Name

advertisement

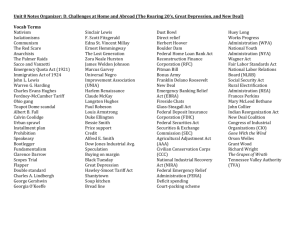

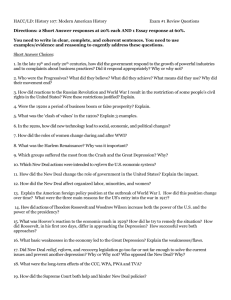

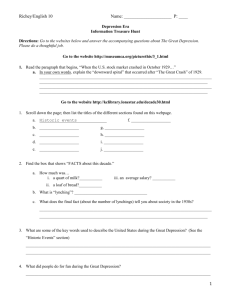

Wisconsin Studies Room 120 Name:________________________________________ Date:________________ Hour:_______ The Great Depression 12 The Great Depression, the worst and longest contraction ever of the American economy, began in 1929 and lasted until 1941. For more than a decade, the American people experienced record levels of unemployment and poverty. At the depth of the Great Depression, in the winter of 1932–33, unemployment was at least one-fourth of the workforce, and national income had dropped by more than 50 percent. From 1933 to 1937, significant economic expansion occurred, although it fell far short of full recovery; and then the recession of 1937–38 sent economic indexes plummeting again. Not until defense spending began to stimulate the economy in 1940–41 did the depression end. In addition to its economic and human impact, the Great Depression affected virtually every aspect of American life, and brought a transformation of American politics by enabling the victory of Franklin D. Roosevelt in the presidential election of 1932. Roosevelt's presidency produced the New Deal and made the Democratic Party the nation's majority party for decades to come. The depression of the 1930s was thus "great" not only in its magnitude but also in its widespread and far-reaching consequences. But while the course and impact of the Great Depression are clear enough, there remains much disagreement about its causes and the reasons for its unprecedented depth and length. Scholars agree that a distinction must be made between the stock market crash of late October 1929 and the Great Depression that engulfed the economy for more than a decade. Because economic indexes turned down so sharply after the stock market crash, that event has often seemed the cause of the Great Depression. But while the market crash played some role in the development of the Great Depression, the economy was already in trouble and evidently heading for at least a recession before the crash. By the late 1920s, construction and automobiles, the two key industries that had supported much of the prosperity of the 1920s, had begun to fall off, and unsold business inventories were increasing in other industries as well. Layoffs and declining production followed. Agriculture had experienced problems throughout the decade. To an important degree, in fact, early signs of difficulty on the stock market in the summer and fall of 1929 apparently reflected concern about the larger economy. Why had the economy begun to stumble, and why did the downturn become the Great Depression of the 1930s? Although those questions elude clear consensus, a number of factors seem important. Much of the economic expansion of the 1920s had been solidly based, but there were flaws in the economy that limited both the extent and the duration of the decade's prosperity. One significant problem was the distribution of income in the United States. Simply put, too little money was in the hands of too many people, and too much money was in the hands of too few. In 1929, the bottom 40 percent of families earned just one-eighth of personal income, while the top 20 percent of families earned more than half— and the top 5 percent alone earned nearly one-third of national income. The average family income of the bottom 40 percent was just $725, a subsistence level or worse. The key issue in the income distribution data involves economic efficiency, not social equity: There was not enough disposable income in the hands of most workers and farmers to help carry the economy. Even for those in the middle-income ranges, there was no longer sufficient money—or credit—to continue the purchases that had sparked the 1920s boom. And for those at the top, who had plenty, money increasingly was saved instead of spent—or was put into the stock market, contributing to the price rise that helped to bring on the stock market crash. The maldistribution of income thus contributed to troubles in the economy evident by 1929. The economic slowdown of the late 1920s was connected to another important pattern: the dependence of 1920s prosperity on housing and automobiles, and the failure of new industries to emerge that might have sustained the economy. Some important older industries—coal, textiles, and railroads in particular—had struggled throughout the decade. Such new industries as electronics and electrical appliances, aviation, processed foods, and petrochemicals had not developed far enough to attract sufficient investment and consumer spending that might have compensated for the saturated housing and automobile industries. Nor was there sufficient government spending at the local or national levels to make up for inadequate private investment. Financial issues comprised a third major set of causes for the Great Depression. The nation's credit and banking system was shaky. Because so many farmers were in debt, small country banks experienced growing difficulties by the late 1920s as their customers defaulted on loans. Many businesses were in debt, too. Beyond that, the banking system itself was unsound—indeed, it was scarcely a system at all—with little real control or integration from the Federal Reserve Board, with no deposit insurance that might have reassured depositors, with undercapitalized small banks, and with unsound practices followed by a number of major banks in their loans and stock market investments. The international debt Wisconsin Studies Room 120 structure was also problematical. Because high American tariffs made it difficult for European nations to earn money by selling goods in the United States, American loans abroad were helping to maintain Germany's war reparation payments and Allied payments of World War I debts to the United States. Finally, economic policy and prevailing economic ideas sustained or exacerbated economic problems and were inadequate for dealing with the depression. High tariffs during the 1920s not only made it difficult for foreign nations to earn credits to buy American goods or repay war debts, but also inhibited purchasing in the United States by propping up prices. The Hawley-Smoot Tariff Act of 1930 made things worse. National farm and labor policies during the 1920s contributed to the low earnings and the inadequate purchasing power of many farmers and workers. The Federal Reserve Board, whose easy credit policies helped fuel borrowing and stock market speculation, could not discipline dangerous banking practices, and there was similarly no control over speculation and shady