CHAPTER 7

Strategy in High-Technology Industries

SYNOPSIS OF CHAPTER

The goal of this chapter is to describe the strategies and concepts that are unique to high -technology

industries. High-tech industries are growing in number and many formerly low-technology industries are

become more high-tech. In addition, high technology industries face similar industry conditions, and thus

tend to employ a similar range of strategies.

One of the most important concepts in understanding high-technology industries is the idea of technical

standards. These standards emerge as a new technology evolves rapidly in its early days. Typically, many

alternate technologies are tried before a new standard is chosen. The existing te chnology is usually

completely replaced by the new technology in time. The contest to decide which firm will own the technical

standard is called a “format war.”

Standards may emerge as a result of government policy, through an agreement made by firms with in an

industry, or gradually emerge based on consumer buying patterns. A critical part of a new technology’s

success is often the support of complementary products. A network of interrelated buyer and supplier firms

creates a support system for new technology.

First movers typically have an economic benefit, due to the early monopoly and the opportunity to gain

technology-specific knowledge, driving down costs and increasing sales. Sometimes, however, firms that

follow first movers can benefit from the first mover’s experience without the steep up-front investment.

In addition, high-tech products are increasingly digitized, which makes it easier to steal the product, through

piracy. Therefore, intellectual property rights are an important concern of high -tech firms. Also, hightechnology industries tend to have high fixed costs and low marginal costs.

Therefore, strategies for success in high-tech industries include being a first mover, owning the technical

standard, building demand early by dropping price, riding down the experience curve, and being open to

strategic alliances with firms that possess complementary assets.

TEACHING OBJECTIVES

1.

Recognize the important role of technical standards in creating success in high-tech industries.

2.

Know the ways in which technical standards can emerge.

3.

Examine the concepts of network effects, positive feedback loops, and customer switching costs.

4.

Know a variety of strategies for winning a format war.

5.

Be aware of the cost structure of high-technology industries and its impact on strategy.

6.

Recognize the importance of intellectual property rights for high-tech firms, and understand the methods by

which firms protect those rights.

7.

Examine the advantages and disadvantages of being a first mover or a follower in a high-tech industry.

8.

Understand the cycle of development of new technologies that underlies technological paradigm shifts.

9.

Examine strategies that can be used by first movers and existing firms to manage during a time of

technological paradigm shift.

Copyright © Houghton Mifflin Company. All rights reserved.

Chapter 7: Strategy in High-Technology Industries

83

OPENING CASE: EXTENDING THE WINTEL MONOPOLY TO

WIRELESS

In the PC software industry, Microsoft and Intel have established the industry standard, based on Intel’s

microprocessors and Microsoft’s Windows operating system. This highly successful duo is now attempting to

create a standard for the next generation of cellular phones, which will be able to compute, send e-mail, and

browse the Internet, in addition to traditional telecommunications functions. The two giant firms are creating a

reference design based on current technologies, that they plan to license to manufacturers. The makers can reduce

their R&D costs substantially, offer the phones at lower prices, increase the number of users, and cause more

applications to be developed for the phones. Increased sales will boost Intel’s and Microsoft’s royalties. It’s not

yet clear if the Wintel design can prevail against industry heavyweights such as Ericsson, Motorola, and Nokia.

Whoever establishes the industry standard will be the dominant firm in the developing industry for years to come.

Teaching Note: This case sets the stage for many of the conclusions that are presented in this chapter. Among

them are the importance of establishing a technical standard and the importance of first-mover advantages. Most

students are familiar with the downside to the dominance of Microsoft and Intel in the PC industry, including the

monopoly pricing power, lack of choices for consumers, and stifling of innovation. You can use this case for

classroom discussion by asking students to consider whether those disadvantages are likely to develop in the cell

phone industry, if the two firms create the industry standard. Are the disadvantages likely to occur if another firm,

for example Nokia, were to win the format war? Why or why not?

LECTURE OUTLINE

I.

II.

Overview

A. Technology refers to “the body of scientific knowledge used in the production of goods or services.”

High-technology industries (also called high-tech industries) are ones in which the scientific

knowledge used by companies in the industry is advancing rapidly, leading to rapid changes in the

attributes of goods and services.

B.

Examples of high-tech industries include the computer industry, telecommunications, consumer

electronics, pharmaceuticals, power generation, and aerospace, among others.

C.

High-technology industries deserve special consideration because they are an ever-increasing part of

our economy, many traditionally low-technology industries and products are becoming more hightech, and high-tech firms a similar competitive situation.

Technical Standards and Format Wars

A. Technical standards are “a set of technical specifications that producers adhere to when making the

product or component,” and they can be a source of differentiation, leading to competitive advantage.

