Enterprises enjoying legislative protections against competition and

advertisement

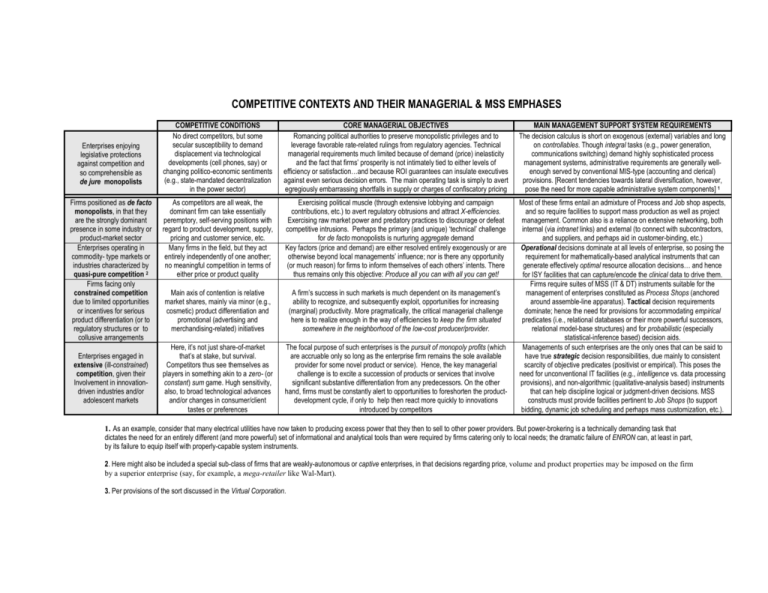

COMPETITIVE CONTEXTS AND THEIR MANAGERIAL & MSS EMPHASES Enterprises enjoying legislative protections against competition and so comprehensible as de jure monopolists Firms positioned as de facto monopolists, in that they are the strongly dominant presence in some industry or product-market sector Enterprises operating in commodity- type markets or industries characterized by quasi-pure competition 2 Firms facing only constrained competition due to limited opportunities or incentives for serious product differentiation (or to regulatory structures or to collusive arrangements Enterprises engaged in extensive (ill-constrained) competition, given their Involvement in innovationdriven industries and/or adolescent markets COMPETITIVE CONDITIONS No direct competitors, but some secular susceptibility to demand displacement via technological developments (cell phones, say) or changing politico-economic sentiments (e.g., state-mandated decentralization in the power sector) CORE MANAGERIAL OBJECTIVES Romancing political authorities to preserve monopolistic privileges and to leverage favorable rate-related rulings from regulatory agencies. Technical managerial requirements much limited because of demand (price) inelasticity and the fact that firms’ prosperity is not intimately tied to either levels of efficiency or satisfaction…and because ROI guarantees can insulate executives against even serious decision errors. The main operating task is simply to avert egregiously embarrassing shortfalls in supply or charges of confiscatory pricing MAIN MANAGEMENT SUPPORT SYSTEM REQUIREMENTS The decision calculus is short on exogenous (external) variables and long on controllables. Though integral tasks (e.g., power generation, communications switching) demand highly sophisticated process management systems, administrative requirements are generally wellenough served by conventional MIS-type (accounting and clerical) provisions. [Recent tendencies towards lateral diversification, however, pose the need for more capable administrative system components] 1 As competitors are all weak, the dominant firm can take essentially peremptory, self-serving positions with regard to product development, supply, pricing and customer service, etc. Many firms in the field, but they act entirely independently of one another; no meaningful competition in terms of either price or product quality Exercising political muscle (through extensive lobbying and campaign contributions, etc.) to avert regulatory obtrusions and attract X-efficiencies. Exercising raw market power and predatory practices to discourage or defeat competitive intrusions. Perhaps the primary (and unique) ‘technical’ challenge for de facto monopolists is nurturing aggregate demand Key factors (price and demand) are either resolved entirely exogenously or are otherwise beyond local managements’ influence; nor is there any opportunity (or much reason) for firms to inform themselves of each others’ intents. There thus remains only this objective: Produce all you can with all you can get! Main axis of contention is relative market shares, mainly via minor (e.g., cosmetic) product differentiation and promotional (advertising and merchandising-related) initiatives A firm’s success in such markets is much dependent on its management’s ability to recognize, and subsequently exploit, opportunities for increasing (marginal) productivity. More pragmatically, the critical managerial challenge here is to realize enough in the way of efficiencies to keep the firm situated somewhere in the neighborhood of the low-cost producer/provider. Here, it’s not just share-of-market that’s at stake, but survival. Competitors thus see themselves as players in something akin to a zero- (or constant) sum game. Hugh sensitivity, also, to broad technological advances and/or changes in consumer/client tastes or preferences The focal purpose of such enterprises is the pursuit of monopoly profits (which are accruable only so long as the enterprise firm remains the sole available provider for some novel product or service). Hence, the key managerial challenge is to excite a succession of products or services that involve significant substantive differentiation from any predecessors. On the other hand, firms must be constantly alert to opportunities to foreshorten the productdevelopment cycle, if only to help then react more quickly to innovations introduced by competitors Most of these firms entail an admixture of Process and Job shop aspects, and so require facilities to support mass production as well as project management. Common also is a reliance on extensive networking, both internal (via intranet links) and external (to connect with subcontractors, and suppliers, and perhaps aid in customer-binding, etc.) Operational decisions dominate at all levels of enterprise, so posing the requirement for mathematically-based analytical instruments that can generate effectively optimal resource allocation decisions… and hence for ISY facilities that can capture/encode the clinical data to drive them. Firms require suites of MSS (IT & DT) instruments suitable for the management of enterprises constituted as Process Shops (anchored around assemble-line apparatus). Tactical decision requirements dominate; hence the need for provisions for accommodating empirical predicates (i.e., relational databases or their more powerful successors, relational model-base structures) and for probabilistic (especially statistical-inference based) decision aids. Managements of such enterprises are the only ones that can be said to have true strategic decision responsibilities, due mainly to consistent scarcity of objective predicates (positivist or empirical). This poses the need for unconventional IT facilities (e.g., intelligence vs. data processing provisions), and non-algorithmic (qualitative-analysis based) instruments that can help discipline logical or judgment-driven decisions. MSS constructs must provide facilities pertinent to Job Shops (to support bidding, dynamic job scheduling and perhaps mass customization, etc.). 1. As an example, consider that many electrical utilities have now taken to producing excess power that they then to sell to other power providers. But power-brokering is a technically demanding task that dictates the need for an entirely different (and more powerful) set of informational and analytical tools than were required by firms catering only to local needs; the dramatic failure of ENRON can, at least in part, by its failure to equip itself with properly-capable system instruments. 2. Here might also be included a special sub-class of firms that are weakly-autonomous or captive enterprises, in that decisions regarding price, volume and product properties may be imposed on the firm by a superior enterprise (say, for example, a mega-retailer like Wal-Mart). 3. Per provisions of the sort discussed in the Virtual Corporation.