dealings on the stock market. When the depression did come and then continued to deepen, the conventional insistence on balanced budgets and preserving the gold standard inhibited federal action, as did the orthodox view that downturns were inevitable and self-correcting. The Federal Reserve Board's tight money policies and higher interest rates in the early 1930s to protect the gold standard contributed to the worsening depression. In a number of ways, then, the economy was unsound by late 1929. Scholars do not agree on precisely what role the stock market crash played in bringing on the Great Depression, but it was clearly a blow to the confidence that had helped support the economic expansion of the 1920s and it no doubt reduced some of the investment and consumer spending necessary for prosperity. The crash also helped bring down some financial institutions that had invested heavily in stocks and to dry up some of the loans supporting international finances. But the crash itself did not begin the economic downturn of the late 1920s, nor did it cause the Great Depression. In fact, it took some time before the realization dawned that the slump was not a normal cyclical downturn in the economy. Spectacular though the stock market crash was, most observers agreed with President Herbert C. Hoover that the economy was fundamentally sound and would soon right itself and begin to expand. Temporary plateaus and rallies reinforced such expectations. Only as the depression deepened year after year, and as it became obviously a worldwide depression by 1931, with the collapse of the European trade and financial system that further damaged the American economy, did the gravity and the distinctiveness of this depression become obvious. By 1933, unemployment was at least one-fourth and perhaps one-third of the labor force, and many who were employed were working part-time or at reduced wages. National income had fallen by 54 percent, manufacturing wages and farm income by 60 percent. Industrial production was down by more than half (automobile production by 80 percent and steel production by 90 percent); foreign trade was off by 70 percent; and new capital investment in plants and equipment had plummeted by 98 percent. Business profits fell sharply, with estimates of the decline ranging from 60 to 90 percent. More than 5,000 banks had failed, and millions of savings accounts were lost or decimated. More than 100,000 businesses failed. The New York Stock Exchange was down to only about onefifth of 1929 levels. The consumer price index fell by about 25 percent—but income had fallen much more than that, and declining prices further inhibited business investment. Such catastrophic figures meant human calamity. Jobs were lost, income shriveled, hundreds of thousands of home and farm mortgages were foreclosed, and decent food, clothing, and shelter often could not be purchased. People starved, or were weakened by malnutrition—while unsold foodstuffs piled up or went bad on the nation's farms for want of enough money to buy them. Breadlines, soup kitchens, and shantytowns dotted cities. Industrial workers and small farmers suffered especially, as did African Americans, Mexican Americans, and other minority groups on the lower rungs of the economic ladder. Young people and the elderly also had particular trouble getting or keeping jobs. The loss of income, houses, bank accounts, and white-collar jobs brought distress and suffering to middle-class Americans, too. Private and public relief was altogether inadequate in the first years of the Depression, and New Deal relief programs, although a major change from the Hoover presidency, never brought help to everyone in need. The Great Depression ramified through American society in other ways as well, especially in the first half of the 1930s. Population trends clearly reflected the depression's impact. Despite the highly visible transients, internal migration fell off, and immigration totals plummeted to their lowest levels in a century. Marriage and family life was affected too. Marriage and birth rates declined in the early years of the depression, and hard times increased strains within families, which often experienced role reversals as unemployed men lost their status as breadwinner and wives necessarily played a larger economic and decision-making role. Following as it did the high expectations and growing prosperity of the 1920s, the depression was an especially heavy psychological blow. Indeed, economic depression could bring personal depression, as Wisconsin Studies Room 120 unemployed and impoverished Americans often blamed themselves for their plight. Such areas of popular culture as sports, recreation, and movies were affected by the depression, as were literature and art and architecture. The Great Depression also had enormous consequences for the American political system. In the election of 1932, voters overwhelmingly turned Hoover and the Republican Party out of office and elected Franklin D. Roosevelt and the Democrats. Particularly in his first term from 1933 to 1937, Roosevelt's presidency produced the New Deal programs that created the modern American regulatory welfare state and transformed American government. In politics in the Roosevelt era, voters responded to Roosevelt and the New Deal by making the Democratic Party the nation's new majority party. Finally, it must be emphasized that the Great Depression lasted for more than a decade, until defense spending brought recovery and full employment in the early 1940s. Not until 1941 did unemployment, which averaged some 20 percent throughout the decade, fall below 14 percent; by 1944, unemployment had plummeted to just 1 percent. Not until 1937 did the volume of gross national product (GNP) equal that of 1929, and then it fell again with the recession of 1937–38, which helped turn the administration toward Keynesianism. Not until 1941 did the dollar value of GNP attain 1929 levels, and it soared to new record levels in the next few years. The New Deal contributed to some economic improvement and brought help and hope to tens of millions of Americans in the 1930s, but it was World War II, not the New Deal, that at last ended the Great Depression. Answer the following question: Please list four reason the decade of the 1920s lead to the Great Depression and NOT the stock market crash of 1929. 7. 1. 8. 2. 3. Please list four attempts (by any party) to eliminate the burdens the Great Depression imposed on American families and the American economy during the 1930s. 9. 4. 10. Please list four problems that most lower and middle class families faced during the Great Depression. 5. 11. 6. 12.