1.

Competitive struggles over control of technical standards are called “format wars.”

2.

Examples of technical standards include the layout of a computer keyboard, the dimensions of

shipping containers such as trucks and railcars, and the components included in a personal

computer.

3.

When an industry relies upon a common set of features or design characteristics, such as the

Wintel design for personal computers, this is called a “dominant design.” Each dominant

design may be made up of a set of related technical standards.

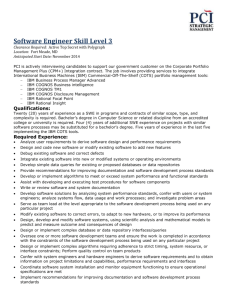

Show Transparency 47

Figure 7.1: Technical Standards for Personal Computers

B.

Standards provide economic benefits to those companies that adhere to them.

1.

Standards guarantee compatibility, such as the ability to use the same software programs on

different brands of PCs.

2.

Standards help reduce consumer confusion. When consumers sense that the technology is still

evolving, they may delay purchase, which can cause the technology itself to fail to gain initial

acceptance in the market.

Copyright © Houghton Mifflin Company. All rights reserved.

84

Chapter 7: Strategy in High-Technology Industries

STRATEGY IN ACTION 7.1: WHERE IS THE STANDARD FOR DVD

RECORDERS?

DVD industry members were able to agree on a standard format for DVD players. But in spite of the existence of

at least three viable technologies, the industry is unable to agree on a standard for DVD recorders. Consumers and

retailers are hesitant to invest in DVD recorders based on a system that might or might not be the standard

ultimately chosen by the industry. On the supply side, manufacturers such as Sony, Matsushita, Philips, and

Hewlett Packard are unwilling to accept their competitors’ standards, which would require them to pay royalties

to their rivals. DVD recorders are also currently expensive compared to VHS or CD recorders, because they are

produced in small volume. In order to drive the price down, sales must be higher, and that requires the

establishment of a standard.

Teaching Note: This case illustrates the types of problems that occur when an industry is unable to agree upon a

format. In this case, the big electronics manufacturers are unwilling to accept each other’s technology as the

standard, although establishing a standard would certainly increase sales and profits for the entire industry in the

long run. You can ask students to name examples of other standards that are beneficial to the industry and

consumers alike. (Examples include gasoline octane ratings, parental advisory ratings on movies and music, and

banks’ reporting of interest as a standardized APR, or Annual Percentage Rate.)

3.

C.

D.

Standards serve to reduce production costs, by facilitating mass production, along with its

consequent economies of scale and lower costs. Both manufacturers and components suppliers

are able to benefit from standards, reducing the cost of components too.

4.

Standards reduce the risk associated with supplying complementary products. Makers of

complementary products, such as software providers for the PC industry, will hesitate to invest

in producing complementary products until standards are reached. A low supply of

complementary products can reduce sales of the product.

Standards emerge in an industry in several ways. When standards are set by the government or

industry group, they are part of the public domain, meaning that any company can use that standard

in their products.

1.

Companies may lobby the government to mandate an industry standard. An example would be

the digital TV broadcast standards put forth by the FCC.

2.

Companies may band together to cooperatively establish standards, without government

intervention, as DVD manufacturers did.

3.

Standards may also be selectively chosen by consumers, who use market demand as a selection

mechanism. Microsoft and Intel both use proprietary standards, which are protected through

patents.

Network effects arise in industries where the number of complementary products is a primary

determinant of standards. For example, the success of VCRs is driven by the standard VHS format for

tapes, creating a positive feedback loop, in which demand for VCRs led to demand for tapes, and the

increased availability of tapes led to further demand for VCRs.

Show Transparency 48

Figure 7.2: Positive Feedback in the Market for VCRs

1.

In a format war, the winner will be the company that best exploits positive feedback loops.

Microsoft beat Apple by creating “open” computer code for its operating system; Matsushita

beat Sony in VHS tapes by licensing its technology to competitors.

STRATEGY IN ACTION 7.2: HOW DOLBY BECAME THE STANDARD IN SOUND

TECHNOLOGY

Dolby technology is the industry standard for sound recording and playback, in industries ranging from consumer

electronics to movie production. Founder Ray Dolby, holder of a Ph.D. in physics, invented a technology in 1965

for reducing the background hiss in professional tape recording. Sales were slow, until Dolby licensed his

technology to KLH, an American producer of audio equipment. Dolby decided to charge a modest licensing fee,

Copyright © Houghton Mifflin Company. All rights reserved.

