Two firms compete as duopolists, producing identical goods in

advertisement

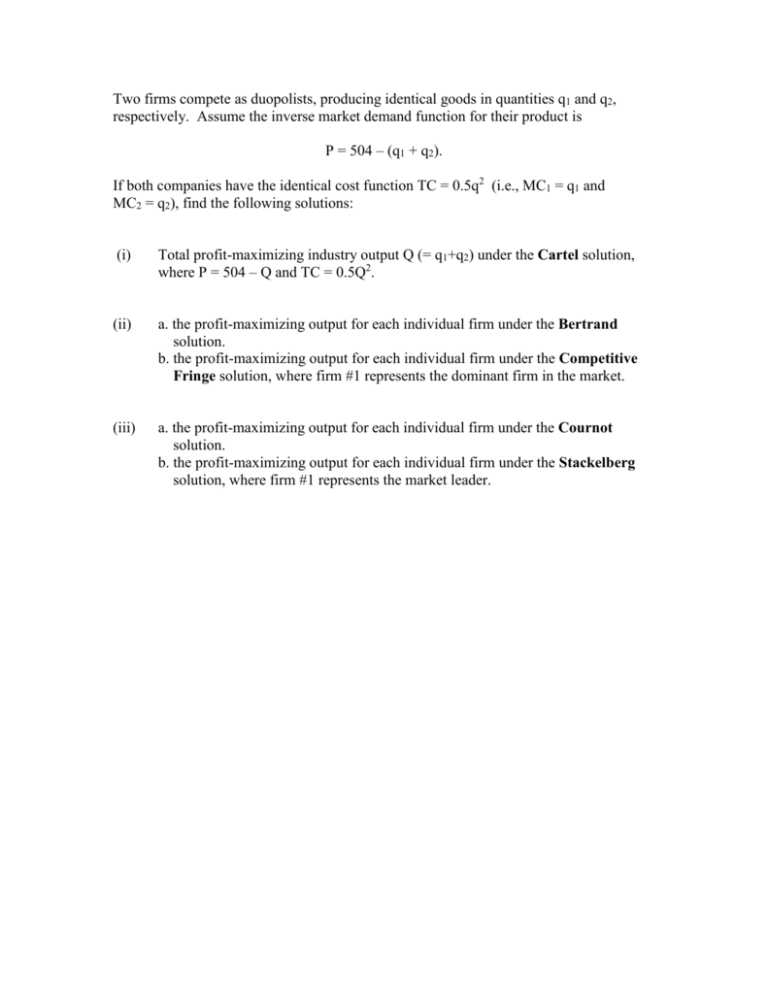

Two firms compete as duopolists, producing identical goods in quantities q1 and q2, respectively. Assume the inverse market demand function for their product is P = 504 – (q1 + q2). If both companies have the identical cost function TC = 0.5q2 (i.e., MC1 = q1 and MC2 = q2), find the following solutions: (i) Total profit-maximizing industry output Q (= q1+q2) under the Cartel solution, where P = 504 – Q and TC = 0.5Q2. (ii) a. the profit-maximizing output for each individual firm under the Bertrand solution. b. the profit-maximizing output for each individual firm under the Competitive Fringe solution, where firm #1 represents the dominant firm in the market. (iii) a. the profit-maximizing output for each individual firm under the Cournot solution. b. the profit-maximizing output for each individual firm under the Stackelberg solution, where firm #1 represents the market leader. ANS: (i) Cartel solution: Q = 168. [Since MR = 504 - 2Q and MC = Q] (ii) Bertrand solution: (q1, q2) = (168, 168). [Since both CV1 & CV2 = -1, the equilibrium outputs solve P = MC1 and P = MC2]. Competitive Fringe solution: The non-dominant firm [#2] has an (initial) CV2 of -1; that is used to form its profit-max equation P = MC2 [after rearranging, q2 = 252 – 0.5q1.] But the equation-based CV2 = q2/q1 = -0.5, and the dominant firm [#1] is credited with (correctly) recognizing this, so its profit-max equation is ultimately 504 – 2.5q1 – q2 = 0, or q1 = 201.6 - 0.4q2. The solution to this equation pair is (q1, q2) = (126, 189). ** Note that firm #2 actually has a bigger market share than firm #1! This is not an illogical result here, since firm #2 in this context is an amalgamation of a large number of small, perfectly competitive firms. (iii) Cournot solution: (q1, q2) = (126, 126). [Since both CV1 & CV2 = 0, the equilibrium outputs solve MR1 = MC1 and MR2 = MC2]. Stackelberg solution: The non-leader firm [#2] has an (initial) CV2 of 0; that is used to form its profit-max equation MR2 = MC2 [after rearranging, q2 =168 – 1/3q1.] But the equation-based CV2 = q2/q1 = -1/3, and the leader firm [#1] is credited (as in the Competitive Fringe solution) with correctly recognizing this, so its profitmax equation is ultimately 504 – 8/3q1 – q2 = 0, or q1 = 189 – 3/8q2. The solution to this equation pair is (q1, q2) = (144, 120).