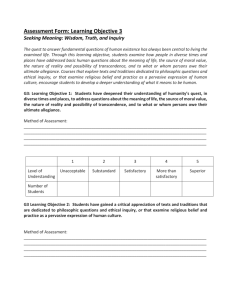

Faculty Performance Evaluation Criteria For Interaction with Practice

advertisement

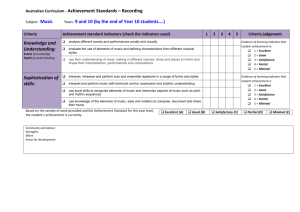

Faculty Performance Evaluation Criteria For Interaction with Practice1 1. In general, “interaction with practice” activities includes hours spent learning about current accounting practices. Learning about professional accounting practice is a critical part of IWP, whether or not faculty learn about practice in the presence of practitioners. The key to awarding IWP credit is the extent to which the learning makes faculty better able to impart relevant professional education to SOA students. 2. Specific activities that constitute interaction with practice include the following, provided that the class deals primarily with practice-relevant topics: a. Developing formal C.P.E. classes. b. Teaching formal C.P.E. classes, at a rate of 2 hours of credit for each class hour taught the first time taught and a rate of 1 hour of credit for each class hour taught thereafter. The faculty must justify instances where re-teaching a course should count as a new course. c. Attending formal C.P.E. classes, including those delivered by academics. d. Webcasts and other electronically-delivered C.P.E. e. Professional dinners and other “social” interactions with practitioners if and only if there is a significant discussion of practice issues at the event. f. Involvement with the Ohio Center for Professional Accountancy (“OCPA”) should ordinarily count as IWP. This includes working on practice issues that do not result in peer-reviewed publications, such as position papers. It also includes participation in CPA firm days sponsored by the OCPA. g. Field studies, plant tours, office tours where practitioners discuss their operations, and attendance at FASB or GASB public hearings. h. Working as a faculty intern for a public accounting firm, in industry, or in a not-forprofit/government entity. i. Serving on a board of directors, if the primary nature of the service relates to financial/accounting issues. 3. Specific activities that do NOT constitute interaction with practice include the following: a. Academic-led sessions dealing with largely academic issues (research, teaching, service); b. Events or other interactions with practitioners that primarily involve marketing our students and recruiting events for which practice issues are not the primary topic of discussion; c. Serving on a board of directors, if the primary nature of the service does not relate to financial/accounting issues. 4. Several of the performance evaluation criteria of interaction with practice are also listed as professional activities in the Service section. For any such activity, the faculty member must choose to count that activity as either service or interaction with practice, but not both. 5. The allowable weights for the interaction with practice section are 5% minimum and 10% maximum except for those activities that specifically allow for greater percentages. 6. Faculty may petition the performance evaluation committee to deem some other interaction with practice activity as “relevant” and award it appropriate status. 7. Interaction with Practice evaluation performance levels (see next page) 1 As amended on May 20, 2005 and September 19, 2008(?). SOA Policy Manual Faculty Composition and Development Page II-2 Unsatisfactory Not meeting the requirements for satisfactory Satisfactory Satisfactory requires 8 interaction with practice hours be achieved plus one of the following activities: o 12 additional interaction with practice hours o Session chair at a state or national conference dealing with current accounting practices. Good Good requires that satisfactory be achieved plus one of the following activities: o 20 additional interaction with practice hours beyond the amount required for achieving satisfactory. o Developing a one to four hour CPE workshop. o Being an active board member of a corporate or business board of directors. o Serving on the audit committee of a governmental or business organization. o Formal consulting accounting engagement(s) that total(s) at least 20 hours in which the professor learns something about current accounting practice. o Active significant service on a state or national committee of a professional organization such as AICPA, IMA, OSCPA. o Editor or section editor of a professional journal. o A member of the editorial board of a professional journal. The faculty member must review at least two manuscripts per year to be awarded credit in this criterion. o Professional practice, with at least 100 hours of accounting, auditing, consulting, or tax services to clients. This criterion applies to group II faculty only. Excellent Excellent requires that satisfactory be achieved plus one of the following activities. SOA Policy Manual Faculty Composition and Development Page II-3 o Two activities listed under Good. o Developing and presenting five or more hours of CPE workshop(s). The faculty member achieving this criterion may choose a weight of up to 15%. o Initial professional certification, such as CPA, CMA, or CIA. The faculty member achieving this criterion may choose a weight of up to 20%. o A significant faculty internship, generally involving one month or more. member achieving this criterion may choose a weight of up to 20%. The faculty o The faculty member may petition the performance evaluation committee to deem some other interaction with practice activity as “outstanding” and award it excellent status.