Chapter 7: Strategy in High-Technology Industries

85

to discourage manufacturers from developing their own, competing technology. He also made licensees agree to

quality inspections from Dolby employees, to protect his firm’s reputation. Dolby chose to give away his

technology for free to prerecorded tape makers, to increase sales of tape players with Dolby capability. The

company today is relatively small but its technology is used in virtually every film, CD, DVD, PC, and video

game.

Teaching Note: Ray Dolby made a number of intelligent decisions that enabled his firm to win the format war for

audio standards. His firm is exemplary in its use of strategies for establishing an industry standard. A class

discussion of this case should center on listing every effective choice, and then describing the benefits that

resulted from those choices.

2.

III.

IV.

Companies that fail to adopt the dominant design as it emerges may find themselves locked out

of the market. Customers may be unwilling to bear the switching costs of changing to an

alternate technology, unless the benefits of doing so outweigh the costs.

3.

As a new technology becomes more widely adopted, there comes a point at which the prior

technology becomes outmoded. For example, CDs replaced the long-playing record.

Strategies for Winning a Format War

A. It’s clear that firms benefit when they exploit network effects and when positive feedback loops are in

operation, so companies must find a way to make the effects work in their favor and against their

competitors. Therefore, they must build an installed base as rapidly as possible, leveraging the

positive feedback loop, forcing customers to bear switching costs, and locking the market into their

technology.

B.

One important step for firms to take in winning a format war is to ensure a supply of complementary

products.

1.

One way for companies to ensure a supply of complements is to diversify into the production of

complements themselves.

2.

Another way is to create incentives for others to produce complements, such as reducing

licensing fees or providing technical assistance.

C.

Another important step is to leverage killer applications, those uses of a product that are so

compelling to consumers that they kill demand for competing formats. The killer applications can

either be developed by the company itself or by other firms.

D. A third strategy for winning a format war is for the companies to price and market their products

aggressively.

1.

One common pricing strategy is to price the product low and the complements high, such as the

way Hewlett-Packard prices printers at cost, and then charges substantial markup on ink

cartridges.

2.

Aggressive marketing strategies include substantial up-front marketing and point-of-sale

promotion to encourage first-time buyers.

E.

Yet another strategy involves cooperation with competitors, in order to ensure compatibility and lock

out alternative technologies.

F.

Another strategy requires licensing the format, so that the licensing firm may profit from licensing

fees while also boosting demand and speeding adoption of the format. A relatively low licensing fee

reduces the financial incentive for competitors to develop their own, alternative formats.

G. These five strategies may be used in combination, depending upon the unique demands of the

situation. Care is needed to select the optimal mix of strategies, as well as to ensure that strategies are

working together, and not counteracting against each other.

Costs in High-Technology Industries

A. In most high-tech industries, the fixed costs of product development are very high, whereas the

marginal costs—the costs of producing one extra unit of the product—are very low. The initial costs

of R&D and building manufacturing capacity contribute to the high fixed costs, whereas the marginal

costs might be just a small amount, especially in a mass production environment where the product

might be a DVD or a piece of software.

B.

The high fixed costs and low marginal costs of high-tech industries stands in contrast to many

traditional industries, where the marginal costs tend to increase as production rises. Figure 7.3

graphically illustrates how the differing relationships between fixed and marginal costs lead to

different levels of profitability.

Copyright © Houghton Mifflin Company. All rights reserved.

86

Chapter 7: Strategy in High-Technology Industries

Show Transparency 49

Figure 7.3: Cost Structures in High-Technology Industries

C.

The implication for strategy is that companies should try to switch from an industry with increasing

marginal costs to one where marginal costs are lower, in order to increase profitability.

STRATEGY IN ACTION 7.3: LOWERING COSTS THROUGH DIGITALIZATION

Ultrasound is an important diagnostic tool, producing images of organs. The technology is very valuable, but the

equipment is bulky, heavy, and expensive, so it is used primarily in dedicated hospital facilities. ATL, a leading

maker of ultrasound technology, decided to reduce the size of an ultrasound set-up to about the size and weight of

a lap top computer. This would be accomplished by replacing many of the machine’s solid circuits with software

(in a process called “digitalizing”), reducing size and costs. Smaller size and lower cost would allow the units to

be placed on ambulances or into physician’s offices-market niches that are impossible with today’s technology.

Late in 1999, the first unit was produced, and by 2001, sales reached $46 million (mostly to buyers for ambulatory

care and foreign markets).

Teaching Note: This case shows how a company reached a previously untapped market niche by digitalizing a

product, which also allows the firm to reduce expenses. Thus, digitalizing can support a firm that is pursuing a

simultaneous advantage in differentiation and cost leadership.

D.

V.

VI.

