inflation targets and the dynamics of inflation will be known with certainty. If credibility is still being built up, the regime will be pushing forecasters to look ahead instead of backwards, but the very inflation dynamics will still have a significant degree of inertia. The degree of inertia in inflation will be changing throughout the disinflation process, but estimating exactly what it is adds a lot of uncertainty to forecasts, which may then end up being inefficient. 21 Table 2 – Tests for Efficiency of Expectations for the Brazilian CPI inflation (IPCA) Regressors Const, Expectation, Prediction Error (-1) Dependent Variable t 0.02 (0.28) Const, Expectation, Exchange Rate (-1), Exchange Rate (-2) t (0.29) (1.98) Const, Expectation, Real Interest Rate (-1), Real Interest Rate (-2) t 0.21 (2.32) Const, Expectation, Prediction Error (-1) t+1 0.27 (2.35) Const, Expectation, Exchange Rate (-1), Exchange Rate (-2) t+1 (0.65) (2.22) Const, Expectation, Real Interest Rate (-1), Real Interest Rate (-2) t+1 1.06 (6.68) Const, Expectation, Prediction Error (-1) 3m 0.79 (3.84) Const, Expectation, Exchange Rate (-1), Exchange Rate (-2) 3m (2.02) (3.94) Const, Expectation, Real Interest Rate (-1), Real Interest Rate (-2) 3m 3.71 (7.54) Const, Expectation, Prediction Error (-1) 6m 1.96 (3.92) Const, Expectation, Exchange Rate (-1), Exchange Rate (-2) 6m (1.49) (0.81) Const, Expectation, Real Interest Rate (-1), Real Interest Rate (-2) 6m 12.68 (8.22) 1.07 (15.59) (0.96) 0.97 (12.76) (0.38) 0.84 (8.44) (1.61) 0.74 (4.43) (1.53) 0.27 (1.38) (3.74) (0.30) (1.34) (5.75) 0.63 (6.16) (3.63) 0.65 (4.99) (2.65) (0.54) (2.33) (6.62) 0.46 (3.18) (3.72) 0.01 (0.04) (4.18) (2.08) (4.85) (7.17) (0.03) (0.30) 4.28 0.53 (1.98) (0.38) (1.37) 13.94 (0.07) (1.15) (0.04) (0.85) 7.71 (0.54) (4.18) 32.13 1.33 (2.43) (0.80) (1.40) 39.64 (0.37) (3.31) (0.09) (0.84) 48.98 (0.94) (9.75) 131.14 4.08 (4.42) (2.74) (2.89) 72.99 (1.35) (4.72) (0.24) (1.02) 63.10 (0.98) (14.67) 325.85 13.25 (4.92) (10.74) (3.44) 105.27 (4.18) (5.04) 0.71 (0.86) 76.12 6. CONCLUSION This paper tested the rationality assumption in Muth (1961)’s sense for a panel of forecasts made by professional analysts for the Brazilian consumer price inflation since June 1999. Due to the presence of severe aggregate shocks that impacted all cross- 22 sections in the period sampled and to evidence of serial correlation in the errors, rationality tests based on OLS render invalid results. To obtain consistency in estimations, the technique proposed by Keane & Runkle (1990) of employing a covariance matrix that accounts for the non-spherical structure of the errors was extended to an unbalanced panel data case. The results showed that with t-tests, inflation forecasts for the current month and accumulated in the next three and six months are unbiased. However, t-statistics do not perform well in the presence of non-spherical errors. Through the analysis of 2 statistics, which are more suitable for the case analyzed in this paper, unbiasedness should be refuted for all cases but the very short-term forecasting horizon. Nonetheless, these results should be looked at carefully. By sampling the forecasts after July 2001 or November 2001, dates after which the database became more reliable, the punctual estimated parameters approach unbiased ones, except for the longer forecasting horizon (12 months). In all cases, the tests may perform better as the sample size increases, which indicates that one should wait longer until the more reliable database contains more information for testing the unbiasedness assumption with a higher degree of confidence in the sample. Until then, a monetary policy that reacts strongly to private forecasts risks biasing its decisions. The tests in the sample of the longer forecasting horizon, in turn, may be jeopardized by the reduced number of cross sections available. However, as this is the forecast horizon that is mostly analyzed and used as a benchmark at the Central Bank of Brazil, the least that one could advise is caution when dealing with them. Efficiency was also refuted for all samples and forecast horizons but the shorter one. Although this indicates that forecasters are not making proper use of the information available, in an inflation targeting regime, these results are not surprising. One of the goals of this regime is to switch forecasters’ attention to the future, rather than the past. If, on the other hand, the credibility in the regime is still being built, uncertainty embedded in the forecasts regarding the forward and backward looking component of future inflation is higher. 