JSP 752 Version 10.2

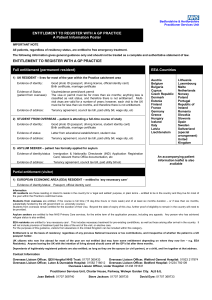

advertisement