Another strategic implication is that companies should deliberately drive prices down to drive volume

up, leading to increased profitability.

Managing Intellectual Property Rights

A. Intellectual property refers to the product of any intellectual and creative effort, which would

include products such as music, film, books, graphic arts, manufacturing and other processes, and new

technology of any type.

B.

Intellectual property is a very important driver of economic progress and social wealth. That is,

nations where many individuals or firms are creating valuable intellectual property will prosper, as

will the individuals or firms. However, the creation of intellectual property is often expensive, risky,

and time-consuming. The costs of a new technology may be in the hundreds of millions of dollars,

and the failure rate may be close to 90 percent in some industries.

C.

Because of the expense and risk, few would undertake the creation of intellectual property unless they

expected some economic return. Therefore, patents, copyrights, and trademarks are used to give

incentives for its creation.

1.

Protection of intellectual property rights is an important strategy for high-tech firms, and they

may use lawsuits against competitors, both to stop actual violations and as a deterrent against

future violations.

2.

The protection of intellectual property rights has been complicated in recent years due to

digitalization, or the rendering of creative output in digital form, which is common today for

artistic works and computer software.

3.

Digitalization lowers the cost of copying and distributing intellectual property, aided by the

Internet, making the marginal costs almost zero.

4.

The low cost of copying and distributing creates an opportunity for piracy, the theft of

intellectual property. Piracy is quite common in the computer software and music recording

industries, costing each of those industries billions of dollars in lost sales annually.

5.

Companies in the software and music industries don’t rely solely on legal protection—they also

protect their works with encryption software. However, sophisticated pirates know how to

defeat the encryption.

D. Digital rights can be effectively managed through the use of several tactics.

1.

One strategy relies on giving something away for free to boost sales of complementary

products, just as companies do to win format wars.

2.

Another strategy is to keep prices so low that customers have little incentive to steal.

Capturing First-Mover Advantages

A. Companies in high-tech industries strive to be a first mover, that is, the first to develop a new

product.

Copyright © Houghton Mifflin Company. All rights reserved.

Chapter 7: Strategy in High-Technology Industries

1.

2.

87

First movers initially have a monopoly position, which can be very profitable if consumers

adopt the new technology.

Once a first-mover has been profitable with a new product, imitators rush into the market,

lowering returns for all competitors.

Show Transparency 50

Figure 7.4: The Impact of Imitation on Profits of a First Mover

3.

In spite of imitators, some first movers have been able to turn that initial advantage into an

enduring advantage. For example, Cisco was the first to create an Internet router and still

dominates that market. They do this by slowing the rate of imitation.

4.

However, there are also first mover disadvantages, which occur when a first mover pursues an

inappropriate strategy.

B.

First movers have five key advantages.

1.

They can exploit network effects and positive feedback loops.

2.

They can establish brand loyalty.

3.

They can increase production earlier than rivals, and thus benefit from cost savings due to scale

economies and learning effects.

4.

They can create customer switching costs.

5.

They can accumulate valuable knowledge about customers, distribution, technology, and so on.

C.

First movers also have four potential disadvantages.

1.

They have to bear the costs of initial development and marketing, called pioneering costs. Later

entrants can free-ride on the pioneer’s investment.

2.

They make more mistakes than do later entrants.

3.

They risk building the wrong resources and capabilities, because they are focusing on an

atypical customer segment, the innovators and early adopters.

4.

They may invest in inferior technology. Later entrants may be able to leapfrog the first mover

and introduce products based on a more sophisticated technology, due to the rapidly changing

nature of the technology.

D. First movers can exploit their advantages in a number of ways.

1.

In order to choose an appropriate strategy, the first mover must answer three key questions.

Table 7.1 of the text summarizes the concepts presented in this section.

a.

Does the company possess the complementary assets needs to exploit the new

innovation? Complementary assets might include competitive, expandable

manufacturing facilities, the ability to ride quickly down the experience curve, marketing

know-how, access to distribution networks, a customer support network, and sufficient

capital.

b.

What is the height of barriers to imitation? Barriers to imitation might include patents

and a secret development process.

c.

Are there capable competitors that could rapidly imitate the innovation? Competitors are

capable if they have excellent R&D skills and access to complementary assets.

2.

The first mover can choose to develop and market the innovation itself, if the firm has

complementary assets, barriers to imitation are high, and capable competitors are few. If this

strategy can be sustained, it will lead to the highest level of profits—but it may not be possible.

3.

The first mover can use a joint venture or strategic alliance to develop and market the

innovation with other companies, if the firm lacks complementary assets, barriers to imitation

are high, and there are several capable competitors. The joint venture partner should be a firm

that possesses the required complementary assets.