23 REFERENCES Alves, S. (2001). ‘Evaluation of the Central Bank of Brazil Structural Model's Inflation Forecasts in an Inflation Targeting Framework’, Working Paper of the Central Bank of Brazil, 16. Beck, N. & Katz, J. (1995). ‘What to do (and not to do) with Time-Series CrossSection Data’, The American Political Science Review, 89, 634-647. Bernanke, B. et al. (1999). ‘Inflation Targeting – Lessons from the International Experience’, Princeton University Press, NJ. Bogdanski et al. (2000). ‘Implementing Inflation Targeting in Brazil’, Working Paper of the Central Bank of Brazil, 1. Bogdanski et al. (2001). ‘Inflation Targeting in Brazil: Shocks, Backward-Looking Prices, and IMF Conditionality’, Working Paper of the Central Bank of Brazil, 24. Bonomo, M. & Brito, R. (2001). ‘Regras Monetárias e Dinâmica Macroeconômica no Brasil: Uma Abordagem de Expectativas Racionais’, Working Paper of the Central Bank of Brazil, 28. Bryan, M. & Gavin, W. (1986). ‘Models of Inflation Expectations Formation: A Comparison of Household and Economist Forecasts: Comment’, Journal of Money, Credit and Banking, 18, 539-544. Chamberlain, G. (1980). ‘Analysis of Covariance with Qualitative Data’, The Review of Economic Studies, 47, 225-238. Fraga et al. (2003). ‘Inflation Targeting in Emerging Market Economies’, Working Paper of the Central Bank of Brazil, 76. Gramlich, E. (1983). ‘Models of Inflation Expectations Formation: A Comparison of Household and Economist Forecasts’, Journal of Money, Credit and Banking, 15, 155173. Grant, A. & Thomas, L. (1999). ‘Inflationary Expectations and rationality revisited’, Economics Letters, 62, 331-338. Greene, W. (2000). ‘Econometric Analysis’, Prentice Hall. Hansen, L. & Hodrick, R. (1980). ‘Forward Exchange Rates as Optimal Predictors of Future Spot Rates: An Econometric Analysis’, The Journal of Political Economy, 88, 829-853. Hansen, L. & Hodrick, R. (1980). ‘Forward Exchange Rates as Optimal Predictors of Future Spot Rates: An Econometric Analysis’, The Journal of Political Economy, 88, 829-853. 24 Hansen, L. & Hodrick, R. (1980). ‘Forward Exchange Rates as Optimal Predictors of Future Spot Rates: An Econometric Analysis’, The Journal of Political Economy, 88, 829-853. Hayashi, F. & Sims, C. (1983). ‘Nearly Efficient Estimation of Time Series Models with Predetermined, but not Exogenous, Instruments’, Econometrica, 51, 783-798. Hvidding, J. (1985). ‘Models of Inflation Expectations Formation: Comment’, Journal of Money, Credit and Banking, 17, 534-538. Joskow, P. & Schmalensee, R. (1987). ‘The Performance of Coal-Burning Electric Generating Units in the United States: 1960-1980’, Journal of Applied Econometrics, 2, 85-109. Keane, M. & Runkle, D. (1989). ‘Are Economic Forecasts Rational?’, Quarterly Review of the Federal Reserve Bank of Minneapolis, 13. Keane, M. & Runkle, D. (1990). ‘Testing the Rationality of Price Forecasts: New Evidence from Panel Data’, The American Economic Review, 80, 714-735. Keane, M. & Runkle, D. (1998). ‘Are Financial Analysts’ Forecasts of Corporate Profits Rational?’, The Journal of Political Economy, 106, 768-805. Marques et al. (2003). ‘Sistema Banco Central de Expectativas do Mercado’, Notas Técnicas do Banco Central do Brasil, 36. Minella et al. (2002). ‘Inflation Targeting in Brazil: Lessons and Challenges’, Working Paper of the Central Bank of Brazil, 53. Minella, A. (2001). ‘Monetary Policy and Inflation in Brazil (1975-2000): a VAR Estimation’, Working Paper of the Central Bank of Brazil, 33. Muinhos, M. (2001). ‘Inflation Targeting in an Open Financially Integrated Emerging Economy: the case of Brazil’, Working Paper of the Central Bank of Brazil, 26. Muth, J. (1961). ‘Rational Expectations and the Theory of Price Movements’, Econometrica, 29, 315-335. Newey, W. & West, K. (1987). ‘A Simple, Positive Semi-Definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix’, Econometrica, 55, 703-708. Roberts, J. (1997). ‘Is Inflation sticky?’, Journal of Monetary Economics, 39, 173196. Sims, C. (1980). ‘Macroeconomics and Reality’, Econometrica, 48, 1-48. Zarnowitz, V. & Lambros, L. (1987). ‘Consensus and Uncertainty in Economic Prediction’, The Journal of Political Economy, 95, 591-621. 25 Zarnowitz, V. (1978). ‘On the Accuracy and Properties of Recent Macroeconomic Forecasts’, The American Economic Review, 68, 313-319. 26