Quiz Chpts 10 & 11

advertisement

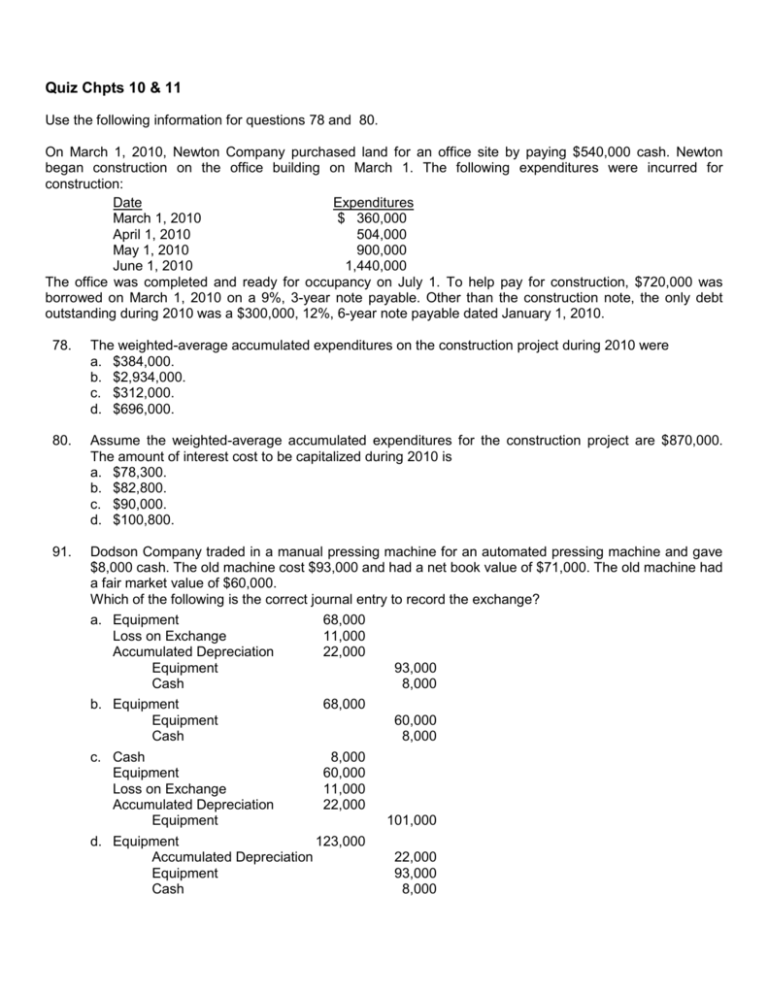

Quiz Chpts 10 & 11 Use the following information for questions 78 and 80. On March 1, 2010, Newton Company purchased land for an office site by paying $540,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction: Date Expenditures March 1, 2010 $ 360,000 April 1, 2010 504,000 May 1, 2010 900,000 June 1, 2010 1,440,000 The office was completed and ready for occupancy on July 1. To help pay for construction, $720,000 was borrowed on March 1, 2010 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2010 was a $300,000, 12%, 6-year note payable dated January 1, 2010. 78. The weighted-average accumulated expenditures on the construction project during 2010 were a. $384,000. b. $2,934,000. c. $312,000. d. $696,000. 80. Assume the weighted-average accumulated expenditures for the construction project are $870,000. The amount of interest cost to be capitalized during 2010 is a. $78,300. b. $82,800. c. $90,000. d. $100,800. 91. Dodson Company traded in a manual pressing machine for an automated pressing machine and gave $8,000 cash. The old machine cost $93,000 and had a net book value of $71,000. The old machine had a fair market value of $60,000. Which of the following is the correct journal entry to record the exchange? a. Equipment 68,000 Loss on Exchange 11,000 Accumulated Depreciation 22,000 Equipment 93,000 Cash 8,000 b. Equipment 68,000 Equipment 60,000 Cash 8,000 c. Cash 8,000 Equipment 60,000 Loss on Exchange 11,000 Accumulated Depreciation 22,000 Equipment 101,000 d. Equipment 123,000 Accumulated Depreciation Equipment Cash 22,000 93,000 8,000 117. Durler Company traded machinery with a book value of $180,000 and a fair value of $300,000. It received in exchange from Hoyle Company a machine with a fair value of $270,000 and cash of $30,000. Hoyle’s machine has a book value of $285,000. What amount of gain should Durler recognize on the exchange? a. $ -0b. $12,000 c. $30,000 d. $120,000 118. Hoyle Company traded machinery with a book value of $285,000 and a fair value of $270,000. It received in exchange from Durler Company a machine with a fair value of $300,000. Hoyle also paid cash of $30,000 in the exchange. Durler’s machine has a book value of $285,000. What amount of gain or loss should Hoyle recognize on the exchange? a. $30,000 gain b. $ -0c. $1,500 loss d. $15,000 loss 120. Sutherland Company purchased machinery for $320,000 on January 1, 2007. Straight-line depreciation has been recorded based on a $20,000 salvage value and a 5-year useful life. The machinery was sold on May 1, 2011 at a gain of $6,000. How much cash did Sutherland receive from the sale of the machinery? a. $46,000. b. $54,000. c. $66,000. d. $86,000. 72. Krause Corporation purchased factory equipment that was installed and put into service January 2, 2010, at a total cost of $60,000. Salvage value was estimated at $4,000. The equipment is being depreciated over four years using the double-declining balance method. For the year 2011, Krause should record depreciation expense on this equipment of a. $14,000. b. $15,000. c. $28,000. d. $30,000. 