4.

The first mover can license the innovation to others and let them develop the market, if the firm

lacks complementary assets, barriers to imitation are low, and there are many capable

competitors. A modest licensing fee will discourage development of competing innovations.

VII. Technological Paradigm Shifts

A. Technological paradigm shifts occur when new technology revolutionizes the structure of an

industry. This alters the nature of competition and requires the use of new strategies. An example is

the current trend toward digital photography in replacing chemical photography.

Copyright © Houghton Mifflin Company. All rights reserved.

88

Chapter 7: Strategy in High-Technology Industries

B.

Paradigm shifts occur when an industry is mature, with technology approaching its “natural limit” and

when a new technology has begun to be adopted by customers who are poorly served by the existing

technology.

1.

The technology S-curve (shown in Figure 7.5) describes the relationship between performance

of a technology and time. Early on, new technologies improve rapidly in performance, but the

effect diminishes over time, and ultimately approaches a natural limit beyond which only

smaller, incremental improvements can be made.

Show Transparency 51

Figure 7.5: The Technology S-Curve

2.

3.

When a technology approaches its natural limit, researchers begin to investigate possible

alternative technologies, increasing the chances that a paradigm shift will occur.

This means that a technology that has just been developed will not be as useful as the existing

technology, until after a period of refinement and improvement. Therefore, new technologies

are sometimes mistakenly dismissed by competitors.

Show Transparency 52

Figure 7.6: Established and Successor Technologies

4.

In many situations, the old technology is dying out just as a host of new technologies are being

developed. It’s often very difficult for established companies to decide which of the possible

alternatives will ultimately be successful.

Show Transparency 53

Figure 7.7: Swarm of Successor Technologies

C.

Clayton Christensen has developed a theory about disruptive technologies, or a new technology that

gets its start away from the mainstream of the industry, and then invades the main market, causing a

paradigm shift.

1.

Christensen claims that established companies are often aware of the new alternatives, but they

listen to their customers, and their customers don’t want the new technology, because it’s not

yet efficient.

2.

As the performance of the new technology improves, customers do want it, but it’s too late for

the established firms to accumulate the technical knowledge in time to meet rising market

demand.

STRATEGY IN ACTION 7.4: DISRUPTIVE TECHNOLOGY IN MECHANICAL

EXCAVATORS

Excavators are used to dig foundations and trenches, and for years the dominant technology was a system of

cables and pulleys that lifted a large bucket of earth. In the 1940s, however, hydraulic technology presented a

more efficient and convenient design, but it could not lift as large a load. Excavator manufacturers surveyed

customers and found that most did not want to use the new technology, because of the limits on load size. This

created an opportunity for new entrants into the industry. Manufacturers such as Case, Deere, and Caterpillar

initially focused on small hydraulic excavators, but as their expertise grew, they solved the engineering limitations

of the hydraulic design. They were able to make hydraulic excavators with larger buckets, and ultimately they

rose to dominate the industry.

Teaching Note: This case describes an example of a disruptive technology revolutionizing an industry. You can

describe other examples of paradigm shifts to reinforce this concept. Examples might include PCs and word

processing software replacing typewriters (along with correction fluid and ink erasers), calculators replacing slide

rules, automobiles replacing horse-drawn buggies (and horseshoes and harnesses), and many more. A book that

discusses one case in extended detail is The Victorian Internet: The Remarkable Story of the Telegraph and the

Nineteenth Century’s On-Line Pioneers (by Tom Standage, published by Berkley Publishing Group, October

Copyright © Houghton Mifflin Company. All rights reserved.

Chapter 7: Strategy in High-Technology Industries

89

1999). This book tells a wonderfully modern story of industrial espionage, wildly ambitious entrepreneurs, and

the development of complementary products—such as the development and placement of a 1,600- mile-long cable

at the bottom of the Atlantic.

3.

D.

E.

Christensen identifies other factors that make it difficult for established firms to adopt a new

technology, including the assumption that new technologies only serve a small market niche,

the necessity of adopting a new business model, and the lack of a new network of suppliers and

distributors.

What can established companies do to remain competitive when disruptive technologies emerge?

1.

Companies should understand the process of technological disruption, and particularly the

rapidity with which a new technology can replace an older one. Awareness of the process could

lead to better strategic decisions.

2.

Established companies should invest in newly emerging technologies, hedging their bets by

investing in several alternatives. They might also enter into joint ventures with new-technology

companies, or acquire them.

3.

Established companies should separate the new technology into its own autonomous division.

This allows the new technology to develop in spite of what is often significant internal

opposition. Autonomy also helps the division develop a new business model, with a radically

different value chain.

What should new entrants do to gain an advantage of established enterprises?

1.

New entrants must deal with problems such as the raising of capital, the management of rapid

growth, and moving their technology from a small niche to a mass market.

2.

Another concern of new entrants is the choice of whether to partner with an established

company or go it alone.

ANSWERS TO DISCUSSION QUESTIONS

1.

What is different about high-tech industries? Were all industries once high tech?

High-technology industries rely heavily on rapidly advancing scientific knowledge, whereas other

industries’ technologies are more stable and evolve slowly and predictably. Thus, high-tech industries are

unstable, chaotic, and prone to sudden disruption. The implications for managers are that high-tech firms

must be extremely innovative, flexible, and forgiving of mistakes.

Every technology was new at some point in human history, thus every industry was rapidly evolving and

chaotic at some time. Even the wheel was a new technology—about 5500 years ago in ancient

Mesopotamia. The astonishing new invention underwent several further refinements as it swept the known

world, revolutionizing transportation.

2.

Why are standards so important in many high-tech industries? What are the competitive implications of

this?

Standards are important in every industry, but in high-tech industries they are still evolving and thus require

a great deal of managerial attention. The development of standards marks an important transition point in an

industry, because after standards are developed, industry evolution will slow. Some early industry

competitors may fail to adopt the new standard in time, and may exit the industry. Establishment of

standards will draw new entrants, and for the first time price competition will become important. Managers

also care about standards because the company that establishes the standard may be able to use that standard

as a significant source of revenue. Thus, the establishment of standards will affect industry participants, the

intensity of rivalry, the basis of rivalry, the strategies used by participants, and the industry’s profit

potential.

3.

You work for a small company that has the leading position in an embryonic market. Your boss believes

that the company’s future is assured because it has a 60 percent share of the market, the lowest cost

structure in the industry, and the most reliable and highly-valued product. Write a memo to him outlining

why his assumptions might be incorrect.

In answering this question, students should focus on the following points:

Copyright © Houghton Mifflin Company. All rights reserved.

90

4.

Chapter 7: Strategy in High-Technology Industries

The embryonic nature of the industry means that the technology is still undergoing major changes,

and therefore the company cannot afford to be complacent, but must continue to innovate.

A high market share, low cost, and high-quality product is no guarantee of future success when the

industry may experience rapid and drastic changes. In fact, the company’s early success may make it

more difficult for them to adapt, when the large changes come. The manager should be warned not to

continue to look for improvements and to monitor the actions of competitors closely.

You are working for a small company that has developed an operating system for PCs that is faster and

more stable than Microsoft’s Windows operating system. What strategies might the company pursue to

unseat Windows and establish its new operating system as the dominant technical standard in the industry?

There are several large hurdles that must be overcome if the company is to succeed with this highly risky

strategy. To do this, the company could consider enlisting the aid of the government or other competitors in

unseating Microsoft. Another strategy would be to encourage PC makers to install the new operating

system, perhaps with a financial incentive. Another key need is for complementary products, and the firm

should enable and encourage software developers in writing applications for use with the new operating

system.

5.

You are a manager for a major record label. Last year, music sales declined by 10 percent, primarily due to

very high piracy rates for CDs. Your boss has asked you to develop a strategy for reducing piracy rates.

What would you suggest that the company do?

One strategy is to work to develop an encryption scheme that will reduce piracy, however, these are

typically not very effective. In one recent case, Sony spent months developing a new CD encryption

scheme, which consumers were able to defeat less than 24 hours after its release, with the simple use of an

ordinary marking pen. Another strategy would be to give something away with each purchase, such as a

poster or collectible, that can’t be easily duplicated. However, this strategy would be expensive to

implement. A third possibility is to reduce the price so low that consumers are willing to pay for the

convenience, however, this strategy may not be very profitable either.

SMALL-GROUP EXERCISE: BURNING DVDS

The students are asked to break up into groups of three to five people and to play roles as managers and engineers

at a small start-up company, with a new technology to allow customers to copy DVDs. The students are asked to

describe the likely development of the market for this new product, including factors that might inhibit adoption

of it. They are then asked to develop a strategy, in conjunction with film studios that would increase their

company’s revenues while also reducing piracy rates.

Teaching Note: Through work on these tasks, students will come to understand that, although the specific

technology changes, the process by which new technologies are adopted follows a strikingly similar path.