76. On January 1, 2010, Graham Company purchased a new machine for $2,100,000. The new machine has an estimated useful life of nine years and the salvage value was estimated to be $75,000. Depreciation was computed on the sum-of-the-years'-digits method. What amount should be shown in Graham's balance sheet at December 31, 2011, net of accumulated depreciation, for this machine? a. $1,695,000 b. $1,335,000 c. $1,306,666 d. $1,244,250 82. On January 1, 2010, the Accumulated Depreciation—Machinery account of a particular company showed a balance of $370,000. At the end of 2010, after the adjusting entries were posted, it showed a balance of $395,000. During 2010, one of the machines which cost $125,000 was sold for $60,500 cash. This resulted in a loss of $4,000. Assuming that no other assets were disposed of during the year, how much was depreciation expense for 2010? a. $85,500 b. $93,500 c. $25,000 d. $60,500 95. Robertson Inc. bought a machine on January 1, 2000 for $300,000. The machine had an expected life of 20 years and was expected to have a salvage value of $30,000. On July 1, 2010, the company reviewed the potential of the machine and determined that its undiscounted future net cash flows totaled $150,000 and its discounted future net cash flows totaled $105,000. If no active market exists for the machine and the company does not plan to dispose of it, what should Robertson record as an impairment loss on July 1, 2010? a. $ 0 b. $ 8,250 c. $15,000 d. $53,250 102. Percy Resources Company acquired a tract of land containing an extractable natural resource. Percy is required by its purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 2,000,000 tons, and that the land will have a value of $1,200,000 after restoration. Relevant cost information follows: Land Estimated restoration costs $9,000,000 1,800,000 If Percy maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material? a. $3.90 b. $4.50 c. $4.80 d. $5.40 Use the following information for question 115: On January 1, 2010, Guzman Company purchased a machine costing $150,000. The machine is in the MACRS 5-year recovery class for tax purposes and has an estimated $30,000 salvage value at the end of its economic life. *115. Assuming the company uses the general MACRS approach, the amount of MACRS deduction for tax purposes for the year 2010 is a. $30,000. b. $60,000. c. $48,000. d. $24,000. 118. A machine with a five-year estimated useful life and an estimated 10% salvage value was acquired on January 1, 2009. The depreciation expense for 2011 using the double-declining balance method would be original cost multiplied by a. 90% × 40% × 40%. b. 60% × 60% × 40%. c. 90% × 60% × 40%. d. 40% × 40%. Multiple Choice Answers—Computational Chpt 10 Item Ans. Item Ans. Item Ans. Item 91. 78. d 80. b Ans. Item Ans. Item Ans. a Item Ans. 117. 118. b d 120. c DERIVATIONS — Computational Chpt 10 No. Answer Derivation 78. d ($900,000 × 4/12) + ($504,000 × 3/12) + ($900,000 × 2/12) + ($1,440,000 × 1/12) = $696,000. 80. b ($720,000 × .09) + ($150,000 × .12) = $82,800. 91. a Equipment = $60,000 + $8,000; Loss: $71,000 – $60,000 = 11,000. 117. b ($300,000 – $180,000) × [$30,000 ÷ ($30,000 + $270,000)] = $12,000. 118. d $270,000 – $285,000 = ($15,000). 120. c [($320,000 – $20,000) ÷ 5] × 4 1/3 = $260,000 ($320,000 – $260,000) + $6,000 = $66,000. Multiple Choice Answers—Computational 11 Item Ans. Item Ans. Item Ans. Item Ans. Item 95. 72. Item Ans. 102. c Item d a 115. 118. b DERIVATIONS — Computational 11 No. Answer Ans. b 82. 76. Ans. Derivation 72. b [$60,000 × (1 – 0.5)] × 0.5 = $15,000. 78. c ($180,000 × 8/36 × 9/12) + ($180,000 × 7/36 × 3/12) = $38,750. 82. a ($395,000 – $370,000) + [$125,000 – ($60,500 + $4,000)] = $85,500. 95. d $150,000 < $158,250 [$300,000 – [($300,000 – $30,000) ÷ 20) × 10.5] $158,250 – $105,000 = $53,250. 102. c ($9,000,000 + $1,800,000 – $1,200,000) ÷ 2,000,000 = $4.80. 115. a $150,000 × 20% = $30,000. 118. b Conceptual. a b

![Quiz chpt 10 11 Fall 2009[1]](http://s3.studylib.net/store/data/005849483_1-1498b7684848d5ceeaf2be2a433c27bf-300x300.png)