(This concept is emphasized dramatically in The Victorian Internet: The Remarkable Story of the Telegraph

and the Nineteenth Century’s On-Line Pioneers, written by Tom Standage and published by Berkley

Publishing Group, October 1999, as discussed in the Teaching Note for Strategy in Action 7.4, above.) This

exercise also highlights the desirability of win-win strategies, such as the type of actions that would increase

sales and reduce piracy, benefiting both firms. You can initiate discussion by asking students to consider

what would be the likely consequences if their firm decided not to cooperate with film studios.

ARTICLE FILE 7

Have students find an example of an industry that has recently undergone a shift in technological paradigm. They

should describe what happened to existing companies as the shift unfolded.

Teaching Note: You may have to point students to industries that have experienced recent paradigm shifts. One

possibility is the telecommunications industries in developing countries, where consumers are choosing to adopt

wireless technology before wired technology, reversing the process in developed nations. Another good example

would be the handheld communications industry, where cell phones can now act like computers or Internet

browsers, in addition to their other functions. Conversely, you can ask students to describe industries that have not

undergone a recent paradigm shift. Do the students see any potential for such industries to change, and will the

change be a radical or an incremental one? Or will they simply continue as is indefinitely?

Copyright © Houghton Mifflin Company. All rights reserved.

Chapter 7: Strategy in High-Technology Industries

91

STRATEGIC MANAGEMENT PROJECT: MODULE 7

This module asks students to analyze their company’s industry environment for vulnerability to shifts in the

technological paradigm. To do this, they should describe the current dominant technology and indicate whether

technological standards are important in the industry. They should also describe the customer attributes and

strategic implications. They are then asked to tell about the diffusion of the dominant technology, including the

drivers of diffusion. Another requirement is to show where the dominant technology falls on the S-curve and tell

whether alternative technologies are currently being developed. Finally, they are asked to examine the importance

of intellectual property rights for their industry, to describe the strategies their firm has adopted for protecting

those rights, and evaluate the effectiveness of that strategy.

Teaching Note: You can point out to students that every industry is vulnerable to paradigm shifts, whether the

potential for those shifts is apparent or not. Paradigm shifts are typically radical, unexpected changes. When

students speculate about possible paradigm shifts, they may be concerned that their ideas sound too extreme, but

they may in fact not be extreme enough. For example, who could have predicted in 1910, as automobiles were just

coming into use for long-distance transportation, that 30 years later flight would replace driving as the dominant

method of travel? Therefore, they may have trouble identifying new technologies, just as managers do.

EXPLORING THE WEB: VISITING KODAK

Students are asked to visit the web site of Kodak (www.kodak.com) to explore the firm’s activities related to

digital photography. Students are then asked to guess what percentage of Kodak’s sales comes from digital

products and evaluate the likelihood of that percentage changing over the next decade. They then compare the Scurves and the set of competitors for digital and traditional photography, and assess the implications for Kodak.

Next, they describe the changing economics of the photo industry. In the last question, they are asked to evaluate

Kodak’s strategy for dealing with digital technology, describing the likely outcome of that strategy. Finally, they

are asked to suggest changes that Kodak can make in its strategy to improve performance. In the General Task,

students are asked to search the web to find information about competition in the market for hand-held computers,

and to answer questions about the standard for operating systems, the process by which that standard emerged,

and the possibility of that standard being replaced by a new technology in the next few years.

Teaching Note: The students will need to estimate the percentage of sales from digital products, as this

information isn’t available on Kodak’s web site. Correspondingly, when students estimate the likelihood of

change and draw the S-curve, their answers will be approximations only. Ask students to consider the strategic

implications for Kodak of the necessity of competing with a new set of competitors. Although Kodak might prefer

a known set of competitors, a technology with which it is familiar, and a developed product, the introduction of

digital photography is a reality and clearly is the future of the industry. Thus, the firm is forced to deal with shift.

Ask students to consider Kodak’s options, and to debate the merits of each. Would it ever be in the firm’s best

interests to continue to pursue a narrower, “traditional” market?

CLOSING CASE: THE EVOLUTION OF IBM

IBM is a world leader in computing and one of the oldest firms in that industry. The company has undergone

several paradigm shifts over the years. From the firm’s founding in 1911 to the 1930s, its most important products

were mechanical calculators. In 1933, it acquired a maker of electric typewriters, and these gave the firm an

insight into electronics, which it then used to develop electronic calculators in 1947 and its first computer in 1952.

Computers of the 1960s and 1970s gave IBM a dominant position in the market, and by the mid-1980s, the firm

was the world’s leading supplier of mainframe computers, the industry standard at that time.

However, personal computers were becoming available from Apple and other competitors. Top managers at IBM

initially resisted moving into PCs, but eventually adopted a radical new concept for the firm—an open system,

developed using off-the-shelf components, rather than proprietary technology. The IBM PC was such a success

that Compaq and others began to sell IBM clone machines, stealing market share. PC technology replaced

mainframes at many firms, and IBM lost $8 billion on its PC business.

At this point, IBM hired Lou Gerstner, a former tobacco executive with no computing experience. He decided to

stop manufacturing PCs, where IBM had no advantage, and to move into the computing services industry instead.

IBM has been very successful with this strategy, and has adapted to provide e-business services as the Internet has

grown in importance.

Copyright © Houghton Mifflin Company. All rights reserved.

92

Chapter 7: Strategy in High-Technology Industries

Teaching Note: Unlike several of the other companies mentioned in this chapter, that had technological

advantages at one time but lost them as new technologies developed, IBM has managed to ride the wave of

technological changes in its industry for almost 100 years. Ask students to speculate on the qualities that have

allowed IBM to do this. Are there any lessons that other firms could find here?

Answers to Case Discussion Questions

1.

How many paradigm shifts has IBM survived in its history?

IBM has survived at least four important paradigm shifts. The first occurred in the 1930s, with the switch

from mechanical to electrical machines. In the 1960s, the company quit thinking of itself as a “business

machines” firm and began to focus on one specific type of machine—the computer. In the 1980s, the firm

had to undergo a painful change from its comfortable position as the industry leader in mainframes, to

restyling itself as a PC supplier. Finally, IBM has repositioned itself in the 1990s as a service firm, rather

than as a manufacturer.

2.

Describe how IBM was able to survive each of these paradigm shifts.

One constant through all these changes is that IBM has always placed a strong emphasis on organizational

learning and expanding the capabilities of its employees. Thus, expertise gained through the sale of one

product (electric typewriters) led to the development of new products (calculators, computers). Another skill

lies in IBM’s flexibility. The firm has been a savvy observer of industry changes, and chosen the time and

direction of strategic shifts wisely. Yet another skill is IBM’s ability to maintain its reputation and brand

name, through all the changes. That brand name has enabled IBM to dominate sales in every one of its

segments.

3.

What does the history of IBM tell you about the strategies that incumbent companies must pursue to survive

paradigm shifts?

Learning, flexibility, and reputation-building through consistent quality are strategies that can be used.

Another is the judicious timing of new product introduction. IBM deliberately did not jump into the PC

industry in its embryonic or early growth stages; instead, the firm waited until demand was at a relatively

high level before introducing their first PC product. This strategy allowed the firm to catch the latter part of

the growth in the industry, but also let them enter with high economies of scale in a mass production

environment.

4.

In many ways, the IBM PC launched the personal computer into the mass market. How was a large

incumbent enterprise able to develop what was a revolutionary product?

The technology used in the IBM PC was not revolutionary; in fact, IBM was able to use off-the-shelf

components to build its first PCs. The revolutionary part was the standardization offered by IBM. The PC

industry before IBM’s entry was perceived as radical, crazy, something that hobbyists might be interested

in, but business people definitely were not. At the time, many observers predicted that business managers

would never have a PC on their desk; they would leave that to their secretaries. Clearly, these observers

were thinking of the PC as a new-fangled typewriter, and not understanding the true significance of the new

technology. But when IBM entered the market, suddenly business people became interested, due to nothing

more than the firm’s reputation as solid, conservative, and quality-minded.

Another action that IBM undertook was to develop the new PC products outside of its usual development

labs, in a separate business unit far from the company’s headquarters. This allowed the designers the

freedom to experiment and to depart from business-as-usual. The PC would probably never have been

developed in IBM’s more mainstream labs.

5.

With the benefit of hindsight, could IBM have done anything different in the development of the IBM PC

that would have not allowed control over the dominant standard in the market to be captured by Microsoft

and Intel?

IBM was focused on the hardware side of the PC industry, while Microsoft was working on the software

side. IBM had a clear advantage in business experience and reputation over Microsoft at first, but they did

not consider software to be as important as hardware in the new industry. In hindsight, software has become

more important, both as a driver of hardware sales and as a source of innovation and improved functionality

Copyright © Houghton Mifflin Company. All rights reserved.

Chapter 7: Strategy in High-Technology Industries

93

for consumers. IBM could have foreseen that development and shifted resources to software development

early in the industry’s growth. They probably could have defeated Microsoft in a head-to-head competition

at that time.

In the same way, IBM could have focused on manufacturing components, such as microprocessors, rather

than on assembling the final product from off-the-shelf components. However, IBM did not have expertise

in the kind of painstaking manufacturing environment that is required to produce microprocessors.

Therefore, they might not have been successful in supplanting Intel as the chief supplier of computer

processors.

Copyright © Houghton Mifflin Company. All rights reserved.